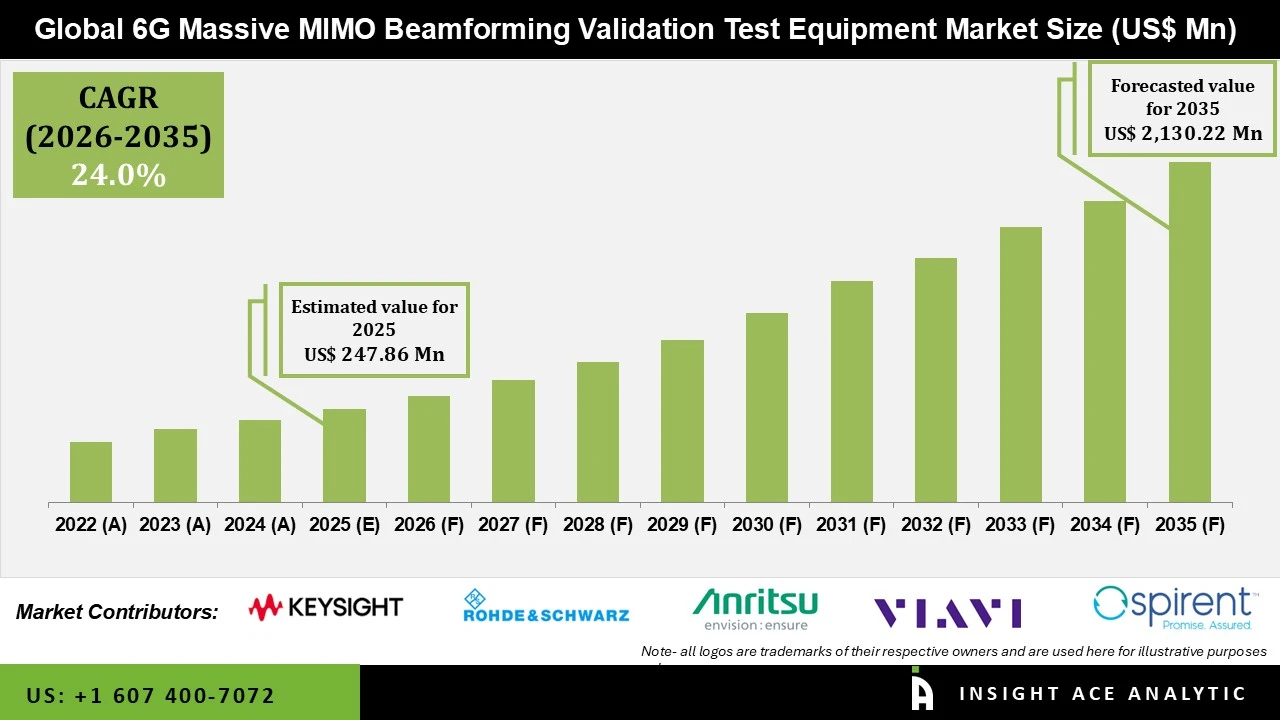

6G Massive MIMO Beamforming Validation Test Equipment Market Size is valued at USD 247.86 Mn in 2025 and is predicted to reach USD 2,130.22 Mn by the year 2035 at a 24.0% CAGR during the forecast period for 2026 to 2035.

