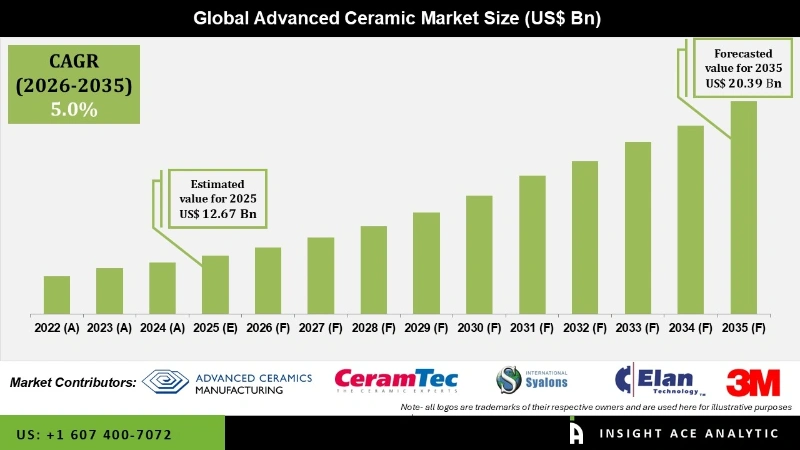

Global Advanced Ceramic Market Size is valued at USD 12.67 Bn in 2025 and is predicted to reach USD 20.39 Bn by the year 2035 at a 5.00% CAGR during the forecast period for 2026 to 2035.

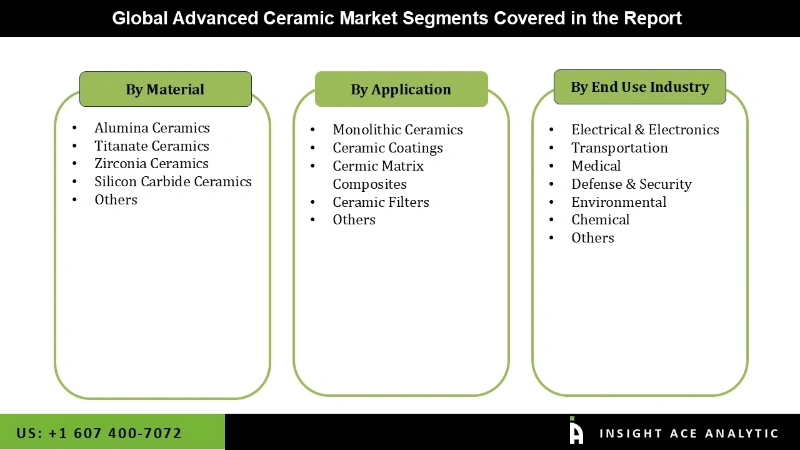

Advanced Ceramic Market Size, Share & Trends Analysis Report By Material (Alumina, Titanate Ceramics, Zirconia, Silicon Carbide), Application (Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites, Ceramic Filters), And By End-Use Industry, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The advanced ceramic market refers to a broad range of ceramic materials designed for specialized, high-performance applications. Advanced ceramics offer a unique combination of properties, including high hardness, strength, heat resistance, wear, and corrosion, making them ideal for use in the aerospace, defense, energy, and electronics industries.

The market for advanced ceramics is highly diverse, with many different types of ceramic materials available for different applications. Some of the most common advanced ceramic materials include alumina, zirconia, silicon carbide, and titanium diboride. The advanced ceramic market demand is expected to rise in the coming years, driven by increasing demand for high-performance materials in the aerospace, defense, and energy industries.

However, the advanced ceramics industry also faces challenges related to cost, processing, and regulatory hurdles, which may limit its growth in certain applications.

The advanced ceramic market is segmented based on material, application, and end-use industry. The market is segmented as alumina, titanate ceramics, zirconia, silicon carbide, and others based on material. By application, the market is segmented into monolithic ceramics, ceramic coatings, ceramic matrix composites, ceramic filters and others. Based on end use, the market is segmented into electrical & electronics, transportation, medical, defense & security, environmental, chemical and others.

Zirconia ceramics was expected to continue its dominance in the global advanced ceramic market. Zirconia ceramics have excellent mechanical properties, including high strength, toughness, and wear resistance, making them ideal for various applications such as cutting tools, medical implants, and electronic components. Additionally, zirconia ceramics offer excellent biocompatibility, making them suitable for medical and dental applications. However, other types of advanced ceramics, such as alumina, silicon carbide, and titanium carbide, also have unique properties and advantages. Their market share may change based on specific industry needs and trends.

The medical industry was one of the leading applications for advanced ceramics and was expected to continue its growth in the coming years. Advanced ceramics have a wide range of applications in the medical industry, such as dental implants, joint replacements, and surgical tools, due to their excellent biocompatibility, mechanical properties, and resistance to wear and corrosion. The increasing demand for advanced ceramics in the medical industry can be attributed to factors such as the growing aging population and rising prevalence of chronic diseases, as well as the increasing awareness of the benefits of advanced ceramics in medical applications. However, advanced ceramics also have applications in other industries, such as electronics, automotive, and energy, and their market share may change based on specific industry needs and trends.

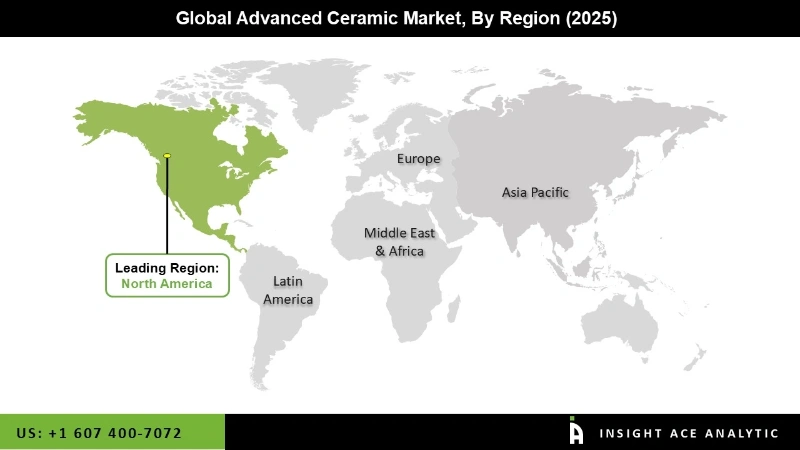

The growth in the North American advanced ceramic market can be attributed to elements such as the increasing need for advanced ceramics in various applications, such as aerospace, defense, and medical industries, as well as the presence of many manufacturers and suppliers in the region. Additionally, favorable government initiatives and investments in research and development activities have also contributed to the growth of the advanced ceramic market in North America. However, other regions, such as Asia Pacific and Europe, also have a significant share in the advanced ceramic market, and their market share may increase in the coming years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 12.67 Bn |

| Revenue forecast in 2035 | USD 20.39 Bn |

| Growth rate CAGR | CAGR of 5.00% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Material, Application, And End-Use Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Kyocera Corporation, CeramTec, CoorsTek, Saint-Gobain Ceramic Materials, Morgan Advanced Materials, and 3M. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Material

By Application-

By End Use Industry-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.