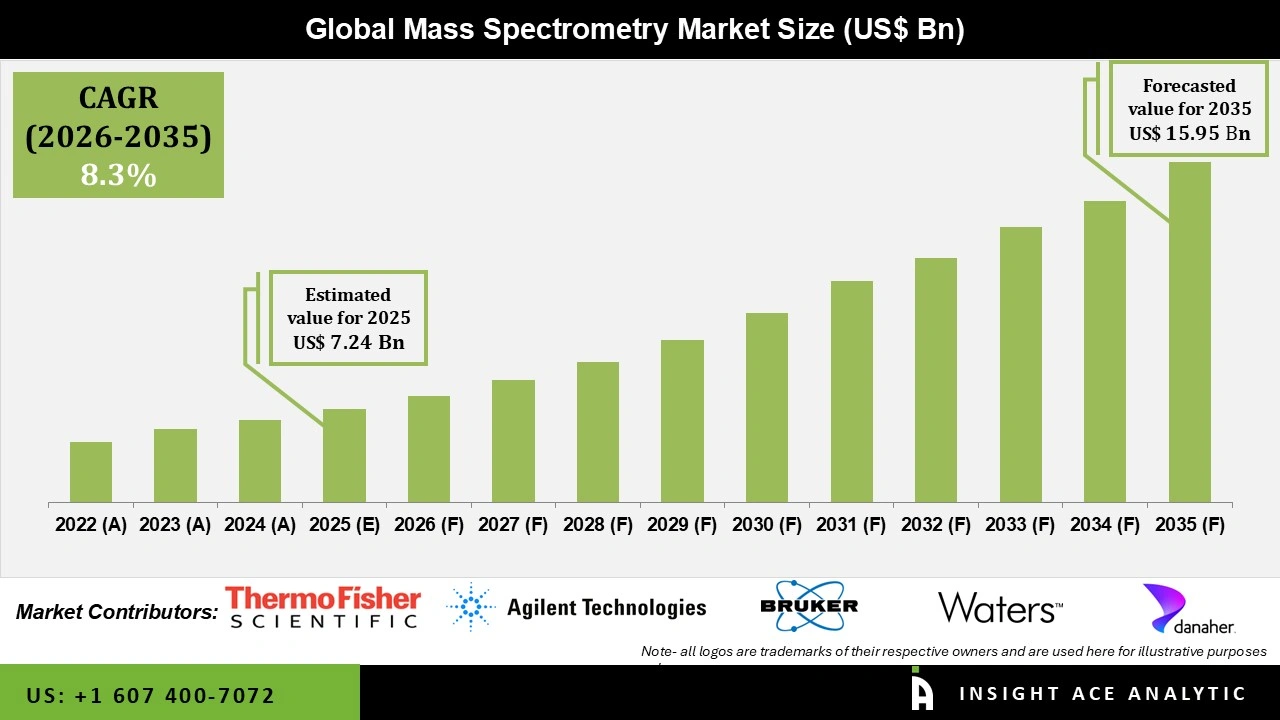

Global Mass Spectrometry Market Size is valued at USD 7.24 Bn in 2025 and is predicted to reach USD 15.95 Bn by the year 2035 at a 8.3% CAGR during the forecast period for 2026 to 2035.

