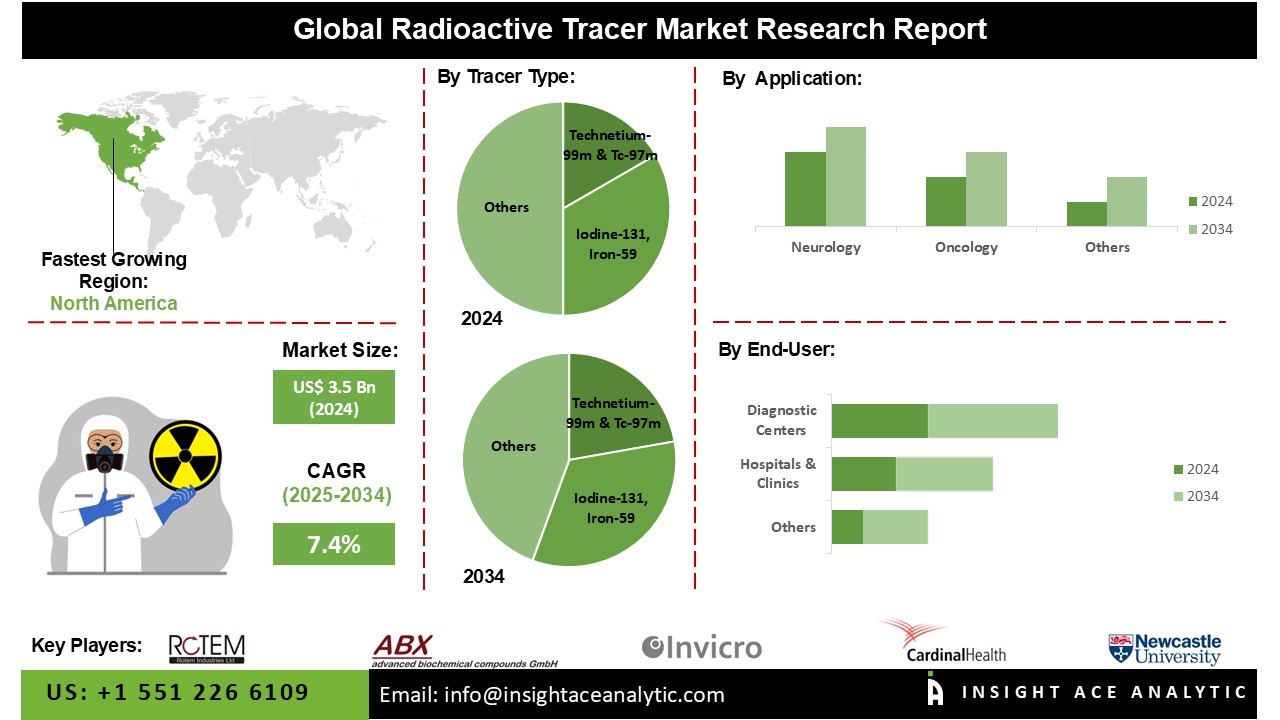

Global Radioactive Tracer Market Size is valued at USD 3.5 billion in 2024 and is predicted to reach USD 7.19 billion by the year 2034 at a 7.4% CAGR during the forecast period for 2025-2034.

The radioactive tracer is a chemical molecule in which one or more atoms have been replaced with a radionuclide. Radioactive tracers are utilized in imaging studies to assist in diagnosing internal health issues. These tracers emit particles that may be detected and reconstructed into an image, which can then be used to locate damage in tissues or organs. The radioactive tracer market is anticipated to develop due to increased diagnostic laboratories staffed by trained professionals and more cutting-edge radiology equipment.

In addition, key players' increased focus on new product development and strategic collaborations was influenced favorably by other variables, such as the improvement in tracer technology adoption and numerous technological breakthroughs, factors expected to augment the growth of the global radioactive tracer market. The need for more trained workers is also slowing the expansion of the radioactive tracer industry in the healthcare sector. Companies involved in the radioactive tracer market can anticipate substantial development prospects and increased spending on cutting-edge technology. It drives expansion globally and is expected to boost market expansion in the coming years.

However, the expensive instruments and the need for trained radiology hamper market growth. Many markets companies finance research and development to create cutting-edge machinery that can speed up the process at a higher price. Furthermore, increasing R&D activities and investments by prominent players are expected to create lucrative growth opportunities in revenue for players operating in the global radioactive tracer market over the forecast period.

The radioactive tracer market is segmented based on tracer type, test type, application, and end-users. Based on tracer type, the market is divided into Technetium-99m & Tc-97m, Iodine-131, Lutetium-171, Rubidium (Rb-82) Chloride & Ammonia (N-13), Hassium-269, FDDNP (F-18) & FDOPA (F-18), Phosphorus-32 & Chromium-51, Thallium-201, F-18, Ga-68 FAPI, Others (Scandium-46, Seaborgium-269). The market is segmented by test type into PET, SPECT, and others. The application segment includes oncology, pulmonary, neurology, cardiology, and others. End user segments the market into hospitals & clinics, diagnostic centres, academic & research institutes, and others.

The PET radioactive tracer category is expected to hold a major global market share in 2022. It is attributed that a PET scan's value lies not in its ability to depict how you look but, in the information, it can provide about your bodily functions. Those with a confirmed case of cancer can use them to learn about the disease's prognosis and treatment efficacy. Also, a PET scan is a highly accurate nuclear medicine imaging tool to grow this segment growth.

The hospital & clinics segment is projected to grow rapidly in the global radioactive tracer market. The growing industry participants and hospitals are working more closely to improve neurologically sick patient care. Increased number of radiopharmaceuticals for treating cancer, cardiovascular illness and the need for healthcare body scan treatment, especially in countries like the US, Germany, the UK, China, and India.

The North American radioactive tracer market is expected to register the highest market share in revenue shortly. It can be attributed to the developments in healthcare infrastructure, growth in the number of diseases treated with fluorine-18 as the world's population ages and the number of established participants in the industry both rise and efforts to maximize patient comfort through technological innovations.

In addition, the presence of key market competitors and improvements in medical technology fuel expansion in the region's industries. In addition, Asia Pacific is projected to grow rapidly in the global radioactive tracer market because there has been an uptick in requests for cancer screening and diagnosis in the region, better radioactive tracer equipment, and growing financial support from the business and medical communities.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 3.5 Bn |

| Revenue Forecast In 2034 | USD 7.19 Bn |

| Growth Rate CAGR | CAGR of 7.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Tracer Type, Test Type, Application, End User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Curium, Telix Pharmaceuticals, Lantheus Holdings, Inc., GE Healthcare, Life Molecular Imaging, Bracco Imaging, Siemens Healthineers, Cardinal Health, Jubilant Pharmova, Eckert & Ziegler, Avid Radiopharmaceuticals |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Radioactive Tracer Market By Tracer Type -

Radioactive Tracer Market By Test Type -

Radioactive Tracer Market By Application-

Radioactive Tracer Market By End User-

Radioactive Tracer Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.