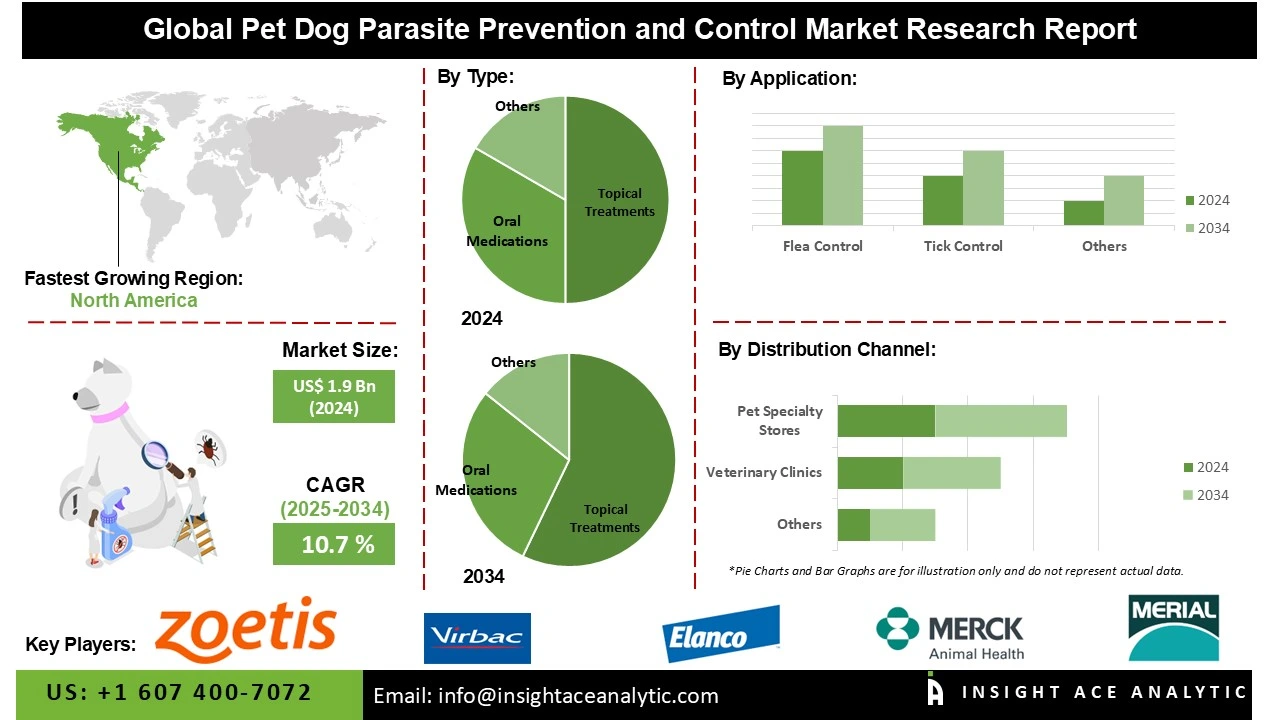

Pet Dog Parasite Prevention and Control Market Size is valued at US$ 1.9 Bn in 2024 and is predicted to reach US$ 5.1 Bn by the year 2034 at an 10.7% CAGR during the forecast period for 2025-2034.

The methods and procedures used to shield dogs from dangerous internal and external parasites that may compromise their general health, comfort, and well-being are referred to as pet dog parasite prevention and control. It includes conventional strategies such as administering antiparasitic medications, spreading flea and tick repellents, maintaining proper sanitation, and regularly cleaning living spaces to minimise environmental contamination.

Early detection and intervention for parasites, including fleas, ticks, mites, heartworms, and intestinal worms, depends substantially on preventive veterinary measures, which encompass timely deworming, annual examinations, and diagnostic testing. Some of the major factors driving the pet dog parasite prevention and control market's strong growth are rising dog ownership, more pet health awareness, and increasing zoonotic illness rates.

The growing availability of novel and efficient parasite prevention and control products (oral medications, topical treatments, injections), the ever-increasing demand for high-end and practical solutions, and the rising rate of veterinary professional recommendations for preventative care are some of the major factors driving the pet dog parasite prevention and control market growth.

However, the varying cost of raw materials, potential regulatory hurdles to new product approvals, and the ongoing need for consumer education on parasite control techniques pose barriers to market expansion. On the other hand, throughout the projection period, there will be prospects for sustained market growth due to continuous research & development into innovative parasite control technologies, as well as a strong focus on product efficacy and safety.

