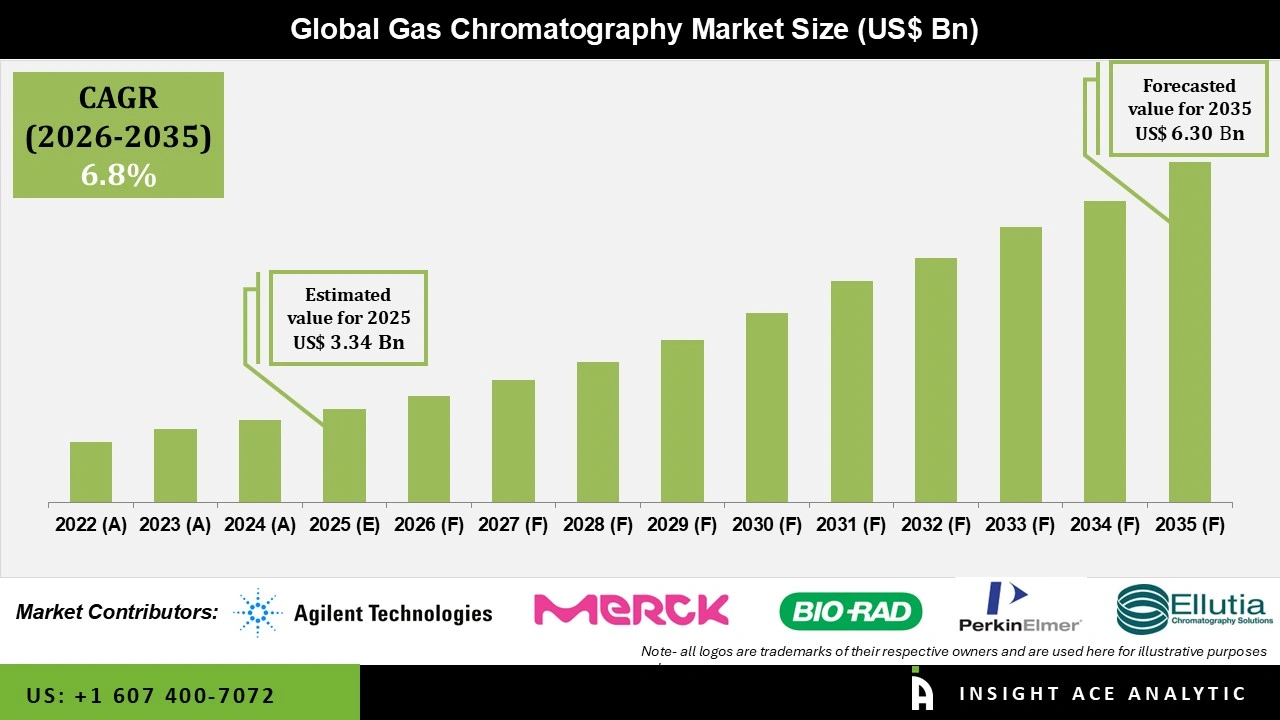

Global Gas Chromatography Market Size is valued at USD 3.34 Bn in 2025 and is predicted to reach USD 6.30 Bn by the year 2035 at a 6.8% CAGR during the forecast period for 2026 to 2035.

