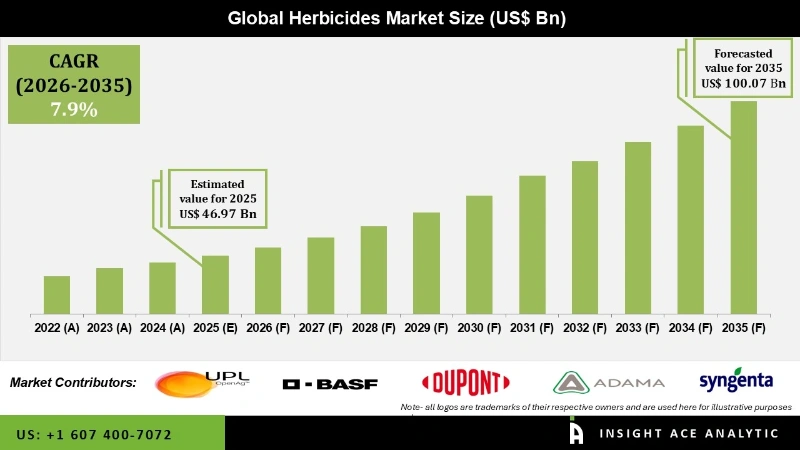

The Global Herbicides Market Size is valued at 46.97 billion in 2025 and is predicted to reach 100.07 billion by the year 2035 at a 7.9% CAGR during the forecast period for 2026 to 2035.

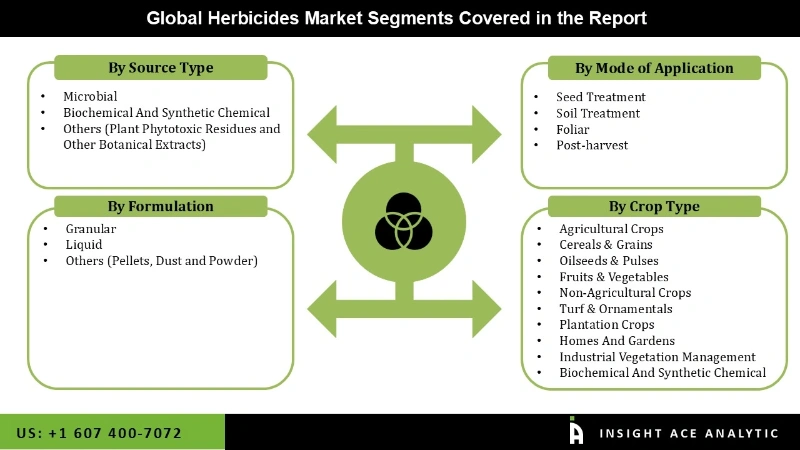

Herbicides Market Size, Share & Trends Analysis Report by Source Type (Microbial, Biochemical and synthetic chemical, Others (plant phytotoxic residues and other botanical extracts)), Formulation (Granular, Liquid, Others (pellets, dust and powder)), Mode of Application (Seed Treatment, Soil Treatment, Foliar, Post-harvest), Crop type, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Herbicides are a type of sustainable agricultural product that kills undesirable plants without harming the plantation, hence boosting agricultural output. For a specific plantation, herbicides are frequently altered based on plant hormones to ensure the safety of the targeted plantation.

Additionally, herbicides are used to rid a field of all vegetation, including plants and herbs. Increased awareness of the benefits of applying herbicides before and after crop production and an increase in global food consumption are significant factors propelling the expansion of the worldwide herbicides market. But there are bright prospects due to the development of the agriculture industry in developing nations and the invention of new formulations.

Commercial agriculture firms and farmers will also buy more arable land to enhance agricultural production. A pattern has emerged where R&D operations are prioritized to develop newer herbicide formulas. This primarily entails the creation of bio-based herbicides due to the adverse effects of chemical-based treatments on the environment and human health. A further factor supporting the sustained demand for herbicides is the pressure on product producers to provide weed-resistant herbicides. As a result, the demand for herbicides grows.

Some of the major key players in the Herbicides market are:

The herbicides market is segmented based on source type, formulation, mode of action and crop type. Source Type segment includes Microbial, Biochemical and synthetic chemical and Others (plant phytotoxic residues and other botanical extracts). According to the formulation, the market is segmented into Granular, Liquid, and Others (pellets, dust and powder). As per the mode of application, the market is categorized into Seed Treatment, Soil Treatment, Foliar, and Post-harvest. At last, the Crop type segment comprises Agricultural crops (Cereals & grains, Oilseeds & pulses, Fruits & vegetables), Non-agricultural crops (Turf & ornamentals, Plantation crops, Homes and gardens, and Industrial Vegetation Management).

The synthetic chemical category is expected to hold a significant share of the global Herbicides market in 2021. Synthetic chemicals are in considerable demand due to their effectiveness and inexpensive price. Additionally, glyphosate is the most widely used herbicide in the world due to its efficiency, low cost, and use in weed control and plant development. Synthetic herbicide use has a variety of adverse effects on both people and animals. Herbicides, which can be a single agent or a combination of substances, are typically used to restrain, eliminate, and prevent the growth of weeds. Due to their chemical components, most herbicides irritate the skin, induce respiratory and digestive issues, and cause skin irritation.

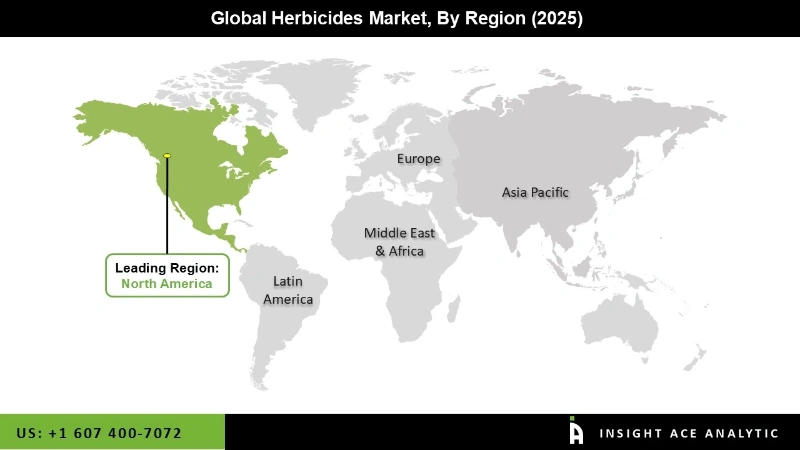

The North American herbicides market is expected to register the highest market share in revenue soon. The large population base and the strong demand for food production drive the market value. Large manufacturers' positions in the herbicide market in this region are being cemented by factors including their extensive product portfolios for plant protection products, strong R&D, and expanding manufacturing facilities at various locations. In addition, the Asia Pacific region is projected to grow rapidly in the global herbicides market. India and China have the largest populations in the Asia-Pacific region. These regions are among the top emerging economies regarding GDP growth and rising disposable income. Demand for herbicides in Asia is anticipated to increase due to the region's large population and rapid economic expansion in these rising economies.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 46.97 billion |

| Revenue Forecast in 2035 | USD 100.07 billion |

| Growth rate CAGR | CAGR of 7.9% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Kiloton and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Source Type, Formulation, Mode Of Application, Cropt Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | UPL, BASF SF, Bayer AG, DUPont, ADAMA, Syngenta, FMC Corporation, Drexel Corporation, Sumitomo Chemical Co., Ltd and Nufarm |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Herbicides Market By Source Type

Herbicides Market By Formulation

Herbicides Market By Mode of Application

Herbicides Market By Crop Type

Herbicides Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.