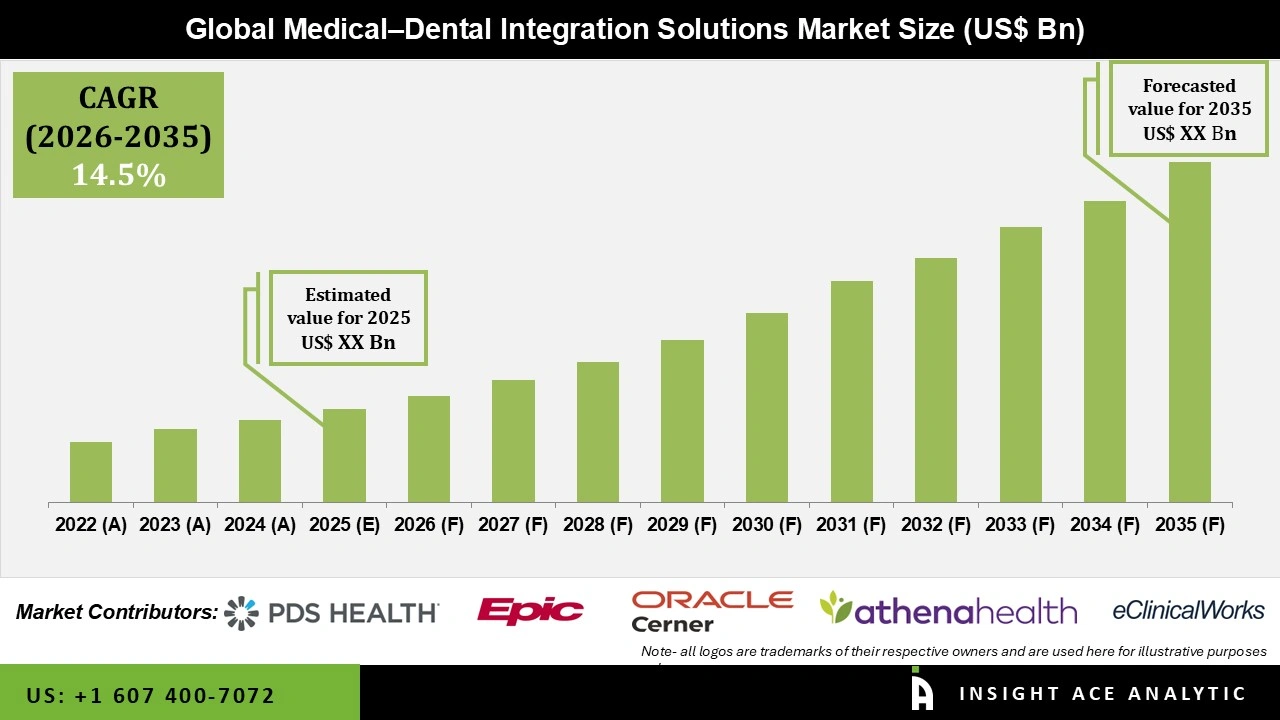

Global Medical–Dental Integration Solutions Market Size is predicted to witness a 14.5% CAGR during the forecast period for 2026 to 2035.

