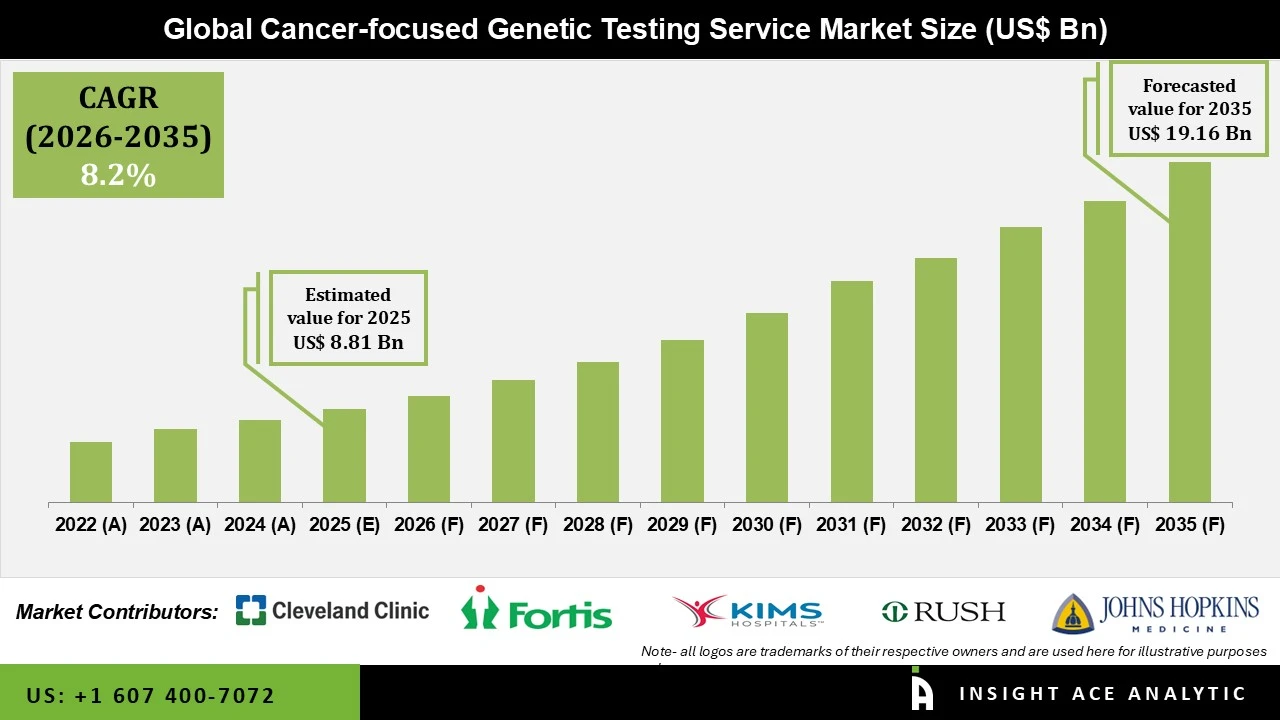

Cancer focused Genetic Testing Service Market Size is valued at USD 8.81 billion in 2025 and is predicted to reach USD 19.16 billion by the year 2035 at an 8.2% CAGR during the forecast period for 2026 to 2035.

