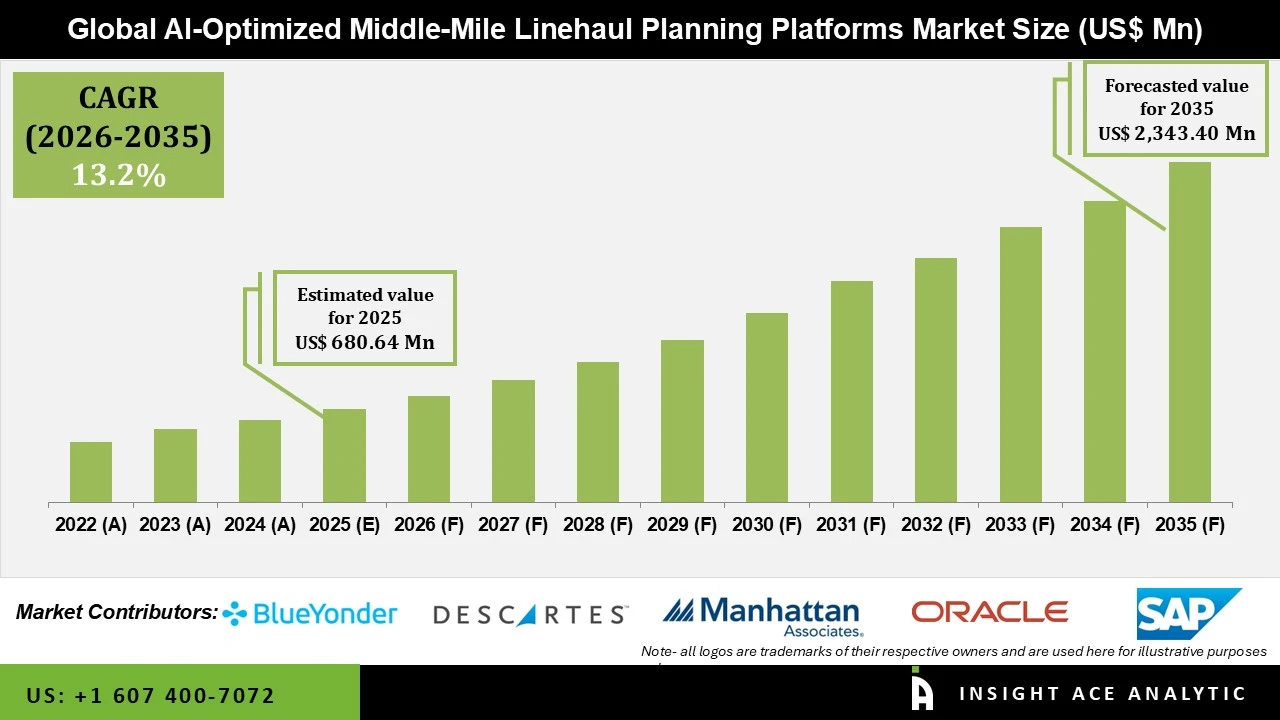

AI Optimized Middle Mile Linehaul Planning Platforms Market Size is valued at USD 680.64 Mn in 2025 and is predicted to reach USD 2,343.40 Mn by the year 2035 at a 13.2% CAGR during the forecast period for 2026 to 2035.

