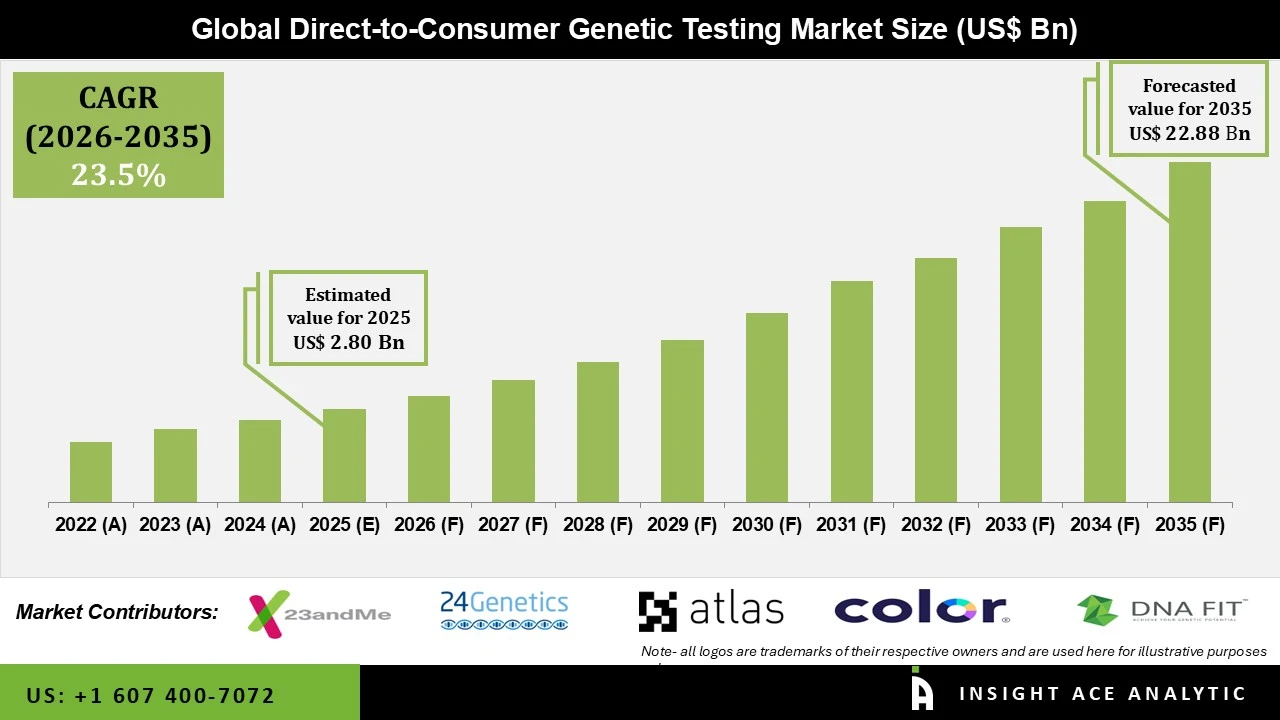

Direct to Consumer Genetic Testing Market Size is valued at USD 2.80 Billion in 2025 and is predicted to reach USD 22.88 Billion by the year 2035 at a 23.5% CAGR during the forecast period for 2026 to 2035.

