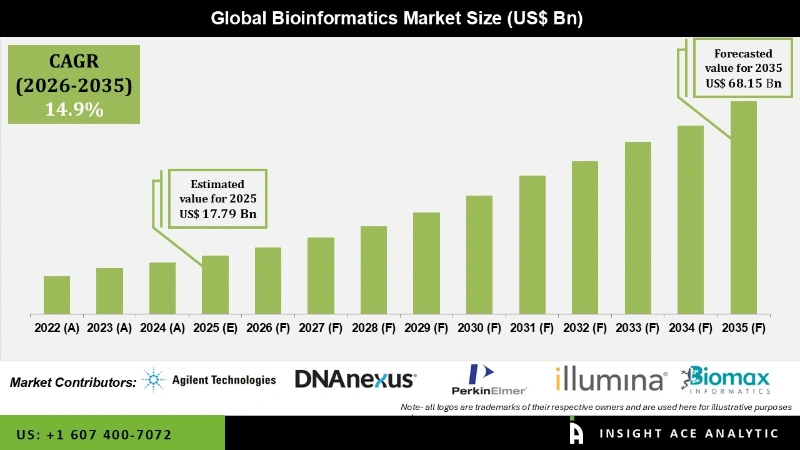

Global Bioinformatics Market Size is valued at USD 17.79 Billion in 2025 and is predicted to reach USD 68.15 Billion by the year 2035 at a 14.5% CAGR during the forecast period for 2026 to 2035.

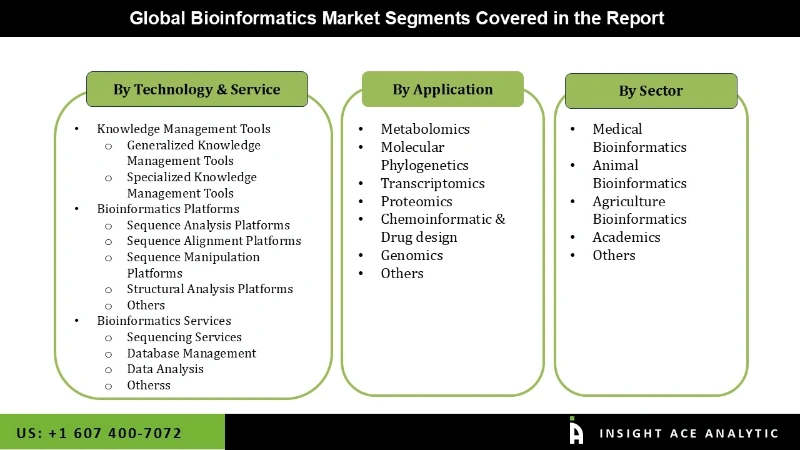

Bioinformatics Market Size, Share & Trends Analysis Report By Technology & Services (Knowledge Management Tools, Bioinformatics Platforms, Bioinformatics Services ), Applications (Metabolomics, Molecular Phylogenetics, Transcriptomics, Proteomics, Chemoinformatic & Drug Design, Genomics) And Sector, By Region, And Segment Forecasts, 2026 to 2035.

The management and analysis of biological information using computer technology are known as bioinformatics. It involves collecting, analyzing, and sharing biological data. The field of bioinformatics uses computer algorithms to discover biological linkages, ascertain the roles of genes and proteins, and forecast the three-dimensional structures of proteins.

However, high prices for bioinformatics software and services and a shortage of experienced workers are projected to impede the bioinformatics market growth. The emergence of numerous next-generation data sets that aim to address long-standing problems regarding the biology of human diseases has intensified the current hype surrounding big data analytics' mostly untapped promise. Attempts to harness the potential of big data currently need to be improved by some important obstacles, despite the likelihood that these techniques will effectively reveal fresh biological insights.

The need for bioinformatics is rising in the global market due to rising demand for protein sequencing and nucleic acids and initiatives from public and commercial entities. The market is also fueled by a surge in molecular biology and drug delivery research, as well as the fields of genomics and proteomics. The movement of precision medicine from disorder and reductionist treatment to system-based, holistic, and beings' treatment has been made possible by advances in systems biology and pharmacogenomics.

