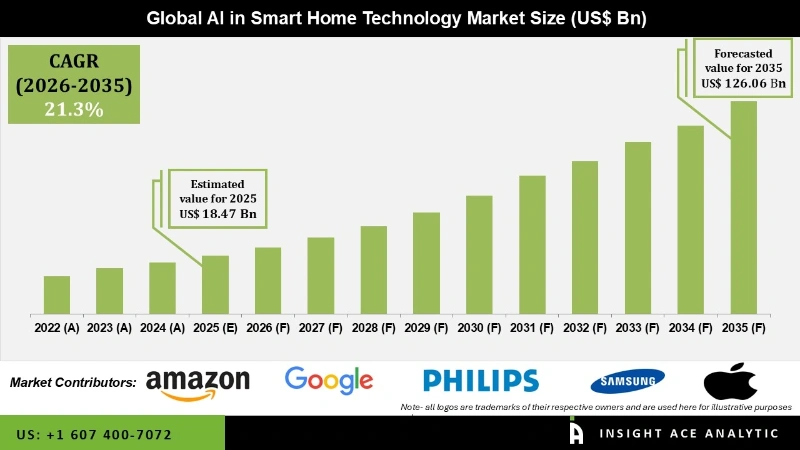

AI in Smart Home Technology Market Size was valued at USD 18.47 Bn in 2025 and is predicted to reach USD 126.06 Bn by 2035 at a 21.30% CAGR during the forecast period for 2026 to 2035.

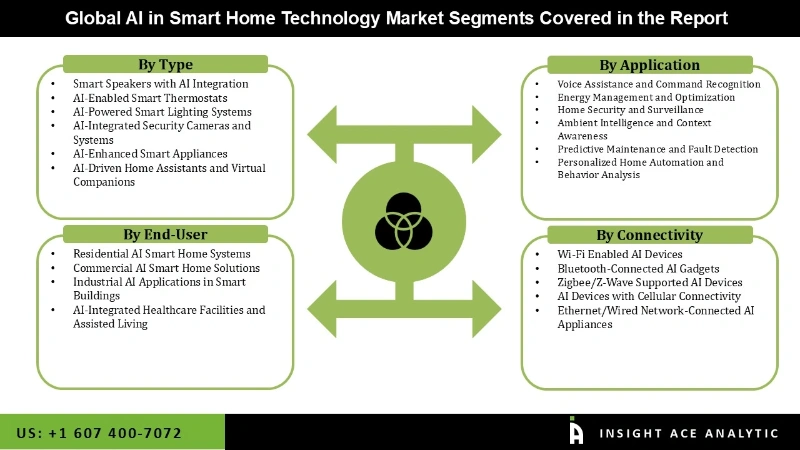

AI in Smart Home Technology Market Size, Share & Trends Analysis Report, By Type (Smart Speakers with AI Integration, AI-Enabled Smart Thermostats, AI-Powered Smart Lighting Systems, AI-Integrated Security Cameras and Systems, AI-Enhanced Smart Appliances, AI-Driven Home Assistants and Virtual Companions), By Application, By Connectivity, By End-User, By Region, Forecasts, 2026 to 2035

AI in Smart Home Technology Market Key Takeaways:

|

Automation, ease, and efficiency are all increased when artificial intelligence (AI) is integrated into smart home devices and systems. In smart home technology, this is referred to as AI. AI-powered smart home technology uses various techniques, including data analytics, machine learning, and natural language processing, to create more personalized and easy-to-use user interfaces.

Artificial intelligence (AI) has enabled smart home equipment to perform tasks autonomously based on user choices, habits, and external conditions. For instance, AI-powered thermostats may determine a home's schedule and adjust the temperature or humidity level accordingly. Market growth is being driven by several factors, including technological advancements, increased consumer demand for convenience, advancements in AI and ML, growing adoption of IoT devices, energy efficiency and sustainability concerns, integration with voice assistants, and many others. However, interoperability challenges and security concerns are expected to hinder market growth during the forecast period.

The AI in smart home technology market is segmented based on type, application, connectivity and end user. Based on type, the market is segmented as smart speakers with AI integration, AI-enabled smart thermostats, AI-powered smart lighting systems, AI-integrated security cameras and systems, AI-enhanced smart appliances, AI-driven home assistants, and virtual companions. The market is segmented by application into voice assistance and command recognition, energy management and optimization, home security and surveillance, ambient intelligence and context awareness, predictive maintenance and fault detection, personalized home automation and behavior analysis. Based on connectivity, the industry is bifurcated into Wi-Fi-enabled AI devices, Bluetooth-connected AI gadgets, zigbee/z-wave supported AI devices, AI devices with cellular connectivity and ethernet/wired network-connected AI appliances. Based on end users, the market is segmented into residential AI smart home systems, commercial AI smart home solutions, industrial AI applications in smart buildings, and AI-integrated healthcare facilities and assisted living.

