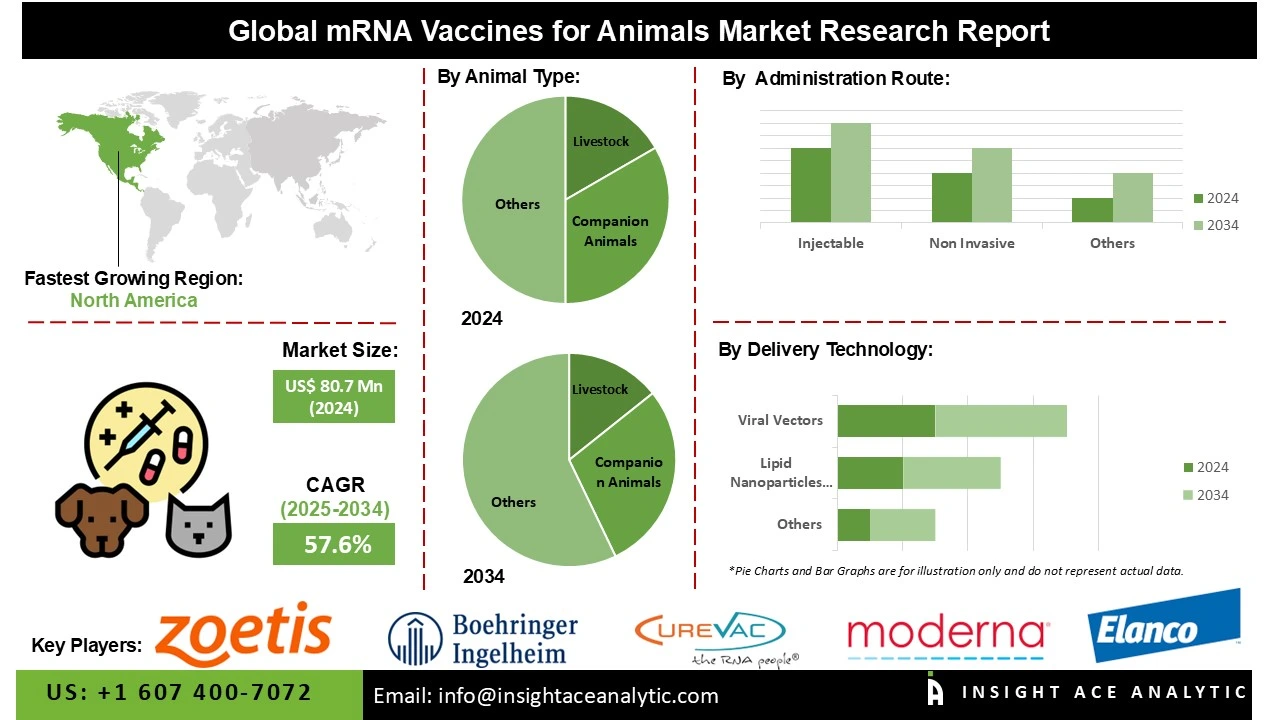

mRNA Vaccines for Animals Market Size is valued at US$ 80.7 Bn in 2024 and is predicted to reach US$ 7,451.5 Bn by the year 2034 at an 57.6% CAGR during the forecast period for 2025-2034.

In livestock and companion animals, mRNA vaccines prevent infectious diseases by stimulating immune responses without live agents. These products can help control outbreaks of viral and bacterial infections in animals, and lead to enhanced herd immunity, minimize mortality and morbidity rates, and provide overall improvements in productivity and greater food security of economically important animals. mRNA technologies enable rapid production of vaccines for emerging diseases, skip the risk of contamination and contamination with wild types, improve antigen flexibility, and, in general, make it easier to adapt to health care programs in veterinary medicine for disease surveillance in animal populations, post-exposure protection, and zoonotic disease prevention.

The global market for mRNA vaccines for animals is expanding due to rising animal disease prevalence is another element propelling the mRNA vaccines for animals market. Increasing outbreaks of infectious diseases in livestock, poultry, and companion animals create urgent demand for effective, rapid-response vaccines, driving the adoption and growth of mRNA vaccines for animals.

The growing prevalence of animal diseases, the increasing desire for vaccines that produce safer and faster protection, advances in the mRNA technology platform, and the increased global investment in animal health. In 2024, the World Organisation for Animal Health (WOAH) reported 14,918 outbreaks of African swine fever, leading to the loss of over 605,000 domestic pigs, and 6,346 outbreaks of highly pathogenic avian influenza (HPAI), resulting in the death of approximately 148.7 million poultry.

