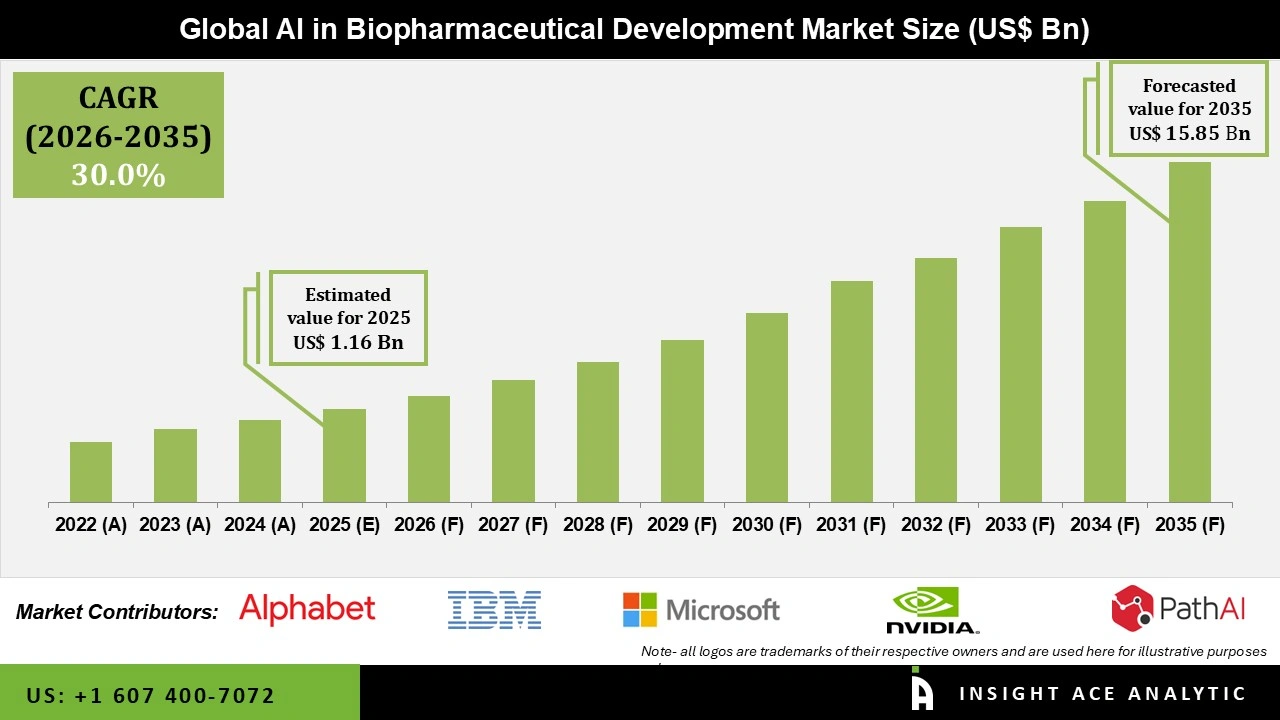

Global AI in Biopharmaceutical Development Market Size is valued at USD 1.16 Billion in 2025 and is predicted to reach USD 15.85 Billion by the year 2035 at a 30.00% CAGR during the forecast period for 2026 to 2035.

