AI in Aging and Elderly Care Market Size was valued at USD 47.4 Bn in 2024 and is predicted to reach USD 322.4 Bn by 2034 at a 21.2% CAGR during the forecast period for 2025 to 2034.

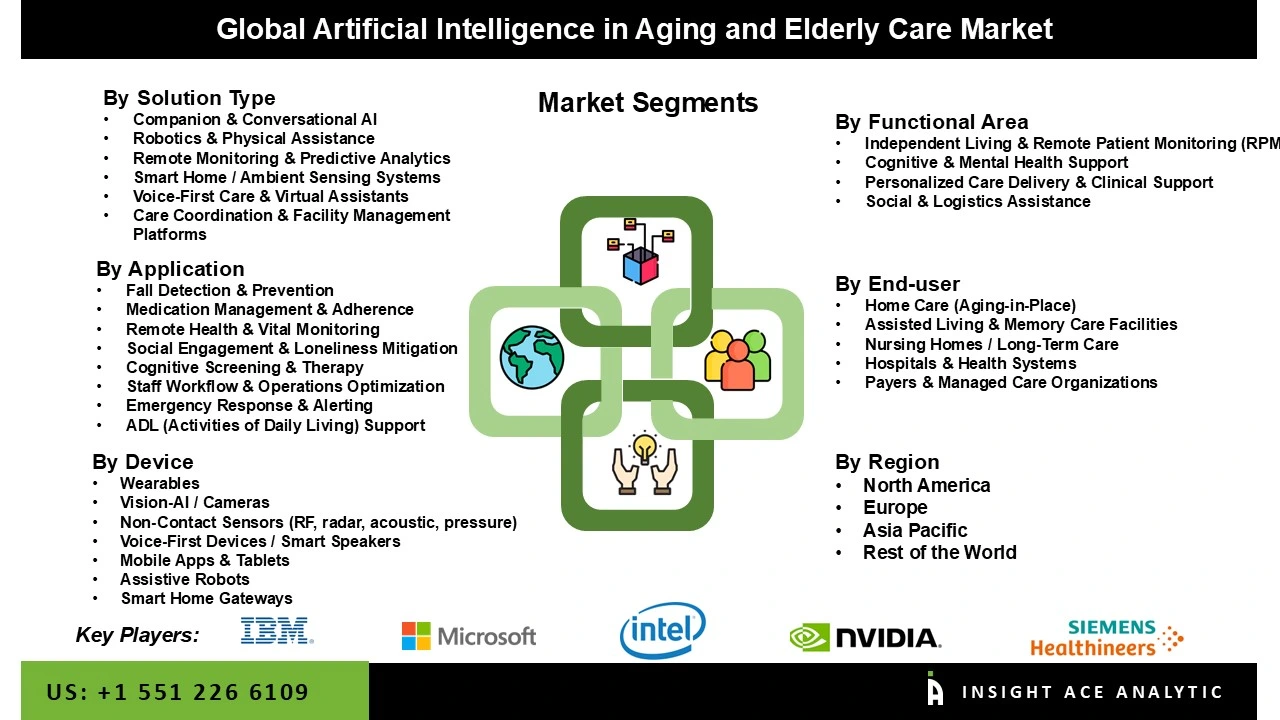

AI in Aging and Elderly Care Market Size, Share & Trends Analysis Report By Solution Type (Companion & Conversational AI, Robotics & Physical Assistance, Remote Monitoring & Predictive Analytics, Smart Home / Ambient Sensing Systems), By Application (Fall Detection & Prevention, Medication Management & Adherence, Remote Health & Vital Monitoring, By Device (Wearables, Vision-AI / Cameras, Non-Contact Sensors (RF, radar, acoustic, pressure), Voice-First Devices / Smart Speakers, Mobile Apps & Tablets, Assistive Robots, Smart Home Gateways), By Functional Area, By End User, By Region and By Segments Forecasts, 2025 to 2034

The main goal of the book Artificial Intelligence in Aging and Elderly Care is to use state-of-the-art AI technologies to address the issues brought on by an aging population. These creative solutions support the growing number of older adults due to increased life expectancy and enable remote monitoring and early health issue detection for caregivers and healthcare providers.

