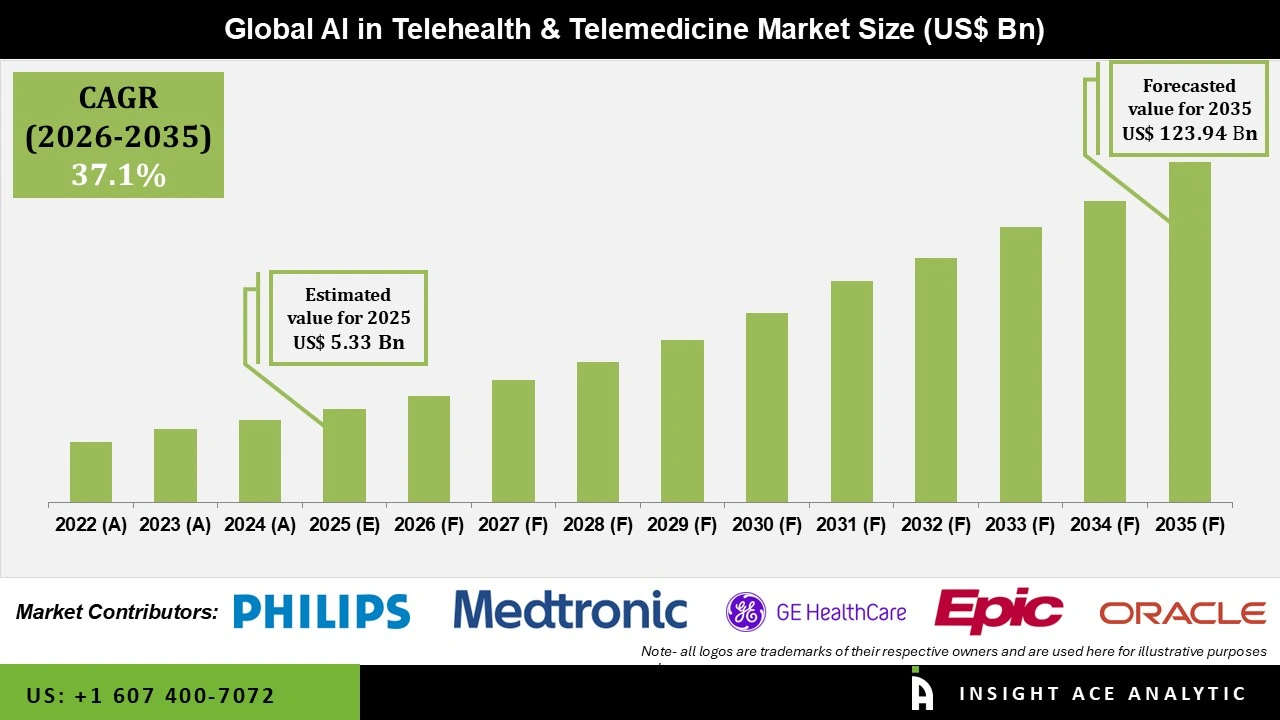

Global AI in Telehealth and Telemedicine Market Size is valued at US$ 5.33 Bn in 2025 and is predicted to reach US$ 123.94 Bn by the year 2035 at an 37.1% CAGR during the forecast period for 2026 to 2035.

