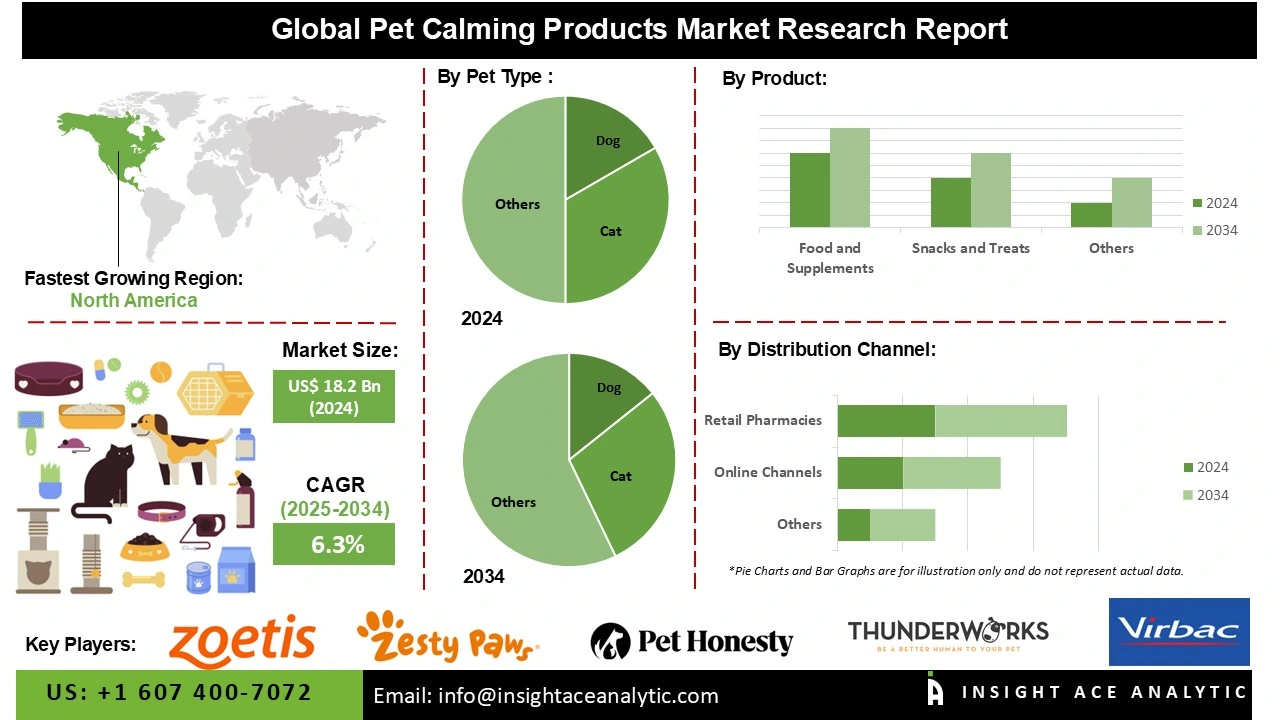

Pet Calming Products Market Size is valued at US$ 18.2 Bn in 2024 and is predicted to reach US$ 32.4 Bn by the year 2034 at an 6.3% CAGR during the forecast period for 2025-2034.

Pet calming products are a category of accessories and solutions designed to help pets relax, particularly during stressful situations. These products can include, among other things, interactive toys, relaxing sprays, anxiety wraps, pheromone diffusers, and herbal supplements.

The objective is to establish a calm atmosphere for pets, lowering fear, anxiety, and other behavioral problems that could result from traumatic events, environmental causes, or separation anxiety. One of the primary factors driving the market for pet calming products is the growing number of pet owners worldwide. People are more committed to maintaining their dogs' well-being, particularly their mental health, as they develop emotional relationships with them.

As more people become aware that pets, like people, can suffer from stress, anxiety, and behavioral problems, an increasing number of pet owners are seeking ways to help their animals cope with these issues. The market for pet calming products is expected to grow over the forecast period. Additionally, creating fresh and creative pet calming products that address certain pet requirements and preferences creates room for market expansion.

Products tailored to specific pet breeds or anxiety triggers, for instance, might give businesses a competitive advantage. However, a sizable section of pet owners is still unaware of the benefits of calming products, despite the increased awareness of pet mental health. This ignorance hinders the market's expansion.

Some of the Key Players in Pet Calming Products Market:

· Zoetis Inc.

· Virbac

· THUNDERWORKS

· GARMON CORP.

· PetIQ, LLC.

· Zesty Paws

· PetHonesty

· NOWFoods

· CEVA

· Nestlé Purina Petcare

The Pet Calming Products market is segmented by pet type, product type, and distribution channel. by pet type, the market is segmented into dog, cat, and others. by product type, the market is segmented into food and supplements, gel and ointment, snacks and treats, spray and mist, others. by distribution channel, the market is segmented into veterinary clinics, online channels, and retail pharmacies.

In 2024, the dog segment dominated the pet calming goods market, driven by rising dog ownership rates worldwide and increased sales of dog-calming products. Due to their close bond with their owners, dogs are a little more prone to anxiety-related problems. Pet calming treatments are appealing since dogs experience extreme anxiety and stress due to social anxiety, noise phobia, and separation from their owners. Several innovations, including collars, treats, supplements, and tracking apps, are driving the industry's growth.

The snack and treat segment held the largest share in 2024 and is anticipated to expand at a substantial compound annual growth rate (CAGR) over the projection period. Natural substances designed to help pets unwind and quiet down are included in pet calming treats and snacks. They are intended to be used in conjunction with other anxiety-reduction techniques, including training, exercise, and environmental enrichment. Pets can be given these treats or chews. CBD and dog treats made from hemp have been increasingly popular in recent years due to natural and non-toxic ways of calming and relaxing pets.

The North America region led the pet calming products market in 2024. The high rates of pet ownership in the United States and Canada have a major impact on the market for pet calming products in North America. The demand for various relaxing remedies, including pheromone diffusers, anxiety wraps, and supplements, has been fueled by rising pet ownership rates, growing awareness of problems like separation anxiety, and environmental changes. Additionally, the market gains from the general trend toward natural and organic products, which usually corresponds with increased customer interest in wellness and health.

In addition, over the projected period, the pet calming products market is expected to grow at the fastest compound annual growth rate (CAGR) in the Asia Pacific. As more people move to cities, pets are living in tighter spaces and are more exposed to stressors like cars and noise pollution. The growing number of pet owners in this region is driving up demand for products that help animals cope with stress and anxiety. The businesses in the pet calming products sector have therefore started collaborating.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 18.2 Bn |

| Revenue Forecast In 2034 | USD 32.4 Bn |

| Growth Rate CAGR | CAGR of 6.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Pet Type, By Product Type, By Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Zoetis Inc., Virbac, THUNDERWORKS, GARMON CORP., PetIQ, LLC., Zesty Paws, PetHonesty, NOWFoods, CEVA, and Nestlé Purina Petcare |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Pet Calming Products Market by Pet Type-

· Dog

· Cat

· Others

Pet Calming Products Market by Product Type -

· Food and Supplements

· Gel and Ointment

· Snacks and Treats

· Spray and Mist

· Others

Pet Calming Products Market by Distribution Channel-

· Veterinary Clinics

· Online Channels

· Retail Pharmacies

Pet Calming Products Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.