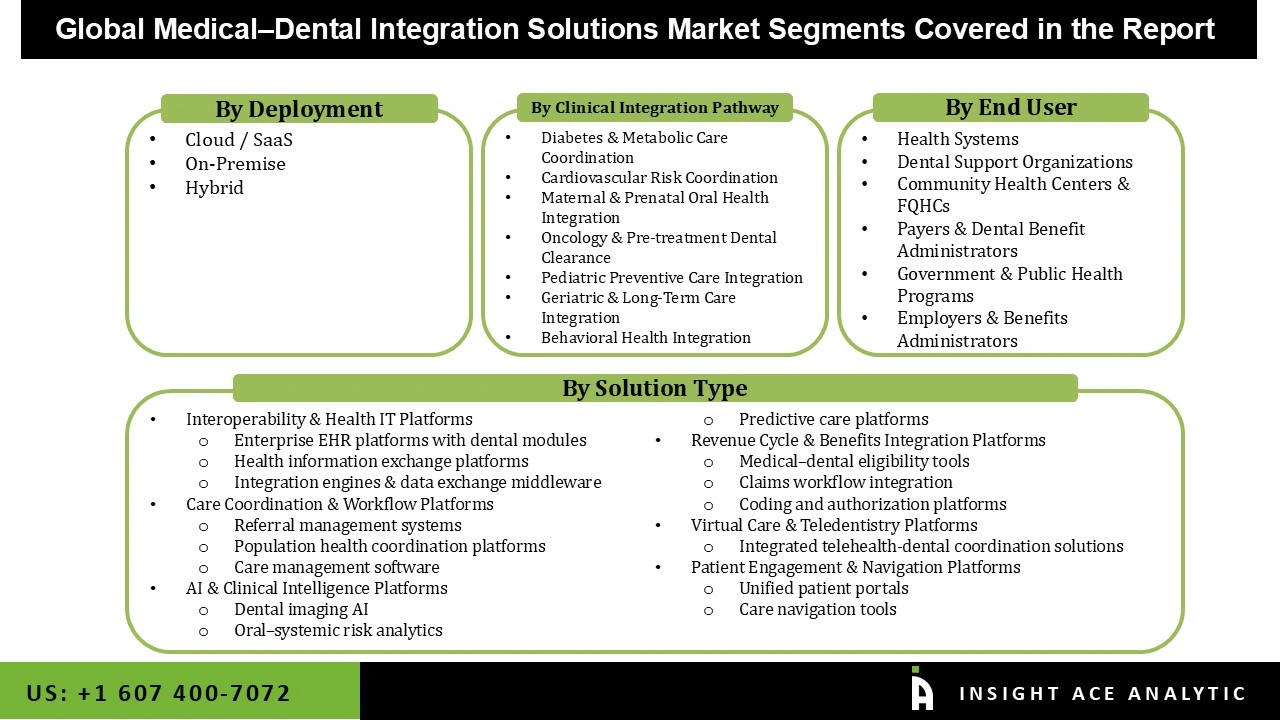

Medical–Dental Integration Solutions Market Size, Share & Trends Analysis Distribution By Solution Type (Interoperability & Health IT Platforms, Care Coordination & Workflow Platforms, AI & Clinical Intelligence Platforms, Revenue Cycle & Benefits Integration Platforms, Virtual Care & Teledentistry Platforms, Patient Engagement & Navigation Platforms), By End User (Health Systems, Dental Support Organizations, Community Health Centers & FQHCs, Payers & Dental Benefit Administrators, Government & Public Health Programs, Employers & Benefits Administrators), By Clinical Integration Pathway (Diabetes & Metabolic Care Coordination, Cardiovascular Risk Coordination, Maternal & Prenatal Oral Health Integration, Oncology & Pre-treatment Dental Clearance, Pediatric Preventive Care Integration, Geriatric & Long-Term Care Integration, Behavioral Health Integration),By Deployement(Cloud / SaaS, On-Premise, Hybrid) and Segment Forecasts, 2026 to 2035

Medical–dental integration solutions refer to the full spectrum of digital platforms, tools, and workflows designed to connect medical and dental care, enabling coordinated, patient-centered treatment. The market includes interoperability and health IT platforms that integrate electronic health records (EHRs) with dental modules, care coordination and workflow platforms that streamline referrals and population health management, AI-driven clinical intelligence platforms for predictive analytics and oral-systemic risk assessment, revenue cycle and benefits integration tools to align medical and dental billing, as well as virtual care and teledentistry solutions that enable remote consultations and patient engagement. These solutions are critical because gaps between medical and dental care can lead to missed diagnoses, fragmented treatment, and lower overall patient outcomes.