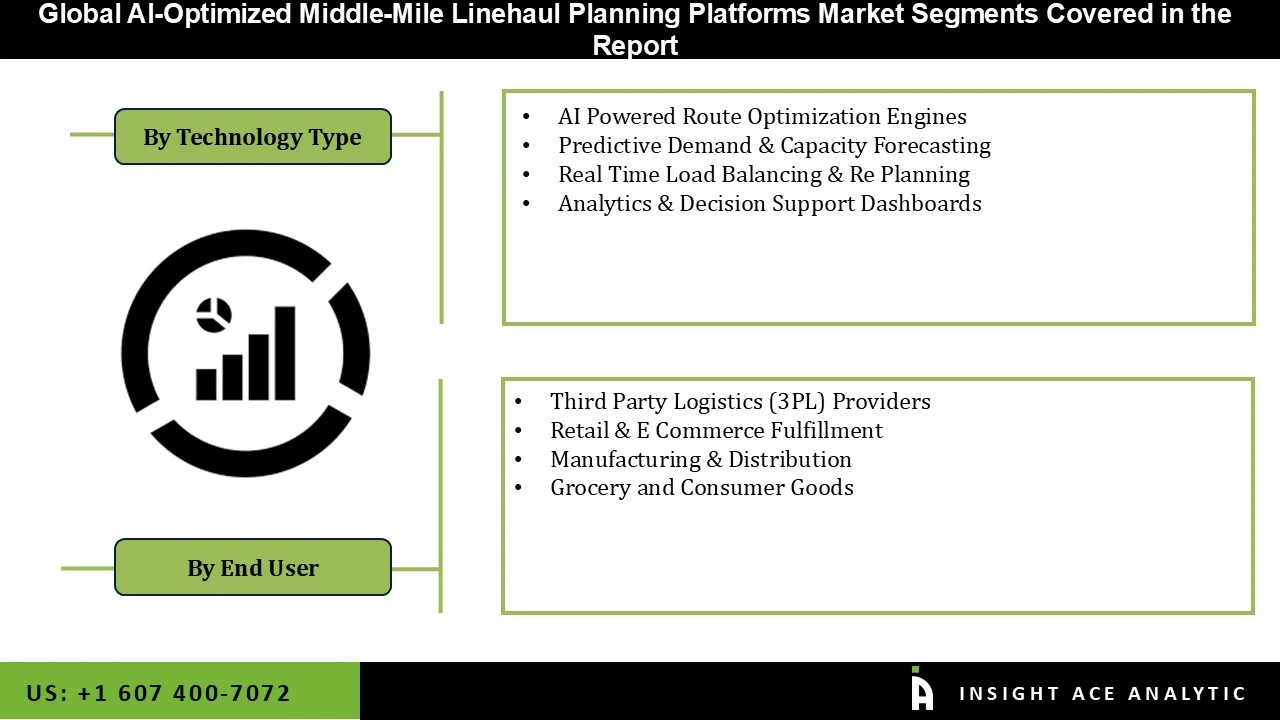

AI Optimized Middle Mile Linehaul Planning Platforms Market Size, Share & Trends Analysis Distribution by Technology Type (AI Powered Route Optimization Engines, Analytics & Decision Support Dashboards, Predictive Demand & Capacity Forecasting, and Real Time Load Balancing & Re Planning), End-user (Retail & E Commerce Fulfillment, Third Party Logistics (3PL) Providers, Grocery and Consumer Goods, and Manufacturing & Distribution), and Segment Forecasts, 2026 to 2035

Middle-mile line haul planning platforms that use artificial intelligence optimization are innovative digital tools used for planning and optimizing freight movement between destination and origin hubs, including warehouses, distribution centers, and cross-docking facilities via artificial intelligence and machine learning. In order to properly design and optimize line haul routing and scheduling, these digital platforms process humongous amounts of data, including, but not limited to, shipment volume, route demand, truck capacity, fuel price, driver time and availability, traffic, and temperature. A substantial and rapid rise in e-commerce and omnichannel retailing, which has significantly raised freight volumes and hub-to-hub transport network complexities, can be considered a primary driver of the AI-optimized middle-mile linehaul planning platforms market.

The adoption of AI-optimized platforms is being accelerated by acute economic pressures and a surge in data availability. Rising fuel costs and transport expenses are compelling logistics firms to seek intelligent solutions for dynamic route optimization and load consolidation. Concurrently, the proliferation of real-time data from telematics and IoT devices, combined with advances in AI and machine learning, enables these platforms to perform predictive forecasting and dynamic replanning, making middle-mile operations significantly more efficient and cost-effective for large-scale shippers and carriers.

While the market is growing rapidly due to the imperatives of supply chain digitalization and sustainability goals, significant adoption barriers persist. The primary constraints are the substantial upfront investment required for implementation and the technical complexity of integrating new AI platforms with legacy Transportation Management Systems (TMS) and enterprise software. However, the shift towards cloud-based Software-as-a-Service (SaaS) deployment models is lowering the barrier to entry for new providers and making advanced solutions more scalable for existing customers, facilitating broader market access and growth.

The rapid rise in transportation cost pressures and operational complexity in middle-mile logistics is one of the main factors driving the AI-optimized middle-mile linehaul planning platforms market. The logistics companies are being forced to maximize efficiency throughout hub-to-hub journeys due to rising fuel prices, driver shortages, and varying freight quantities. Additionally, to produce the best routing and schedule choices in real time, AI-powered route optimization engines constantly analyze sizable datasets, such as shipment density, lane demand, vehicle availability, traffic patterns, and delivery time windows. These platforms greatly save operating costs and increase service reliability by reducing empty miles, enhancing load consolidation, and facilitating quicker response to interruptions.

The complexity and high cost of integrating AI platforms with current traffic management systems, legacy planning tools, and business data warehouses, which call for technical know-how and financial commitment, is one of the main factors limiting the AI-optimized middle-mile linehaul planning platforms market. Smaller logistics companies may be reluctant to use sophisticated planning tools because of financial constraints or a lack of internal change management expertise. Additionally, some of the organizations are apprehensive because the accuracy of AI suggestions can be impacted by regional variations in data quality and availability. Planning and deployment schedules may need to be adjusted due to regulatory and privacy considerations surrounding data processing in some markets.

The AI Powered Route Optimization Engines category held the largest share in the AI-Optimized Middle-Mile Linehaul Planning Platforms market in 2025 driven by the requirement to oversee hub-to-hub freight operations that are becoming more complicated and time-sensitive. AI-based optimization engines that can assess millions of routing scenarios in real time are becoming more and more popular as a result of the increase in e-commerce volumes, multi-node distribution networks, and stricter delivery SLAs that have rendered manual or static route planning inefficient. These engines continuously optimize linehaul routes, departure schedules, and load sequencing by utilizing machine learning, predictive analytics, and real-time inputs like traffic conditions, weather, fuel prices, vehicle availability, and shipment priority.

