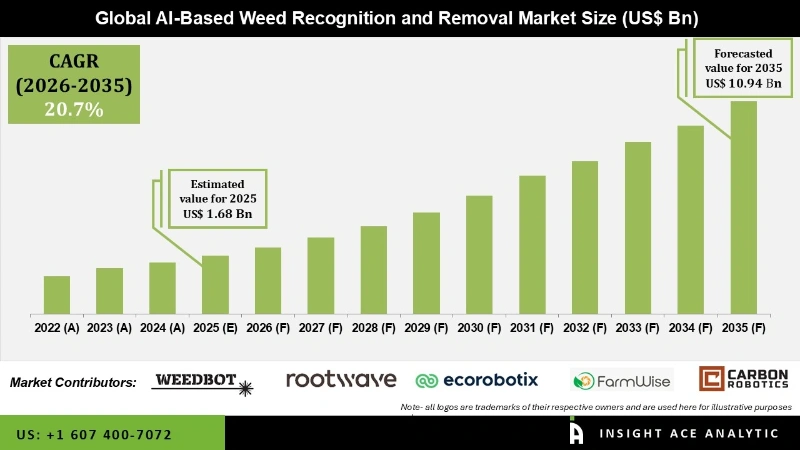

Global AI-Based Weed Recognition and Removal Market Size is valued at US$ 1.68 Bn in 2025 and is predicted to reach US$ 10.94 Bn by the year 2035 at an 20.7% CAGR during the forecast period for 2026 to 2035.

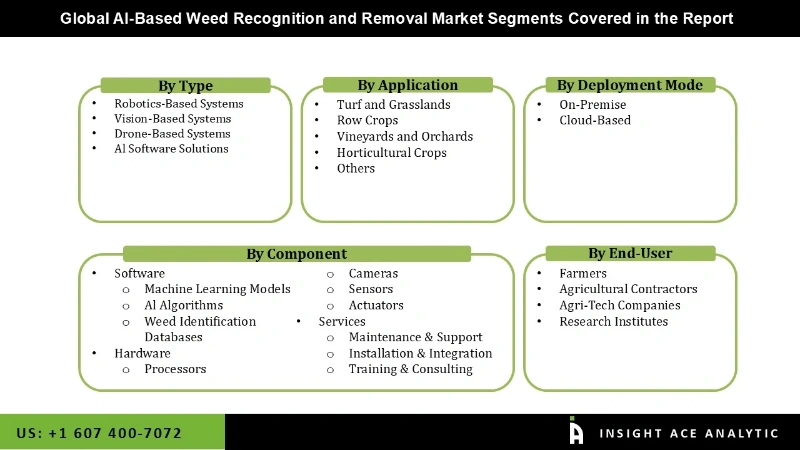

AI-Based Weed Recognition and Removal Market Size, Share & Trends Analysis Distribution by Component (Software [Machine Learning Models, Al Algorithms, Weed Identification Databases], Hardware [Processors, Cameras, Sensors, Actuators], and Services [Maintenance & Support, Installation & Integration, Training & Consulting]), Type (Robotics-Based Systems, Vision-Based Systems, Drone-Based Systems, and Al Software Solutions), Deployment Mode (On-Premise and Cloud-Based), Application (Turf and Grasslands, Row Crops, Vineyards and Orchards, Horticultural Crops), End-user and Segment Forecasts, 2026 to 2035.

AI-Based Weed Recognition and Removal Market Key Takeaways:

|

AI-based weed recognition and removal systems are precision agriculture technologies that combine computer vision, machine learning, and robotic automation to identify and eliminate weeds with minimal human intervention. These systems analyze field data in real time using advanced sensors (e.g., cameras, drones, or satellites) and AI algorithms trained to distinguish crops from invasive plants, enabling targeted treatment.

AI-based weed recognition and removal systems are revolutionizing agriculture by enabling precise identification and targeted elimination of unwanted plants. Leveraging advanced sensors and machine learning algorithms, these technologies detect weeds in real time, allowing farmers to significantly reduce herbicide use and manual labor. By selectively targeting weeds, the systems enhance crop health and boost overall yields.

The market for AI-driven weed control is rapidly expanding due to its proven accuracy and efficiency. Farmers are increasingly adopting these solutions to minimize reliance on chemical herbicides and labor-intensive processes, driving the transition toward more sustainable and productive farming practices.

