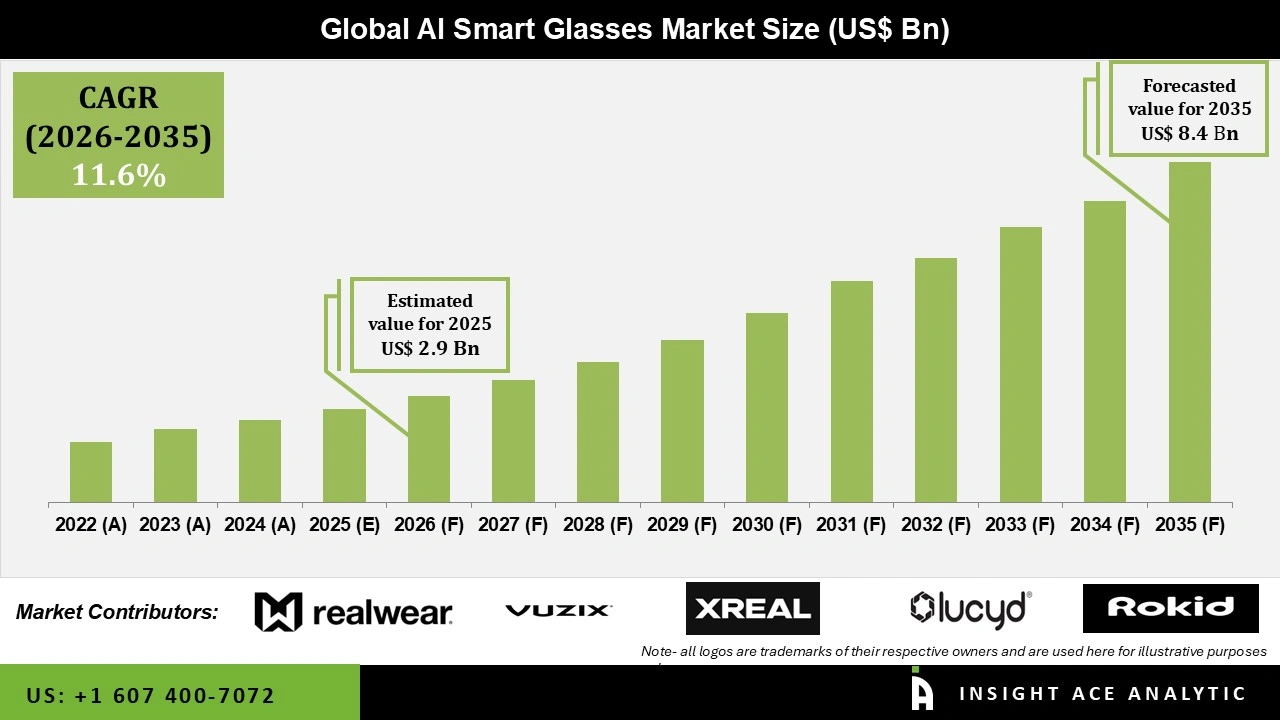

Global AI Smart Glasses Market Size is valued at USD 2.9 Billion in 2025 and is predicted to reach USD 8.4 Billion by the year 2035 at a 11.6% CAGR during the forecast period for 2026 to 2035.