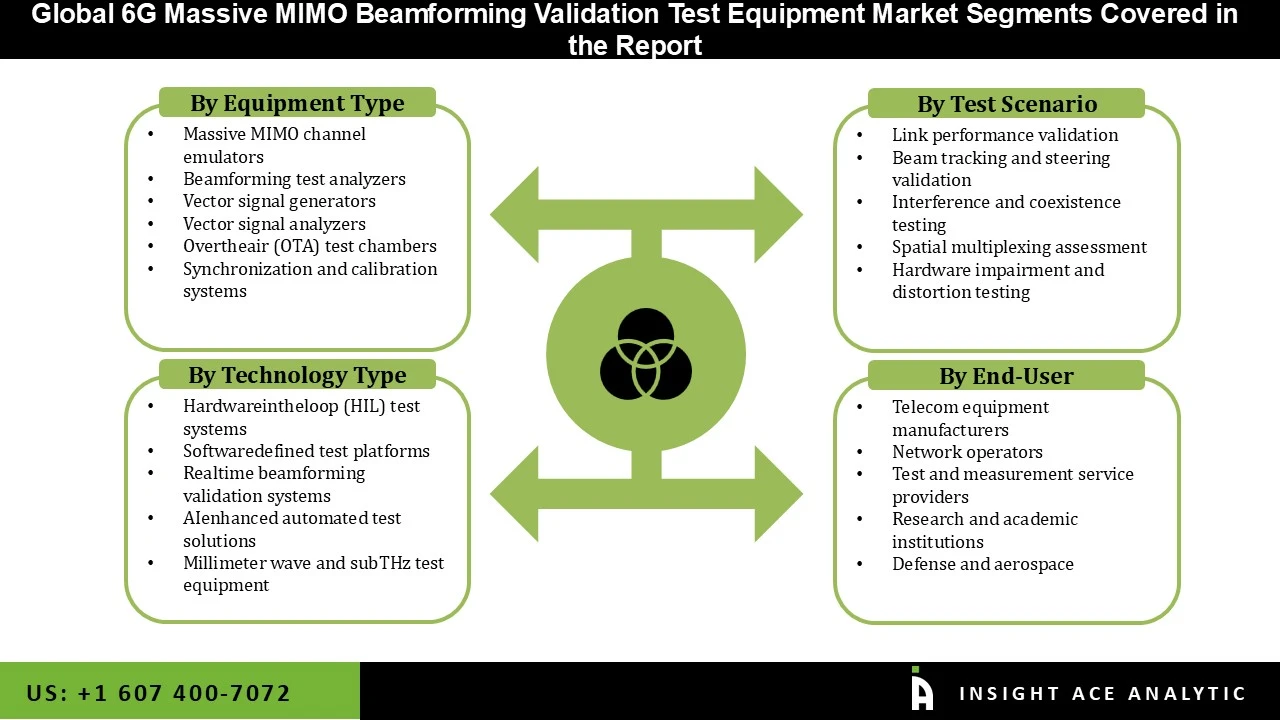

6G Massive MIMO Beamforming Validation Test Equipment Market Size, Share & Trends Analysis Distribution by Equipment Type (Massive MIMO Channel Emulators, Synchronization and Calibration Systems, Beamforming Test Analyzers, Over-the-air (OTA) Test Chambers, Vector Signal Generators, and Vector Signal Analyzers), By Test Scenario (Link Performance Validation, Interference and Coexistence Testing, Hardware Impairment and Distortion Testing, Beam Tracking and Steering Validation, Spatial Multiplexing Assessment), By Technology Type (Hardware in the Loop (HIL) Test Systems, Software-defined Test Platforms, Realtime Beamforming Validation Systems, AI-enhanced Automated Test Solutions, and Millimeter Wave and SubTHz Test Equipment), By End-user (Network Operators, Telecom Equipment Manufacturers, Aerospace and Defense, Test and Measurement Service Providers, Research and Academic Institutions), and Segment Forecasts, 2026 to 2035

6G massive MIMO beamforming validation test equipment is specialized high-tech gear used to test and check how well beamforming works in future 6G wireless networks that use very large antenna arrays (massive MIMO). These tools work at extremely high frequencies like millimeter-wave (mmWave) and sub-terahertz bands, where 6G will operate.

The equipment usually includes over-the-air (OTA) test chambers, multi-channel signal generators, vector network analyzers, phase-coherent receivers, and smart software that creates 3D beam maps and measures signal quality (like error vector magnitude or EVM). Researchers, chip makers, base-station companies, and mobile network operators use this equipment to make sure 6G massive MIMO systems can really deliver super-fast data speeds, almost-zero delay (sub-millisecond latency), low energy use, and reliable connection everywhere.

The global telecommunications landscape is seeing an increasing focus on the development of next-generation wireless solutions that are capable of supporting ultra-high data rates, extremely low latency, and massive connectivity. This has led to an increasing focus on the 6G massive MIMO beamforming validation test equipment market. In order to develop the complex beamforming algorithms that need to be implemented in massive MIMO solutions that operate at the mmWave as well as sub-terahertz bands, there have been growing investments in advanced solutions by equipment suppliers in the telecom sector, chipset suppliers, and research institutions.

