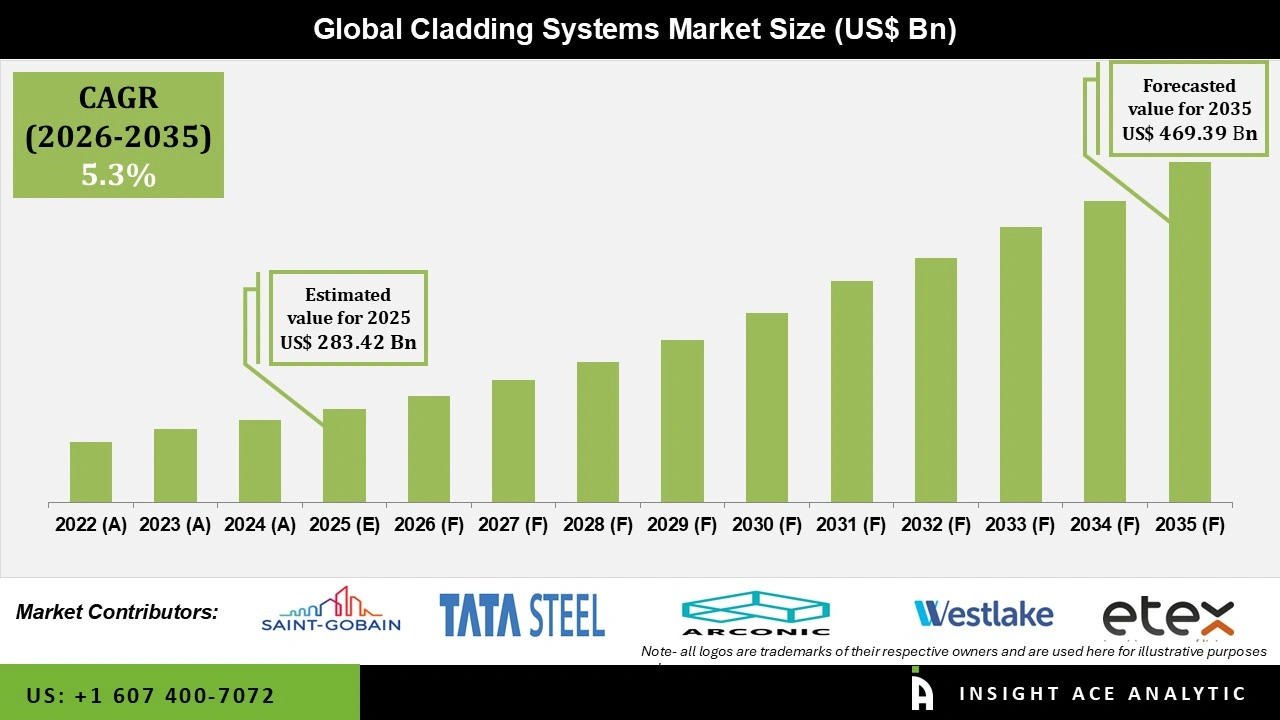

Global Cladding Systems Market Size is valued at USD 283.42 Bn in 2025 and is predicted to reach USD 469.39 Bn by the year 2035 at a 5.3% CAGR during the forecast period for 2026 to 2035.

