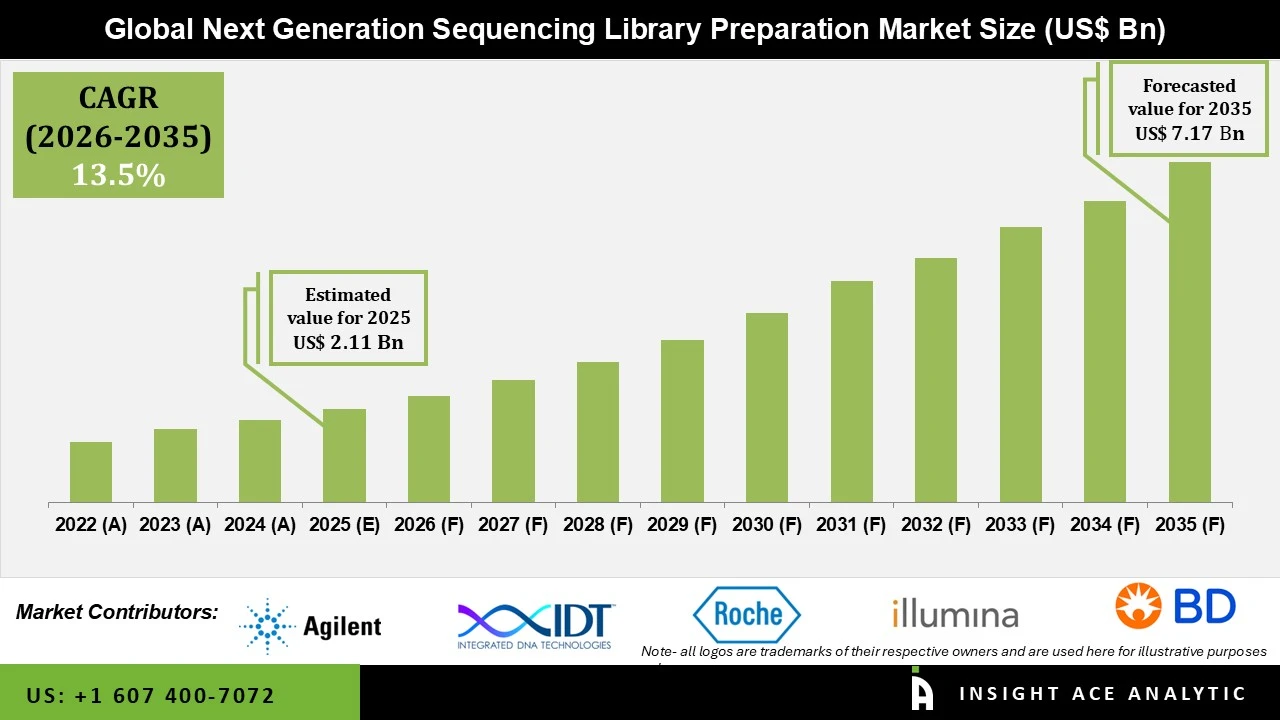

Next Generation Sequencing Library Preparation Market Size is valued at USD 2.11 billion in 2025 and is predicted to reach USD 7.17 billion by the year 2035 at a 13.5% CAGR during the forecast period for 2026 to 2035.

Next Generation Sequencing Library Preparation Market Size, Share & Trends Analysis Report By sequencing Type, By Product (Reagents and consumables, Instruments), By Application, By End-Use, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

The massively sequencing technology known as "next-generation sequencing" (NGS) provides extremely high throughput, scalability, and speed. The global market for NGS sample preparation is projected to be stimulated by developments in the life sciences sector that reduce workflow to increase effectiveness and quality.

The main obstacles to the expansion of this industry include issues with regulations and standards in diagnostic testing, as well as the limited experience and sequencing capabilities of mid and small-sized laboratories. Companies in the NGS sample preparation market are expanding their income streams by taking advantage of new animal research and agriculture prospects. This is clear given that the market is expected to grow at an astounding CAGR throughout the evaluation period. The need for NGS sample preparation will continue to grow both now and in the future.

Furthermore, the current studies and research in this area fuel the market expansion for NGS sample preparation. Governmental and non-governmental entities fund research organizations for their NGS sample preparation initiatives. Businesses in the NGS sample preparation market are building a solid research foundation for determining how coronavirus strains may impact animal health. To prevent food waste globally, NGS is assisting in tracing the origin of plant illnesses. A thorough description of the RNA and DNA virome that causes foodborne viral infections is also provided by viral partial genomic sequencing.