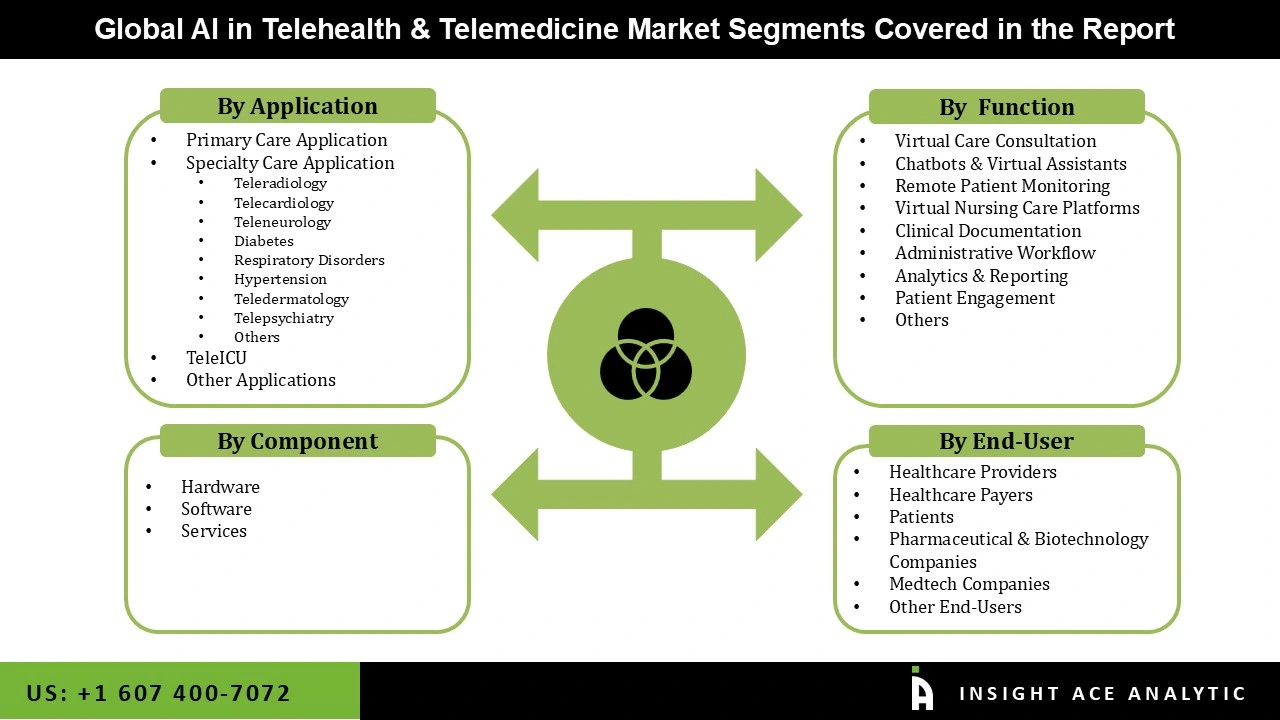

AI in Telehealth and Telemedicine Market Size, Share & Trends Analysis Distribution by Component (Hardware, Software, and Services), By Function (Virtual Care Consultation, Chatbots & Virtual Assistants, Remote Patient Monitoring, Virtual Nursing Care Platforms, Clinical Documentation, Administrative Workflow, Analytics & Reporting, Patient Engagement, and Others), By Application (Primary Care Application, Specialty Care Application, Teleicu and Other Applications), By End-User (Healthcare Providers, Healthcare Payers, Patients, Pharmaceutical & Biotechnology Companies, Medtech Companies, and Other End-Users) and Segment Forecasts, 2026 to 2035

AI in telehealth and telemedicine refers to the integration of artificial intelligence technologies to enhance remote healthcare delivery, enabling efficient diagnosis, monitoring, treatment, predictive insights, and improved patient-provider interactions across digital platforms. A major driver for AI in telehealth and telemedicine is the rising demand for remote patient monitoring (RPM). With chronic diseases on the rise, an ageing global population, and a need to reduce hospital visits, healthcare systems are increasingly relying on AI-powered RPM tools.

These solutions continuously track patient vitals, detect anomalies early, and send alerts to physicians for timely intervention. AI enhances predictive analytics, helping doctors anticipate complications and reduce emergency admissions. Additionally, post-pandemic, patients prefer virtual care for convenience and safety. The integration of wearable devices with AI-based telemedicine platforms enables more accurate, efficient, and scalable remote healthcare delivery.

The AI in the telehealth & telemedicine market is expanding rapidly as healthcare providers integrate advanced algorithms to expand patient monitoring, diagnostics, and treatment delivery remotely. AI-powered systems extend decision-making, reduce operational costs, and personalize care through predictive analytics and virtual health assistants.