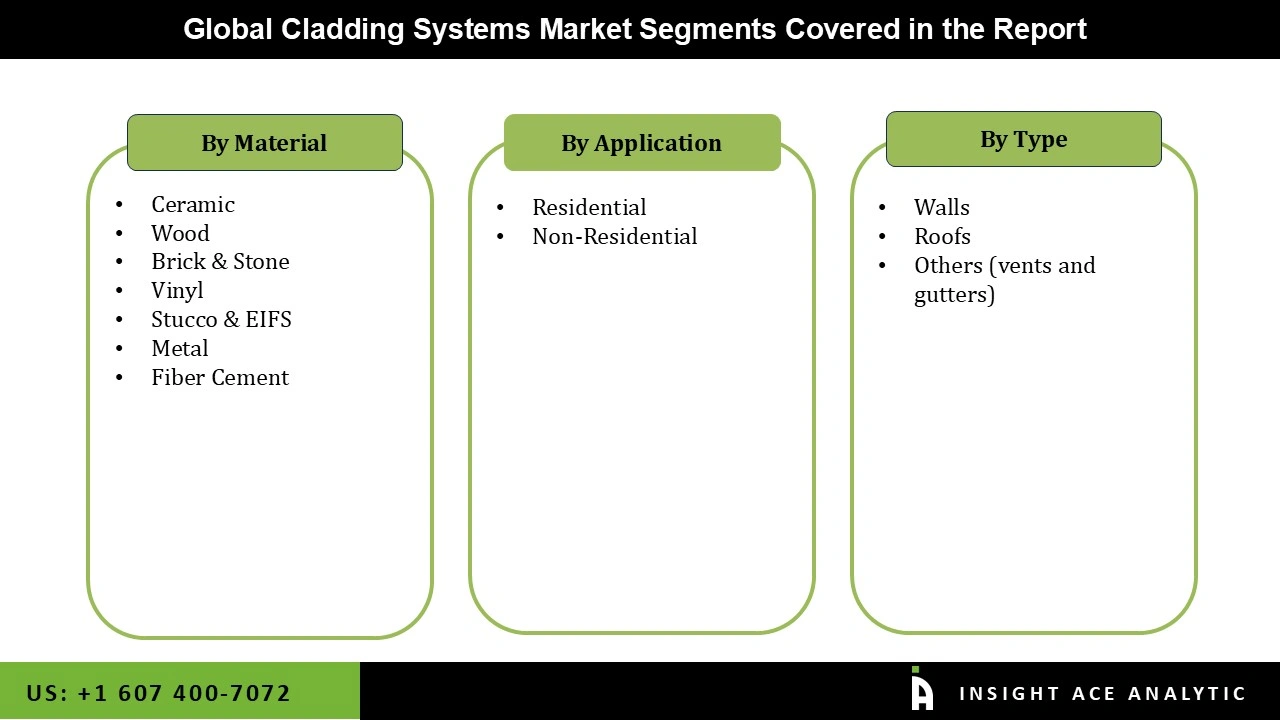

Cladding Systems Market Size, Share & Trends Analysis Report By Material (Ceramic, Wood, Brick & Stone, Vinyl, Stucco & EIFS, Metal, Fiber Cement), By Type (Walls, Roofs, Others (vents and gutters)), By Application (Residential, Non-Residential), By Region, And By Segment Forecasts, 2026 to 2035

Cladding systems are protective and decorative coverings for building exteriors. They shield structures from weather, enhance aesthetics, and provide thermal insulation. Various materials, designs, and installation methods offer durability and customization. These systems are crucial for both aesthetics and functional performance in modern architecture. They help protect the building from the elements by deflecting wind, snow, rain, and dust. Cladding systems can provide visual appeal and decorative flair to buildings. Adding cladding to a building also makes it last longer. Despite the fact that it is not a load-bearing component, it aids in shifting the weight of snow and wind.

In addition, it provides soundproofing and thermal insulation, which boosts the efficiency of air conditioning. Furthermore, the growing consumer preference for aesthetically beautiful buildings is expected to fuel the cladding system industry's future growth. Industry leaders are concentrating on providing a wide variety of cladding systems in a variety of colours and patterns to complement and enhance the aesthetic appeal of building facades.

However, the market growth is hampered by the high price of raw materials and labour for installation. There may be an impact on the cost-effectiveness of cladding systems due to fluctuations in raw material prices, unavailability, and increased demand. Higher installation costs, caused in part by complex installation methods and specialized personnel needs, might be a deterrent for some building projects. Demand for cladding systems is affected by a variety of factors, including constrained spending, price-conscious customers, and the state of the economy.

The Cladding Systems market is segmented based on material, type and application. Based on material, the market is segmented into ceramic, brick & stone, wood, vinyl, stucco & EIFS, metal, and fibre cement. The Type segment includes Walls, Roofs, Others (vents and gutters). By application segment, the market is categorized into residential and non-residential.

The fibre cement cladding systems market is expected to hold a major global market share in 2024. Fiber cement is a popular substitute for traditional external cladding materials like wood and PVC/vinyl due to its long lifespan and low maintenance demand. Waterproof and resistant to warping, cracking, and rotting, fibre cement cladding has a long lifespan.

The residential segment will likely grow rapidly in the global cladding systems market. Demand for advanced forms of protection, such as wall and roof cladding, in residential buildings has increased due to shifting consumer habits, increased household wealth, and heightened awareness, especially in countries like the US, Germany, the U.K., China, and India.