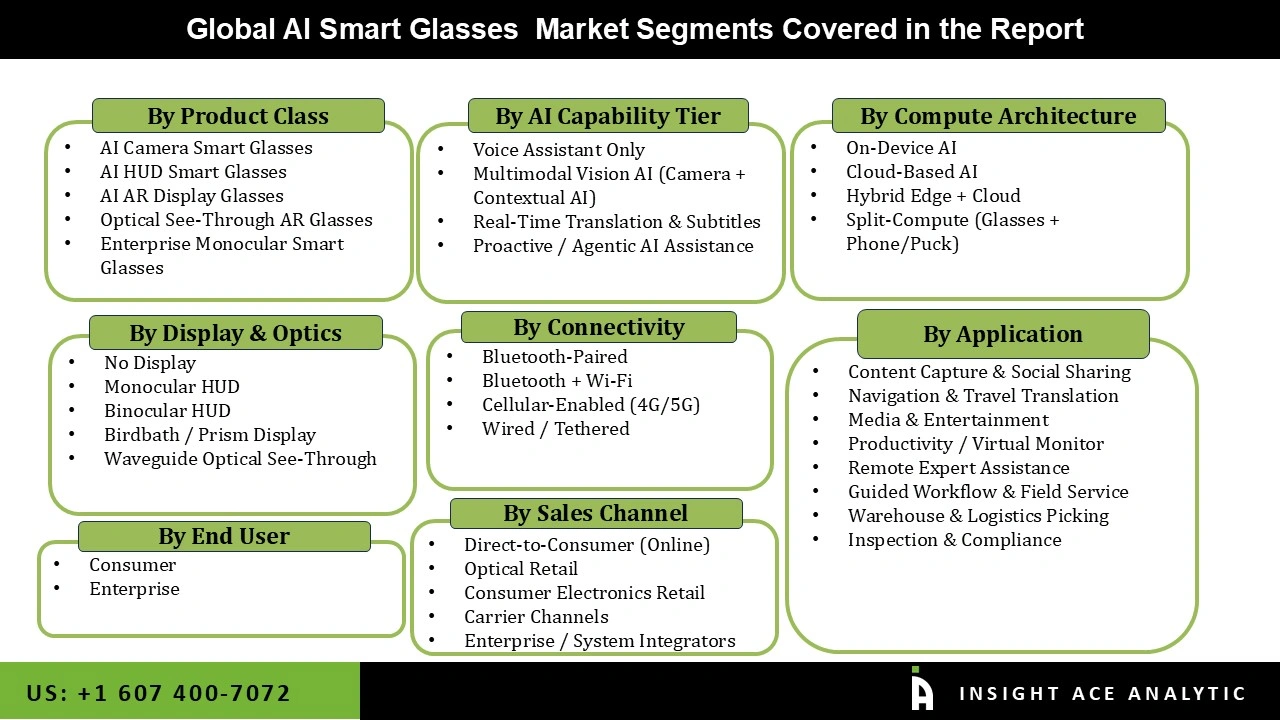

AI Smart Glasses Market Size, Share & Trends Analysis By Product Class (AI Camera Smart Glasses, AI HUD Smart, Glasses, AI AR Display Glasses, Optical See-Through AR Glasses, Enterprise Monocular Smart Glasses), By AI Capability Tier (Voice Assistant Only, Multimodal Vision AI (Camera + Contextual AI), Real-Time Translation & Subtitles, Proactive / Agentic AI Assistance), By Compute Architecture (On-Device AI, Cloud-Based AI, Hybrid Edge + Cloud, Split-Compute (Glasses + Phone/Puck)), By Display & Optics, By Connectivity, By End User, By Application, By Sales Channel, By Region and Segments Forecasts, 2026 to 2035.

AI smart glasses are wearable eyewear that combine sensors, cameras, microphones, artificial intelligence, and connectivity to deliver digital help in real time, right in front of the wearer. Features like hands-free calling, voice-activated help, navigation advice, live translation, and contextual information presentation via augmented reality (AR) are made possible by these glasses' ability to identify objects, faces, text, and environments.

Smart glasses, which are powered by on-device or cloud-based AI, may evaluate visual and audio inputs to provide tailored insights, facilitate accessibility for users who are blind or hard of hearing, and boost productivity in industries including manufacturing, healthcare, education, and logistics. The AI smart glasses market is propelled by the expanding use of wearable technology and the growing need for augmented reality solutions in business and consumer settings. The adoption is accelerating due to a growing reliance on hands-free gadgets for safety and productivity. The need for AI smart glasses to increase productivity is being driven by the expansion of field services, logistics, and e-commerce. The market is expanding due to growing customer interest in linked wearables for entertainment, fitness, and lifestyle enhancement.

he market for AI smart glasses is anticipated to develop at the fastest rate due to significant investments in wearables, their widespread use in field services and logistics, and the availability of 5G networks for real-time data processing. Furthermore, the growing need for remote collaboration tools across workplace solutions and the growing emphasis on immersive learning and training experiences are driving the global adoption of AI-enabled smart glasses.