Additionally, the requirement for accurate and genuine beamforming validation solutions has been fueled by the dramatic increase in data-intensive applications such as extended reality, AI, autonomous vehicles, and smart infrastructures that have dramatically escalated the need to improve network performance.

Moreover, with growing attention toward early-stage 6G trials and standardization efforts, stakeholders are being encouraged to deploy advanced test equipment in order to ensure interoperability, signal accuracy, and network robustness. Furthermore, because the antenna arrays and AI-driven beam management algorithms are becoming increasingly complex, highly scalable, and flexible, validation systems with the ability to emulate real-world propagation conditions are needed.

These test devices allow for faster prototyping and reduce time-to-market since they can quickly identify performance constraints at an early stage in the product development process. In addition, supportive government initiatives and public-private funding for 6G research programs also further driven the 6G massive MIMO beamforming validation test equipment market adoption, as several regulatory agencies and academic institutions look for more advanced forms of validation capabilities.

The global push for 6G research and development, which includes cutting-edge antenna technologies like Massive MIMO and adaptive beamforming to handle ultrahigh data rates and seamless coverage, is one important driver in the 6G massive MIMO beamforming validation test equipment market. The test systems that can verify array performance, spatial multiplexing, beam steering precision, and dynamic adaptation to shifting channels are being purchased by telecom operators and OEMs. Additionally, specialized validation equipment with accurate measurement capabilities is needed due to the growing complexity of Massive MIMO implementations, which include multiuser cooperation and high antenna counts.

The high cost and technical complexity of 6G massive MIMO beamforming validation test equipment are one of the main obstacles in this sector. It takes sophisticated hardware, cutting-edge software, and specialized knowledge to design and implement test systems that can support hundreds or thousands of antenna elements, ultra-wide bandwidths, and extremely high frequencies. These elements considerably raise capital costs, which restricts adoption among regional testing facilities, startups, and smaller research labs. Furthermore, it is difficult for manufacturers and users to justify significant investments in test equipment that would need regular upgrades or redesigns due to the uncertainty created by the absence of completed worldwide 6G standards.

The Massive MIMO Channel Emulators category held the largest share in the 6G Massive MIMO Beamforming Validation Test Equipment market in 2025. For MIMO systems, which are essential to the upcoming generation of wireless communication technologies, these simulators are crucial in replicating realistic channel conditions. A crucial element of 6G is massive MIMO (Multiple Input, Multiple Output), which aims to greatly expand the capacity and coverage of wireless networks. By simulating intricate radio environments, channel emulators allow engineers to test and optimize MIMO systems without requiring a physical deployment. The need for precise, scalable channel emulators has increased as a result of the development of 6G technology, which focuses on ultra-high-frequency bands and beamforming techniques.

In 2025, the Telecom Equipment Manufacturers category dominated the 6G Massive MIMO Beamforming Validation Test Equipment market, driven by original equipment manufacturers' (OEMs') active participation in the creation of next-generation network infrastructure. In order to provide cutting-edge base stations, antenna arrays, and radio access network (RAN) solutions that can function at incredibly high frequencies with ultra-dense massive MIMO configurations, top telecom equipment manufacturers are making significant investments in 6G research. During the design, prototyping, and pre-commercial testing stages, these manufacturers increasingly depend on advanced beamforming validation test equipment to guarantee performance accuracy, interoperability, and compliance with developing 6G frameworks.

