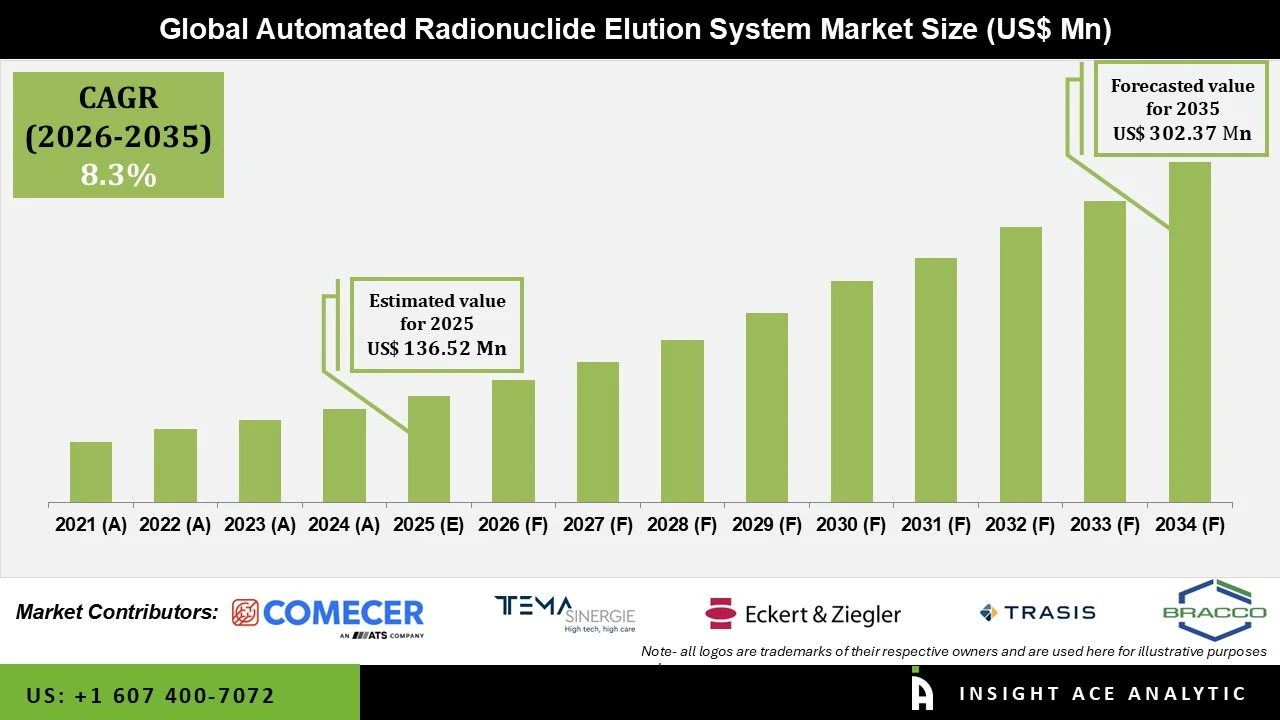

Automated Radionuclide Elution System Market Size is valued at USD 136.52 Mn in 2025 and is predicted to reach USD 302.37 Mn by the year 2035 at a 8.3% CAGR during the forecast period for 2026 to 2035.