Common challenges include the efficient evaluation of analytical software tools, the acceleration of the overall process using hybrid parallel computing (HPC) parallelization and kinetic energy technology, the development of automation strategies, data storage alternatives, and, finally, the creation of novel techniques for the full utilization of results across various experimental conditions.

The bioinformatics market is segmented based on technology & services, applications and sectors. Based on technology & services, the market is segmented as knowledge management tools (generalized knowledge management tools and specialized knowledge management tools), bioinformatics platforms (sequence analysis platforms, sequence alignment platforms, sequence manipulation platforms, structural analysis platforms and others), services (sequencing services, database management, data analysis and others) By applications, the market is segmented into metabolomics, molecular phylogenetics, transcriptomics, proteomics, chemoinformatic & drug design, genomics and others. By sectors, the market is segmented into medical bioinformatics, animal bioinformatics, agriculture bioinformatics, academics and others.

The platforms category is expected to hold a major share of the global bioinformatics Industry in 2022. because more platform applications are being made, drug development requires improved tools. A surge in demand from life science companies for structural health monitoring and modification may be to blame for the increase, in addition to potential. In turn, this would support the development of new drugs and the assessment of their therapeutic effects. Better drug development tools must also be created to boost the speed and safety of drug discovery and development. The increasing use of diverse tools for database administration is fueling the development of bioinformatics platforms. The extensive use of next-generation sequencing also aids the development of bioinformatics platforms. The segment is expanding due to the rising demand for exome and genome technologies.

The proteomics segment is projected to grow at a rapid rate in the global bioinformatics market. Big data analytics' unrealized potential is a feed buzz that has the expansion of R&D initiatives and significant financial investments in technology development credited with driving the proteomics market. These tools aid in the large-scale management and analysis of data. Moreover, algorithms are employed in database management and data monitoring. All these causes are driving the growth of the proteomics market.

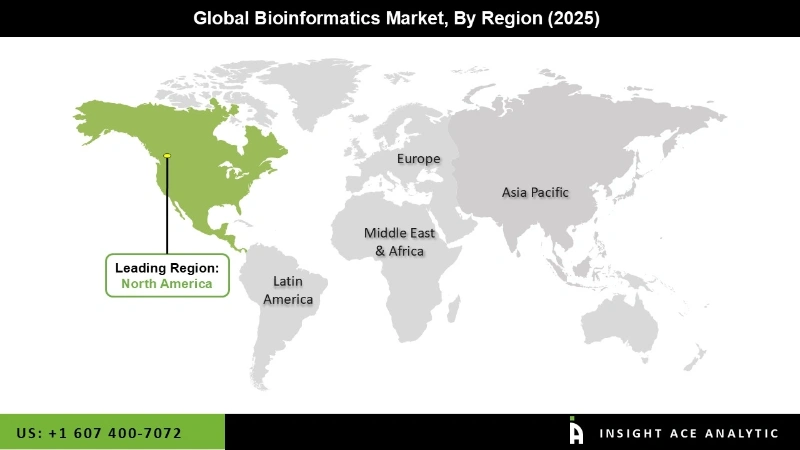

The North American bioinformatics market is expected to register the highest market share in revenue soon. The North American bioinformatics market position is expanding due to government policies beneficial to market participants and the increasing adoption of trying-to-cut technologies. The American government is still investing in the bioinformatics industry's growth. Also, expanding R&D activities creates opportunities for regional bioinformatics market development. In addition, Asia Pacific egis projected to grow in the global Bioinformatics market demand. The need for more advanced bioinformatics tools, which are essential for medication study and development, as well as a rise in the use of cutting-edge technology, are both to blame for this because of developments in the fields of genomics and proteomics, which produce vast amounts of data that need to be processed and interpreted.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 17.79 Billion |

| Revenue forecast in 2035 | USD 68.15 Billion |

| Growth rate CAGR | CAGR of 14.5 % from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn,, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Technology & Services, Applications And Sectors |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Agilent Technologies, Inc., Biomax Informatics Ag, Dnanexus, Inc., Genedata Ag, Intrexon Bioinformatics Germany Gmbh, Illumina, Inc., Perkinelmer, Inc., Qiagen N.V., Seven Bridges Genomics Inc., Thermo Fisher Scientific, Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Bioinformatics Market By Technology & Service

Bioinformatics Market By Application

Bioinformatics Market By Sector

Bioinformatics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.