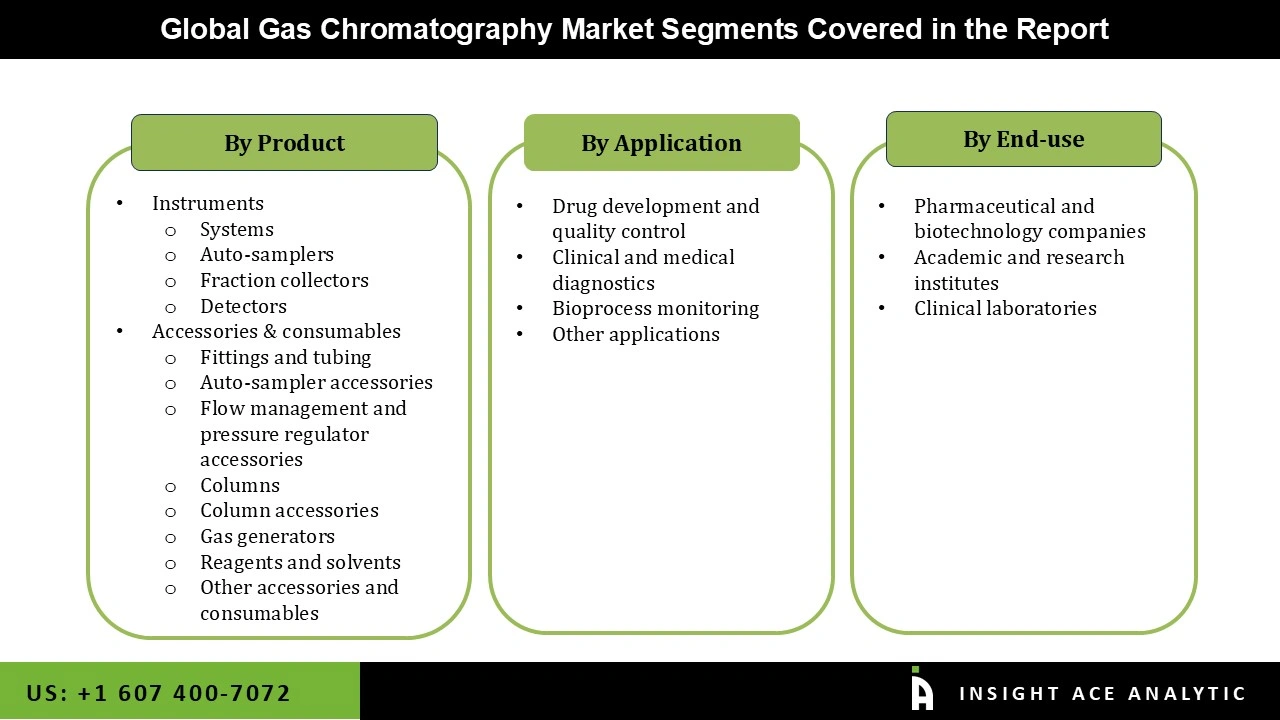

Gas Chromatography Market Size, Share & Trends Analysis Distribution by Product Type (Instruments (Systems, Detectors, Auto-samplers, Fraction Collectors) and Accessories & Consumables (Fittings and Tubing, Gas Generators, Flow Management and Pressure Regulator Accessories, Columns, Reagents and Solvents, Auto-sampler Accessories, Column Accessories, Others)), Application (Drug Development and Quality Control, Bioprocess Monitoring, Clinical and Medical Diagnostics, Others), End-user (Pharmaceutical and Biotechnology Companies, Clinical Laboratories, Academic and Research Institutes), by Region and Segment Forecasts, 2026 to 2035.

Gas chromatography (GC) remains one of the most widely applied separation techniques in analytical chemistry, enabling the high-resolution separation, identification, and quantification of volatile and semi-volatile compounds in complex matrices. The method relies on the differential partitioning of analytes between a mobile phase (inert carrier gas) and a stationary phase within a temperature-controlled column, followed by detection using sensitive detectors such as flame ionization (FID), mass spectrometry (MS), or thermal conductivity (TCD). Its exceptional reproducibility, sensitivity, and ability to handle trace-level analysis have established GC as an indispensable tool across diverse fields, including pharmaceutical quality control, environmental monitoring of persistent organic pollutants, petrochemical hydrocarbon profiling, food safety assessment, and forensic toxicology. Recent instrumental and methodological advances particularly in capillary column technology, multidimensional GC (GC×GC), and hyphenated techniques such as GC-MS/MS—have further expanded its analytical power and applicability, supporting the growing demand for precise, reliable, and high-throughput chemical analysis in both research and regulatory contexts.

The development of gas chromatography technology is one of the main factors propelling the market's expansion. By making the technique more approachable and user-friendly, instrument innovations such as compact and portable GC systems have broadened the range of gas chromatography applications. It is a more useful tool for labs due to advancements in detector technology, column efficiency, and data analysis software that improve the accuracy and dependability of results.

Additionally, advancements in GC systems, including the creation of high-resolution columns, powerful detectors, and more complex software programs, have greatly increased the accuracy, sensitivity, and adaptability, which has accelerated the expansion of the gas chromatography market. These advancements have made it possible to conduct more intricate and precise studies, especially for difficult samples in industries like pharmaceuticals and environmental science.

In addition, the expanding use of gas chromatography in a variety of industries, including forensics, petrochemicals, food and beverage, pharmaceuticals, and environmental testing, is another important reason propelling the market's expansion.