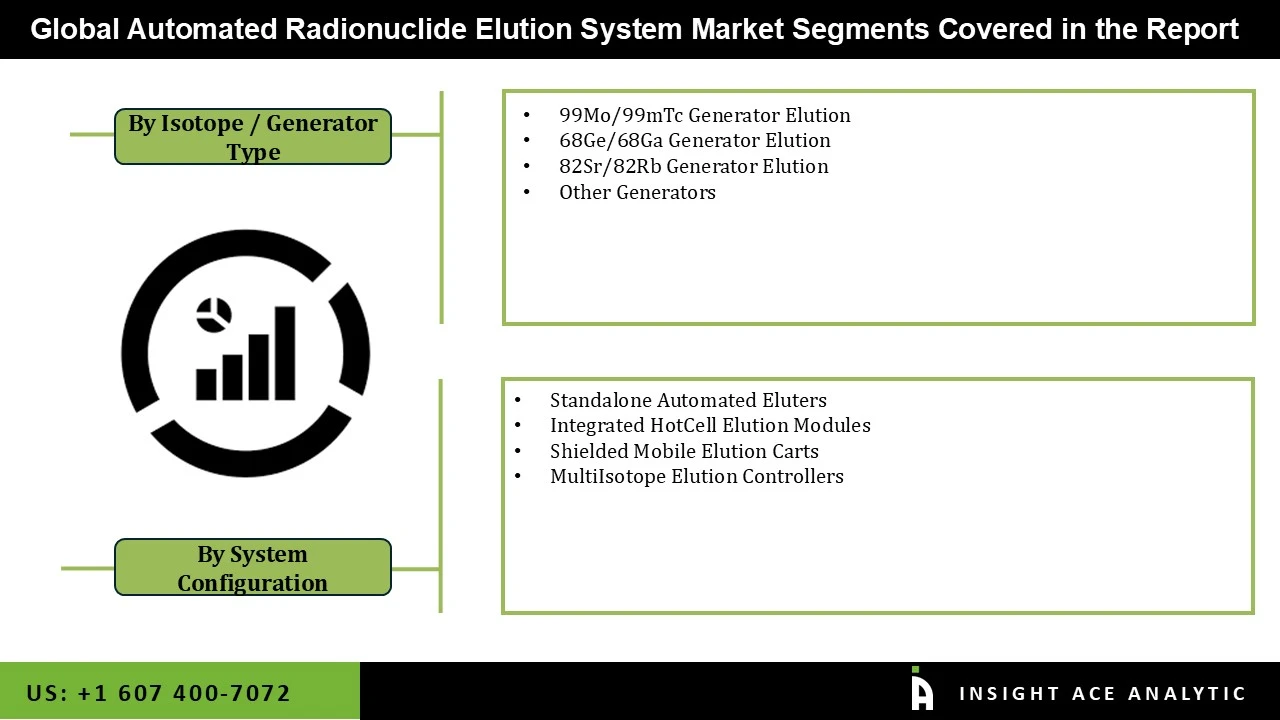

Automated Radionuclide Elution System Market Size, Share & Trends Analysis Distribution by Isotope / Generator Type (99Mo/99mTc Generator Elution, 82Sr/82Rb Generator Elution, 68Ge/68Ga Generator Elution, and Others), System Configuration (Standalone Automated Eluters, Shielded Mobile Elution Carts, Integrated HotCell Elution Modules, and MultiIsotope Elution Controllers), and Segment Forecasts, 2026 to 2035

An Automated Radionuclide Elution System is a specialized, fully automated machine used in radiopharmacies to safely and precisely extract (elute) short-lived radioactive isotopes from radionuclide generators. The most common use is pulling technetium-99m (Tc-99m) from molybdenum-99 (Mo-99/Tc-99m) generators — the workhorse isotope for millions of diagnostic nuclear medicine scans every year (heart, bone, thyroid, and cancer imaging). The system operates inside a shielded hot cell or behind lead glass, automatically controlling flow rates, volumes, pressure, sterility, and timing to deliver a consistent, high-purity dose while minimizing human contact. This reduces radiation exposure to operators, lowers contamination risk, and ensures reliable daily production of ready-to-use radiopharmaceuticals.

The automated radionuclide elution system market is being fueled by the requirement to enhance radiation protection and efficiency in the nuclear medicine units, as well as by the continuing dependence on technetium-99m-based methods of diagnosis. Further contributing to the expansion of the automated radionuclide elution system market is the increasing adoption of automation to prevent manual handling of the radioactive product and to ensure the quality of the elution process according to the regulatory and quality requirements. Additionally, the increasing demand for the adoption of automated elution systems is being fueled by the emerging nuclear medicine units and the establishment of radiopharmacy services.

