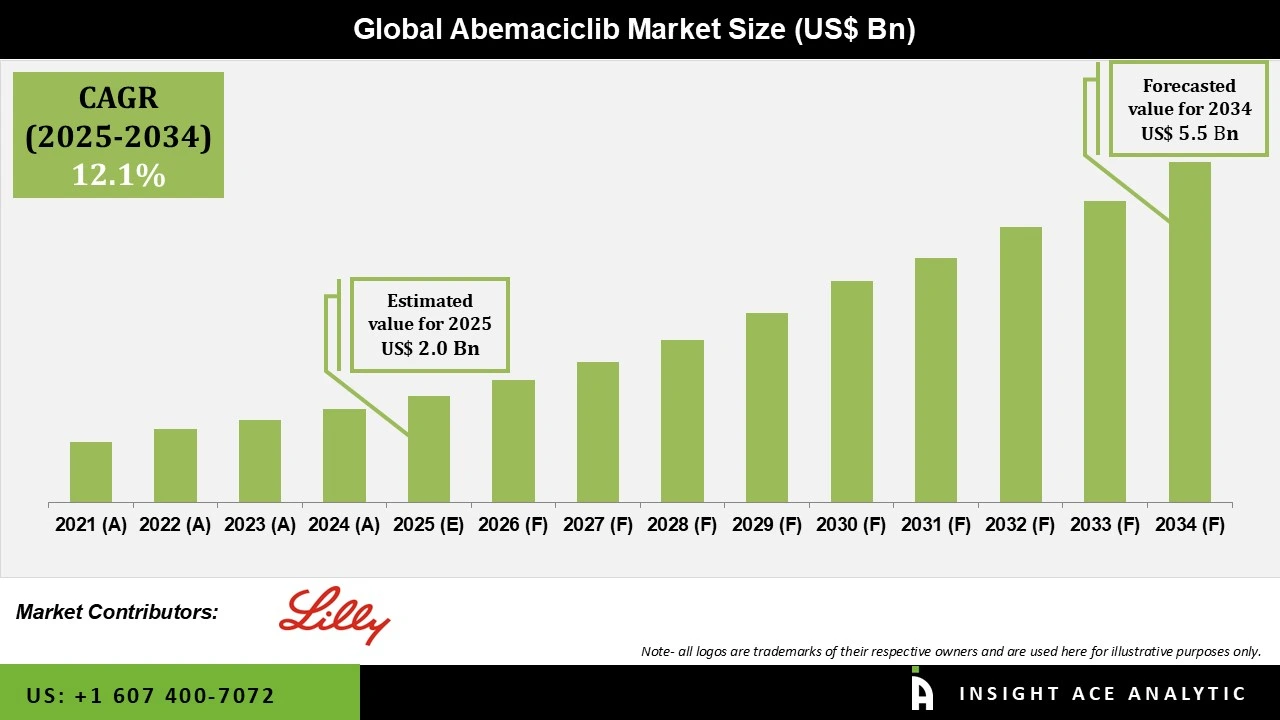

Global Abemaciclib Market Size is valued at USD 2.0 Bn in 2025 and is predicted to reach USD 5.5 Bn by the year 2034 at a 12.1% CAGR during the forecast period for 2025 to 2034.

