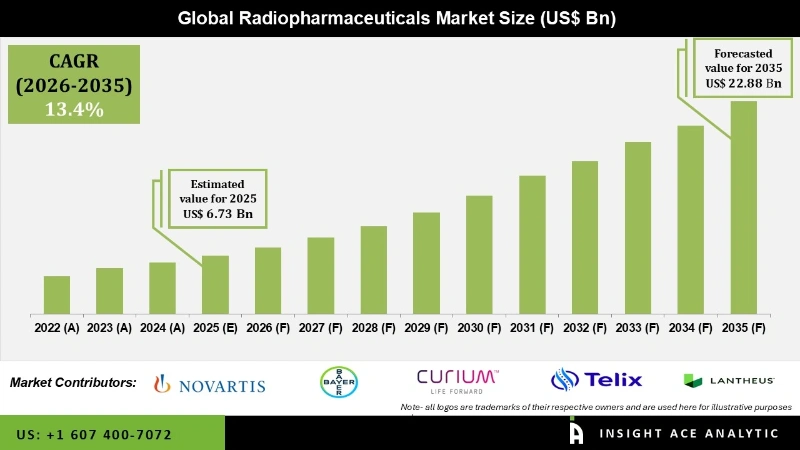

Global Radiopharmaceuticals Market Size is valued at USD 6.73 Bn in 2025 and is predicted to reach USD 22.88 Bn by the year 2035 at a 13.4% CAGR during the forecast period for 2026 to 2035.

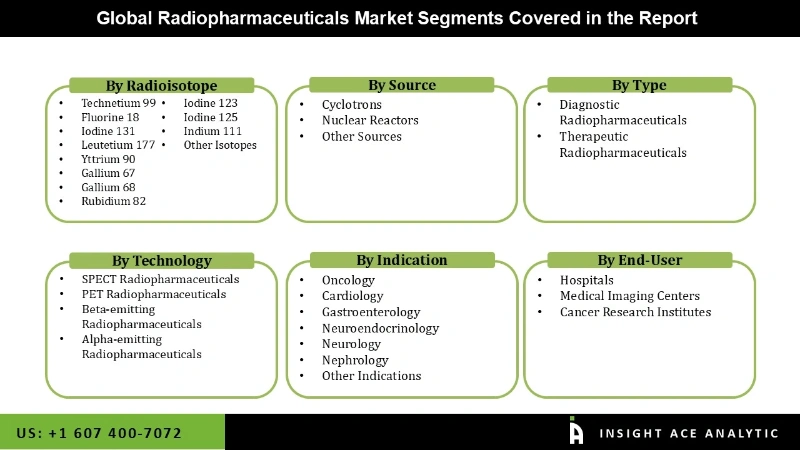

Radiopharmaceuticals Market Size, Share & Trends Analysis Report By Type (Diagnostic Radiopharmaceuticals, Therapeutic Radiopharmaceuticals), By Radioisotope (Technetium-99m, Fluorine-18, Iodine-131, Lutetium-177, Yttrium-90, Gallium-67, Gallium-68, Rubidium-82, Iodine-123, Iodine-125, Indium-111 ,Other Isotopes), By Technology / Modality (SPECT Radiopharmaceuticals, PET Radiopharmaceuticals, Beta-emitting Radiopharmaceuticals , Alpha-emitting Radiopharmaceuticals), By Indication (Oncology, Cardiology, Gastroenterology, Neuroendocrinology, Neurology, Nephrology, Other Indications), By Source, By End User and By Segments Forecasts, 2026 to 2035.

Radiopharmaceuticals are medications that incorporate radioactive isotopes. These chemicals are utilized in the field of nuclear medicine for diagnostic and therapeutic applications. They produce detectable radiation that may be captured in images, enabling healthcare workers to visually examine and evaluate the performance of organs, tissues, and physiological processes in the body.

In addition to traditional cancer therapies, the oncologist may consider utilizing radiopharmaceuticals, which employ a blend of radioactive particles and drugs to selectively target and eradicate cancer cells. Radiopharmaceuticals are a specific category of radioactive compounds used in modern medicine. The drugs that contain radionuclides are as follows. Most radiopharmaceuticals employ a radioactive nuclide or radionuclide in combination with a drug or biologically active substance to assess the distribution and localization within the body.

Furthermore, the rising range of radiopharmaceuticals is finding its way into clinical practice, providing doctors with more specific data about the features of various tumour forms. Many cancers are responding to radionuclides as a soothing and curative therapeutic option.

However, the market growth is hampered by the strict regulatory criteria for the safety and health of the radiopharmaceuticals market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high radiopharmaceuticals because radiopharmaceuticals are costly to create and execute because the market might not be growing quickly, several possible roadblocks could stop the sector from reaching its maximum potential. In all their manifestations, government regulations are thus deemed a barrier to product introduction. Every nation has several regulatory bodies, and every country has its own distinct set of rules. Strict regulatory and product approval processes are expected to slow the growth of the global radiopharmaceutical market.