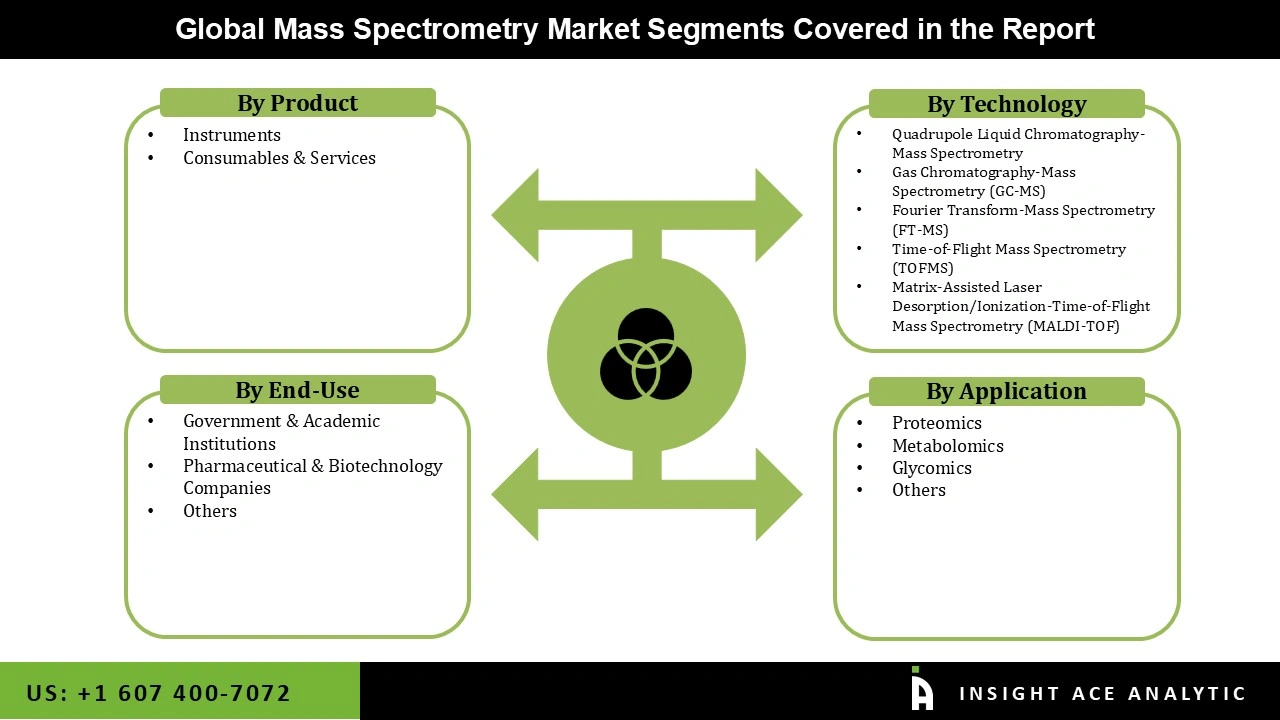

Mass Spectrometry Market Size, Share & Trends Analysis Distribution by Product Type (Consumables & Services and Instruments), Technology (Magnetic Sector Mass Spectrometry, Gas Chromatography-Mass Spectrometry (GC-MS), Quadrupole Liquid Chromatography-Mass Spectrometry, Time-of-Flight Mass Spectrometry (TOFMS), Fourier Transform-Mass Spectrometry (FT-MS), Matrix-Assisted Laser Desorption/Ionization-Time-of-Flight Mass Spectrometry (MALDI-TOF), and Others), Application (Glycomics, Proteomics, Metabolomics, and Others), End-user (Pharmaceutical & Biotechnology Companies, Government & Academic Institutions, and Others), By Region and Segment Forecasts, 2026 to 2035.

Mass spectrometry (MS) is a cornerstone analytical technique in modern biological sciences, particularly for omics-based research in proteomics, metabolomics, and lipidomics. It enables the precise identification, quantification, and structural characterisation of molecules within complex biological samples by ionising analytes and separating ions according to their mass-to-charge ratio. Due to its exceptional sensitivity, specificity, and versatility, MS has become indispensable in academic research institutions, biotechnology companies, and pharmaceutical development. In drug discovery and development, it plays a central role in metabolite identification, pharmacokinetic/pharmacodynamic studies, drug metabolism and disposition (ADME) analysis, biomarker discovery, and safety/toxicity evaluation. The technique’s expanding utility is driven by growing demand in clinical diagnostics, biotechnology, pharmaceutical research, food safety testing, and environmental analysis, supported by ongoing advancements in instrumentation, sample preparation, and data interpretation tools.

The growth of healthcare infrastructure, increased healthcare spending, and advancements in mass spectrometry (MS) technology are the main factors propelling the market. Additionally, the use of mass spectrometry has increased as a result of the increased emphasis on drug development, biomarker identification, and customized medicine. The field of metabolomics and proteome investigations is expanding in tandem with precision medicine. The importance of mass spectrometry for life sciences research is increased by the precise insights it provides into molecular pathways.

Moreover, the demand for quick contamination detection techniques has also significantly increased due to rising food sales worldwide and an increase in foodborne illness cases. The detection of poisons, pesticide residues, and allergies in food is a common use for mass spectrometry. Over the course of the projected period, these factors are therefore expected to accelerate the mass spectrometry market expansion.