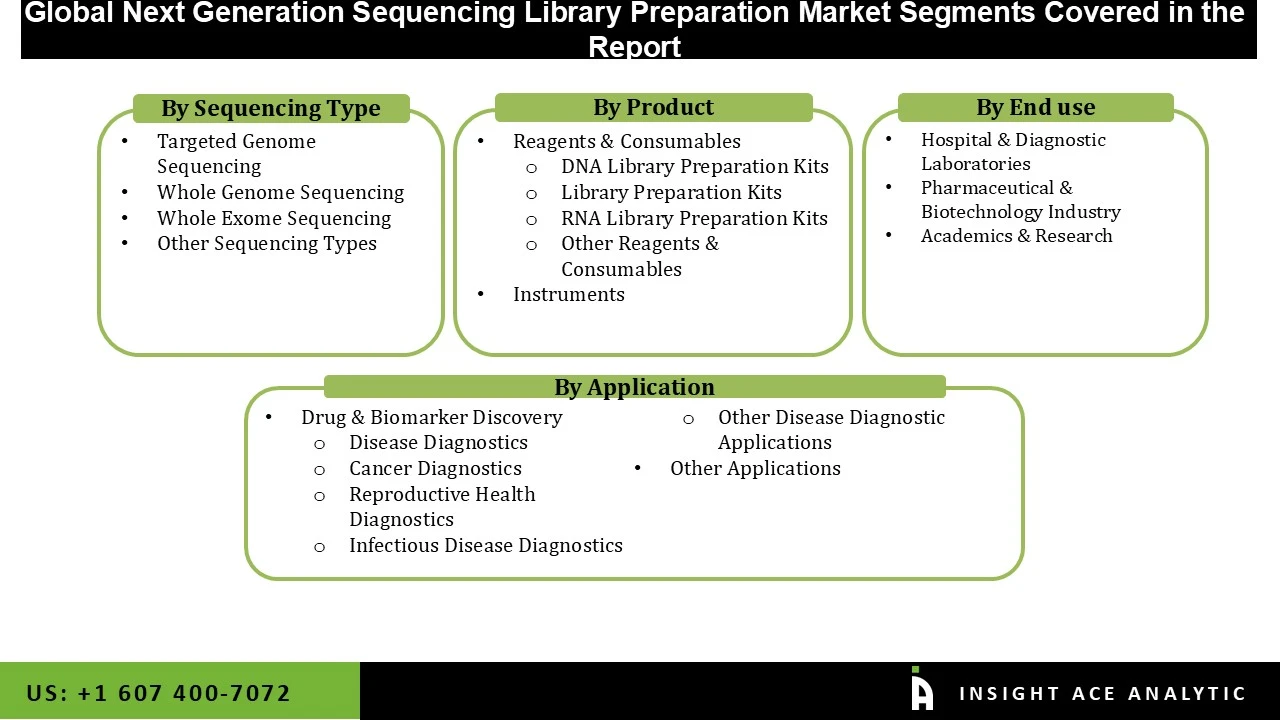

The next-generation sequencing library preparation market is segmented on the sequesncing type, product, applications and end-use. Based on the sequencing type, the next-generation sequencing library preparation market is segmented into Targeted Genome Sequencing, Whole Genome Sequencing, Whole Exome Sequencing, and Other Sequencing Types. Based on product, the next-generation sequencing library preparation market is segmented into Reagents & Consumables (DNA library preparation kits, library preparation kits, RNA library preparation kits, other reagents & consumables) and instruments. Based on application, the next-generation sequencing library preparation market is segmented into Drug & Biomarker Discovery, Disease Diagnostics (Cancer Diagnostics, Reproductive Health Diagnostics, Infectious Disease Diagnostics, Other Disease Diagnostic Applications), drug discovery and other applications. Based on end-use, the next-generation sequencing library preparation market is segmented into Hospitals and Clinics, Academic and Research Institutions, Pharmaceutical and Biotechnology Companies, and Others.

The most significant revenue share was accounted for by the library preparation category, which is anticipated to dominate the NGS sample preparation market over the projected period because of the rising prevalence of cancer medical problems and the increased importance of research operations. Furthermore, new opportunities for sample sequencing at astounding levels of coverage have been opened up by recent developments in library preparation sequencing kits. With technology, library preparation can sequence nucleic acids and has significantly higher sensitivity than other traditional approaches.

