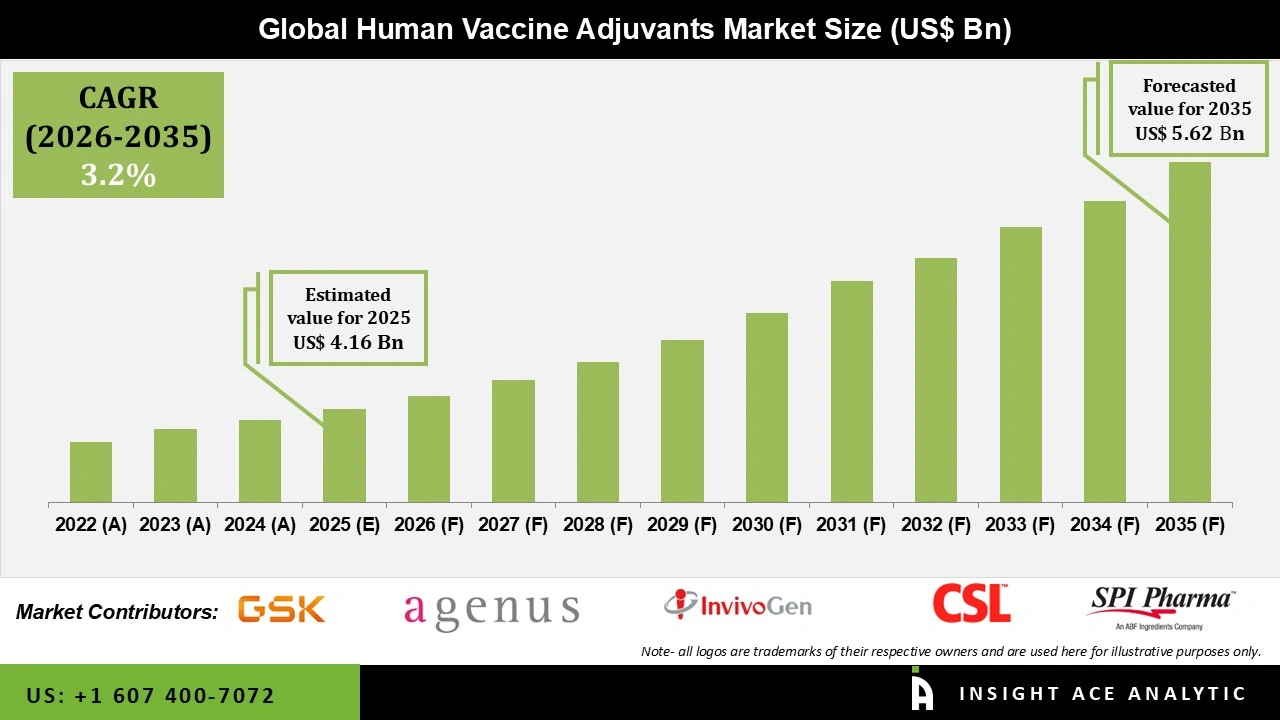

Global Human Vaccine Adjuvants Market Size is valued at USD 4.16 Bn in 2025 and is predicted to reach USD 5.62 Bn by the year 2035 at a 3.2% CAGR during the forecast period for 2026 to 2035.