In addition, another key factor driving the mass spectrometry market expansion is the development of technology. Small in both size and weight, a compact mass spectrometer is portable and simple to use. It has become very popular among food safety inspectors and doctors.

Furthermore, the development of technologically sophisticated mass spectrometers has become necessary due to the growing biomedical sector's advancements and the growing demand for mass spectrometry in metabolomics, lipidomics, and genomics. Additionally, the fact that organizations and regulatory authorities have issued recommendations and guidelines for the use of mass spectrometry in proteomics is another important driver propelling the market's growth. For instance, the Human Proteome Organization's Human Proteome Project (HPP) revised the standards for interpreting data from mass spectrometry. However, a major barrier to adoption, especially for smaller labs, is the expensive cost of mass spectrometry equipment.

Driver

Growing Focus on Molecular-level Understanding in Proteomics and Metabolomics

One of the main factors propelling the mass spectrometry market's expansion is the growing focus on molecular-level understanding in proteomics and metabolomics. In order to facilitate accurate biomolecule identification, post-translational modification studies, and pathway mapping, academic institutions and advanced research labs are making significant investments in high-resolution MS equipment. Mass spectrometry is used in pharmaceutical research to describe biological drug candidates, evaluate protein structures, and identify minute molecular changes that are not detectable by conventional analytical methods. Furthermore, the need for in-depth biomarker research has increased due to the global rise in chronic and lifestyle diseases, with MS methods playing a key role. The adoption in upscale research settings is being driven by the expansion of multi-omics processes, the integration of MS with automation and chromatography, and rising financing for biomedical innovation. For instance, Bruker's timsTOF Pro 2 supports deep-coverage proteomics processes by enabling acquisition speeds of up to 200 Hz and consistently identifying over 7,000 human proteins in a single LC-MS run.

Restrain/Challenge

High Initial and Ongoing Expenditures

A major barrier to the mass spectrometry market's expansion is the high initial and ongoing expenditures. High upfront costs make advanced mass spectrometry equipment, particularly those with cutting-edge features like high-resolution detectors and AI integration, unaffordable for small and medium-sized labs or emerging markets. Furthermore, owing to their intricacy, these devices require frequent, frequently expensive maintenance, calibration, and expert assistance in order to guarantee peak performance and accuracy. Contracts for maintenance and the requirement for specialist staff raise operating costs even more. For instance, Thermo Fisher's Orbitrap mass spectrometers can be too costly for smaller labs, as can their service contracts. These financial obstacles may restrict adoption, especially in areas with high costs or in sectors with limited resources, which could impede market expansion even in the face of growing demand.

The Gas Chromatography-Mass Spectrometry (GC-MS) category held the largest share in the Mass Spectrometry market in 2025, driven by its remarkable capacity to accurately and sensitively isolate, identify, and measure volatile and semi-volatile chemicals. Due to its reliability, repeatability, and established analytical databases, GC-MS is extensively used in forensic investigations, pharmaceutical research, environmental testing, food safety analysis, and petrochemical applications. Additionally, the need for GC-MS systems is being greatly boosted by the growing regulatory scrutiny of pollutants, pesticides, residual solvents, and dangerous substances across industries. The breadth of its applications is being further expanded by technological developments such as increased automation, ionization procedures, higher scanning rates, and integration with sophisticated data analysis tools.

In 2025, the Metabolomics category dominated the Mass Spectrometry market because of the emphasis placed on metabolic pathways and how they relate to disease, health, and the creation of new treatments. Since their research necessitates very sensitive and high-resolution analytical equipment, this section makes mass spectrometry the appropriate platform for such studies. With the growing interest in precision medicine, nutritional science, and biomarker identification, metabolomics processes are being adopted more and more in academic, clinical, and pharmaceutical research. Metabolite profiling enhances proteomics, glycomics, and genomes to provide a more thorough understanding of biology. Consequently, it is anticipated that the use of mass spectrometry in this field would grow quickly.