Gas chromatography is crucial to the pharmaceutical industry for quality control, complex mixture analysis, and guaranteeing regulatory compliance. It is crucial for locating active pharmaceutical ingredients (APIs) and spotting contaminants in medications. Furthermore, by detecting impurities, confirming flavour compounds, and examining food packaging materials, it is utilised in the food and beverage sector to guarantee product quality. The market for gas chromatography is expanding as a result of its versatility, which has established it as a vital instrument in various industries. However, the intricacy of these systems necessitates specific training and knowledgeable staff in order to properly operate, interpret data, and maintain the equipment. This knowledge and skill gap further restricts the growth of the gas chromatography market.

Driver

Growing Need in the Biotechnology and Pharmaceuticals Sector

The biotechnology and pharmaceutical sectors are undergoing fast change, characterized by rigorous quality control procedures, strong regulatory compliance, and notable advances in medication research. The necessity to guarantee pharmaceutical products meet the strictest safety and effectiveness requirements is driving the gas chromatography market expansion. In this context, gas chromatography has become a key technology that is essential to ensuring the stability, potency, and purity of medicinal substances. Gas chromatography makes it possible to precisely and accurately separate, identify, and quantify chemical components, ensuring that medications fulfil all necessary requirements and regulatory criteria. Additionally, gas chromatography is used in the biotechnology industry to create biopharmaceuticals, analyse complex biological samples, and assist advanced proteomics and genomics research. Gas chromatography will become increasingly important in maintaining strict quality control and compliance as the need for creative and superior pharmaceutical items rises, propelling its broad adoption and expansion in these sectors.

Restrain/Challenge

High Cost of Maintaining Gas Chromatography Devices

One major obstacle to market growth is the high cost of maintaining gas chromatography devices. The cost of advanced GC systems, especially those combined with mass spectrometry, can surpass $50,000, rendering them unaffordable for smaller labs and organisations. The financial strain is increased by operational costs like consumables and high-purity carrier gases. The cost of materials and equipment for laboratories has been steadily increasing, which has compelled many institutions to look for less expensive options, according to the U.S. Bureau of Labour Statistics. In underdeveloped nations, where funding for scientific infrastructure is scarce, this financial difficulty is especially severe. For instance, according to UNESCO, many low-income nations devote less than 1% of their GDP to R&D, which further limits access to sophisticated analytical instruments like gas chromatography.

The Accessories & Consumables category held the largest share in the Gas Chromatography market in 2025 because of its crucial function in GC systems' upkeep and operation. For precise and effective chromatographic analysis, these supplies, which include columns, syringes, vials, filters, and detectors, are essential. To preserve accuracy and performance, columns must be replaced on a regular basis. Additionally, consumables like liners, septa, and carrier gases require regular replacement due to their frequent use. Because these transactions are recurrent, suppliers benefit from a consistent and sizable income stream. The requirement for these consumables and accessories increases along with the demand for high-precision analytical testing across a range of sectors, which further propels the expansion of the gas chromatography market.

In 2025, the Drug Development and Quality Control category dominated the Gas Chromatography market. The need for contemporary analysis methods like gas chromatography has grown as a result of the pharmaceutical industry's increased quality assurance control and increasingly complex pharmaceutical procedures. It is a crucial stage in determining the drug product's safety, potency, and purity during the development and manufacturing stages. Furthermore, organizations like the FDA have strong legal requirements that need thorough study and drug confirmation, and they heavily regulate the use of pharmaceutical items. Gas chromatography is therefore essential to preserving the items' quality. The use of gas chromatography to analyze biologics and biosimilars increases its significance to the drug development process, which supports the segmental expansion of biopharmaceuticals.