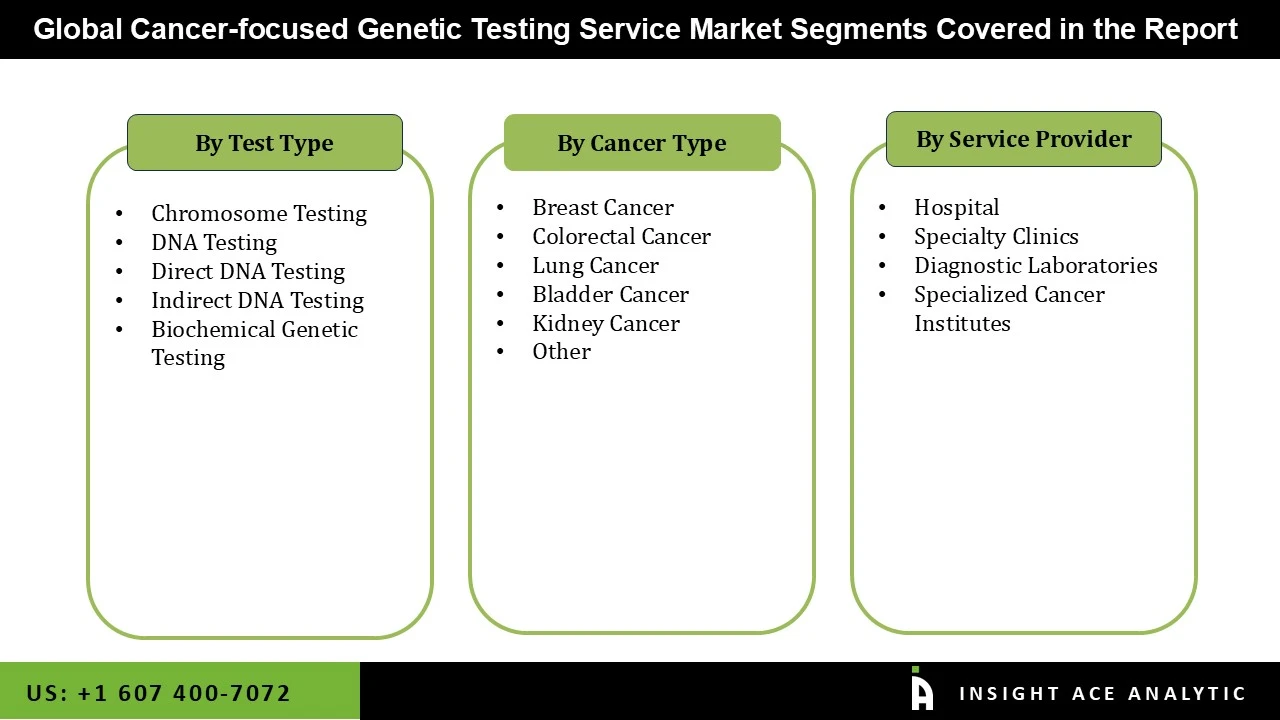

Cancer focused Genetic Testing Service Market Size, Share & Trends Analysis Report By Test Type (Chromosome Testing, DNA Testing, Direct DNA Testing, Indirect DNA Testing, Biochemical Genetic Testing), By Cancer Type (Breast Cancer, Colorectal Cancer, Lung Cancer, Bladder Cancer, Kidney Cancer, Other), By Service Provider, By Region, And By Segment Forecasts, 2026 to 2035

Cancer focused Genetic Testing Service Market Key Takeaways:

|

Genetic testing services that specifically target cancer are an essential part of contemporary oncology, providing substantial advantages in evaluating risk, preventing the disease, and tailoring treatment to individual patients. Through comprehending genetic predispositions, individuals and healthcare practitioners can make well-informed judgments that enhance outcomes and potentially preserve lives.

The increasing prevalence of cancer worldwide is fueling the need for specialized genetic testing services tailored to cancer detection. Prompt detection and personalized therapy are crucial as the prevalence of cancer increases. Genetic testing services have the ability to identify gene mutations that drive the likelihood of developing cancer, allowing for focused treatment and preventative strategies. These services are also more precise and efficient due to the utilization of advanced genetic testing technologies such as next-generation sequencing (NGS). Next-generation sequencing (NGS) rapidly and comprehensively examines many genes, unveiling an individual's genetic makeup and susceptibility to cancer. This technique has facilitated cost reduction and simplification of genetic testing, hence fostering the growth of the sector.

The cancer-specific genetic testing business faces obstacles due to regulatory and ethical concerns, despite its increasing potential. The development and adoption of novel diagnostic technologies might be hindered by restrictions on patient privacy and the exploitation of genetic data. Issues such as hereditary discrimination and the psychological impact of test results add complexity to the situation. Specialized expertise is required for the interpretation of genetic data, so skilled specialists are necessary. The limited availability of these experts might impede the collaboration of genetic testing into clinical practice.

The Cancer-focused Genetic Testing Service market is segmented on the basis of Test Type, Cancer Type, and Service Provider. Based on Test Type segment, the market is divided into Chromosome Testing, DNA Testing, Direct DNA Testing, Indirect DNA Testing, and Biochemical Genetic Testing. By Cancer Type, the market is segmented into Breast Cancer, Lung Cancer, Bladder Cancer, Colorectal Cancer, Kidney Cancer, and Others. By service providers, the market is segmented into hospitals, speciality clinics, diagnostic laboratories, and specialized cancer institutes.

The Breast Cancer sub-segment is expected to hold a major share in the global Cancer-focused Genetic Testing Service market in 2023. Breast cancer, a widespread kind of cancer that affects women worldwide, often does not exhibit clear signs in its first stages. The proliferation of private diagnostic centres for breast cancers worldwide may be ascribed to escalating demand for diagnostic imaging operations and the increasing burden on public hospitals, which often have restricted access to imaging modalities. In response to this prevailing pattern, FUJIFILM Corporation developed NURA, a dedicated medical screening facility with a specific emphasis on cancer screening, located in Bangalore, India. This facility is a partnership between FUJIFILM DKH LLP (FUJIFILM DKH) and Dr. Kutty's Healthcare (DKH). FUJIFILM DKH LLP is a collaborative partnership between FUJIFILM and Dr. Kutty's Healthcare, a healthcare provider that manages hospitals and screening facilities across India and the Middle East.