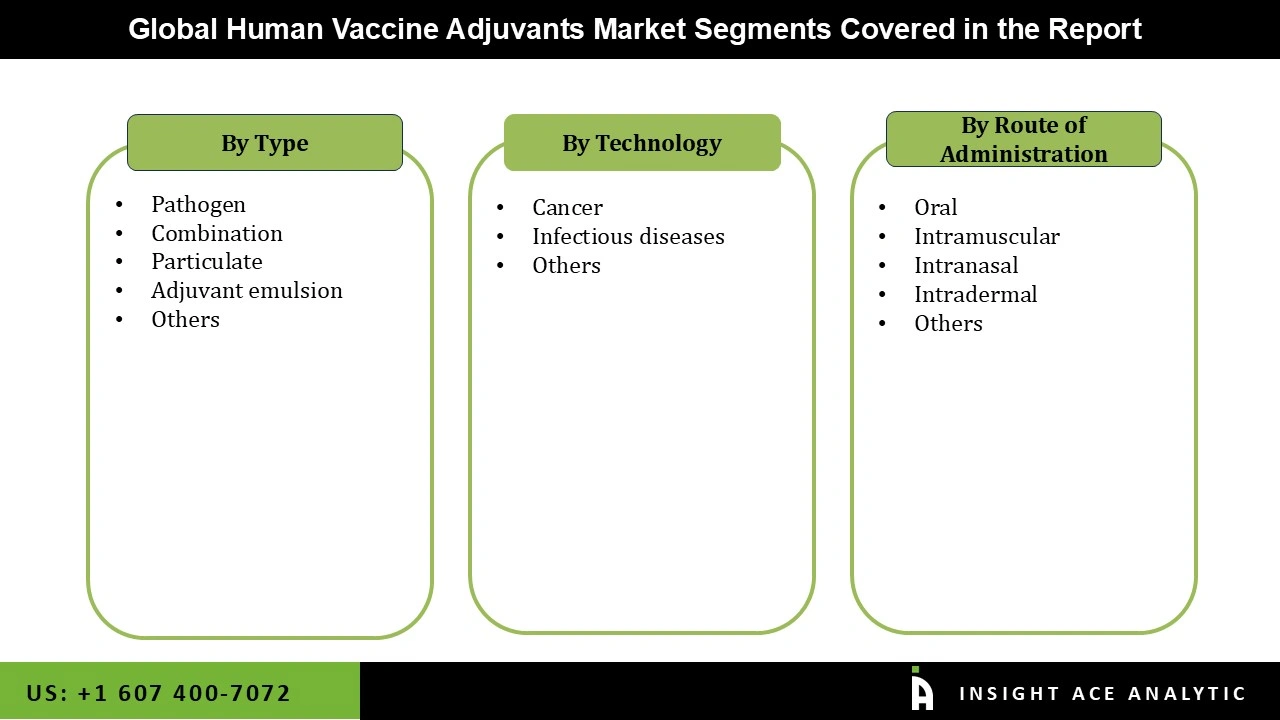

Human Vaccine Adjuvants Market Size, Share & Trends Analysis Distribution by Type (Pathogen, Combination, Particulate, Adjuvant emulsion, and Others), Application (Cancer, Infectious diseases, and Others), Route of Administration (Oral, Intramuscular, Intranasal, Intradermal, and Others), and Segment Forecasts, 2026 to 2035

Vaccine adjuvants are substances or components included in vaccines that strengthen the immune response by boosting the body's immunogenic reaction to antigens that are not immunostimulatory. It is a substance added to a vaccine to enhance the vaccine's immunological response. By lowering antigen doses, reducing the number of vaccination sessions, and improving antigen stability, it enhances the immunological response to vaccines. Aluminum salts, such as aluminum hydroxide and aluminum phosphate, are frequently used adjuvants and are well-known for their efficacy in approved vaccines. By boosting the immune system's response to antigens, adjuvants increase the efficacy of vaccinations. The market for vaccine adjuvants is expanding rapidly worldwide due to the increasing prevalence of infectious diseases, significant advances in immunology and vaccine technology, and growing awareness of rare diseases.

The human vaccine adjuvants market is expected to rise due to a number of causes, including the increasing global focus on personalized medicine, which modifies vaccination formulations to meet each person's specific immunological demands and accounts for a significant portion of this growth. Moreover, novel technologies in bioinformatics and systems biology have led to a greater knowledge of immune responses and subsequent improvement in adjuvant design, contributing greatly to the growth of the vaccination adjuvants market growth. Furthermore, the introduction of therapeutic vaccines for long-term illnesses like cancer and Alzheimer's has created a major opportunity to broaden the adjuvant's use, and the increase in antibiotic resistance necessitates the creation of stronger vaccines, which is driving the market expansion for vaccine adjuvants. Additionally, a number of environmental shifts and increased disease risks have driven dynamic changes, necessitating ongoing adjuvant innovation.