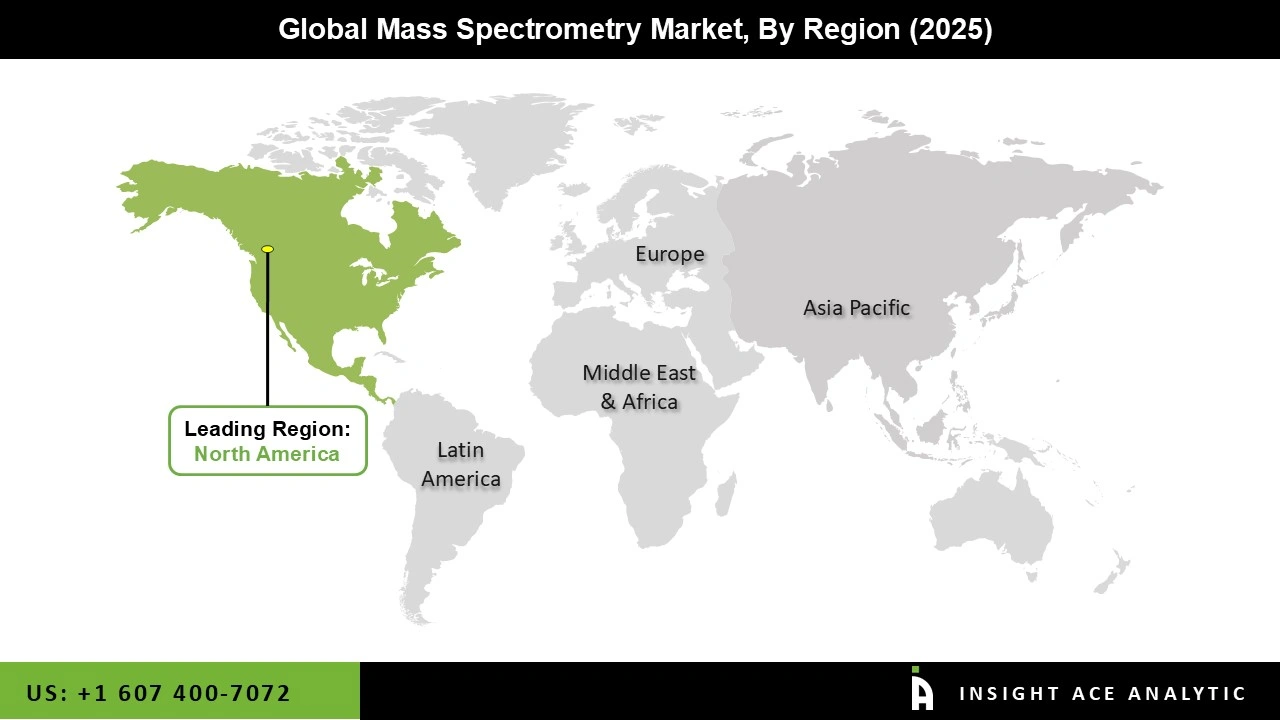

The Mass Spectrometry market was dominated by the North America region in 2025. The regional market is expanding due to a number of factors, including sophisticated healthcare infrastructure, high healthcare costs, a large number of industry participants, and strict government controls in the biotechnology and pharmaceutical industries. Additionally, the region is experiencing a significant demand for mass spectrometers due to growing worries about food safety, established healthcare infrastructure, technological breakthroughs in MS, and new GMP and GDP certifications for pharmaceutical excipients.

Furthermore, the region's manufacturers have a lot of potential to generate income due to the growing use of mass spectrometers in clinical testing and proteomics, as well as the rising demand for sophisticated MS products. The growing number of partnerships and acquisitions, as well as the introduction of new products, are some of the major trends in the North American market.

June 2025: Thermo Scientific Orbitrap Astral Zoom and Orbitrap Excedion Pro mass spectrometers (MS) were introduced by Thermo Fisher Scientific Inc. These products offer speed and analytical performance. Additionally, the tools reveal intricate biological mechanisms that promote precision therapy and provide new understanding of illnesses like cancer and Alzheimer's.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 7.24 Bn |

| Revenue forecast in 2035 | USD 15.95 Bn |

| Growth Rate CAGR | CAGR of 8.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Technology, Application, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Bruker Corporation, Danaher Corporation (SCIEX), Waters Corporation, Rigaku Corporation, LECO Corporation, JEOL Ltd., Shimadzu Corporation, and PerkinElmer, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.