AI-driven solutions encourage healthy aging and active lifestyles among the aged population by providing them with smart home appliances, virtual health assistants, and robotic companions. These innovations make society more inclusive and age-friendly.

The COVID-19 epidemic has significantly impacted artificial intelligence in the aging and elder care sector. The increased susceptibility of older persons to the virus has led to an increased emphasis on using AI-driven solutions to guarantee their security and welfare—distant medical. During the pandemic, telemedicine, virtual health aids, and monitoring have become more popular, enabling medical professionals to give care with less direct patient interaction. AI-driven solutions have also been crucial in detecting early COVID-19 signs in older people, allowing for prompt therapies and lowering the risk of transmission in care settings. But the pandemic has also brought attention to issues with older persons' access to technology and data privacy, which calls for more work to solve these issues.

The AI in the aging and elderly care market is segmented based on type, application, end-user, and technology. The market is segmented based on type, such as natural language processing (NLP) systems, robotics and robotic assistance, smart home devices and IoT solutions, machine learning and predictive analytics and virtual health assistants. Based on the application, the market is segmented into fall detection and prevention, medication management, remote health monitoring, social engagement companion AI, cognitive stimulation and brain training. The market is segmented based on end-users into assisted living facilities, home care settings, nursing homes, long-term care centres, hospitals, and healthcare institutions. The market is segmented based on technology such as wearable devices, smart home systems, mobile apps, cloud computing, and the Internet of Things (IoT).

Integrating the Internet of Things (IoT) and connected devices is a major growth element in the AI-powered solutions for the elder care market. IoT and connected devices in the senior care industry have several uses and advantages. Real-time data gathering and processing is made possible by wearable sensors, smart home automation systems, and remote monitoring equipment. By integrating these devices, caregivers and medical professionals may keep an eye on vital signs, activity levels, medication compliance, and fall or emergency detection from a distance. The intelligent amalgamation of diverse gadgets and AI-driven systems facilitates proactive and customized care, guaranteeing security, welfare, and an enhanced standard of living for senior citizens. The application of IoT and linked devices in elder care enhances the capacity for remote monitoring and enables early health diagnosis.

The industry offers a variety of solutions, such as natural language processing (NLP) systems, which provide easy engagement and communication with senior citizens. IoT solutions and smart home devices enable networked settings for remote safety monitoring, while robotics and robotic assistance are essential for giving companionship and physical support. Personalized treatment plans and early health issue diagnosis are primarily made possible by machine learning and predictive analytics. Furthermore, virtual health assistants provide medication management assistance, cognitive stimulation, and virtual companionship.

In the market for AI-powered senior care solutions, North America is expected to register the highest market share. Other elements add to the region's importance. The need for innovative aged care solutions is fueled by North America's vast aging population and highly developed healthcare system. Significant R&D activity, government financing, and collaboration between IT companies and healthcare institutions all benefit the area. Additionally, the wearables, AI-powered platforms, and remote monitoring systems markets are well-established in North America, which facilitates the integration of AI technologies into elderly care. It is important to remember, though, that the market for AI-powered solutions for senior care is expanding quickly.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 47.4 Bn |

| Revenue Forecast In 2034 | USD 322.4 Bn |

| Growth Rate CAGR | CAGR of 21.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Solution Type, Functional Area, Application, End User and Device. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | IBM Corporation, Intel Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., NVIDIA Corporation, Siemens Healthineers AG, Oracle Corporation, General Electric Company, Medtronic PLC, Koninklijke Philips N.V., Samsung Electronics Co., Ltd., CarePredict, Inc., Intuition Robotics, Vayyar (Vayyar Care), Kami Vision (KamiCare), Nobi, K4Connect, Inc., Aiva Health, Best Buy Health, GrandPad and others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

AI in the Aging and Elderly Care Market- By Solution Type

AI in the Aging and Elderly Care Market- By Application

AI in the Aging and Elderly Care Market -By Functional Area

AI in the Aging and Elderly Care Market- By End-User

AI in the Aging and Elderly Care Market- By Device

AI in the Aging and Elderly Care Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.