However, the high initial cost of automated elution equipment and related shielding and validation requirements restrict the growth of the automated radionuclide elution system market and may prevent the implementation of these systems in facilities with limited resources or low volume. On the contrary, the increasing modernization of nuclear medicine departments and the steady migration toward automated radiopharmacy workflows present significant potential opportunities for the automated radionuclide elution system market. Additionally, the replacement of manual and semi-automated elution processes with fully automated systems is creating new demand as healthcare providers focus on improving safety, consistency, and throughput, particularly in developing countries where nuclear medicine infrastructure is expanding.

The automated radionuclide elution system market is expected to grow as PET and SPECT imaging for early illness detection expands. The use of PET and SPECT imaging for early and precise diagnosis is growing due to the expanding global burden of cancer, heart disease, and neurological illnesses. Because of its better metabolic sensitivity and capacity to identify micro-metastatic lesions that traditional imaging overlooks, PET imaging utilizing F-18 FDG is still the gold standard for oncology staging. Simultaneously, Tc-99m-based SPECT is still the most popular method for bone scans and heart perfusion studies due to its huge installed device bases and established clinical pathways.

To enhance prostate cancer diagnosis, governments and private healthcare systems are updating nuclear imaging infrastructure, adding PET-CT machines, and implementing Ga-68-based tracers. Moreover, the higher patient throughput is encouraged by major markets' increased payment support for PET procedures.

Due to limited worldwide manufacturing capacity for certain isotopes, particularly Tc-99m, Mo-99, Ge-68, and Rb-82, the automated radionuclide elution system market still faces serious supply chain risks. There is a possibility of unexpected shortages because many industrial reactors are decades old and prone to outages. Since radiotracers have short half-lives, highly coordinated logistics are required, which increases the impact of equipment failures, transit delays, and regulatory obstacles. Additionally, the operational complexity of radioisotope shipment is increased by the need for stringent temperature control, security clearance, and specific packing. Due to their heavy reliance on imports and lack of regional cyclotrons, emerging markets are especially vulnerable. Despite growing demand, these limitations can impede automated radionuclide elution system market expansion by interfering with imaging schedules, decreasing clinical availability, and increasing procurement costs.

The 99Mo/99mTc Generator Elution category held the largest share in the Automated Radionuclide Elution System market in 202. The extensive clinical application of SPECT imaging and the vital requirement for dependable, high-purity elution in diagnostic processes are the sources of leadership. High clinical reliability guaranteeing consistent 99mTc elution for precise SPECT imaging and patient safety are the main benefits propelling the 99Mo/99mTc generator elution market. Additionally, standardized clinical use and quality assurance are supported by regulatory adherence to specified protocols. Rapid, high-purity elution appropriate for high-throughput nuclear medicine operations is made possible by operational efficiency. Both standard and specialized methods are supported by broad applicability across hospitals, diagnostic centers, and imaging facilities.

In 2025, the Standalone Automated Eluters category dominated the Automated Radionuclide Elution System market because they are affordable, simple to install, and appropriate for a variety of nuclear medicine facilities. Small to mid-sized hospitals and diagnostic facilities that use generator-based radionuclides especially favor these systems because they offer automation advantages without necessitating complete radiopharmacy integration. Additionally, the adoption is also being aided by the growing focus on radiation safety, consistent elution quality, and workflow standardization. Furthermore, the ongoing need for standalone automated eluters is guaranteed by the prolonged use of technetium-99m-based imaging techniques, particularly in areas with significant volumes of SPECT procedures.

