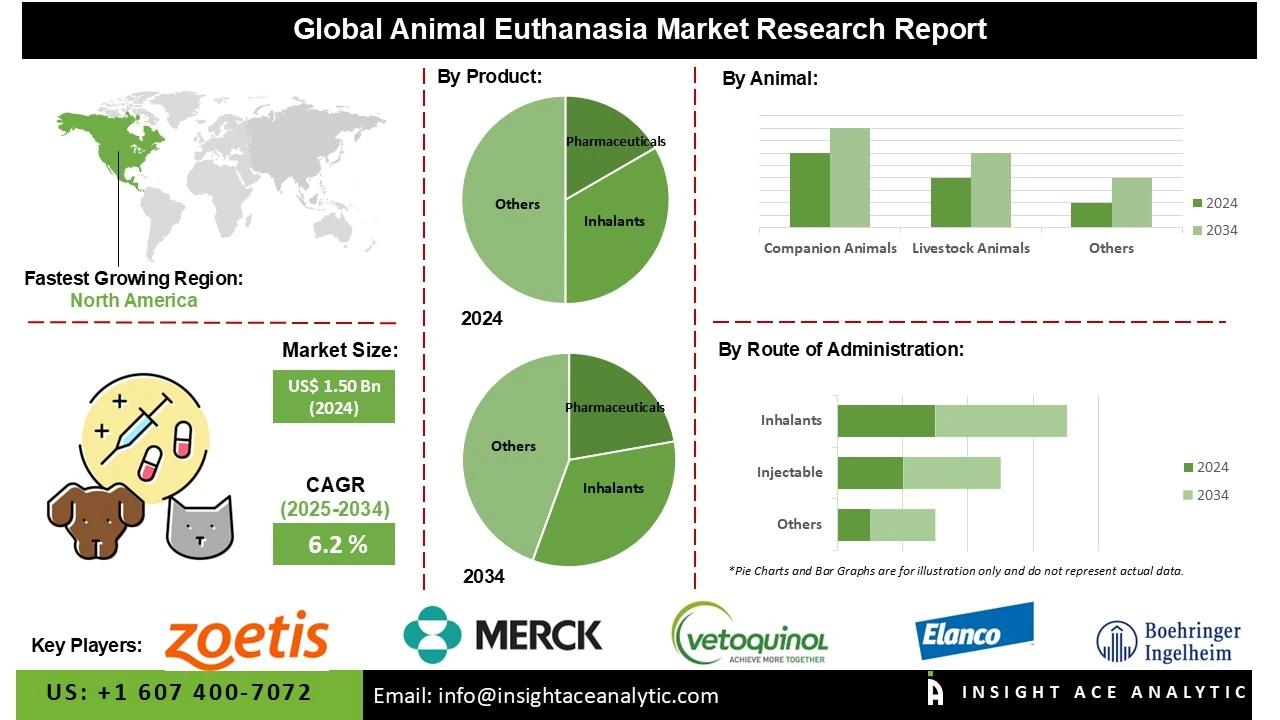

Animal Euthanasia Market is valued at US$ 1.50 Bn in 2024 and it is expected to reach US$ 2.68 Bn by 2034, with a CAGR of 6.2% during the forecast period of 2025-2034.

Animal euthanasia involves the humane termination of an animal’s life to prevent unnecessary suffering or control disease spread. Guided by veterinary standards, it ensures rapid unconsciousness with minimal distress and safe carcass handling. The practice is applied across companion animal care, livestock management, wildlife control, and research settings. Growing pet ownership, rising veterinary care costs, and heightened awareness of ethical treatment are driving market expansion. Additionally, disease outbreaks in livestock and poultry increase the demand for humane depopulation methods. Advances in veterinary training, approved drugs, and equipment further support consistent, compassionate euthanasia practices worldwide.

The market is expanding because large-scale, disease-driven euthanasia events highlight the critical role of shelter medicine and emergency protocols, potentially increasing demand for veterinary euthanasia drugs, mobile euthanasia services, and disease-prevention measure. According to the ASPCA, an estimated 920,000 dogs and cats are euthanized annually in U.S. shelters, including about 390,000 dogs and 530,000 cats, mainly due to overpopulation and limited capacity. However, pentobarbital shortages and barbiturate supply shocks are some of the obstacles impeding the growth of the animal euthanasia sector. Over the course of the forecast period, opportunities for the animal euthanasia market will be created by specific growing emphasis on animal welfare programs, in-home end-of-life care, and humane alternatives.

Some of the Key Players in Animal Euthanasia Market:

· Zoetis Inc.

· Boehringer Ingelheim GmbH

· Merck & Co. Inc.

· Elanco

· Vetoquinol SA

· Dechra Pharmaceuticals PLC

· Virbac

· Hikma Pharmaceuticals PLC

· Akorn Animal Health, Inc.

· Piramal Critical Care Inc.

