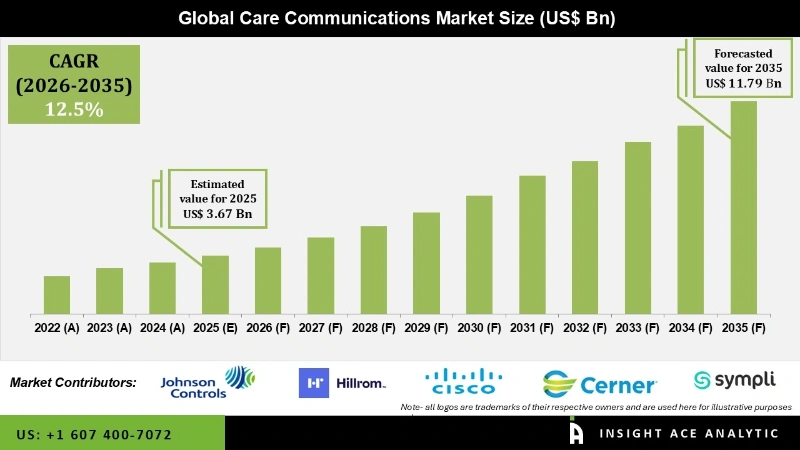

Global Care Communications Market Size is valued at USD 3.67 Bn in 2025 and is predicted to reach USD 11.79 Bn by the year 2035 at a 12.5% CAGR during the forecast period for 2026 to 2035.

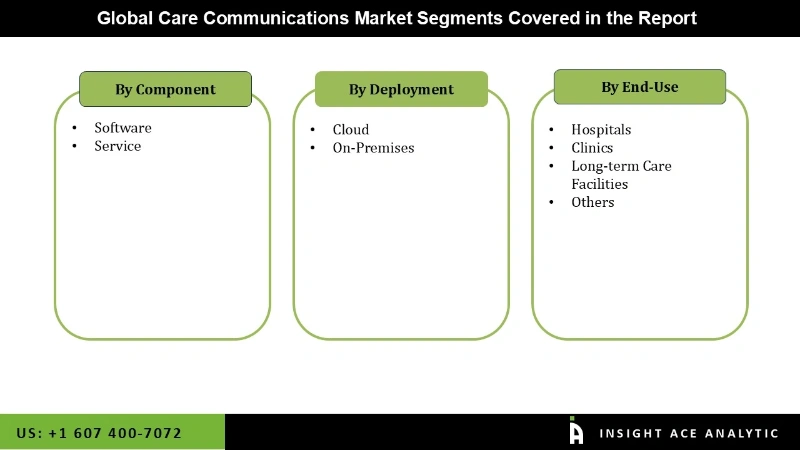

Care Communications Market Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment (Cloud, On-Premises), By End-Use (Hospitals, Clinics, Long-term Care Facilities, Others), By Region, And By Segment Forecasts, 2026 to 2035.

Care Communications Market Key Takeaways:

|

Care communication pertains to the exchange of information and interactions among healthcare professionals, patients, and their families, intending to ensure the delivery of safe, effective, and patient-centred healthcare. The swift expansion of telehealth and telemedicine has notably heightened the need for communication solutions facilitating remote consultations, video conferencing, and secure messaging between healthcare providers and patients.

Furthermore, the shift towards patient-centred care underscores the significance of efficient communication between patients and their healthcare providers, resulting in a growing demand for communication tools and platforms that empower patients to take an important role in their care.

Moreover, engaging patients in managing their healthcare can yield improved outcomes, which fuels the demand for communication tools that enhance patient engagement, such as patient portals and mobile apps. This technological advancement promises enhanced access to patients' medical records, more effective patient-related communication, and improved administrative processes. All these advantages are expected to propel the CC&C market's rapid growth in the coming years.