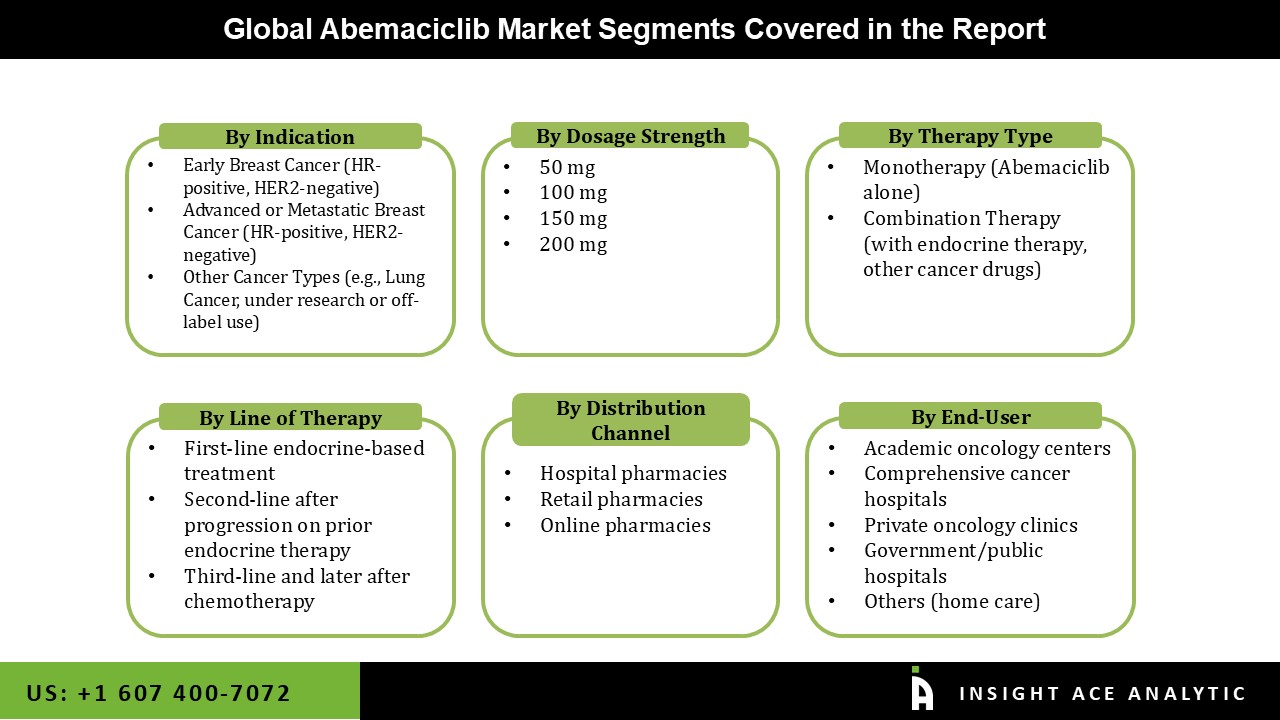

Abemaciclib Market Size, Share & Trends Analysis Distribution by Therapy Type (Monotherapy (Abemaciclib Alone) and Combination Therapy (with Endocrine Therapy, other Cancer Drugs)), By Indication (Early Breast Cancer (HR-positive, HER2-negative), Advanced or Metastatic Breast Cancer (HR-positive, HER2-negative), and Other Cancer Types), By Dosage Strength (50 mg, 100 mg, 150 mg, and 200 mg), By Line of Therapy (First-line Endocrine-based Treatment, Second-line After Progression on Prior Endocrine Therapy, and Third-line and Later After Chemotherapy), By End-user (Comprehensive Cancer Hospitals, Academic Oncology Centers, Private Oncology Clinics, Government/Public Hospitals, and Others (Home Care)), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Segment Forecasts, 2025 to 2034

Abemaciclib is a significant drug classified as a CDK 4 and 6 inhibitor. It is mostly used to treat HER2-negative, hormone receptor-positive breast cancer, which implies it targets particular forms of the illness that react favorably to targeted treatments. It efficiently slows the growth and proliferation of cancer cells by upsetting their cell cycle. Because of this, it is very helpful for patients with breast cancer, regardless of whether the disease is in its early stages or more advanced. It is considerably more successful, according to several oncologists, when paired with other hormone treatments. The rising incidence of cancer, especially breast cancer, which continues to be the world's leading cause of death, is the key factor driving the abemaciclib market's growth.