Some of the Key Players in AI-Based Weed Recognition and Removal Market:

The AI-based weed recognition and removal market is segmented by component, type, deployment mode, application, and end-user. By component, the market is segmented into software [machine learning models, al algorithms, weed identification databases], hardware [processors, cameras, sensors, actuators], and services [maintenance & support, installation & integration, training & consulting]. By type, the market is segmented into robotics-based systems, vision-based systems, drone-based systems, and al software solutions. By deployment mode, the market is segmented into on-premise and cloud-based. By application, the market is segmented into turf and grasslands, row crops, vineyards and orchards, horticultural crops, and others. By end-user, the market is segmented into farmers, agricultural contractors, agri-tech companies, and research institutes.

Since robotics-based systems provide highly automated, accurate, and scalable weed removal solutions, they are revolutionizing contemporary weed management techniques. By utilizing onboard artificial intelligence algorithms to differentiate between crops and weeds, these autonomous robotic platforms traverse fields and provide effective and targeted weed management. In conjunction with the movement toward chemical-free farming and the growing labor shortage in agriculture, these robotic systems have become a popular alternative to conventional herbicides. Additionally, countries centered on mechanized farming and high-value crop production have a particularly high need for robotics, which is driving research and investment into more versatile and affordable robotic units.

The ability of AI-based weed recognition and removal technologies to precisely manage large acres of monoculture farming is making them indispensable in row crops. Farmers use these instruments to differentiate weeds and increase productivity while using fewer herbicides accurately. AI systems are more effective when row crops are planted in a structured manner since this enables quicker model training and more accurate weed elimination. Machine learning models adapt in real time to crop circumstances and development patterns, rapidly learning the subtleties of various weed species.

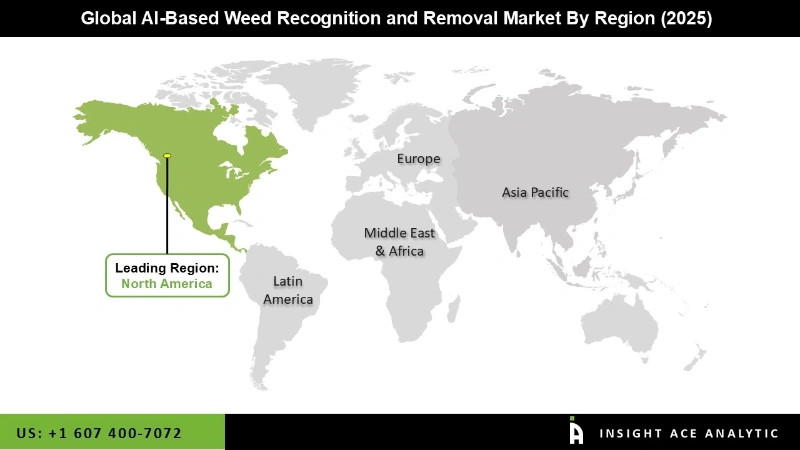

In 2024, the market for AI-based weed recognition and removal was dominated by North America. Precision agriculture's broad use, significant investments in agri-tech innovation, and a strong digital infrastructure are the main factors contributing to the region's dominance. Adoption of AI-powered weed management solutions is spearheaded by large-scale commercial farms and agribusinesses in the US and Canada. Furthermore, the region's innovation and deployment are further accelerated by the presence of top research institutes and technology providers.

The Europe region is seeing the fastest development in the AI-based weed recognition and removal market. Due to the region's numerous smallholder farmers and varied agroclimatic conditions, AI-based weed recognition and removal faces both special potential and obstacles. To meet the unique requirements of various marketplaces in the area, vendors are increasingly creating locally tailored solutions.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.68 Bn |

| Revenue Forecast In 2035 | USD 10.94 Bn |

| Growth Rate CAGR | CAGR of 20.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, By Type, By Deployment Mode, By Application, By End-user |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | WeedBot, RootWave, Carbon Robotics, EcoRobotix, Naïo Technologies, FarmWise, Blue River Technology (John Deere), Raven Industries, Trimble, Aigen, PrecisionHawk (DroneDeploy), Greeneye Technology, TerraClear, BASF Digital Farming (xarvio), CNH Industrial, Stout Industrial Technology, Small Robot Company, OneSoil, Agremo, and Vision Robotics |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of AI-Based Weed Recognition and Removal Market -

AI-Based Weed Recognition and Removal Market by Component-

AI-Based Weed Recognition and Removal Market by Type -

AI-Based Weed Recognition and Removal Market by Deployment Mode-

AI-Based Weed Recognition and Removal Market by Application-

AI-Based Weed Recognition and Removal Market by End-user-

AI-Based Weed Recognition and Removal Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.