Conversely, the diagnostic laboratory category is seeing the most rapid growth among end users in the worldwide genetic testing market. Genetic testing firms are forming partnerships and collaborations with digital labs, resulting in a rapid increase in their growth rate. Thermo Fisher Scientific has facilitated genetic research in labs by offering tools such as NGS (Next-Generation Sequencing) and quantitative PCR. The use of these emerging technologies will facilitate the detection and analysis of genetic testing, hence stimulating market growth throughout the projected timeframe.

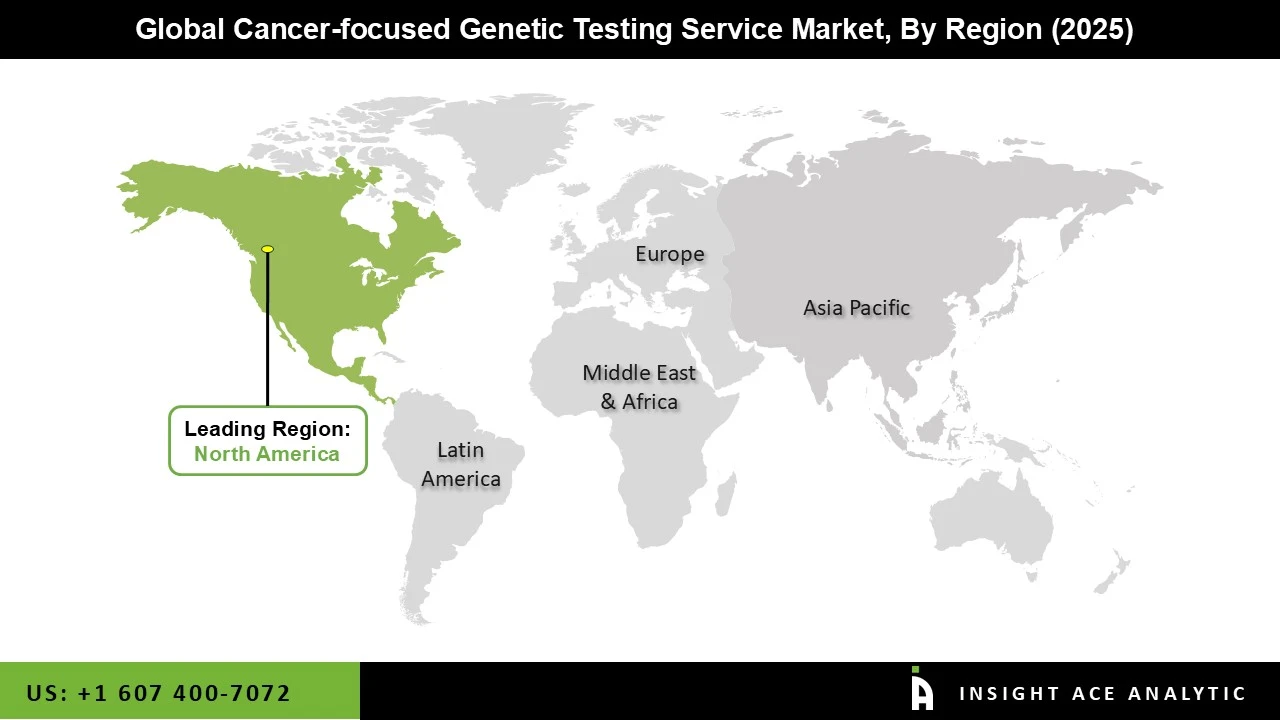

North America leads the way in market innovation due to its robust healthcare infrastructure, rapid technology advancements, and elevated prevalence of cancer. Prominent industry leaders emphasize the advancement of genetic testing capabilities to provide complete solutions for tailored cancer treatment and prevention.The market is also propelled by government initiatives targeted at fostering accessible healthcare and advancements in genetic research and technology.

Leading companies in these fields use artificial intelligence and big data analytics to improve the accuracy and efficiency of genetic testing, hence fueling their rapid expansion in the market. Moreover, The Asia-Pacific region is at the forefront of the market for cancer-focused genetic testing services. This phenomenon may be attributed to the fast development of the healthcare sector and the growing incidence of cancer, both of which are fueled by significant investments. These nations benefit from the increase in healthcare expenditure, the expansion of the middle-class population, and the increasing recognition of the benefits of genetic testing for cancer therapy.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 8.81 Bn |

| Revenue Forecast In 2035 | USD 19.16 Bn |

| Growth Rate CAGR | CAGR of 8.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Test Type, Cancer Type And Service Provider |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Cleveland Clinic, Fortis Healthcare, KIMS Hospitals, Rush University Medical Center, The Johns Hopkins Hospital, Bridgeport Hospital, Greenwich Hospital, Lawrence Memorial Hospital, Westerly Hospital, Yale New Haven Hospital, and Northeast Medical Group. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cancer-focused Genetic Testing Service Market By Test Type -

Cancer-focused Genetic Testing Service Market By Cancer Type -

Cancer-focused Genetic Testing Service Market By Service Provider-

Cancer-focused Genetic Testing Service Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.