However, high production costs, complex storage, and cold-chain requirements are some of the obstacles impeding the growth of the mRNA vaccines for animals sector. Over the course of the forecast period, opportunities for the mRNA vaccines for animals market will be created by specific advancements in mRNA technology and biotechnology.

Some of the Key Players in mRNA Vaccines for Animals Market:

· Elanco Animal Health

· Boehringer Ingelheim Animal Health

· CureVac AG

· Moderna, Inc.

· GSK (GlaxoSmithKline Animal Health)

· Vaxxas Pty Ltd

· Agenus Inc.

· Tiba Biotech

· Arcturus Therapeutics

· Inovio Pharmaceuticals

The mRNA vaccines for animals market is segmented by animal type, administration route, delivery technology, disease indication, and end user. By animal type, the market is segmented into livestock animals and companion animals. By administration route, the market is segmented into injectable and non invasive. By delivery technology, the market is segmented into lipid nanoparticles (LNPs) and viral vectors. By disease indication, the market is segmented into avian influenza, swine fever, and canine diseases. By end user, the market is segmented into veterinary hospitals & clinics, research institutes, and farms.

The livestock segment led the mRNA vaccines for animals market in 2024. This convergence is fueled by due to the cattle, poultry, swine, and other farm animals have economic significance. Infectious diseases in livestock can cause substantial loss of revenue, reduced production, and directly affect food security, creating continuous demand for effective vaccination alternatives. The advanced technology of messenger RNA, or mRNA, vaccines offer rapid development and design, high efficacy, and safety for herd protection, making mRNA vaccination an ideal candidate for herd immunity and large populations of livestock to be vaccinated. mRNA vaccination for livestock in areas such as preventing disease outbreaks, improving animal health, and supporting safe, sustainable agricultural production are being increasingly adopted by government agencies, organizations, and farmers, creating a driving force within this segment of livestock animal types in the market.

The largest and fastest-growing administration route is Injectable, as they provides accurate dosing, high bioavailability, and strong immune responses. Existing veterinary frameworks and systemic infrastructure support injectable vaccine administration and sero-monitoring for animal vaccination, which lends to efficiency in delivering large-scale vaccination programs. Injectable mRNA vaccines also maintain stability through storage and reduce the risk of degradation which increases safety and efficacy. For these reasons, this is the most widely used and preferred administration route in veterinary medicine for increasing health outcomes.

North America dominated the mRNA vaccines for animals market in 2024. The United States is at the forefront of this expansion. This is due to the advanced clinics, innovative animal health technologies, and significant investment in biotech. The region faces real challenges with livestock disease management, which has led to strong government initiatives supporting modern vaccination programs. Major animal health companies have a solid presence here, and R&D is always pushing forward. Plus, awareness is climbing among both farmers and pet owners. All of this adds up to rapid adoption of mRNA vaccines across the region.

Moreover, increasing prevalence of infectious diseases in animals, and the increasing consumption of animal protein in the Asia-Pacific area, the mRNA vaccines for animals market is expanding at the strongest and fastest rate in this region. Additionally, the tendency to support and respond to changes made by government policies around veterinary healthcare, investment in veterinary healthcare assets, biotechnology-based vaccines, and cold-chain logistics to facilitate veterinary care can promote the acceptance of mRNA vaccines. Emerging markets such as, India, China, and Southeast Asia represent tremendous potential for mRNA vaccines for animals.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 80.7 Mn |

| Revenue Forecast In 2034 | USD 7,451.5 Mn |

| Growth Rate CAGR | CAGR of 57.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Animal Type, By Administration Route, By Delivery Technology, By Disease Indication, By End User, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Elanco Animal Health, Boehringer Ingelheim Animal Health, CureVac AG, Moderna, Inc., GSK (GlaxoSmithKline Animal Health), Vaxxas Pty Ltd, Agenus Inc., Arcturus Therapeutics, and Inovio Pharmaceuticals. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

mRNA Vaccines for Animals Market by Animal Type

· Livestock

· Companion Animals

mRNA Vaccines for Animals Market by Administration Route

· Injectable

· Non Invasive

mRNA Vaccines for Animals Market by Delivery Technology

· Lipid Nanoparticles (LNPs)

· Viral Vectors

mRNA Vaccines for Animals Market by Disease Indication

· Avian Influenza

· Swine Fever

· Canine Diseases

mRNA Vaccines for Animals Market by End User

· Veterinary Hospitals & Clinics

· Research Institutes

· Farms

mRNA Vaccines for Animals Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.