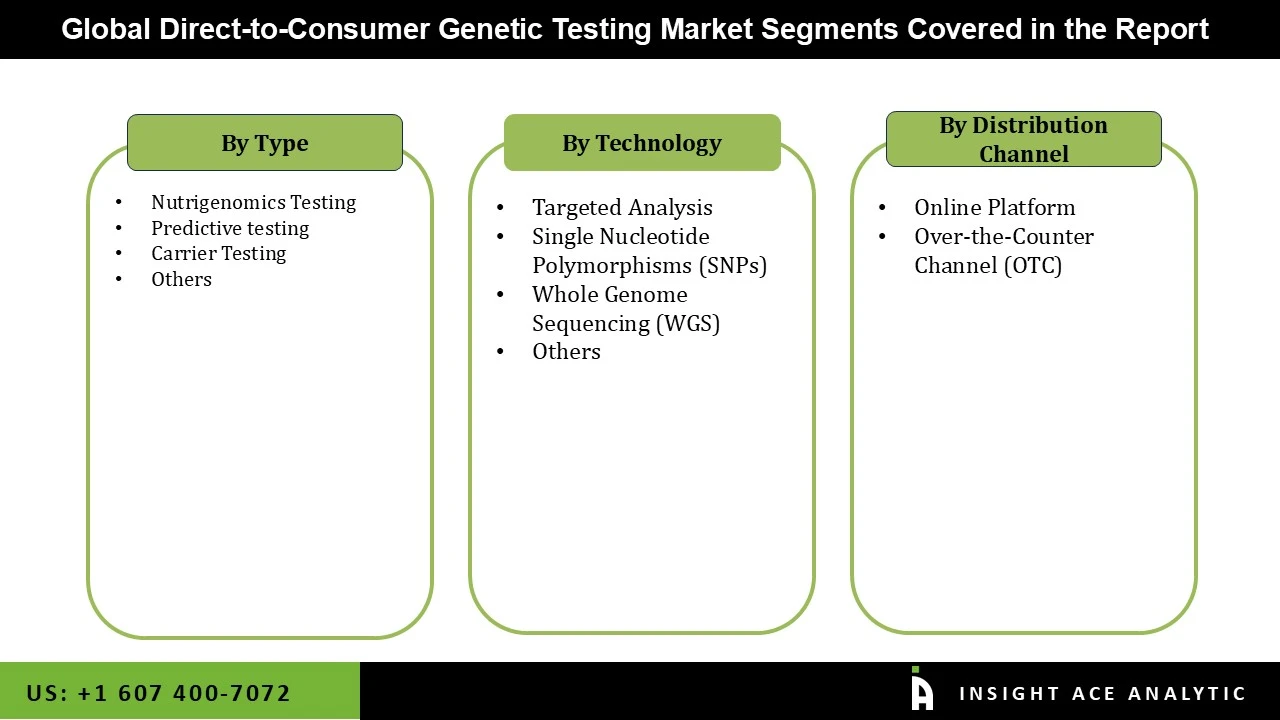

Direct-to-Consumer Genetic Testing Market, Share & Trends Analysis Report, By Type (Nutrigenomics Testing, Predictive testing, Carrier Testing, Others), Type of Technology (Whole Genome Sequencing, Single Nucleotide, Polymorphism Chips, Targeted Analysis, Others), By Distribution Channel, By Region, and Segment Forecasts, 2026 to 2035

Direct access testing, also known as direct-to-consumer (DTC) testing, enables clients to order laboratory tests directly from a laboratory without necessarily involving their healthcare provider. Direct-to-consumer genetic testing provides a person's genetic information without needing a doctor or health insurance company. Customers can send the business a DNA sample and get immediate results. Direct-to-consumer genetic testing, among other things, raises awareness of numerous genetic illnesses that aid in predicting one's health and offer information on standard features and ancestry. DTC genetic testing is quick to deliver findings confidently, inexpensively, and easy to use. Such scenarios will help the market expand beneficially.

One of the main factors projected to fuel the growth of the direct-to-consumer (DTC) genetic testing market over the anticipated period is the rise in public awareness. The direct-to-consumer (DTC) genetic testing industry is also expected to grow due to the increase in income levels in developing nations. Additionally, the growing need for service personalization will likely create additional chances for the direct-to-consumer (DTC) genetic testing industry to expand over the next few years.

However, direct-to-consumer (DTC) genetic testing market expansion may be hindered in the near future by flaws in the DTC testing kits. Direct-to-consumer (DTC) genetic testing market expansion is anticipated to be hampered over the timeframe due to the rising cost of DTC genetic testing. Furthermore, insufficient data links a particular genetic mutation to a given illness or functionality. Genetic privacy may also be jeopardized if testing businesses utilize their clients' genetic data improperly or if the information is stolen.

The Direct-to-Consumer Genetic Testing Market is segmented based on type, type of technology, and distribution channel. Based on type, the market is segmented into nutrigenomics testing, predictive testing, carrier testing, and others. Based on the type of technology, the market is divided into whole genome sequencing, single-nucleotide polymorphism chips, targeted analysis, and others. Based on the distribution channel, the market is divided into online platforms, OTC.

Based on type, the market is segmented into nutrigenomics testing, predictive testing, carrier testing, and others Among these, the predictive testing segment is expected to have the highest growth rate during the forecast period. his segment is also expected to experience the fastest growth over the forecast period. The popularity of predictive testing is driven by consumers' increasing interest in understanding their genetic predispositions to various health conditions, enabling proactive health management. Predictive genetic tests offer valuable information on potential health risks, giving consumers a sense of control over their health and the ability to make informed decisions. Tests that assess genetic risks for common diseases like breast cancer (or cardiovascular disease are particularly popular.

Based on the type of technology, the market is divided into whole genome sequencing, single-nucleotide polymorphism chips, targeted analysis, and others. The whole genome sequencing (WGS) segment dominates the market. Advancements in sequencing technologies and a reduction in the cost of genome sequencing have made WGS more affordable and accessible to consumers. The initial high cost of whole genome sequencing has decreased significantly, making it a viable option for direct-to-consumer testing. WGS offers high accuracy and reliability in identifying genetic variations across the entire genome. This comprehensive data allows for a more precise understanding of an individual's genetic predispositions and potential health risks.