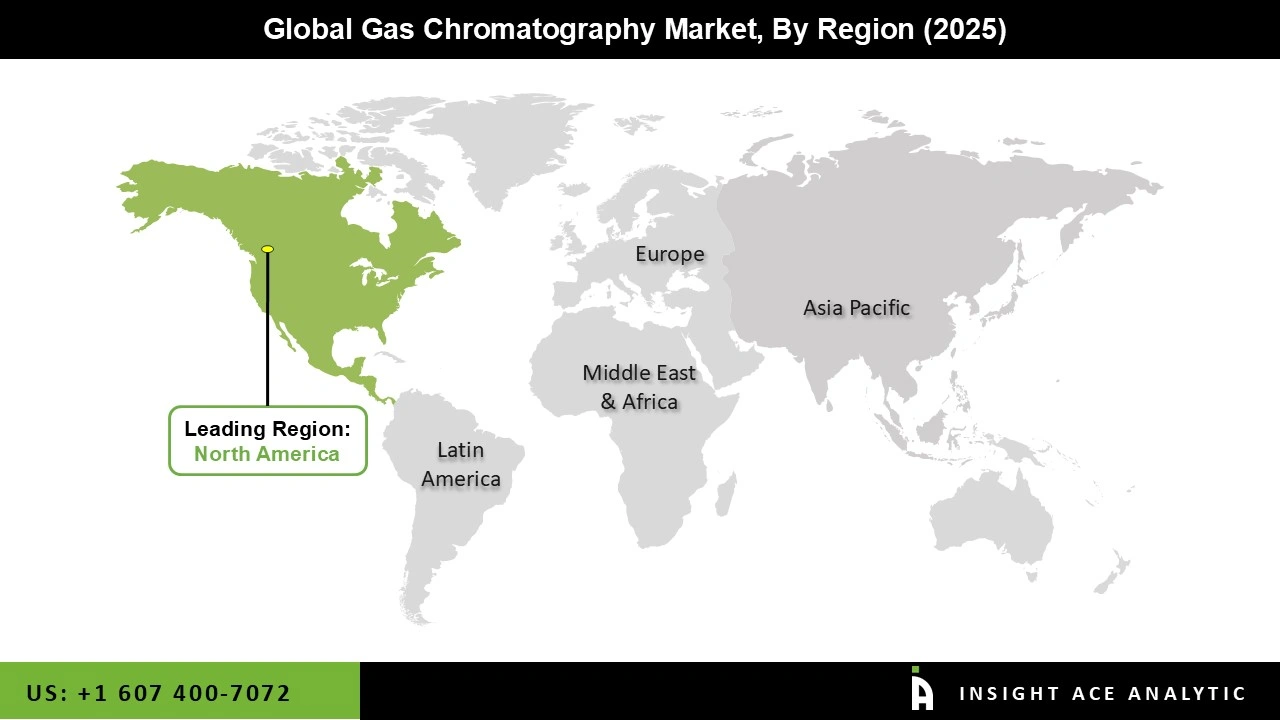

The Gas Chromatography market was dominated by the North America region in 2025 because of its vast R&D efforts, sophisticated technological infrastructure, and strict industry-wide regulations. Many pharmaceutical, biotechnology, food and beverage, and petrochemical businesses in the area mostly depend on gas chromatography for quality control and analytical testing. Furthermore, the existence of top gas chromatography manufacturers promotes ongoing innovation and the accessibility of cutting-edge systems and consumables.

The deployment of gas chromatography technology is also fueled by strict government requirements pertaining to food safety and environmental monitoring. Additionally, the North American gas chromatography market is firmly established due to the region's strong academic and research institutions, which also fuel the high demand for advanced GC equipment. Moreover, the market is expanding throughout these regions due to growing demand for accurate analytical procedures and increased investments in research and development (R&D).

• May 2025: The Agilent 8850 Gas Chromatograph (GC) was improved by Agilent Technologies Inc. to increase laboratory productivity by improving compatibility with single and triple quadrupole mass spectrometry (MS) systems and related equipment. The 8850 GC is one of the smallest and quickest benchtop GC/MS systems on the market. It was created especially for labs that need high-speed performance in a small package.

• January 2025: The Brevis GC-2050, the first gas chromatograph system in the world featuring a CO₂ reduction visualisation feature, was introduced by Shimadzu Corporation. This cutting-edge feature encourages environmentally responsible laboratory practices by enabling users to track and measure the system's energy savings. The Brevis GC-2050's strong analytical capabilities and low environmental impact are intended to serve the Green Transformation sector.

• November 2024: Thermo Fisher Scientific and a multinational chemical manufacturer have partnered to jointly develop a next-generation gas chromatography solution. The goal of this partnership is to improve the industrial applications' sensitivity and speed of volatile chemical detection. By pooling their resources and experience, the two businesses hope to develop a cutting-edge analytical instrument that will increase the precision and efficiency of chemical analysis while meeting the demands of several industries.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3.34 Bn |

| Revenue forecast in 2035 | USD 6.30 Bn |

| Growth Rate CAGR | CAGR of 6.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Merck KGaA, Agilent Technologies, Ellutia, PerkinElmer, Restek Corporation, Bio-Rad Laboratories, Shimadzu Corporation, Thermo Fisher Scientific, Phenomenex, VWR International, and SCION Instruments |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.