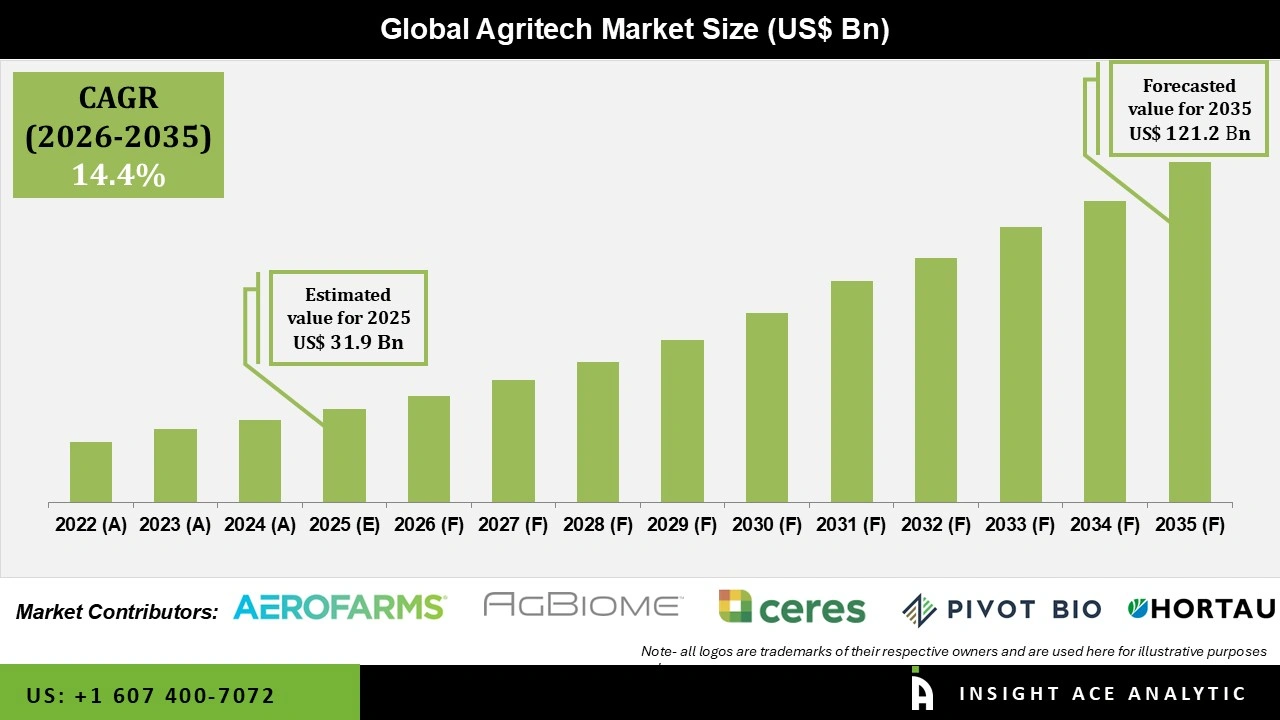

Global Agritech Market Size is valued at USD 31.9 Bn in 2025 and is predicted to reach USD 121.2 Bn by the year 2035 at a 14.4% CAGR during the forecast period for 2026 to 2035.