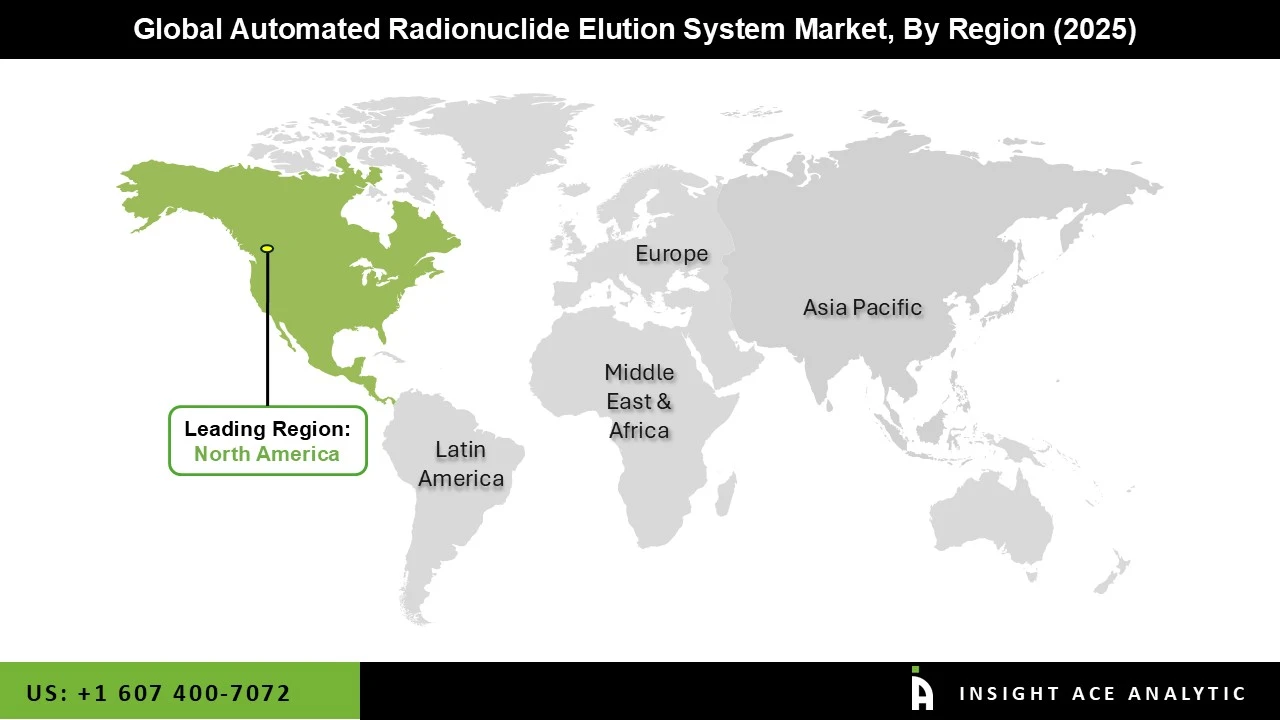

The Automated Radionuclide Elution System market was dominated by the North America region in 2025 propelled by high PET-CT and SPECT-CT installation density, robust reimbursement frameworks, and sophisticated nuclear medicine infrastructure. With strong clinical research pipelines in radioligand therapy and increased cyclotron capacity for Tc-99m and Ga-68 manufacture, the United States leads the world in the use of radiopharmaceuticals. Furthermore, the strong FDA activity in authorizing new tracers and medicinal isotopes contributes to the automated radionuclide elution system market growth. Canada also contributes by investing in the creation of isotopes using reactors. The region's leadership in diagnostic and therapeutic nuclear medicine is strengthened by strategic partnerships between isotope suppliers, academic institutions, and radiopharmacies.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 136.52 Mn |

| Revenue forecast in 2035 | USD 302.37 Mn |

| Growth Rate CAGR | CAGR of 8.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Isotope / Generator Type, System Configuration, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Siemens Healthineers, Comecer (ATS Group), Eckert & Ziegler, Bracco Diagnostics, IBA Radiopharma Solutions, Mirion Technologies, Trasis, Lemer Pax, and Tema Sinergie |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• 99Mo/99mTc Generator Elution

• 82Sr/82Rb Generator Elution

• 68Ge/68Ga Generator Elution

• Others

• Standalone Automated Eluters

• Shielded Mobile Elution Carts

• Integrated HotCell Elution Modules

• MultiIsotope Elution Controllers

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.