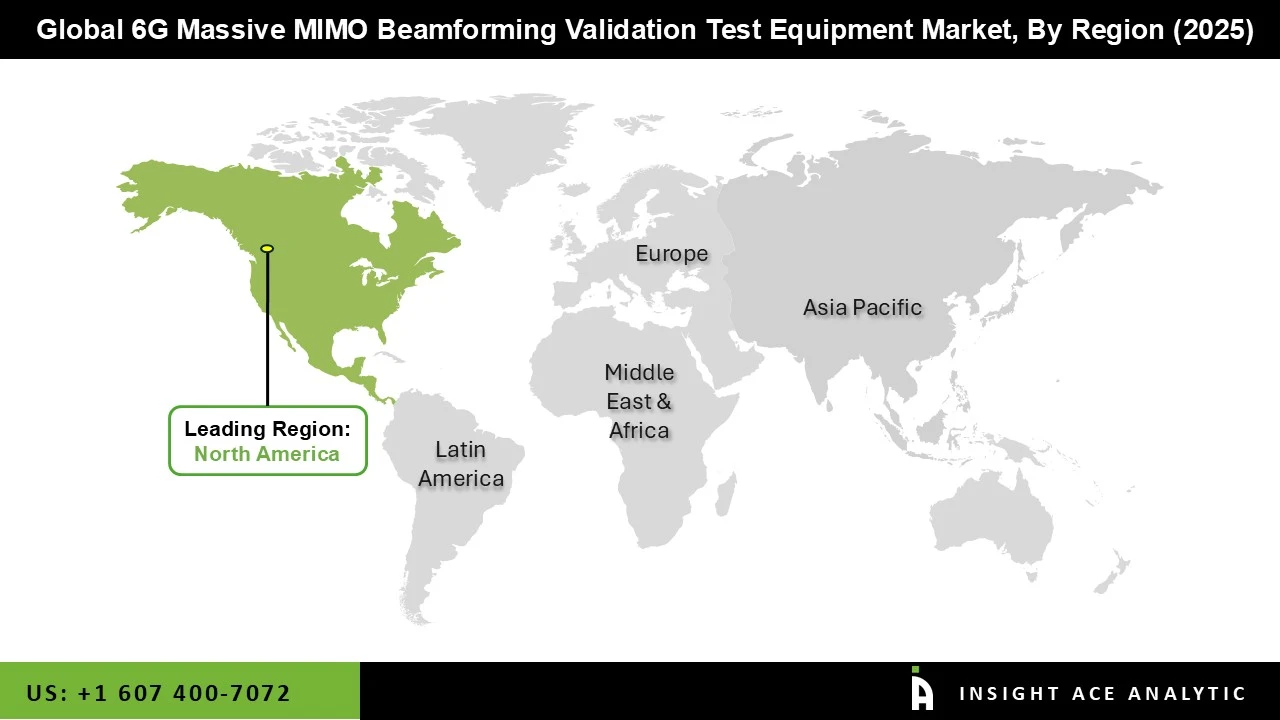

The 6G Massive MIMO Beamforming Validation Test Equipment market was dominated by the North America region in 2025 because of its early adoption of cutting-edge wireless technology and robust R&D ecosystem. The presence of leading telecom companies, semiconductor manufacturers, test and measurement companies, and research institutes in the US and Canada is driving the extensive testing and development of 6G technology. Furthermore, because these industries need accurate performance verification, high reliability, and detailed simulation of complicated propagation conditions, North America's emphasis on defence, aerospace, and private 6G testbeds is driving up demand for advanced beamforming validation equipment.

The Asia Pacific region is likely to record the fastest growth in the coming years. This growth will be fueled by unprecedented government and industry investment, the drive for technological sovereignty, and the region's significant role in the global manufacturing and commercialization of 6G infrastructure and devices.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 247.86 Mn |

| Revenue forecast in 2035 | USD 2,130.22 Mn |

| Growth Rate CAGR | CAGR of 24.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Equipment Type, Test Scenario, Technology Type, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Intel Corporation, Ericsson, Huawei Technologies Co Ltd, Keysight Technologies, Anritsu Corporation, Samsung Electronics Co Ltd, VIAVI Solutions Inc., Spirent Communications, National Instruments (NI), EXFO, Rohde & Schwarz, Tektronix, Nokia Corporation, Qualcomm Incorporated, and ZTE Corporation. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Massive MIMO Channel Emulators

• Synchronization and Calibration Systems

• Beamforming Test Analyzers

• Over-the-air (OTA) Test Chambers

• Vector Signal Generators

• Vector Signal Analyzers

• Link Performance Validation

• Interference and Coexistence Testing

• Hardware Impairment and Distortion Testing

• Beam Tracking and Steering Validation

• Spatial Multiplexing Assessment

• Hardware in the Loop (HIL) Test Systems

• Software-defined Test Platforms

• Realtime Beamforming Validation Systems

• AI-enhanced Automated Test Solutions

• Millimeter Wave and SubTHz Test Equipment

• Network Operators

• Telecom Equipment Manufacturers

• Aerospace and Defense

• Test and Measurement Service Providers

• Research and Academic Institutions

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.