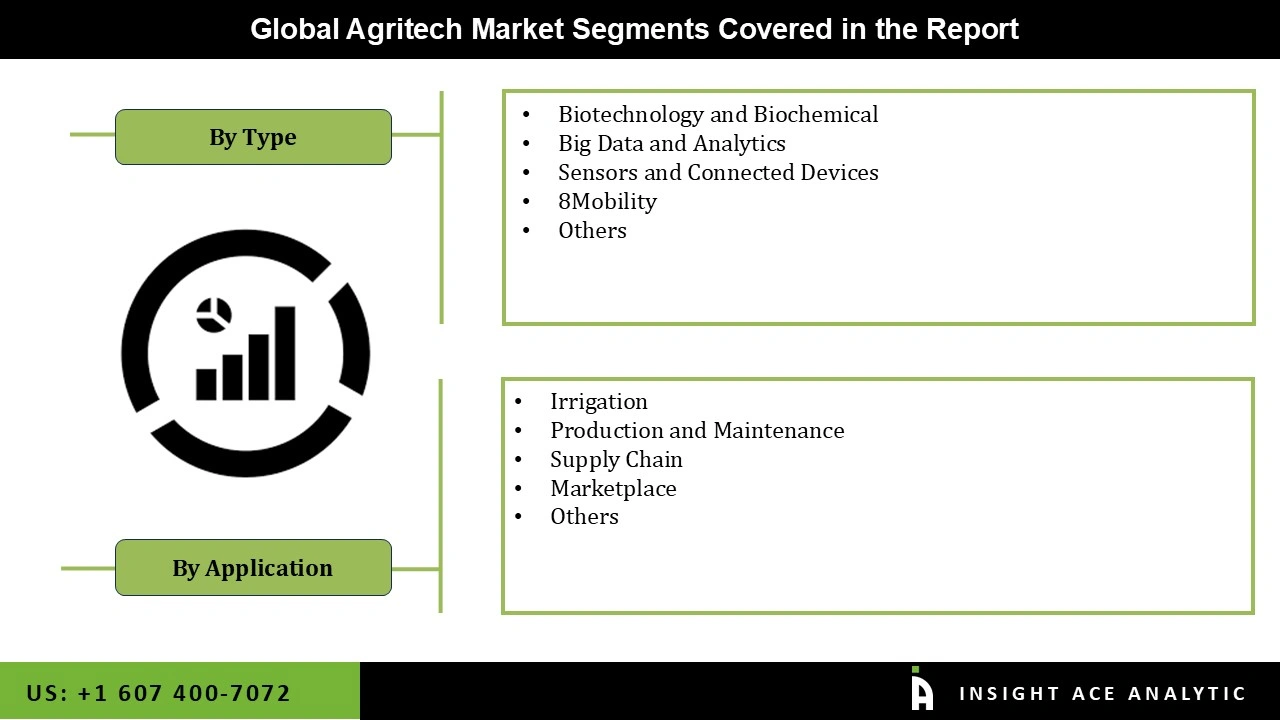

Agritech Market Size, Share & Trends Analysis Report By Type (Biotechnology and Biochemicals, Big Data and Analytics, Sensors and Connected Devices, Mobility) and Application (Irrigation, Production and Maintenance, Supply Chain, Marketplace), By Region and By Segment Forecasts, 2026 to 2035.

Agritech technologies strive to enhance the sustainability, resilience, and profitability of agriculture while simultaneously addressing the worldwide demand for food. They are implementing revolutionary alterations in farming techniques, supply chain administration, and agricultural sustainability on a global scale, so facilitating the modernization and progress of the agricultural sector.

Governments incentivize Agritech to support this trend, while consumers' emphasis on food safety and transparency further propels the market forward. Additionally, emerging business models like farm management software contribute to this revolution in agriculture, promising both growth and sustainability. However, despite these advancements, challenges persist, including limited rural connectivity, interoperability issues, high initial costs, regulatory barriers, and concerns regarding data privacy and security.

Moreover, addressing these hurdles is vital for widespread adoption and innovation in Agritech. Governments must play a pivotal role in refining regulatory frameworks to encourage innovation and investment while also implementing cost-effective models and financial incentives to make Agritech solutions accessible to a broader spectrum of farmers, especially those in developing regions.

The Agritech market is segmented on the basis of type and application. Based on type, the market is segmented as biotechnology and biochemical, big data and analytics, sensors and connected devices, 8mobility and other types. As per the application, the market is segmented into irrigation, production and maintenance, supply chain, marketplace, and others.

The Big Data and Analytics segment dominates the Agritech market primarily due to its pivotal role in transforming agricultural practices. Through the analysis of extensive datasets collected from diverse sources like sensors, satellites, and machinery, farmers can make data-driven decisions that optimize crop management, reduce resource consumption, and mitigate risks. Precision agriculture, facilitated by big data analytics, allows for targeted interventions in specific areas of fields based on real-time insights, enhancing yields and minimizing environmental impact. Furthermore, the application of big data analytics extends to optimizing the agricultural supply chain, from production to distribution, by leveraging data on factors such as demand forecasts, weather conditions, and market trends to streamline operations and minimize waste.

Additionally, predictive maintenance algorithms powered by big data analytics ensure the efficient operation of agricultural equipment, minimizing downtime and maximizing productivity. Moreover, big data analytics provide valuable insights into market dynamics, enabling farmers to make informed decisions regarding crop selection, pricing strategies, and risk management. In essence, the dominance of the Big Data and Analytics segment underscores its indispensable role in revolutionizing agriculture and fostering efficiency, sustainability, and profitability throughout the industry.

