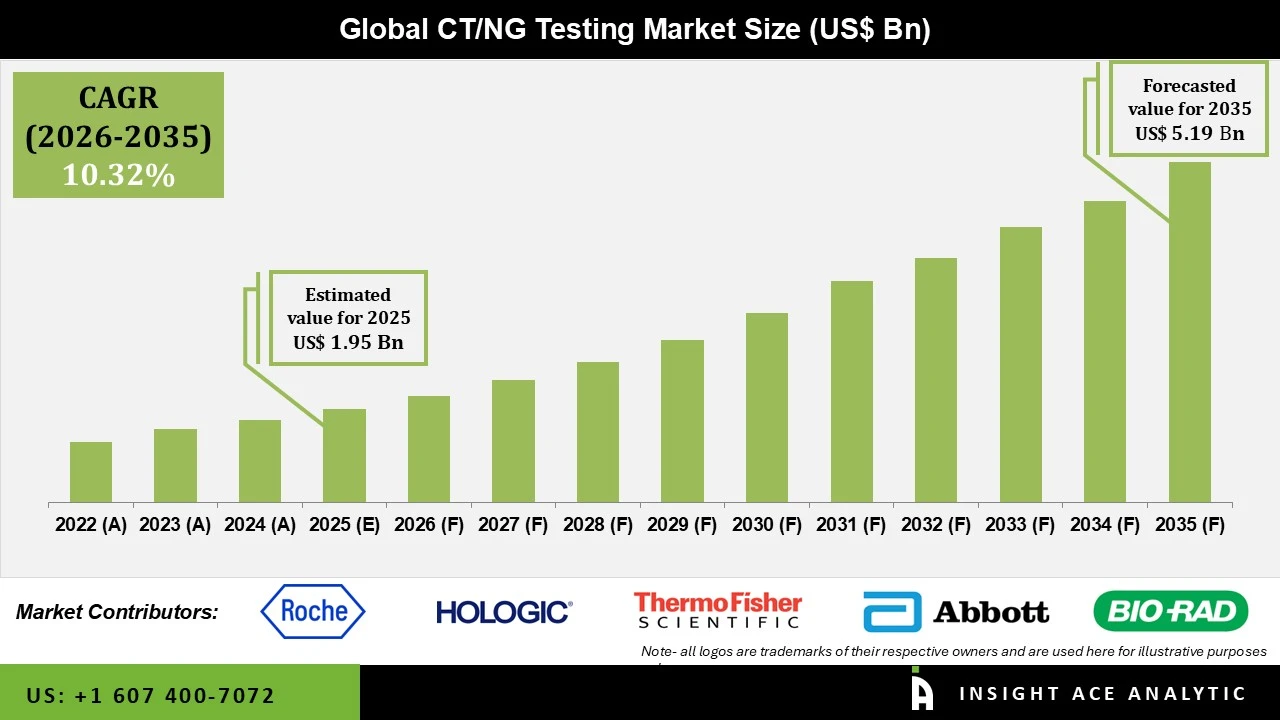

CT/NG Testing Market Size is valued at USD 1.95 Bn in 2025 and is predicted to reach USD 5.19 Bn by the year 2035 at a 10.32% CAGR during the forecast period for 2026 to 2035.