However, vaccines are subject to strict regulations, and the approval process can be lengthy and complex. This may result in the removal of current vaccinations from the human vaccine adjuvants market and postpone the release of new vaccines. It may also be challenging for new businesses to enter the market due to the protracted approval process. Though promising, the future presents a variety of opportunities. The COVID-19 pandemic has accelerated the investments in the human vaccine adjuvants market. As a result, the market analysis of vaccine adjuvants continues to expand, and the investigation of new adjuvants to transform vaccine design enhances global health safety. The shift toward adjuvant systems that can stimulate both humoral and cellular immunity is another opportunity driving the growth of the human vaccine adjuvants market. In addition, rising innovations in adjuvants, including emulsions, saponin-based adjuvants, and toll-like receptor agonists (TLRs), is projected to increase market acceptance and expansion during the forecast period.

Driver

Rising Incidence of Infectious Illnesses

The increased need for vaccine adjuvants is largely due to the rising incidence of infectious illnesses, including influenza, hepatitis, and tuberculosis, as well as new threats such as COVID-19 and monkeypox. Adjuvants are essential for boosting immune responses, particularly for populations with lower immunity, as global health systems work to increase vaccination efficacy and attain greater immunization coverage. Additionally, adjuvants improve vaccine scalability and accessibility by lowering the amount of antigen needed per dose, which is crucial during pandemics and widespread immunization campaigns. Furthermore, next-generation adjuvants with enhanced safety profiles and immunostimulatory properties have been developed as a result of continuous developments in immunology and vaccine formulation. This driver is particularly significant for the elderly, young children, and immunocompromised people who need more robust, long-lasting vaccine protection.

Restrain/Challenge

High Development Cost of Vaccine Adjuvants

One major obstacle to expanding the vaccine adjuvants business is high development costs. The complex R&D processes involved in creating and evaluating new adjuvants require significant financial investment and time. Since they require specialized production and strict regulations, advanced technologies like polymeric systems and lipid nanoparticles further raise expenses. Clinical studies for efficacy and safety also increase costs, particularly for small and mid-sized biopharmaceutical firms. These exorbitant prices may discourage innovation and restrict new companies' access to the market. Therefore, despite the growing need for improved vaccination efficacy, the expansion of the vaccine adjuvant market is hampered by financial limitations.

The adjuvant emulsion category held the largest share in the Human Vaccine Adjuvants Market in 2025. The increasing demand for adjuvant emulsions in the vaccine market owing to its power to boost the efficiency of the vaccine, as well as the rising awareness about the necessity of immunization among the population are important factors driving the expansion of this segment. For instance, the composition and efficacy of certain emulsion adjuvants used in commercially available influenza vaccines, like MF59 and AS03, have been thoroughly investigated and documented. Moreover, the expansion of this category is also being aided by the government's growing efforts to encourage the use of adjuvant-containing vaccines to lower the cost of vaccine delivery and improve vaccine effectiveness.

In 2025, the infectious diseases category dominated the Human Vaccine Adjuvants Market driven by the growing frequency of worldwide pandemics and new disease risks, which emphasize the vital need for efficient vaccinations. Travel abroad, urbanization, and climate change are some of the factors that contribute to the spread of infectious diseases, making the development and use of vaccines with powerful adjuvants urgent. Along with large investments in research and development, federal and international efforts to fight infectious diseases also contribute to the segment's growth. Additionally, immunization efforts are supported by advancements in healthcare infrastructure and public knowledge, which increases demand for novel vaccine adjuvants designed to successfully fight these illnesses.