The irrigation segment holds the largest share of the market. Firstly, irrigation is a fundamental aspect of agriculture, essential for sustaining crop growth and ensuring optimal yields, particularly in regions with irregular rainfall patterns or limited access to water resources. As such, the demand for efficient irrigation solutions remains consistently high across diverse agricultural landscapes. The increasing recognition of water shortage and the necessity for sustainable water management techniques have driven the implementation of sophisticated irrigation systems. These technologies encompass precision irrigation systems, drip irrigation, and sensor-based irrigation controllers. They allow farmers to supply an optimal amount of water directly to the root zone of crops, reducing water wastage and maximizing water use efficiency.

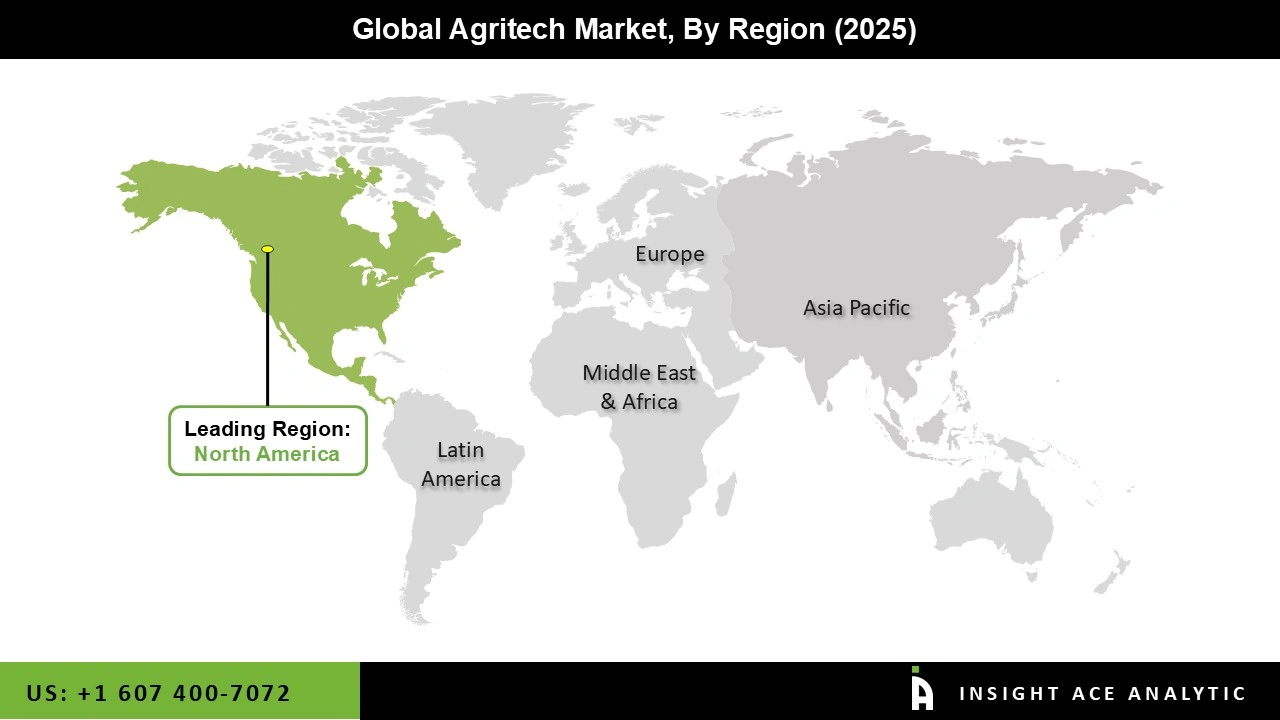

North American region is home to leading Agritech companies and research institutions pioneering advancements in areas such as precision agriculture, drone technology, genetic engineering, and data analytics. Farmers in North America leverage cutting-edge technologies to optimize crop yields, reduce input costs, and minimize environmental impact.

Additionally, supportive regulatory frameworks and robust infrastructure facilitate the adoption of Agritech solutions. However, challenges such as rural connectivity issues, data privacy concerns, and the need for skilled labour persist, driving ongoing innovation and collaboration within the Agritech ecosystem.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 31.9 Bn |

| Revenue Forecast In 2035 | USD 121.2 Bn |

| Growth Rate CAGR | CAGR of 14.4% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Crofarm Agriproducts Pvt Ltd, Pivot Bio, ARSR Tech, Harvest Automation, Indigo Ag Inc., Conservis,m Apollo Agriculture, AgBiome Inc., Hortau, AeroFarms, Farmers Business Network, Ceres Imagin, AgWorld and Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.