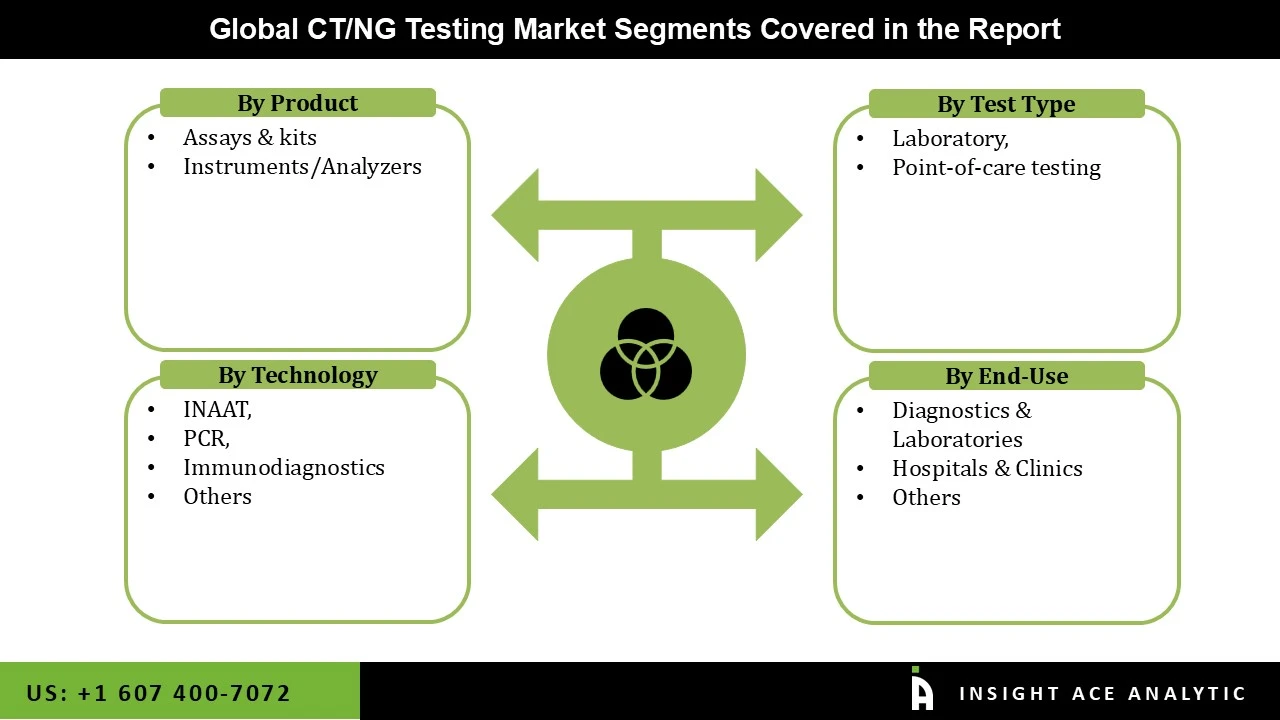

CT/NG Testing Market Size, Share & Trends Analysis Report By Product (Assays & kits, Instruments/Analyzers), By Test Type (Laboratory, Point-of-care testing), By Technology (INAAT, PCR, Immunodiagnostics, Others), By End-User, By Region, And By Segment Forecasts, 2026 to 2035

Players in the CT/NG testing market have numerous prospects for expansion in developing nations, including South Korea, Mexico, Brazil, India, and South Korea. This can be ascribed to a lack of legislative restrictions, advancements in healthcare infrastructure, an increase in the number of patients, an increase in the prevalence of infections, and rising healthcare costs.

Furthermore, compared to wealthy nations, some of these countries have regulatory frameworks that are more flexible and business friendly. For instance, the OECD projects that the expanding middle-class population's purchasing power will rise from 23% in 2009 to 65% in 2022. This is anticipated to increase the middle-class population's medical needs, which would help the industry grow.

Additionally, as US and European markets develop, the majority of players will turn their attention to emerging countries. Upgrading laboratory infrastructure in emerging economies is made possible in large part by the significant investments made in healthcare and life science research in these nations. This thus encourages the construction of diagnostic equipment in laboratories and promotes the expanding use of CT/NG testing.

The CT/NG Testing market is segmented based on product, test type, technology, and end-user. The market is segmented as assays & kits and instruments/analyzers based on product. The test-type segment includes laboratory and point-of-care testing. The technology segment includes INAAT, PCR, and Immunodiagnostics. Based on end-user the market is bifurcated as diagnostic labs, hospitals & clinics.

The market for CTING testing was dominated by the assays & kits sector. Due to the strong demand and ongoing need for diagnosis and treatment, this segment has a large market share. It is a high-cost product as a result of frequent purchases, which contributes to the segment's growth.

According to test type, the lab tests segment held the majority of the CTING testing market. This market's expansion can be due to elements like the rising demand for automation in lab settings and the prevalence of numerous infectious diseases. In comparison to PoC tests, lab tests are more sensitive and specific. A controlled lab setting ensures more precise and sensitive measurements, lowering the possibility of false-negative or false-positive results. The capacity of lab testing to process more samples at once is an additional benefit. These elements should encourage the expansion of this market.