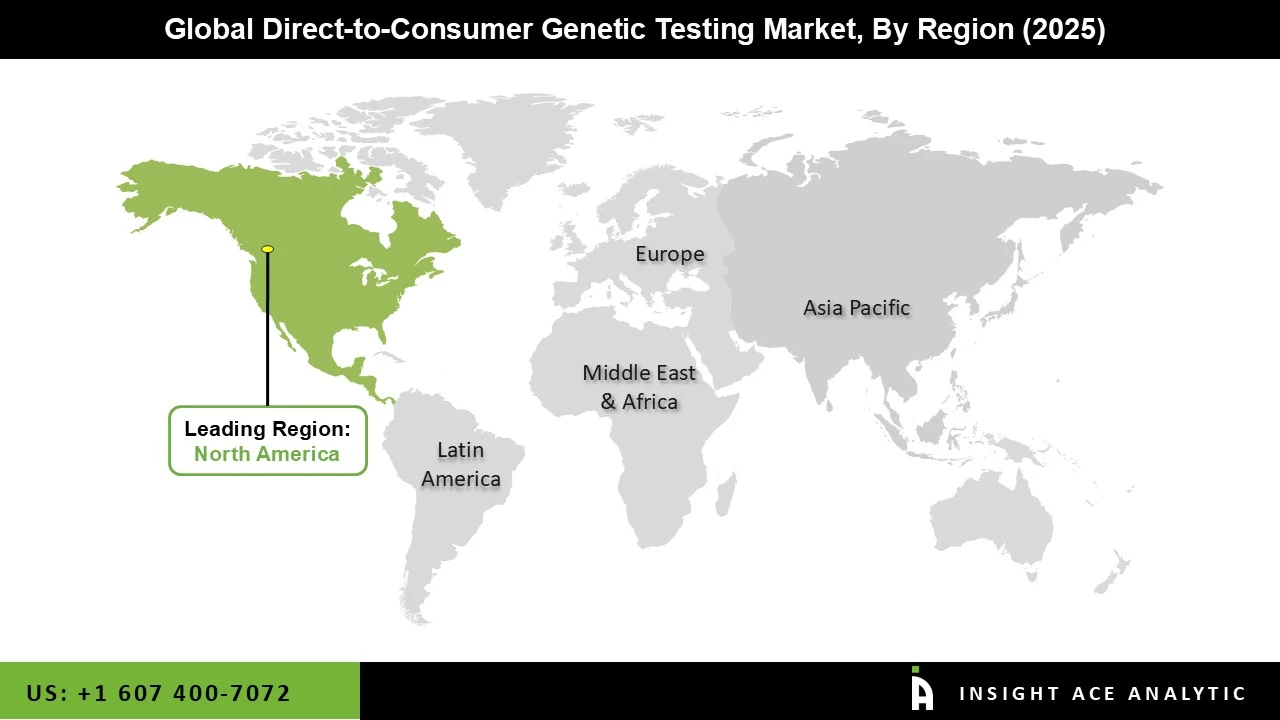

In the forecast period, North America to hold a major global market share. The high prevalence of rare illnesses, the presence of numerous disease registries, a sizable number of R&D centres for ultra-rare diseases, and significant investments in disease detection are all factors that contribute to the region's considerable market share. Customers with a lot of disposable money can spend more on direct-to-consumer genetic testing, like genetic and nutrigenomics testing, which encourages regional growth. In addition, the arrival of significant industry players in the area and accelerated technology advancements will foster market expansion locally.

During the forecasted years, Asia Pacific is anticipated to experience significant growth. This is primarily due to improvements in awareness and diagnostic skills. Furthermore, this region will benefit financially from implementing frameworks and policies that support illness management. In China, only a relatively smaller percentage of the population uses genetic screening services, although demand is augmenting. With this, many foreign businesses are anticipated to enter the China direct-to-consumer genetic testing industry to offer affordable services.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.80 Billion |

| Revenue Forecast In 2035 | USD 22.88 Billion |

| Growth Rate CAGR | CAGR of 23.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Type of Technology, Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East Asia; |

| Competitive Landscape | 23andme Inc., 24Genetics, Ancestry.com LLC, Atlas Biomed, Color Genomics, DNAfit, Gene by Gene, Chengdu Twenty-Three Rubik’s Cube Biotechnology Co., Ltd., EasyDNA, Mapmygenome, MyHeritage Ltd., Laboratory Corporation of America Holdings, Myriad Genetics, Inc., Konica Minolta, Inc., XCODE Life. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Direct-to-Consumer Genetic Testing Market - By Type

Direct-to-Consumer Genetic Testing Market By Technology

Direct-to-Consumer Genetic Testing Market By Distribution Channel-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.