Global Aerogel Market Size is valued at USD 1.1 Bn in 2024 and is predicted to reach USD 4.0 Bn by the year 2034 at an 13.4% CAGR during the forecast period of 2025-2034.

A variety of ultralow synthetic materials called aerogels are made from gels in which the liquid portion has been replaced with gas through a process called supercritical drying. It comprises a network of connected nanostructures with at least 50% porosity. Despite being sturdy, it is incredibly light and has little thermal conductivity, which makes it the perfect insulating material.

The main element fueling the growth of the aerogel market in the anticipated time is the industry's robust expansion. The market is being driven by the perception of aerogel as the best material for thermal protection due to its low density and low thermal conductivity. The aerogel market is also anticipated to expand over the forecast period due to rising demand from various end-use industries, including oil and gas, building and construction, automotive, aerospace and marine, and performance coatings.

However, the aerogel market is constrained by high costs and a lack of consumer awareness, whereas sophisticated heating and supercritical drying will provide growth challenges. Aerogel market prospects will be plentiful throughout the forecast period because it is not as widely used as other insulating materials.

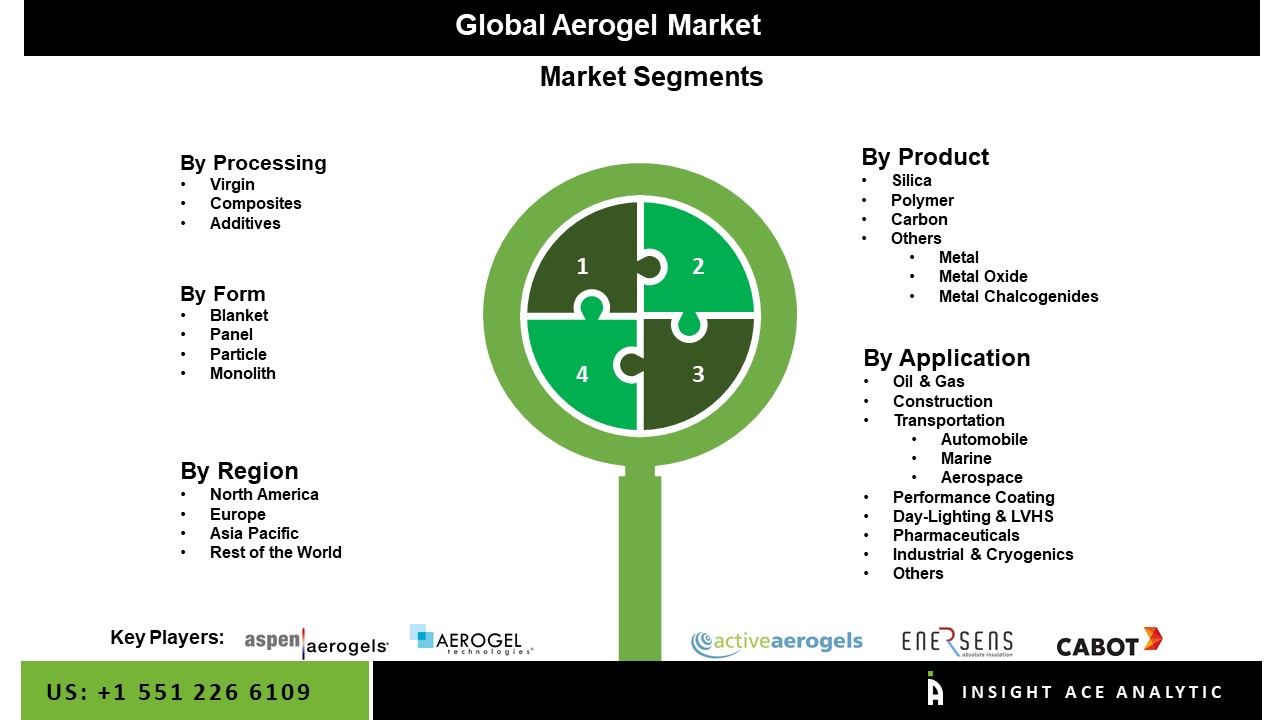

The aerogel market is segmented on the product, form, processing, and application. Based on product, the market is segmented into Silica, Ploymer, Carbon, and Others (Metal, Metal Oxide, Metal Chalcogenides). Based on Form, aerogel market is segmented into Blanket, Panel, Particle, and Monolith. Based on Processing, aerogel market is segmented into Virgin, Composites, Additives. Based on end-use applications, aerogel market is segmented into Oil & Gas, Construction, Transportation (Automobile, Marine, Aerospace), Performance Coating, Day-Lighting & LVHS, Pharmaceuticals, Industrial & Cryogenics, and Others.

The polymer category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. The market is expanding due to the rising usage of polymer-based materials for the shelter and rising R&D spending. Such materials can be utilized to update antiquated monuments because they are light and transparent. Polymer materials are becoming increasingly popular as an interior insulation substitute for the roof, side balconies, and historic monument renovations.

The automotive category is anticipated to grow significantly over the forecast period. The expanding use of materials in the construction and oil and gas industries is a key driver fueling the expansion of the aerogel market. Such material coatings are used as insulators in buildings and the oil and gas industries. The oil and gas sector uses pipelines to transport massive volumes of crude oil. Such coatings prevent leaks and are great for pipe insulation and security due to their chemical inertness.

The Asia Pacific aerogel market is expected to register the highest market share in revenue in the near future due to the top firms' increased research and development efforts for the Aerogel product. The market in the region is expected to be driven by rising investments in end-use industries throughout the forecast period. The demand for insulation materials in the aerospace, marine, defense, electrical, and electronics industries has driven nations like China, Japan, and India to record-breaking market growth.

In addition, North America is projected to grow rapidly in the global aerogel market, primarily responsible for driving the oil and gas sector. It has a particularly strong need for cutting-edge solutions due to its reduced thickness, improved insulating qualities, and low thermal conductivity. The growing usage of aerogel materials in North America's automotive, marine, and aerospace applications is anticipated to fuel the aerogel business.

| Report Attribute | Specifications |

| Market Size Value in 2024 | USD 1.1 Billion |

| Revenue Forecast in 2034 | USD 4.0 Billion |

| Growth Rate CAGR | CAGR of 13.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume in Ton and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product, Form, Processing, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Aspen Aerogels, Inc., Cabot Corporation, Aerogel Technologies, LLC, Guangdong Alison Hi-Tech Co., Ltd, Active Aerogels, EnersensJIOS Aerogel Corporation, Armacell, Svenska Aerogel AB, Green Earth Aerogel Technologies, Armacell, Nano Technology Co. Ltd., BASF SE, and Dow Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Aerogel Market-

Aerogel Market By Product

Aerogel Market By Form

Aerogel Market By Processing

Aerogel Market By Application

Aerogel Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.