Some of the Key Players in Pet Dog Parasite Prevention and Control Market:

· Boehringer Ingelheim

· Zoetis

· Merck Animal Health

· Elanco Animal Health

· Bayer Animal Health

· PetIQ

· Virbac

· Merial

· Ceva Santé Animale

· Vetoquinol

· Hartz Mountain Corporation

· Pets Best Insurance

· Nestlé Purina PetCare

· Patterson Companies

· Kemin Industries

· Boehringer Ingelheim Vetmedica

· NexGard

· Frontline

· Advantage

· PetSafe

· Sentry Pet Care

· Vet’s Best

· Zodiac

· Adams Flea and Tick

· Tickless

· Other Prominent Players

The pet dog parasite prevention and control market is segmented by type, application, and distribution channel. By type, the market is segmented into oral medications, topical treatments, vaccines, and collars. By application, the market is segmented into flea control, tick control, intestinal worm control, and heartworm prevention. By distribution channel, the market is segmented into veterinary clinics, online retail, and pet specialty stores.

In 2024, the pet dog parasite prevention and control industry is primarily focused on topical treatments, as they offer an easy-to-use and practical way to prevent and treat common parasitic infestations, such as fleas and ticks. Dog owners are increasingly using topical parasiticide solutions, which are typically applied directly to the pet's skin or coat, due to their targeted distribution, ease of use, and potential for long-lasting protection. Additionally, these medications have been widely used to treat flea and tick infestations, as well as other parasitic problems affecting companion animals. They may contain active substances such as fipronil, selamectin, or imidacloprid.

Moreover, this segment has grown due to the increasing need for efficient, user-friendly parasiticide solutions, the recognition of the importance of comprehensive parasite control strategies, and the ongoing development of novel topical formulations.

Since veterinary clinics are the primary point of contact for pet health concerns, they hold a substantial market share. Veterinary clinics are frequently relied upon by pet owners for accurate diagnosis and effective treatment of parasitic infestations. Veterinary clinics are a crucial distribution channel for parasite prevention and control products due to their reputation for reliability and expertise. Additionally, veterinary-delivered products are more appealing than ad hoc OTC solutions due to advancements in quick in-clinic diagnostics and safer, longer-acting treatments, and stronger professional recommendations from veterinarians affect owner purchasing behavior.

Furthermore, the adoption of pet insurance, collaborations with shelters and groomers that direct patients to clinics, and digital tools that facilitate adherence and repeat dispensing all contribute to the growth of this category, strengthening the Veterinary Clinics channel in the pet dog parasite prevention and control market.

North America held the largest share of the pet dog parasite prevention and control market in 2024, primarily due to the high prevalence of parasitic diseases in companion animals, a well-established infrastructure for animal healthcare, and a robust regulatory framework for the approval and use of these veterinary therapies. Additionally, North America's market is expanding due to the availability of a range of innovative products and rising awareness of pet health and welfare. The region's pet dog parasite prevention and control market expansion is further supported by the availability of innovative products and the presence of several reputable industry players.

Over the forecast period, the pet dog parasite prevention and control market is expected to grow at the fastest rate in the Asia-Pacific region due to rising pet dog ownership, increased emphasis on pet health and wellbeing, and a growing focus on enhancing animal healthcare infrastructure. To meet the evolving needs of their companion dog populations, countries such as China, Japan, and India are making substantial investments in advancing their animal healthcare infrastructures and proactively pursuing accessible and effective parasiticide options.

Furthermore, it is expected that the development of veterinary healthcare infrastructure and increased investment in research and development within the region will propel the growth of the companion dog parasite prevention and control market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.9 Bn |

| Revenue Forecast In 2034 | USD 5.1 Bn |

| Growth Rate CAGR | CAGR of 10.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Boehringer Ingelheim, Zoetis, Merck Animal Health, Elanco Animal Health, Bayer Animal Health, PetIQ, Virbac, Merial, Ceva Santé Animale, Vetoquinol, Hartz Mountain Corporation, Pets Best Insurance, Nestlé Purina PetCare, Patterson Companies, Kemin Industries, Boehringer Ingelheim Vetmedica, NexGard, Frontline, Advantage, PetSafe, Sentry Pet Care, Vet’s Best, Zodiac, Adams Flea and Tick, and Tickless. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Pet Dog Parasite Prevention and Control Market by Type-

· Oral Medications

· Topical Treatments

· Vaccines

· Collars

Pet Dog Parasite Prevention and Control Market by Application -

· Flea Control

· Tick Control

· Intestinal Worm Control

· Heartworm Prevention

Pet Dog Parasite Prevention and Control Market by Distribution Channel-

· Veterinary Clinics

· Online Retail

· Pet Specialty Stores

Pet Dog Parasite Prevention and Control Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.