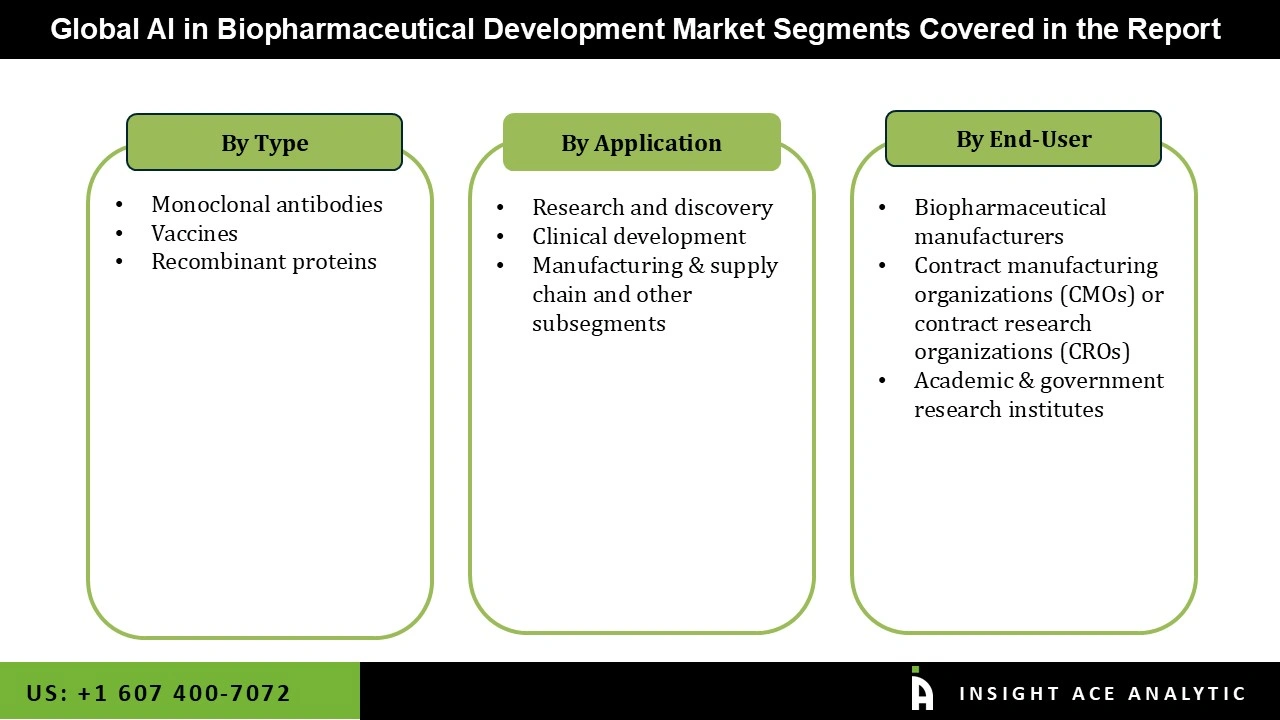

AI in Biopharmaceutical Development Market Size, Share & Trends Analysis Report By Type (Monoclonal antibodies, Vaccines, Recombinant proteins), By Application (Research and discovery, Clinical Development, Manufacturing & supply chain and other subsegments), By End-User, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Artificial intelligence (AI) is a technology-based system that utilizes various advanced tools and networks to simulate human intelligence. Simultaneously, it does not appear to be on the verge of totally replacing human physical presence. With greater automation, Artificial Intelligence can manage massive volumes of data. AI employs systems and software that can read and learn from input data to make autonomous decisions to achieve specified goals. In the pharmaceutical industry, its uses are constantly being expanded.

AI encompasses a variety of approach domains, including reasoning, knowledge representation, solution search, and machine learning (ML). It can help with rational drug development, decision-making, determining the best treatment for a patient, including tailored medicines, and managing clinical data for future drug development. In the case of drug discovery, AI can distinguish hit and lead compounds, allowing for faster therapeutic target validation and structural design optimization. The pharma industry faces challenges in overcoming the high attrition rates in drug development. The pharma industry is collaborating with AI industries to overcome challenges, and AI will improve the efficiency of the drug development process.

The biopharma industry has been changed by continuous medical and scientific innovation. New business models have emerged due to the growing demand for greater patient involvement and experience. As a result, AI is becoming increasingly common in the biopharmaceutical business, resulting in market expansion. Also, increasing drug development expenditure and awareness about AI’s capacity to work are significant reasons to elevate the market growth in the upcoming years. In 2021, Health-tech giant Nvidia collaborated with AstraZeneca and the University of Florida’s academic health centre, UF Health, on new artificial intelligence research projects to accelerate drug discovery and improve patient care.

The deficiency of skilled workers is a significant challenge in front of this market. Apart from this, a lack of regulations and ethical issues will hamper the market growth. Increasing use will affect unemployment and rise in competition. In addition, the cost of artificial intelligence devices, applications, and software are the most prominent issues in this AI-based biopharmaceutical development market.