A major driver is the increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders, which need continuous monitoring and timely intervention. AI-driven telemedicine enables real-time data analysis from wearable devices and remote sensors, helping clinicians detect health deterioration early and deliver proactive care. This significantly enhances patient outcomes while reducing hospital readmissions and overall healthcare burdens.

· Koninklijke Philips N.V. (Netherlands)

· Medtronic (Ireland)

· GE Healthcare (US)

· Epic Systems Corporation (US)

· Oracle (US)

· Doximity, Inc. (US)

· Teladoc Health, Inc. (US)

· American Well (US)

· Siemens Healthineers AG (Germany)

· Cisco Systems Inc. (US)

· Included Health, Inc. (US)

· AMC Health (US)

· TeleSpecialists (US)

· Walgreen Co. (US)

· Caregility (US)

· CVS Health (US)

· AliveCor, Inc. (US)

· Elation (US)

· Health Tap, Inc. (US)

· ZoomCommunications, Inc. (US)

The AI in telehealth & telemedicine market is segmented by component, function, application, and end-user. By component, the market is segmented into hardware, software, and services. By function, the market is segmented into virtual care consultation, chatbots & virtual assistants, remote patient monitoring, virtual nursing care platforms, clinical documentation, administrative workflow, analytics & reporting, patient engagement, and others. By application, the market is segmented into primary care application, specialty care application, teleicu and other applications. By end-user, the market is segmented into healthcare providers, healthcare payers, patients, pharmaceutical & biotechnology companies, medtech companies, and other end-users.

In 2024, the chatbots & virtual assistants held the major market share due to the rising demand for advanced technologies to improve accessibility, efficiency, and patient outcomes. AI tools such as chatbots and virtual assistants are playing a transformative role by automating appointment scheduling, offering preliminary diagnoses, guiding patients through symptom checks, and providing mental health support. Rising demand for remote healthcare services, shortage of medical professionals, and growing adoption of 24/7 patient engagement solutions are major drivers. These technologies reduce clinician workload, enhance patient satisfaction, and lower healthcare costs, fueling strong market growth.

The AI in telehealth & telemedicine market is dominated by healthcare providers due to rising adoption of advanced technologies to enhance patient care, reduce costs, and improve operational efficiency. AI-driven tools allow real-time patient monitoring, predictive analytics, and clinical decision support, permiting providers to detect early warning signs and deliver personalized treatment. Virtual assistants streamline administrative tasks, while natural language processing enhances documentation and patient interactions. Rising need for remote consultations, chronic disease management, and post-operative monitoring drives adoption, positioning AI as a critical enabler for scalable, efficient, and accessible healthcare delivery.