Medical–dental integration solutions are widely adopted to improve care coordination, enhance clinical decision-making, reduce administrative inefficiencies, and support preventive, value-based healthcare models. Market growth is driven by increasing awareness of the links between oral health and systemic conditions such as diabetes, cardiovascular disease, and maternal health, along with rising adoption of EHRs, telehealth platforms, and AI-enabled analytics in healthcare systems. At the same time, market expansion is tempered by challenges such as high implementation costs, interoperability complexities across legacy systems, and stringent, region-specific data privacy and regulatory requirements, which can slow adoption among smaller clinics and practices.

Care Integration Organizations

Interoperability & Health IT Platforms

Care Coordination & Workflow Platforms

AI & Clinical Intelligence Platforms

Revenue Cycle & Benefits Integration Platforms

Virtual Care & Teledentistry Platforms

Patient Engagement & Navigation Platforms

Driver

Rising Awareness and Clinical Impact of Oral–Systemic Health on Integrated Care Solutions

The major driver for the medical–dental integration solutions market is the growing awareness of the strong connection between oral health and overall systemic health. Conditions such as diabetes, cardiovascular disease, and maternal health complications are increasingly recognized as being closely linked to oral health, prompting healthcare providers to prioritize coordinated care between medical and dental services. This awareness is encouraging hospitals, clinics, and dental practices to adopt integrated solutions that enable seamless sharing of patient information, improve care coordination, and support preventive health strategies. By bridging the gap between medical and dental care, these solutions help enhance patient outcomes, reduce fragmented treatment, and promote a more holistic approach to health.

Restrain/Challenge

High Cost Implementation in Medical–Dental Integration Solutions.

The main restraint for the medical–dental integration solutions market has been high cost of implementation. Integrating medical and dental systems often requires substantial investment in software, EHR upgrades, staff training, and IT infrastructure. For smaller clinics and practices, these upfront expenses can be prohibitive, delaying adoption despite clear clinical advantages. Addressing this challenge through scalable solutions, flexible pricing models, and phased implementation strategies is essential for wider adoption and long-term market growth.

The medical–dental integration solutions market is led by interoperability & health it platforms, which include enterprise EHR systems with dental modules, health information exchange platforms, and integration engines or middleware. These solutions allow seamless sharing of patient data between medical and dental providers, improving care coordination and workflow efficiency. By giving clinicians access to complete and accurate patient information across different care settings, these platforms play a central role in delivering integrated, patient-centered care. Their adoption is further supported by the growing awareness of the link between oral health and systemic conditions, as well as the increasing need for practices to comply with regulatory requirements and enhance operational efficiency. As a result, these platforms are widely recognized as essential tools for modern healthcare and dental organizations looking to provide holistic, coordinated care

Cloud / SaaS deployment is the leading model in the medical–dental integration solutions market. These solutions allow healthcare and dental organizations to access integrated platforms over the internet without heavy upfront investment in IT infrastructure. Cloud-based systems offer scalability, easy updates, and seamless integration with existing EHRs, making them ideal for multi-location practices and large health systems. They also support secure data storage, real-time collaboration among providers, and remote access for telehealth and care coordination, helping organizations improve operational efficiency and deliver more coordinated, patient-centered care.