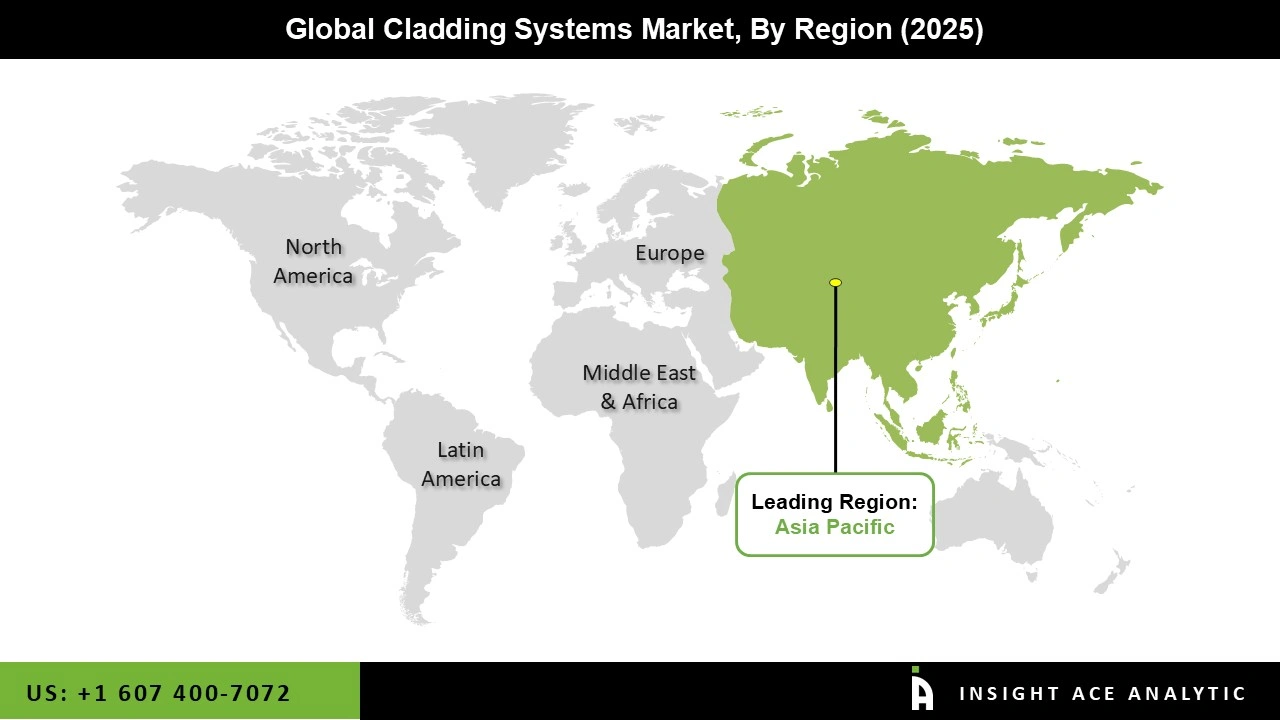

The Asia Pacific cladding systems market is expected to register the maximum market share in revenue in the near future. It can be attributed to an increase in the population and the effort of governments to upgrade social infrastructure. The construction market is expanding as more people become aware of the benefits of weatherproofing.

In addition, Europe is estimated to grow rapidly in the global cladding systems market due to high demands from emerging economies. The construction industry in emerging economies is booming thanks to rising incomes, a growing population, and the trend toward urbanization.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 283.42 Bn |

| Revenue Forecast In 2035 | USD 469.39 Bn |

| Growth Rate CAGR | CAGR of 5.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Material, Type, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East |

| Competitive Landscape | Compagnie de Saint-Gobain S.A., DuPont, Tata Steel Limited, Arconic, Westlake Chemical, Etex Group, James Hardie Industries PLC, CSR Limited, Nichiha Corporation, Boral Limited, Swisspearl Group Ag, Louisiana Pacific Corporation, Kingspan Group Plc, Coverworld UK, Westman Steel, Ca Group Limited, Arcelormittal, Carea, Timco, Middle East Insulation Llc, Trespa International B.V., Dumaplast, Accord Floors and others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.