The catastrophic COVID-19 pandemic impacts have shocked the world's healthcare institutions and crippled their operations. Consequently, hospitals have ramped up testing to save lives and contain the infection. The COVID-19 pandemic has created significant financial difficulties, and governments worldwide have been forced to reduce spending.

The Radiopharmaceuticals Market is segmented based on radioisotope, technology type, indication, source, type, and end user. Based on Radioisotope, the market is segmented into technetium 99, fluorine 18, iodine 131, leutetium 177, yttrium 90, gallium 67, gallium 68, rubidium 82, iodine 123, iodine 125, indium 111, other isotopes. Based on the Indication, the market is divided into oncology, cardiology, gastroenterology, neuroendocrinology, neurology, nephrology, and other indications. Based on the Source, the market is divided into cyclotrons, nuclear reactors, and other sources. Based on the type, the segment is divided into diagnostic and therapeutic. Based on the end Use, the market is divided into hospitals, medical imaging centres, and cancer research institutes.

Based on radioisotope, the market is segmented into technetium 99, fluorine 18, iodine 131, leutetium 177, yttrium 90, gallium 67, gallium 68, rubidium 82, iodine 123, iodine 125, indium 111, other isotopes. Among these, the technetium-99m segment is expected to have the highest growth rate during the forecast period. Technetium-99m (Tc-99m) dominates the radiopharmaceuticals market primarily because of its ideal characteristics for diagnostic imaging and the well-established global infrastructure for its production and distribution. Tc-99m has been used since the 1960s, and infrastructure for its production, transport, and usage is highly developed and regulated.

Based on the Indication, the market is divided into oncology, cardiology, gastroenterology, neuroendocrinology, neurology, nephrology, and other indications. Among these segments, the oncology segment dominates the market. Rising incidence of cancers such as prostate, breast, lung, and neuroendocrine tumours. Cancer is one of the prominent causes of death worldwide, driving high demand for advanced diagnostic and therapeutic solutions. Oncology dominates the radiopharmaceuticals market due to its high disease burden, use of both diagnostic and therapeutic agents, and the rise of personalized medicine through theranostic approaches.

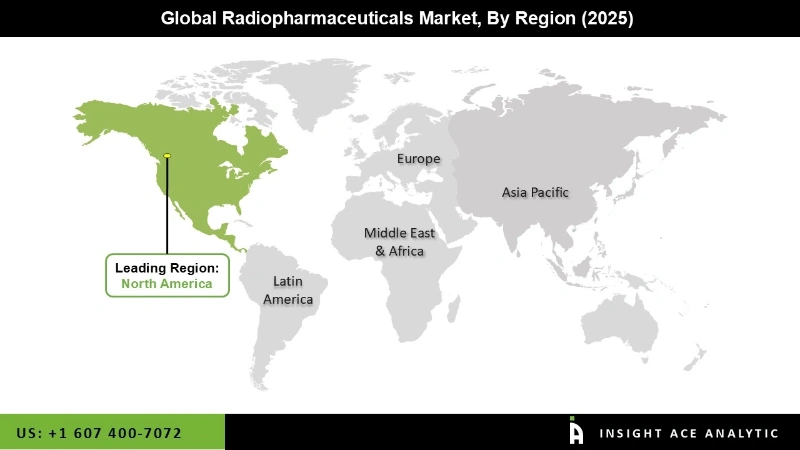

North America leads the radiopharmaceuticals market due to the widespread availability of PET/SPECT scanners and nuclear medicine facilities, along with the high adoption of advanced diagnostics and targeted therapies in hospitals and imaging centres. The region has a large patient pool requiring radiopharmaceutical-based diagnostics and therapies, driven by a significant burden of cancer and other chronic diseases. Additionally, there is a strong demand for personalized medicine and early cancer detection, supported by a robust healthcare system and technological advancements.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 6.73 Billion |

| Revenue Forecast In 2035 | USD 22.88 Billion |

| Growth Rate CAGR | CAGR of 13.4 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Radioisotope, Indication, Technology / Modality,Indication, Source and End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Novartis AG, Curium SAS, Bayer AG, Telix Pharmaceuticals Limited, Lantheus Holdings, Inc., GE HealthCare Technologies Inc., Cardinal Health, Inc., Jubilant Pharmova Limited, ITM Isotope Technologies Munich SE, Eli Lilly and Company, AstraZeneca PLC, PharmaLogic Holdings Corp., Life Molecular Imaging GmbH, Bracco Imaging S.p.A., Siemens Healthineers AG, Eckert & Ziegler Strahlen- und Medizintechnik AG, NorthStar Medical Radioisotopes, LLC, Nusano, Inc., Nordion (Canada) Inc., IBA RadioPharma Solutions (Ion Beam Applications S.A.), ANSTO, Yantai Dongcheng Pharmaceutical Group Co., Ltd. and others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Radiopharmaceuticals Market - By Radioisotope

Radiopharmaceuticals Market – By Source

Radiopharmaceuticals Market – By Type

Radiopharmaceuticals -By Technology / Modality

Radiopharmaceuticals -By Indication

Radiopharmaceuticals- By End User

Radiopharmaceuticals Market – By End User

Radiopharmaceuticals Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.