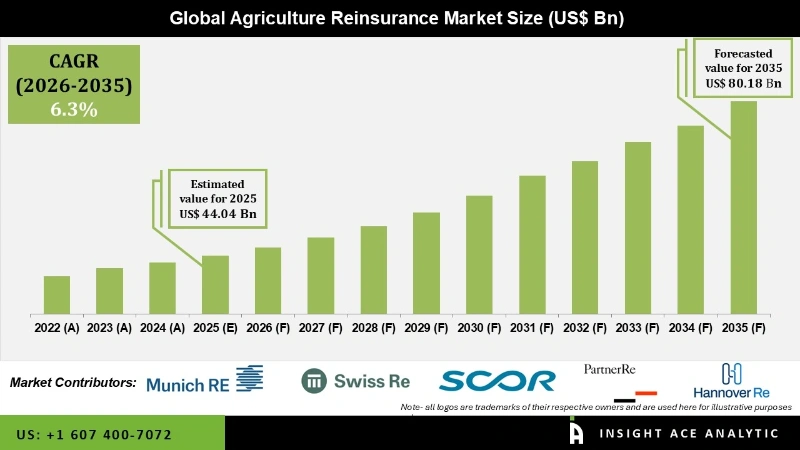

Agriculture Reinsurance Market Size is valued at USD 44.04 billion in 2025 and is predicted to reach USD 80.18 billion by the year 2035 at a 6.30% CAGR during the forecast period for 2026 to 2035.

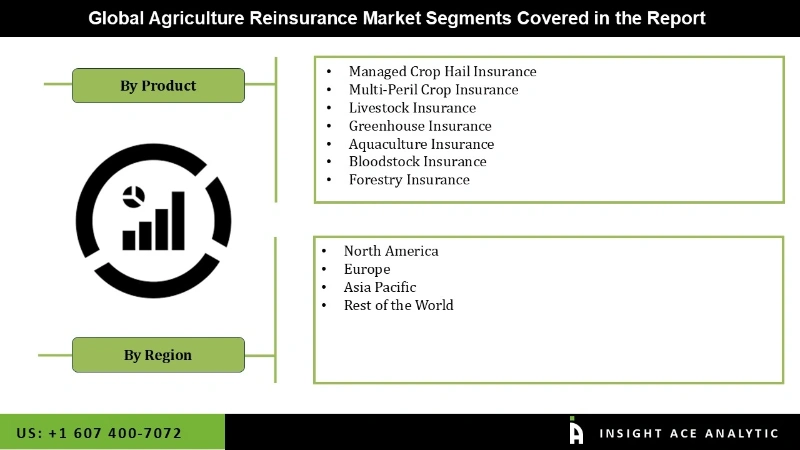

Agriculture Reinsurance Market Size, Share & Trends Analysis Report by Product (Managed Crop Hail Insurance, Livestock Insurance, Bloodstock Insurance, Multi-Peril Crop Insurance, and Forestry Insurance), Region And Segment Forecasts, 2026 to 2035.

Agriculture reinsurance is a type of insurance that protects insurance firms and other organizations that supply farm insurance policies. It operates as a risk management strategy for these insurers by shifting a portion of their policyholders' agricultural risk to a reinsurance business. To address the large demand, there is an increasing need for an alternative to shareholder capital, which is driving market expansion. Reinsurers are critical in reducing damage, supplying capital to the actual economy, and preventing dangers. Government support in many countries, such as the Indian Government's commitment to subsidizing crop insurance reinsurance plans, is also boosting market expansion.

However, the pandemic created uncertainty in agricultural productivity due to supply chain interruptions, labor shortages, and movement limitations. This ambiguity made assessing and pricing agricultural risks difficult for reinsurance companies.

The Agriculture Reinsurance Market is segmented on the basis of product. Product segment includes Managed Crop Hail Insurance, Multi-Peril Crop Insurance, Greenhouse Insurance, Aquaculture Insurance, Livestock Insurance, Bloodstock Insurance, and Forestry Insurance.

The Managed Crop Hail Insurance category is expected to hold a major share of the global Agriculture Reinsurance Market in 2022. This type of insurance protects against crop loss or damage caused by hail or fire. It is typically offered by private insurance companies and is purchased by farmers who grow crops in hail-prone areas. Furthermore, Multi-Peril Crop Insurance is projected to skyrocket. This insurance protects against various hazards that could result in crop losses, such as natural disasters, disease, pests, and weather-related occurrences. It is often provided by government-sponsored programs and is intended to cover a considerable amount of the agricultural production of the insured farmer.

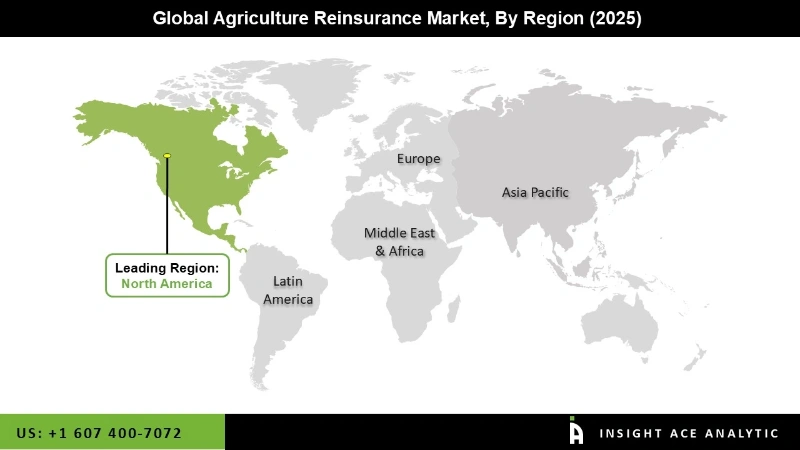

The North America Agriculture Reinsurance Market is expected to register the highest market share in terms of revenue shortly due to its substantial agricultural activity and implementation of innovative technologies in the area. The US government assists its farmers significantly and significantly contributes to the region's agriculture reinsurance market. Furthermore, Asia Pacific is predicted to grow considerably during the projection period.

Increased government initiatives and assistance to farmers in managing crop losses are driving demand for agriculture reinsurance in the region. The growing frequency of extreme weather catastrophes such as floods, droughts, and typhoons has raised the demand for crop insurance and reinsurance.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 44.04 billion |

| Revenue forecast in 2035 | USD 80.18 billion |

| Growth Rate CAGR | CAGR of 6.30% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Disease Type, By Treatment, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Munich Re, Swiss Re, Hannover Re, Partner Re, Scor Re, Everest Re, Polish Re, Hamilton Re, Sompo International, and Toa Re |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.