In 2025, the Third Party Logistics (3PL) Providers category dominated the AI-Optimized Middle-Mile Linehaul Planning Platforms market. In order to improve the effectiveness of their middle-mile linehaul operations, 3PL providers—who are essential to the management of logistics for companies in a variety of industries—are progressively implementing AI-optimized systems. Additionally, 3PL providers can estimate demand, adapt to real-time conditions, and make better decisions due to AI-driven solutions, which lowers costs and raises service standards. The need for AI-powered platforms among 3PL providers is anticipated to increase as the logistics and supply chain sector continues to embrace digital transformation.

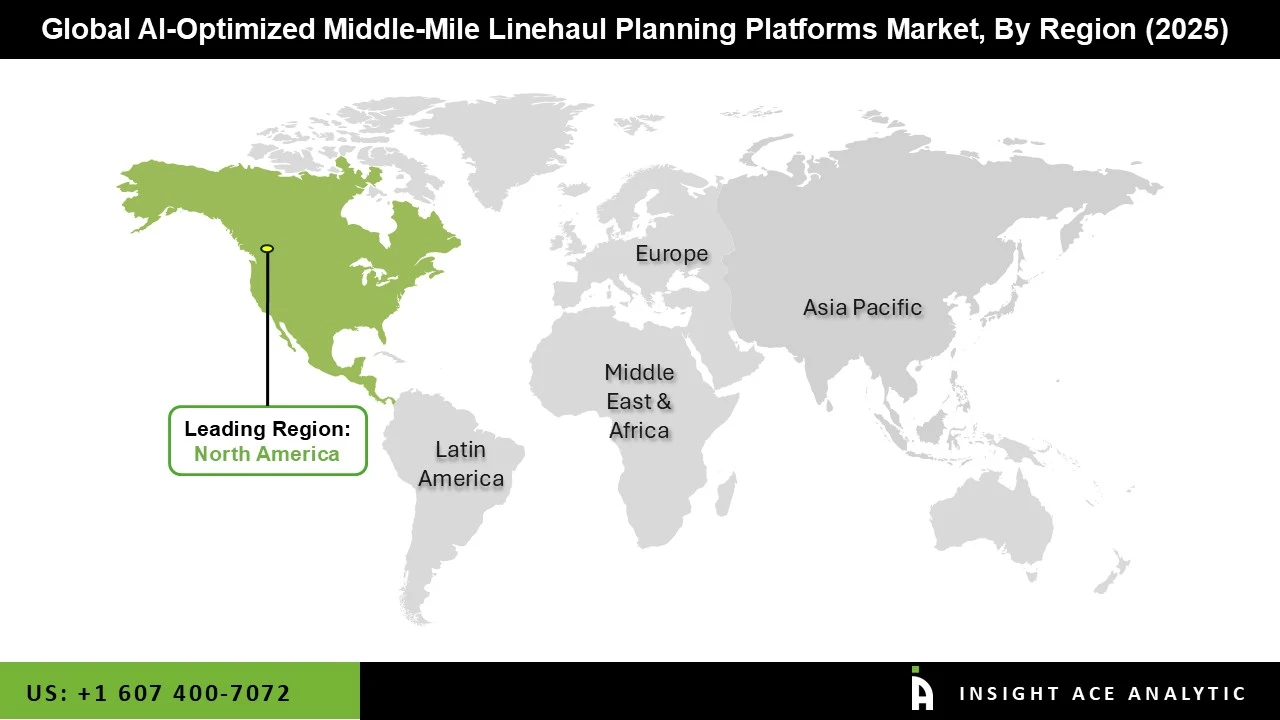

The AI-Optimized Middle-Mile Linehaul Planning Platforms market was dominated by North America region in 2025. The need for efficiency in the logistics sector, particularly in light of the growing demand for quicker delivery services in the e-commerce sector, is driving the market expansion. By enhancing load distribution, route planning, and empty mile reduction, AI-based technologies optimize middle-mile operations and result in substantial cost reductions.

AI-optimized planning solutions are becoming more popular as the US logistics sector prioritizes automation, cost-cutting, and sustainability. Additionally, supply chains are continuously changing due to customer demands and technology breakthroughs, which is driving the AI-optimized middle-mile linehaul planning platforms market expansion in North America.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 680.64 Mn |

| Revenue forecast in 2035 | USD 2,343.40 Mn |

| Growth Rate CAGR | CAGR of 13.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Technology Type, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | SAP, Blue Yonder, Manhattan Associates, Descartes Systems Group, and Oracle. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• AI Powered Route Optimization Engines

• Analytics & Decision Support Dashboards

• Predictive Demand & Capacity Forecasting

• Real Time Load Balancing & Re Planning

• Retail & E Commerce Fulfillment

• Third Party Logistics (3PL) Providers

• Grocery and Consumer Goods

• Manufacturing & Distribution

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.