The AI in the biopharmaceutical development market is segmented by type, application and end-user. Based on the types of the market includes monoclonal antibodies, vaccines, and recombinant proteins. Among these, monoclonal antibodies and vaccines type will lead the segment due to maximum usage of AI-based technologies and increasing investments in their research. While by applications, the market comprises research and discovery, clinical development, manufacturing & supply chain and other subsegments. At last End-User subsegment contains biopharmaceutical manufacturers, contract manufacturing organizations or contract research organizations (CRO), and academic & government research institutes. CROs and CMOs are expected to lead the market due to increased demand for their services regarding therapeutic developments.

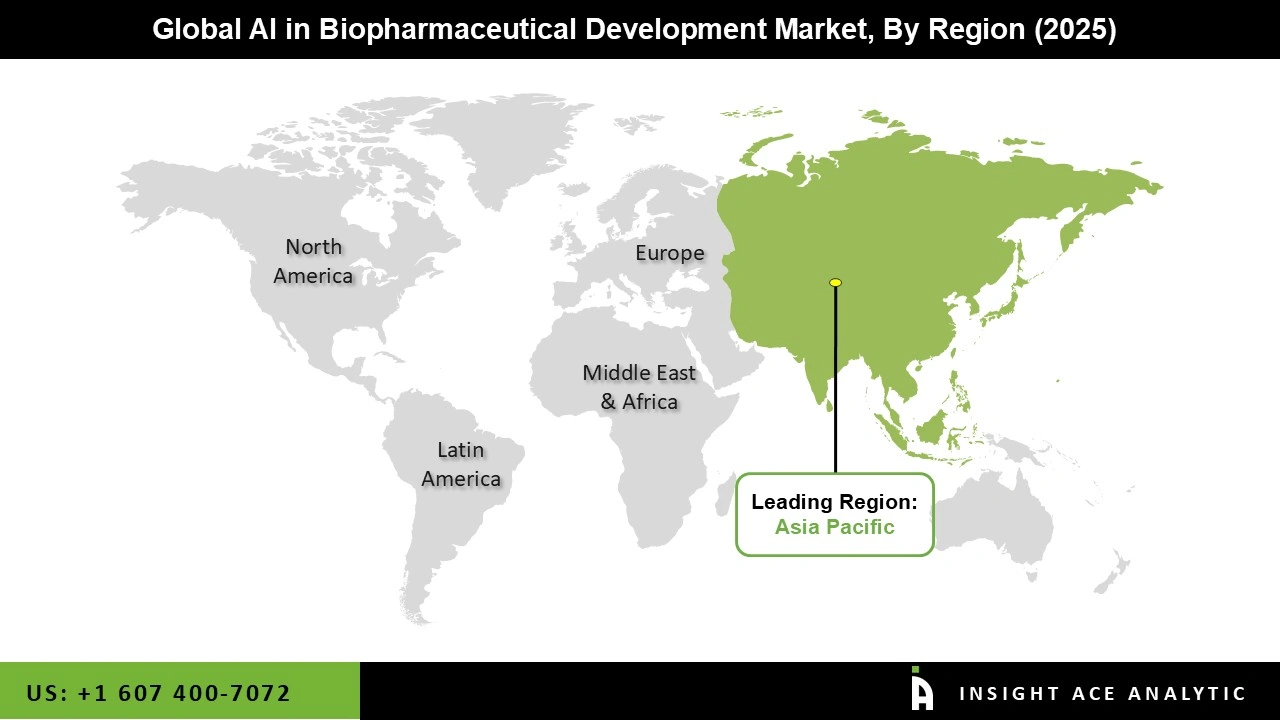

By region, Asia Pacific is likely to account for the majority shares in the coming forecasting period 2024-2031 because of the growing software and services industry and funding for their development.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.16 Billion |

| Revenue Forecast In 2035 | USD 15.85 Billion |

| Growth Rate CAGR | CAGR of 30.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | IBM Watson Health, Google (Alphabet Inc.), Concreto HealthAI, Nvidia Corporation, PathAI, Atomwise, Inc., Deep Genomics, Cloud Pharmaceuticals, Inc., Ai-biopharma S.A.S., and Microsoft Corporation, others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.