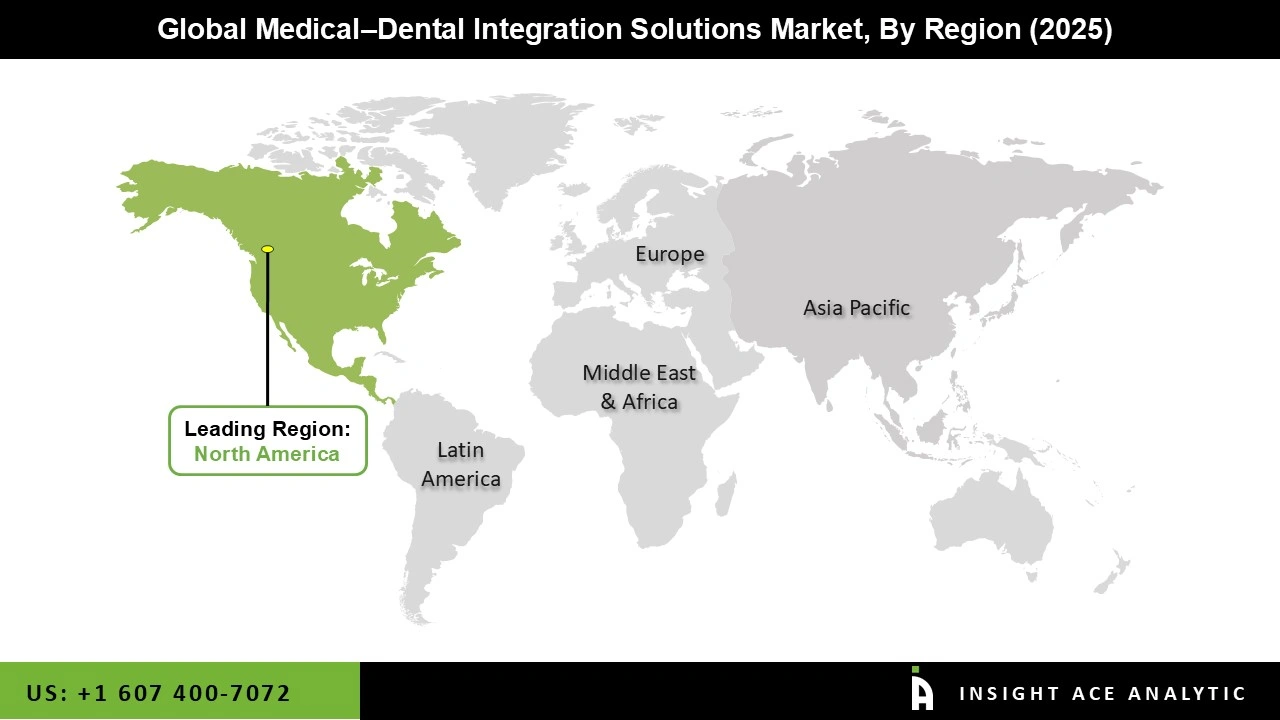

North America has emerged as the leading market for medical–dental integration solutions due to a combination of strong healthcare infrastructure, high adoption of electronic health records (EHRs), and growing awareness of the link between oral health and systemic conditions such as diabetes and cardiovascular disease.

Healthcare providers and dental practices in the region are increasingly focused on delivering coordinated, patient-centered care, driving demand for integrated platforms that streamline workflows, improve care coordination, and enhance clinical decision-making. Additionally, supportive regulatory frameworks, technological advancements in telehealth and AI-driven analytics, and substantial investments by hospitals, dental support organizations, and health systems have further strengthened the region’s leadership in this growing market.

In April 2025, PDS Health launched PDS Health Technologies to expand its healthcare technology and operational support offerings, helping providers adopt integrated EHR systems and improve coordinated medical‑dental care across practices. The initiative supported shared medical and dental records and revenue cycle management services.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 14.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Solution Type, End User, Clinical Integration Pathway, Deployment and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | PDS Health, Epic Systems, Oracle Health (Cerner), athenahealth, eClinicalWorks, NextGen Healthcare, Greenway Health, InterSystems, Veradigm (Allscripts), Redox, Particle Health, Innovaccer, HealthEdge (GuidingCare), AssureCare, ZeOmega, WellSky, Bamboo Health, Unite Us, Overjet, Pearl AI, VideaHealth, Dentrix Ascend Analytics (Henry Schein One), Change Healthcare, Waystar, Zelis, CareStack, Adit, Dentulu, MouthWatch (TeleDent), The TeleDentists, Denteractive, Luma Health, Phreesia, Solutionreach, NexHealth |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.