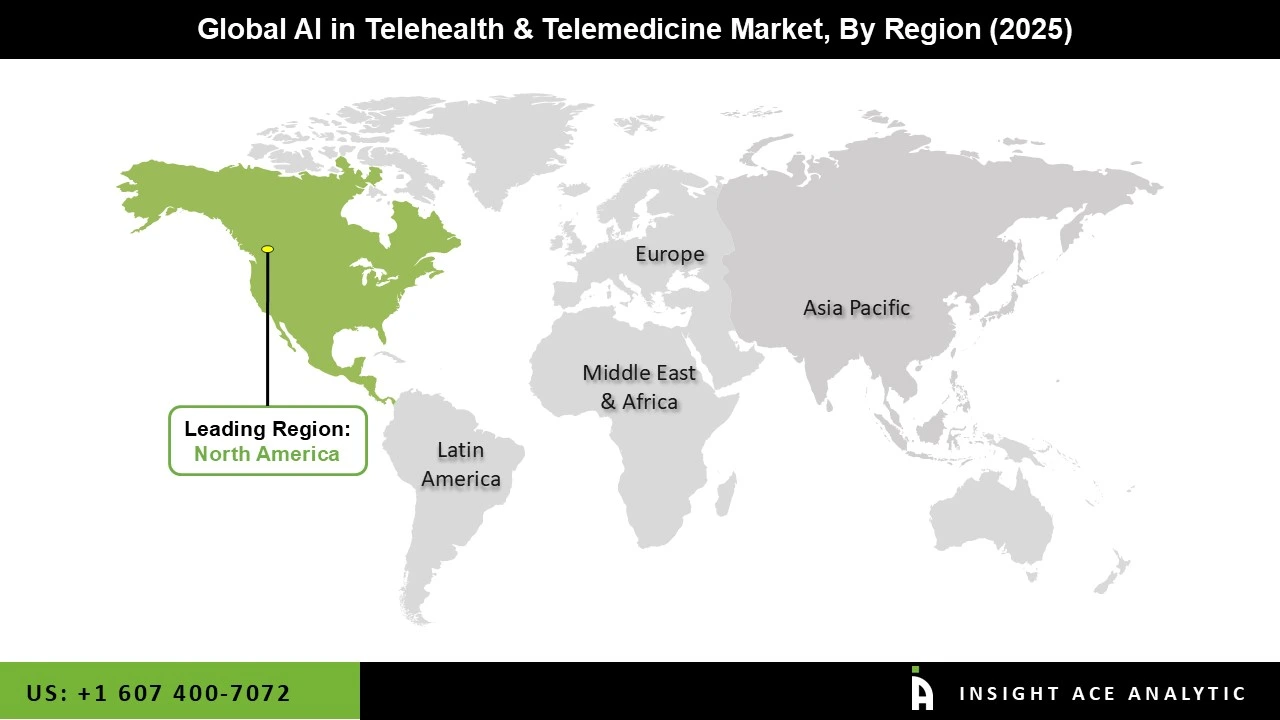

North America dominates the market for AI in telehealth & telemedicine due to region’s rising demand for remote healthcare, cutting-edge digital infrastructure, and growing adoption of AI-powered diagnostic tools. Rising prevalence of chronic diseases and an aging population are driving providers to implement AI-driven platforms for predictive analytics, personalized care, and efficient triage. Supportive government initiatives, investments in digital health, and increasing consumer acceptance of virtual consultations further accelerate adoption. Integration of AI with wearable devices and EHRs expands accuracy, efficiency, and accessibility of healthcare services.

Moreover, Europe's AI in telehealth & telemedicine market is also fueled by region’s rising need for remote healthcare services, efficiency in clinical workflows, and rising digital adoption in hospitals. AI-powered tools enhance diagnostics, patient monitoring, and personalized treatment while decreasing healthcare expenses. The growing elderly population, higher prevalence of chronic diseases, and supportive EU regulations on digital health further accelerate adoption. Moreover, post-pandemic emphasis on virtual care and integration of AI in electronic health records is reinforcing the market’s expansion across Europe.

| Report Attribute | Specifications |

| Market Size Value In 2025 | US$ 5.33 Bn |

| Revenue Forecast In 2035 | US$ 123.94 Bn |

| Growth Rate CAGR | CAGR of 37.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, By Function, By Application, By End-User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Epic Systems Corporation (US), Oracle (US), Doximity, Inc. (US), Teladoc Health, Inc. (US), American Well (US), Siemens Healthineers AG (Germany), Cisco Systems Inc. (US), Included Health, Inc. (US), AMC Health (US), TeleSpecialists (US), Walgreen Co. (US), Caregility (US), CVS Health (US), AliveCor, Inc. (US), Elation (US), Health Tap, Inc. (US), and ZoomCommunications, Inc. (US) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

· Hardware

· Software

· Services

· Virtual Care Consultation

· Chatbots & Virtual Assistants

· Remote Patient Monitoring

· Virtual Nursing Care Platforms

· Clinical Documentation

· Administrative Workflow

· Analytics & Reporting

· Patient Engagement

· Others

· Primary Care Application

· Specialty Care Application

o Teleradiology

o Telecardiology

o Teleneurology

o Diabetes

o Respiratory Disorders

o Hypertension

o Teledermatology

o Telepsychiatry

o Others

· TeleICU

· Other Applications

· Healthcare Providers

· Healthcare Payers

· Patients

· Pharmaceutical & Biotechnology Companies

· Medtech Companies

· Other End-Users

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.