The care communications market is segmented on the basis of component type, deployment and end users. The product segment is segmented as software and services. By application, the market is segmented into cloud and on-premises. According to end users, the market is segmented as hospitals, clinics, long-term care facilities and others.

The software category is likely to hold a major share of the global Care Communications market in 2024. The expansion in revenue within the software sector is propelled by the growing utilization of digital technologies in the healthcare sector. Healthcare institutions are swiftly integrating clinical communication and collaboration software to enhance clinical procedures, elevate the quality of patient care, and lower costs. This software enables healthcare practitioners to securely exchange vital patient information, engage in real-time collaboration, and access clinical data from any location. Moreover, it streamlines administrative responsibilities and enhances the efficiency of clinical operations, thereby enabling healthcare providers to prioritize their efforts in delivering patient care.

The on-premises segment is likely to grow at a rapid rate in the global Care Communications market. The rising utilization of data storage and access systems in healthcare facilities, like hospitals and clinics, is driving the expansion of the on-premises segment. These healthcare institutions have bolstered their IT infrastructure to accommodate increasing data requirements. In the past, these organizations were cautious about adopting cloud-based deployment methods and favoured on-premises solutions because they give IT administrators greater control over physical data centres. The increased investments made by hospitals and clinics to improve their IT infrastructure have played a crucial role in boosting the revenue of this segment.

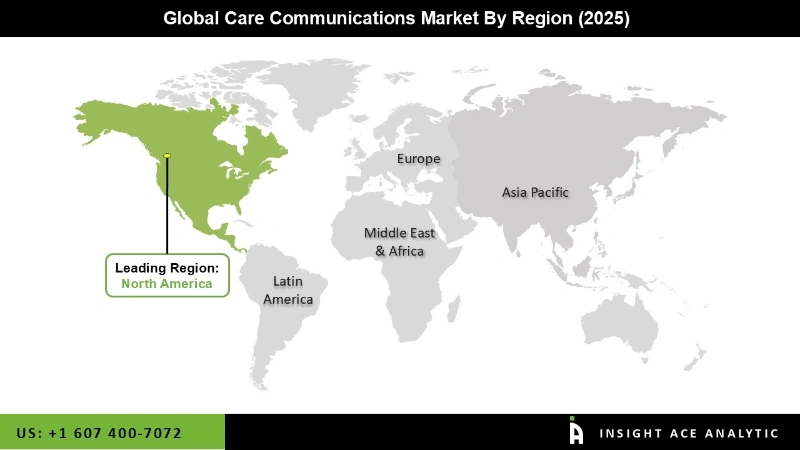

The North America Care Communications market is expected to register the highest market share factors, such as evolving healthcare regulations, technological advancements, and the need for improved patient care and operational efficiency. As healthcare organizations across Europe continue to adopt digital technologies and telehealth solutions, the care communications market is expected to expand further. This growth is pushed by ongoing efforts to enhance healthcare communication and collaboration, ultimately leading to better patient outcomes and experiences. In addition, Asia Pacific is estimated to grow at a rapid rate in the global Care Communications market. This market encompasses various products and services to enhance communication and collaboration among healthcare professionals, patients, and other stakeholders. These communication solutions aim to improve the quality of patient care, streamline administrative processes, and enhance overall efficiency in healthcare delivery.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.67 Bn |

| Revenue Forecast In 2035 | USD 11.79 Bn |

| Growth Rate CAGR | CAGR of 12.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, Deployment, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Johnson Controls International Plc, Hill-Rom Holdings, Inc., Cisco Systems Inc., Cerner Corporation, Symplr, Koninklijke Philips N.V., NEC Corporation, Plantronics, Inc., Vocera Communications, Avaya LLC, and Spok Holdings, Inc. Jive Sotware, Microsoft Corporation, Everbridge, Ascom, TigerConnect, UDG Healthcare PLC, Intelligent Business Communication, Voalte |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Care Communications Market By Component

Care Communications Market By Deployment

Care Communications Market By End-Use

Care Communications Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.