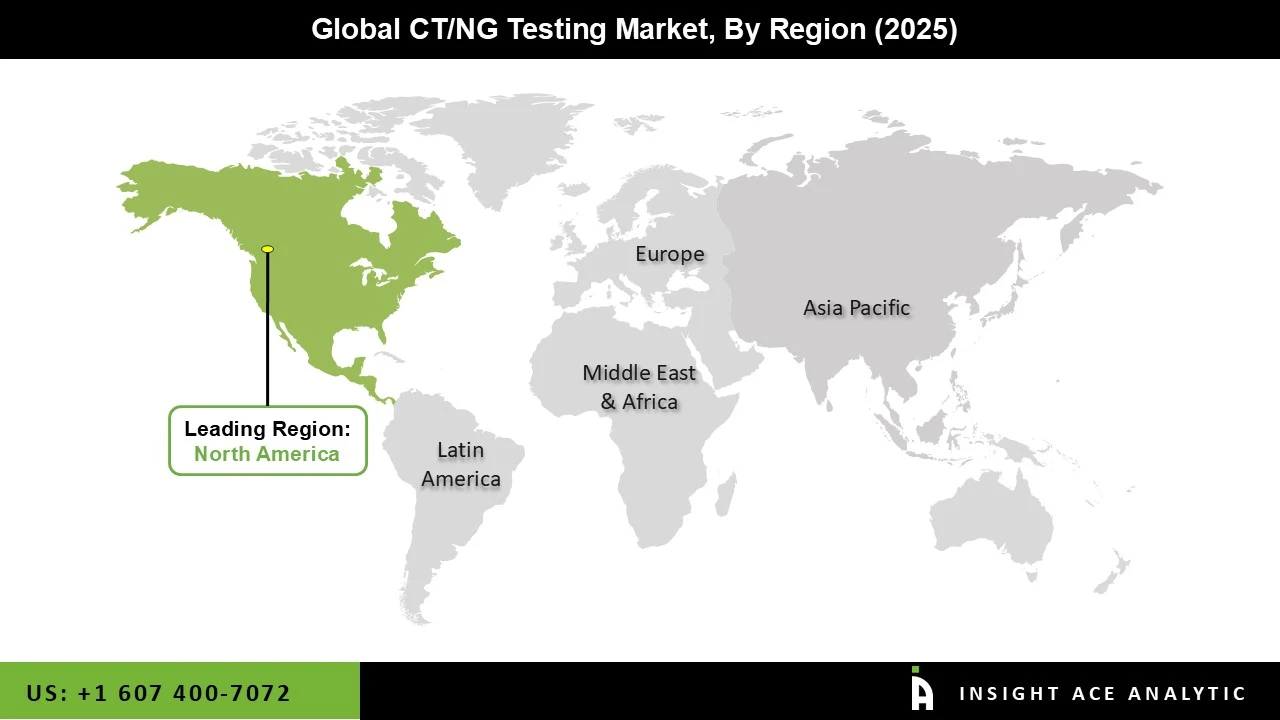

Technological developments in the area of diagnostics have largely been led by North America. The region has a solid research & development infrastructure, which has sped up the adoption of cutting-edge diagnostic platforms and methods. In addition, North America is home to several significant businesses engaged in the CT/NG testing industry. Due to the substantial knowledge, resources, and established distribution networks of these businesses, the area dominates the market. Hologic, Inc. (US), PerkinElmer, Inc. (US), Abbott Laboratories (US), and Thermo Fisher Scientific Inc. (US) are a few examples of well-known CT/NG testing businesses in North America.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.95 Bn |

| Revenue Forecast In 2035 | USD 5.19 Bn |

| Growth Rate CAGR | CAGR of 10.32% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Technology, Test Type, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | F. Hoffmann-La Roche Ltd. (Switzerland), Hologic, Inc. (US), Thermo Fisher Scientific Inc. (US), Abbott Laboratories (US), Bio-Rad Laboratories, Inc. (US), Siemens Healthineers AG (Germany), Danaher (US), Becton, Dickinson and Company (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

CT/NG Testing Market By Product-

CT/NG Testing Market By Test Type-

CT/NG Testing Market By Technology-

CT/NG Testing Market By End-User-

CT/NG Testing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.