In addition, the rapid technological advancement, evolving end-user acceptance trends, and robust cross-industry applications define the AI smart glasses market. The AI smart glasses market momentum is being driven by growing demand for immersive experiences in consumer electronics, precision tools in healthcare, and real-time visualization in logistics. While increasing investment in AR optics and 5G connections is improving product usability, partnerships between wearable makers and AI software companies are boosting deployment capabilities. However, issues with infrastructure preparedness, data privacy, and device pricing continue to be significant determinants of adoption patterns across geographical boundaries. This is therefore limiting the AI smart glasses market growth over the forecast period.

The AI smart glasses market is growing because of the rapid improvements in augmented reality (AR) and artificial intelligence (AI) technologies, which enhance the device's functionality and user experience. Wider 5G networks and greater wearable technology investments enable near real-time data processing, which boosts adoption rates across a variety of industries. This is further fueled by the increasing need for efficient, hands-free operations across a range of industries, such as manufacturing, healthcare, and logistics.

Additionally, the AI smart glasses market is growing due to an increase in customer demand for immersive experiences through communication, exercise, and gaming applications. With over 3 million active users worldwide participating in AR-enhanced interactive experiences, the adoption of AI smart glasses in gaming and fitness apps increased by 35% in 2024.

The high cost of production is one major factor restraining the demand for AI smart glasses. Manufacturing costs are driven by the intricacy of incorporating several sensors, cameras, 5G modules, and strong AI processors into a small, light frame. Because of this, many potential customers are still unable to afford the price, which prevents wider acceptance outside of early adopters and business users. Furthermore, it is expensive to maintain a balance between performance, design, and battery life, which drives up costs. Large-scale production and rollouts are slowed considerably by the costly components and specialized manufacturing techniques. It is more difficult for new firms to enter the market or for established businesses to provide competitive, affordable models as a result of this financial barrier.

The voice interaction segment held the largest share in the AI smart glasses market in 2024 because of its use in the retail, e-commerce, and educational industries. This domination is fueled by voice commands' natural and hands-free communication style, which improves user comfort and safety across a variety of verticals, particularly in the industrial, logistics, and healthcare sectors.

Additionally, businesses and individuals alike are quickly embracing voice interaction because it allows them to easily access information, manage applications, and complete activities without losing focus. Furthermore, improvements in natural language processing have improved the precision and intuitiveness of voice instructions. Integration into AI smart glasses for smooth communication with other linked devices has been prompted by this. Voice-based smart glasses are becoming more popular among a broad user base as AI helpers become more communicative.

In 2024, the consumer electronics segment dominated the AI smart glasses market. The strong demand for wearable technology that blends exercise, entertainment, and daily use in a lightweight design favors the AI smart glasses market. The real-time translations, immersive media experiences, and smart home controls are some of the features that attract consumers to AI smart glasses.

Additionally, the demand for wearables with several functions has increased due to the rise in digitally active lifestyles. Glasses with AI capabilities are becoming more and more viewed as an extension of smartphones, providing consumers with a more engaging and natural method to access data and services without being dependent on conventional screens.