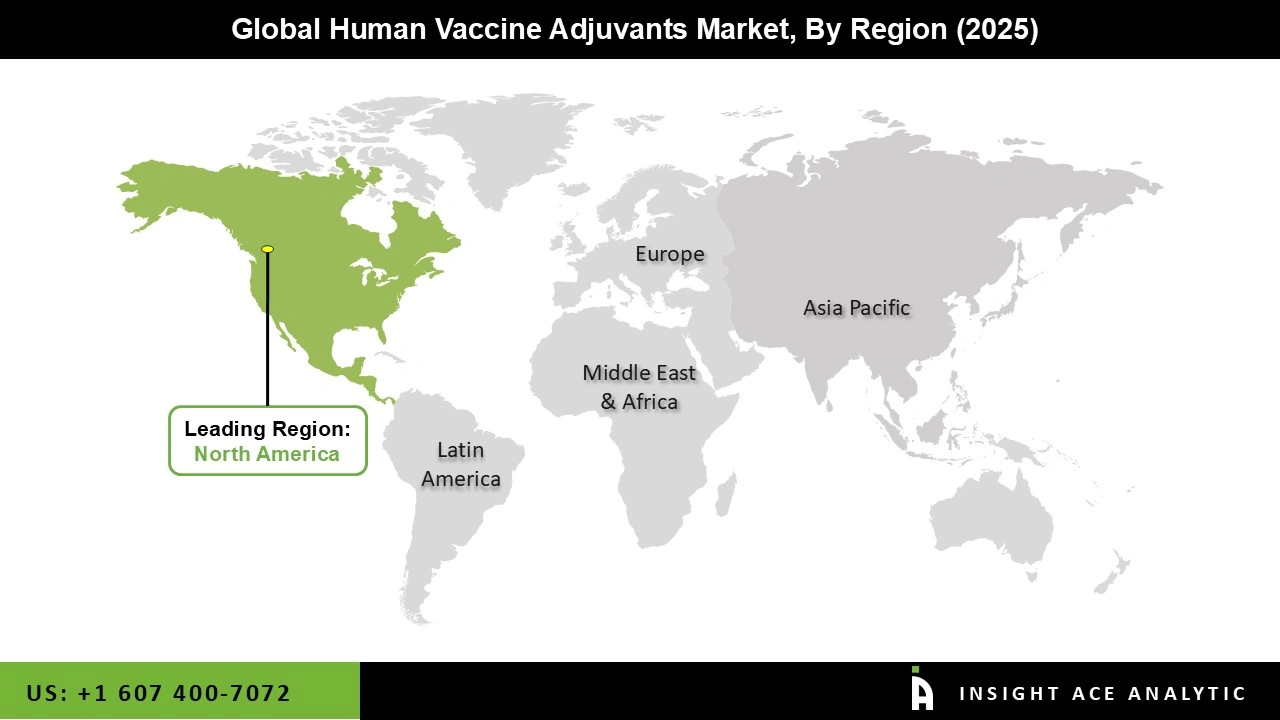

The human vaccine adjuvants market was dominated by North America region in 2025. The increased number of senior people and the rising incidence of chronic illnesses including cancer, diabetes, and heart disease are the main causes of the expansion of vaccination adjuvants market. Vaccine adjuvants strengthen and enhance the immune system's response to the vaccine.

The demand for vaccine adjuvants in North America is anticipated to rise due to the high recommendations for children's immunizations. Additionally, the market in this region is expected to grow due to rising awareness of the importance of vaccinations, advancements in vaccine technologies, such as mRNA, and the expanding use of preventive healthcare measures.

• September 2025: In order to extend Sanofi's authorization to utilize Novavax's Matrix-M adjuvant in Sanofi's pandemic influenza vaccine candidate program, Novavax, Inc. announced that it had amended its cooperation and license agreement with Sanofi. In addition to continuing royalties for all products using the adjuvant, Novavax was entitled to milestone payments of up to USD 210 million for each subsequent product and up to USD 200 million for the first four medicines developed by Sanofi using Matrix-M.

• June 2025: The use of aluminum-based adjuvants in commonly used vaccinations such as hepatitis B, Gardasil, and Prevnar is said to have been reviewed by U.S. Health Secretary RFK Jr. This indicates increased regulatory scrutiny as well as possible increased scrutiny and consequences for adjuvant decisions in the future.

• May 2024: Merck declared that it was growing its pipeline of vaccines, especially in cancer immunotherapy, where it is investigating novel adjuvant-based formulations for customized therapies. This action demonstrates Merck's dedication to developing vaccine technologies for both therapeutic and infectious diseases.

• March 2024: To explore and create new adjuvant formulations, Croda International Plc and The Access to Advanced Health Institute (AAHI) partnered. The goal of this partnership is to improve access to cutting-edge vaccination adjuvants worldwide by combining Croda and AAHI expertise

| Report Attribute | Specifications |

| Market size value in 2025 | USD 4.16 Bn |

| Revenue forecast in 2035 | USD 5.62 Bn |

| Growth Rate CAGR | CAGR of 3.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, Route of Administration, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Novavax, Inc., GlaxoSmithKline plc., SPI Pharma, Agenus, Inc., CSL Limited, InvivoGen, Brenntag Biosector, Adjuvance Technologies, Inc., Other Prominent Players |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.