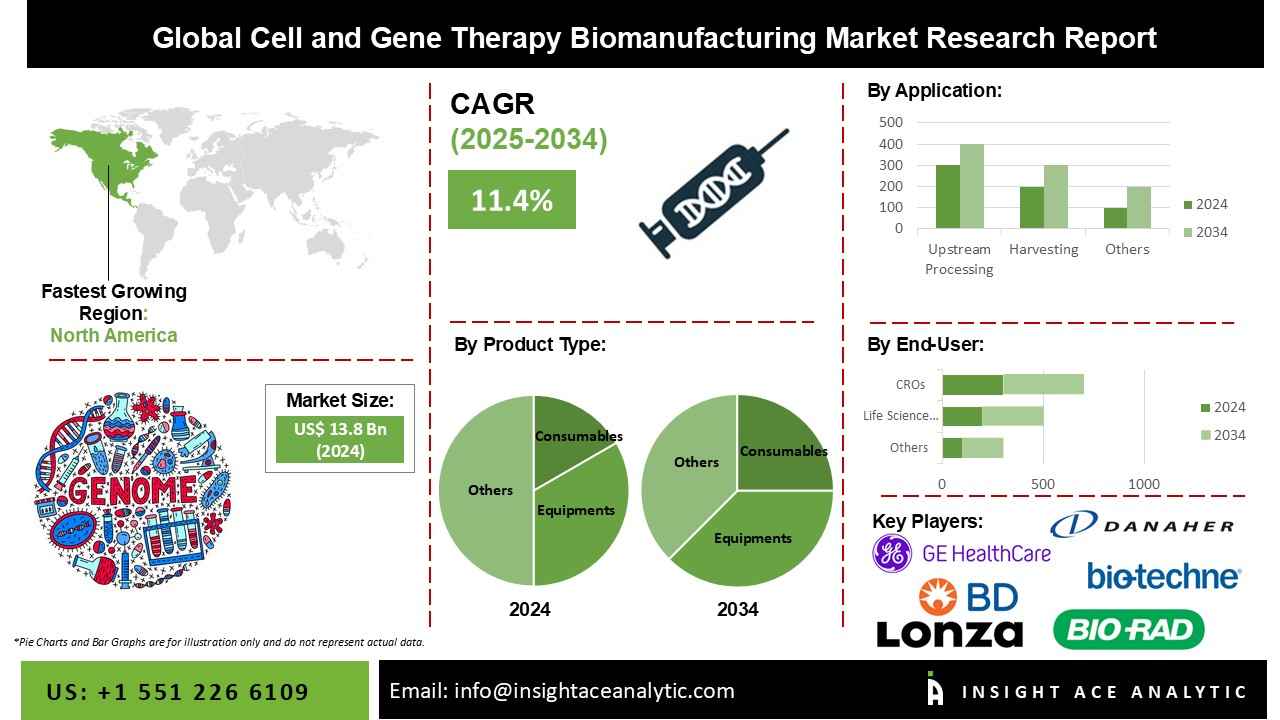

Global Cell and Gene Therapy Bio-Manufacturing Market Size is valued at USD 13.8 billion in 2024 and is predicted to reach USD 40.2 billion by the year 2031 at an 11.4% CAGR during the forecast period for 2025 to 2034.

Cell and Gene Therapy Bio-manufacturing Market Size, Share & Trends Analysis Report By Product Type (Consumables, Equipment, And Software Solutions), Usage (Commercial-Stage Manufacturing And Research-Stage Manufacturing), Application (Upstream Processing, Harvesting, And Downstream Processing), And End-User, By Region, And Segment Forecasts, 2025 to 2034

The global cell and gene therapy bio-manufacturing market is advancing. The cell and gene therapy industry is rapidly expanding due to its promise to cure chronic and rare/orphan diseases that previously had few therapeutic choices. The development of sophisticated medicines has been critical in redefining the treatment paradigm of various life-threatening and uncommon diseases, as well as in reshaping the biopharmaceutical sector. The rapid expansion of the advanced therapy landscape is a key driver of the cell and gene therapy manufacturing market.

However, due to its unprecedented scale and severity, the COVID-19 epidemic has significantly disrupted social, economic, and political activities all around the world. As a result, COVID-19 has upset the cell and gene therapy (CGT) sector, which has historically suffered from considerable complexity in the supply of materials, production, and logistical operations.

The cell and gene therapy bio-manufacturing market is segmented on the basis of product type, usage, application, and end-user. Based on product type, the market is categorized as consumables, equipment, and software solutions. The usage segment includes commercial-stage manufacturing and research-stage manufacturing. By application, the market is segmented into upstream processing, harvesting, and downstream processing. The end-user segment includes life science companies, contract research organizations (CROs), contract manufacturing organizations (CMOs), and cell banks.

The commercial stage manufacturing segment category is expected to hold a considerable share in the global cell and gene therapy bio-manufacturing Market in 2024. As the number of regulatory approvals for gene and cell therapy products grows, so does the demand for commercial production of these medicines. To meet shifting industry demands, key market players such as Thermo Fisher Scientific and AGC Biologics are launching a number of strategic initiatives. For example, Thermo Fisher Scientific will launch new Patheon Commercial Packaging Services for cell and gene therapy in the United States and Europe in February 2022. This comprehensive solution integrates logistics, serialization compliance, and global distribution. Such characteristics are predicted to provide a favorable environment for segment expansion.

The contract manufacturing organizations segment is projected to grow at a rapid rate in the global cell and gene therapy bio-manufacturing market. With rising demand for cell and gene therapies, a need for manufacturing capacity is opening up new prospects for contract manufacturing service providers. Due to the non-standardized and frequently changing nature of the cell and gene therapy sector, outsourcing to a contract manufacturing service provider is likely to provide a competitive advantage in terms of experience and competence.

The North America Cell and Gene Therapy Bio-manufacturing Market is expected to register the highest market share in terms of revenue in the near future. This can be attributed to the region's rising involvement in gene and cell therapy research and product development, as well as a large number of contract development businesses. Also, domestic firms are increasing their production operations in the region. Asia Pacific is expected to be a rising market for the production of cell and gene therapies. Cell treatment has gained traction in Asia during the last few years. This is due to the introduction of expedited approval procedures, increased healthcare requirements, and increased commercial and government spending.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 13.8 Bn |

| Revenue forecast in 2034 | USD 40.2 Bn |

| Growth rate CAGR | CAGR of 11.4% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product Type, Usage, Application, And End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Bio-Techne Corporation, Danaher Corporation, Endress+Hauser Group Services AG (Analytik Jena GmbH), General Electric Company (G.E. Healthcare), Getinge AB, Infors AG, Lonza Group Ltd, Merck KGaA, Miltenyi Biotec B.V. & Co. K.G., PIERRE GUERIN, Sartorius AG (Sartorius Stedim Biotech S.A.), Thermo Fisher Scientific Inc., and WuXi AppTec. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cell and Gene Therapy Bio-manufacturing Market By Product Type-

Cell and Gene Therapy Bio-manufacturing Market By Usage-

Cell and Gene Therapy Bio-manufacturing Market By Application-

Cell and Gene Therapy Bio-manufacturing Market By End-User-

Cell and Gene Therapy Bio-manufacturing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.