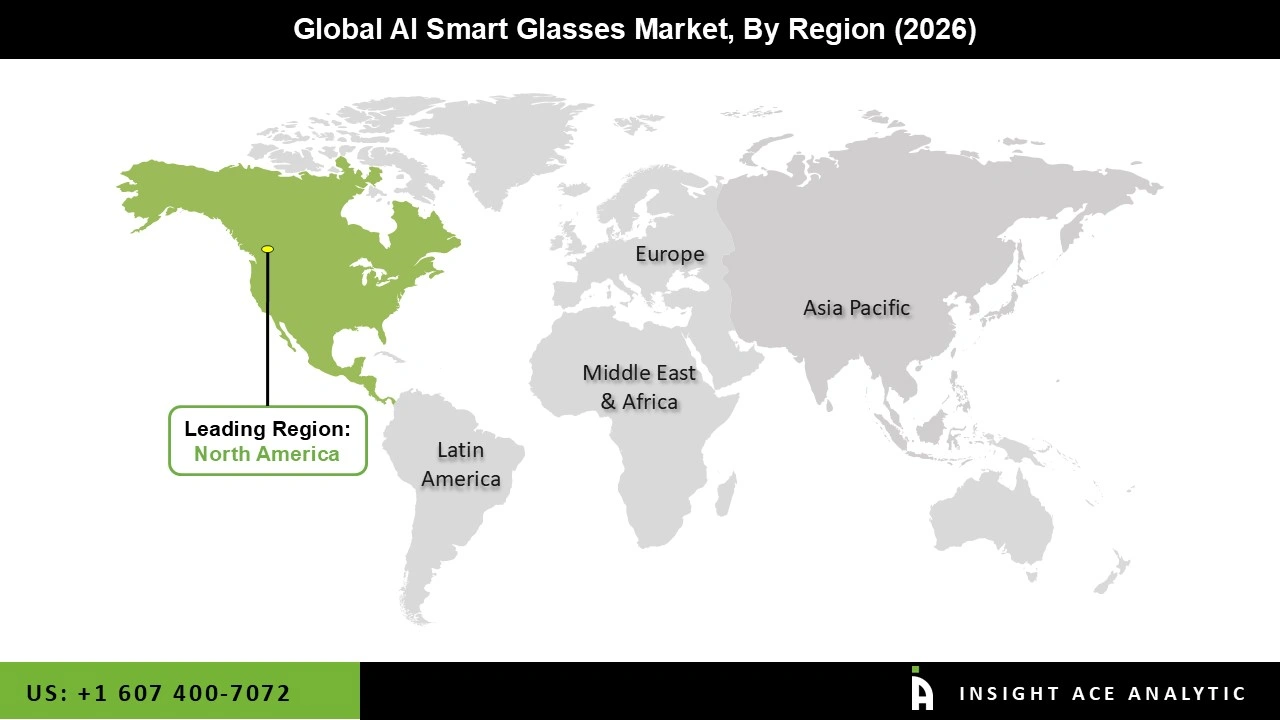

The AI Smart Glasses market was dominated by the North America region in 2024, driven by the high consumer demand for cutting-edge wearable technology and the region's technological advancements. North America is a center for the development of smart glasses, with a strong ecosystem of tech firms and artificial intelligence (AI)-focused businesses.

This expansion has been further accelerated by the growing integration of AI smart glasses in industries like enterprise solutions, healthcare, and education. Additionally, large tech firms like Google, Microsoft, and Apple actively invest in smart glass technology, which leads to more sophisticated features and better user experiences. The region’s tech-savvy populace is keen to adopt new devices such as AI smart glasses that improve entertainment and productivity, adding to its expanding consumer base.

• July 2025: Microsoft revealed plans for the CoPilot AR smart glasses' design and AI integration through patent applications. The patents, which emphasize accessibility and real-time spatial data processing, allude to a Windows-based spatial computing device with AI-assisted environment interaction.

• May 2025: Google reentered the smart glass industry with the release of new prototype Android XR glasses. The business highlighted how AR and AI capabilities may be seamlessly integrated.

• April 2025: The official launch of Meta Ray-Ban eyewear is scheduled for soon in India. With the help of these AI-powered smart glasses, users will be able to converse with the voice assistant hands-free and ask questions for immediate replies, listen to music, retrieve information, and perform a number of other hands-free tasks.

• March 2024: With enhanced waveguide optics and complete voice-activated AI assistant integration, Vuzix introduced its next-generation Ultralite OEM smart glasses platform, aimed at business remote assistance and logistics.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.9 Billion |

| Revenue forecast in 2035 | USD 8.4 Billion |

| Growth Rate CAGR | CAGR of 11.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Class, AI Capability Tier, Compute Architecture, Display & Optics, Connectivity, End User, Application, Sales Channel and Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Meta Platforms (Ray-Ban Meta, Oakley Meta), Google (Android XR ecosystem), Samsung Electronics, Apple, XREAL, Rokid, Vuzix, RayNeo (TCL), Solos, Amazon (Echo Frames), Xiaomi, Huawei, Lenovo (ThinkReality), RealWear, Epson, VITURE, Brilliant Labs, INMO, Nimo Planet, MAD Gaze, Lumus (optics platform), DigiLens (waveguide tech provider), Kopin Corporation, Goertek (ODM/OEM smart glasses) and Other Prominant Players. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.