Hospitals & diagnostics grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the expected time. The high proportion of this market can be ascribed to some factors, including the expanding applications of NGS in medicine, the rising use of NGS in the diagnosis of infectious diseases, hereditary diseases, and cancers, and the expanding use of precision medicine. The accuracy and consistency of genetic diagnosis have increased due to the growing use of NGS in diagnostic laboratories. Advanced genetic diagnostic techniques are used in prenatal and predictive genetic testing.

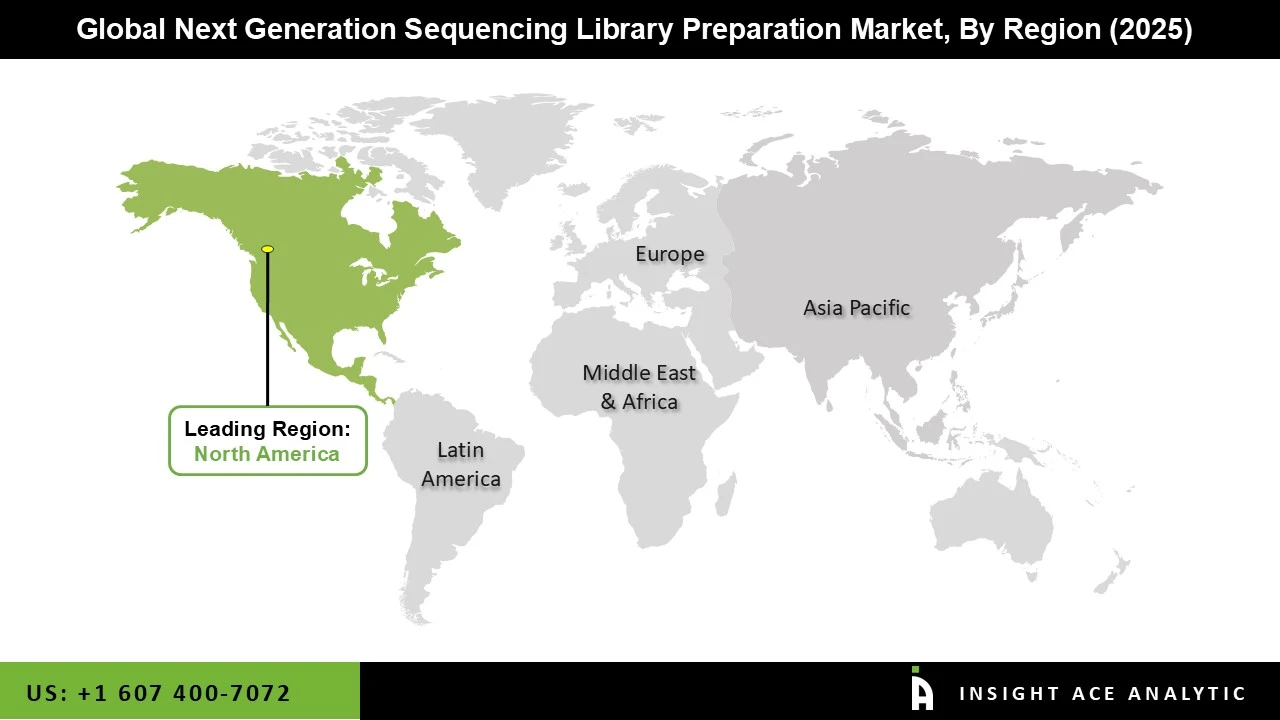

The North American next-generation sequencing library preparation market is expected to register the highest market share in revenue soon. This is because sequencing technology and NGS sample preparation sequencing solutions are widely used there. Additionally, the rise in NGS-based clinical and research applications and the favourable government and private body activities for developing and implementing NGS technologies all contribute to the regional market's growth. Besides, the Asia Pacific market is anticipated to grow the fastest over the next few years. The expansion of medical research, the growing popularity of specific treatments, and the presence of eminent service providers in the area are further likely to boost the regional market growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.11 billion |

| Revenue Forecast In 2035 | USD 7.17 billion |

| Growth rate CAGR | CAGR of 13.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Sequencing Type, Product, Application, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Agilent Technologies, Inc., Integrated DNA Technologies, F. Hoffmann-La Roche AG, Inc., Illumina, Inc., Beckman Coulter Inc. (now part of Danaher Corporation), Merck KGaA, Becton, Dickinson and Company, New England Biolabs, Inc., PerkinElmer Inc., QIAGEN N.V., Pacific Biosciences of California, Inc., Thermo Fisher Scientific Inc., and Tecan Group Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Sequencing Type

By Product-

By Application

By End use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.