The AI-powered smart lighting systems segment is expected to hold a major share of the global AI in smart home technology market. AI-powered smart lighting systems are becoming more and more common as more people adopt smart home technologies. These systems provide convenience, energy economy, and improved lighting environment management. Furthermore, smart lighting systems may now offer cutting-edge capabilities like automatic scheduling, voice control, and adaptive lighting due to advancements in AI and machine learning. These enhancements support increased sales and market growth. Furthermore, AI-powered smart lighting systems maximise energy consumption by modifying brightness in response to occupancy and ambient light. Both residential and commercial customers find this to be appealing because it results in lower energy expenses.

Commercial AI smart home solutions are projected to increase in the global AI in smart home technology market. To improve productivity and customer satisfaction, commercial AI smart home solutions are being implemented in several industries, including retail, hotel, and office buildings. Furthermore, a developing trend in commercial settings is using AI to create tailored surroundings that increase consumer engagement and satisfaction. Additionally, as smart city programs become more comprehensive, commercial AI smart home solutions are increasingly included, creating more efficient and related urban environments.

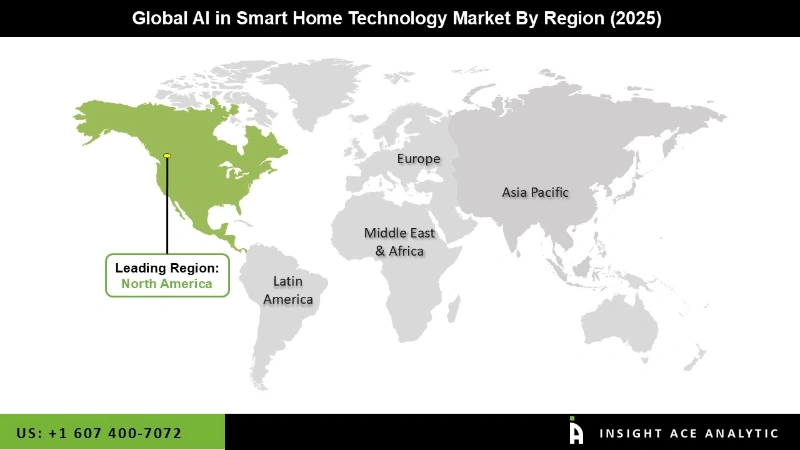

The North America AI in smart home technology market is expected to register the highest market share in terms of revenue in the near future. Smart home solutions that provide ease, automation, and improved control over living spaces are highly preferred by consumers. Smart lights, security systems, and thermostats are just a few of the high-demand gadgets with AI capabilities. Furthermore, businesses and consumers in the area are becoming more concerned about sustainability and energy use. Users in both residential and business settings are drawn to AI-powered smart home systems that maximize energy efficiency and cut expenses. The use of AI in smart home devices is also fueled by the popularity of voice assistants like Apple Siri, Google Assistant, and Amazon Alexa, which allow for smooth voice control and connection with other smart products. In addition, Asia Pacific is projected to grow at a rapid rate in the global AI in smart home technology market due to rapid urbanization and infrastructure development, rising disposable incomes, increasing government initiatives, focus on energy efficiency and others.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 18.47 Bn |

| Revenue Forecast In 2035 | USD 126.06 Bn |

| Growth Rate CAGR | CAGR of 21.30% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Connectivity, By End-user |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Apple Inc., Amazon.com, Inc., Google LLC, SAMSUNG, Koninklijke Philips N.V., Xiaomi, Honeywell International Inc., LG Electronics, TP-LINK CORPORATION PTE. LTD, Sony, Logitech, Belkin, Ecobee, August Home, Arlo, iRobot Corporation, Vivint, Inc., Snap One, LLC, Sonos, Inc., Netatmo, Anker, Ecovacs Robotics, and LIFX. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

AI in Smart Home Technology Market- By Type

AI in Smart Home Technology Market- By Application

AI in Smart Home Technology Market- By Connectivity

AI in Smart Home Technology Market- By End-user

AI in Smart Home Technology Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.