· Others

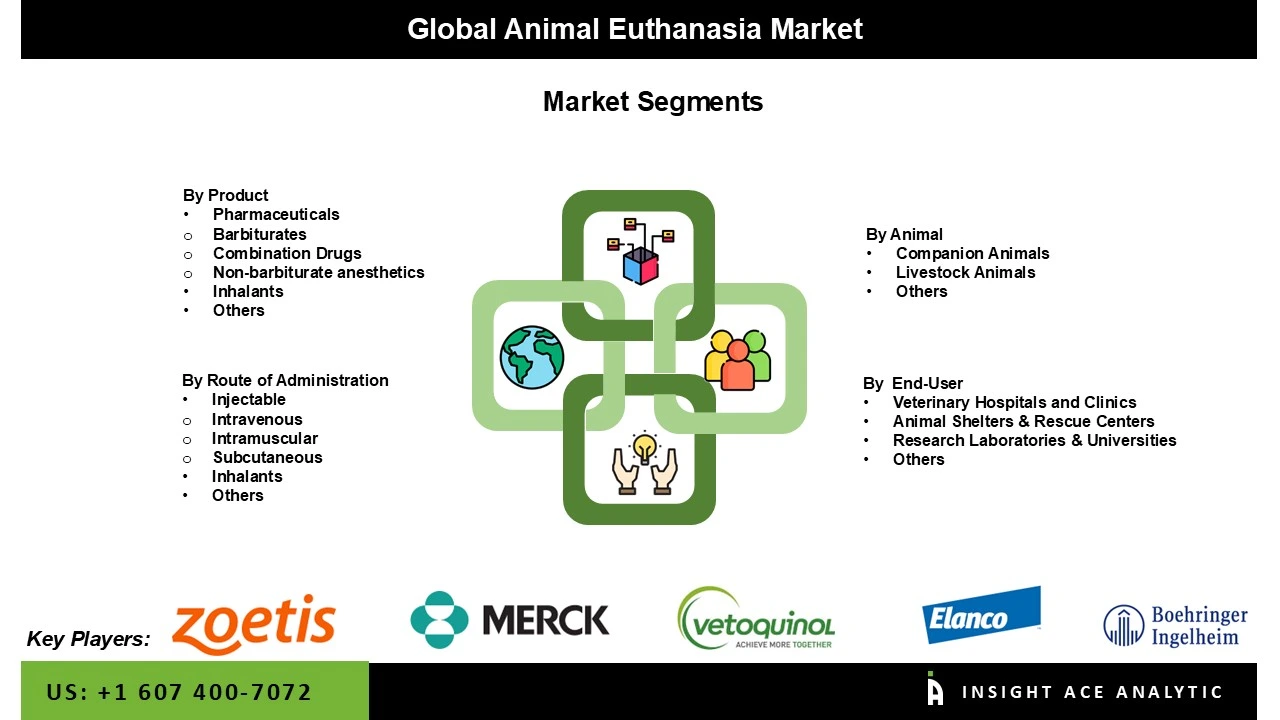

The animal euthanasia market is segmented by product, animal, route of administration, and end use. By product, the market is segmented into pharmaceuticals, inhalants, and others. pharmaceuticals is further classified into barbiturates, combination drugs, and non-barbiturate anesthetics. By animal, the market is segmented into companion animals, livestock animals, and others. By route of administration, the market is segmented into injectable, inhalants, and others. injectable are further classified into intravenous, intramuscular, and subcutaneous. By end use, the market is segmented into veterinary hospitals and clinics, animal shelters & rescue centers, research laboratories & universities, and others.

In 2024, the pharmaceuticals segment dominated the animal euthanasia market. This leadership is driven by the widespread preference for pharmaceutical agents in veterinary hospitals, clinics, and animal shelters due to their rapid onset of action, reliable outcomes, and minimal stress on animals. Pharmaceuticals have become the preferred choice for both companion and livestock animal euthanasia over mechanical or inhalant methods, supported by established regulatory approvals, broad availability, and extensive veterinary familiarity with these drugs.

The companion animals segment dominated the animal euthanasia market, driven by rising pet ownership, growing pet humanization, and the increasing demand for compassionate end-of-life care. Pet owners are progressively seeking professional veterinary assistance both in-clinic and in-home to ensure a painless and dignified process for their dogs, cats, and other domestic animals. This segment’s commercial strength is further reinforced by deep emotional bonds between owners and pets, higher disposable incomes, and heightened awareness of ethical euthanasia practices, solidifying its leading position in the market.

In 2024, North America dominated the animal euthanasia market, with the United States leading regional growth. This dominance is attributed to advanced veterinary care infrastructure, rising pet ownership, and greater awareness of compassionate end-of-life care. The increasing popularity of in-home euthanasia services highlights the region’s focus on providing humane, accessible, and emotionally supportive options for pet owners.

The Asia-Pacific region is witnessing the fastest growth in the animal euthanasia market. Expanding pet ownership, improved veterinary services, and a growing understanding of humane end-of-life practices are driving this surge. Countries such as China and India are seeing particularly strong demand, fueled by the rapid increase in companion animals and the adoption of ethical pet care standards.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.50 Bn |

| Revenue Forecast In 2034 | USD 2.68 Bn |

| Growth Rate CAGR | CAGR of 6.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Animal, By Route of Administration, By End Use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Zoetis Inc., Boehringer Ingelheim GmbH, Merck & Co. Inc., Elanco, Vetoquinol SA, Dechra Pharmaceuticals PLC, Virbac, Hikma Pharmaceuticals PLC, Akorn Animal Health, Inc., and Piramal Critical Care Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Animal Euthanasia Market by Product

· Pharmaceuticals

o Barbiturates

o Combination Drugs

o Non-barbiturate anesthetics

· Inhalants

· Others

Animal Euthanasia Market by Animal

· Companion Animals

· Livestock Animals

· Others

Animal Euthanasia Market by Route of Administration

· Injectable

o Intravenous

o Intramuscular

o Subcutaneous

· Inhalants

· Others

Animal Euthanasia Market by End Use

· Veterinary Hospitals and Clinics

· Animal Shelters & Rescue Centers

· Research Laboratories & Universities

· Others

Animal Euthanasia Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.