The abemaciclib market is also expected to increase significantly due to rising cancer awareness, better cancer diagnosis rates, and an aging population that is more vulnerable to cancer. Since cancer incidence rates increase with age, the aging population is especially important because more effective treatment options are required. Additionally, the increased use of abemaciclib, which is frequently a component of a customized treatment plan based on particular genetic and protein markers of tumors, has been made possible by the healthcare sector's transition to personalized medicine and targeted therapies, guaranteeing better patient outcomes. Furthermore, the abemaciclib market's growth is also fueled by investments in oncology research and healthcare facilities.

In addition, a growing number of clinical trials and subsequent approvals of abemaciclib in various locations are the result of increased funding for cancer research by both public and private organizations. The medication's commercial presence is further strengthened by its inclusion in several clinical guidelines as a suggested treatment option. This is anticipated to boost the abemaciclib market growth over the forecast period. Additionally, improved patient compliance and market penetration may result from developments in formulations and delivery systems, such as sustained-release tablets. However, a number of market constraints, such as the development of drug resistance, the high cost of therapy, and the availability of substitute treatment choices, restrict the abemaciclib market's expansion. The existence of biosimilar development programs, which may have an effect on pricing dynamics, further shapes the competitive landscape.

Which are the Leading Players in Abemaciclib Market?

Driver

Increasing Effectiveness of Abemaciclib in Treatment of Human Epidermal Growth Factor Receptor 2-negative (HER2-) and Hormone Receptor-positive (HR+) Breast Cancer

Since abemaciclib is effective in treating hormone receptor-positive (HR+) and human epidermal growth factor receptor 2-negative (HER2-) breast cancer, which accounts for a large percentage of breast cancer patients, the abemaciclib market is expected to rise. The medication is an essential part of cancer treatment regimens, particularly for patients with advanced and metastatic breast cancer, due to its capacity to inhibit cyclin-dependent kinases 4 and 6 (CDK4/6), which are critical in cell cycle regulation. Additionally, the drug's potential to attract a larger patient base is highlighted by continuing research and development efforts aimed at extending its indications beyond breast cancer, such as lung cancer, which further accelerates the abemaciclib market growth.

Restrain/Challenge

Increasing CDK4/6 Inhibitor Drug Side Effects

The adverse effects of CDK4/6 inhibitor drug therapy are impeding the market for these medications. Diarrhea, low white blood cell counts, low red blood cell counts, blood clots, nausea, abdominal discomfort, exhaustion, and vomiting are some of its adverse effects. In certain situations, it might lead to liver issues. Liver function tests are done both before and during treatment. It can lead to lung irritation in extreme situations, which can be lethal. Consequently, it is anticipated that the adverse effects will impede the abemaciclib market expansion in the near future.

The advanced or metastatic breast cancer (HR-positive, HER2-negative) segment held the largest share in the abemaciclib market in 2025. For patients with hormone receptor-positive (HR+) and HER2-negative advanced or metastatic breast cancer, this medication—a cyclin-dependent kinase 4/6 (CDK4/6) inhibitor—has proven to be a game-changer. Finding successful solutions is crucial because these patients have frequently already tried a variety of treatments without success. Additionally, abemaciclib can greatly increase overall survival (OS) and progression-free survival (PFS), particularly when combined with drugs like fulvestrant or letrozole, according to clinical research. Furthermore, abemaciclib’s strong market position is being driven by the growing incidence of HR+/HER2- breast cancer cases as well as the continuous need for novel therapeutic options.

In 2025, the hospital pharmacies segment dominated the abemaciclib market. Appropriate capital investments and acceptable infrastructure are responsible for the segmental growth. When oncologists prescribe CDK4/6 inhibitors, hospital pharmacies can supply them to patients. They have qualified experts who can give people advice on the drug. The growing number of cancer patients who visit hospitals prefer to buy their medications from hospital pharmacies. Additionally, the existence of specialized oncology departments in hospitals guarantees that patients receive professional care and direction, enabling the efficient use of abemaciclib in cancer management.

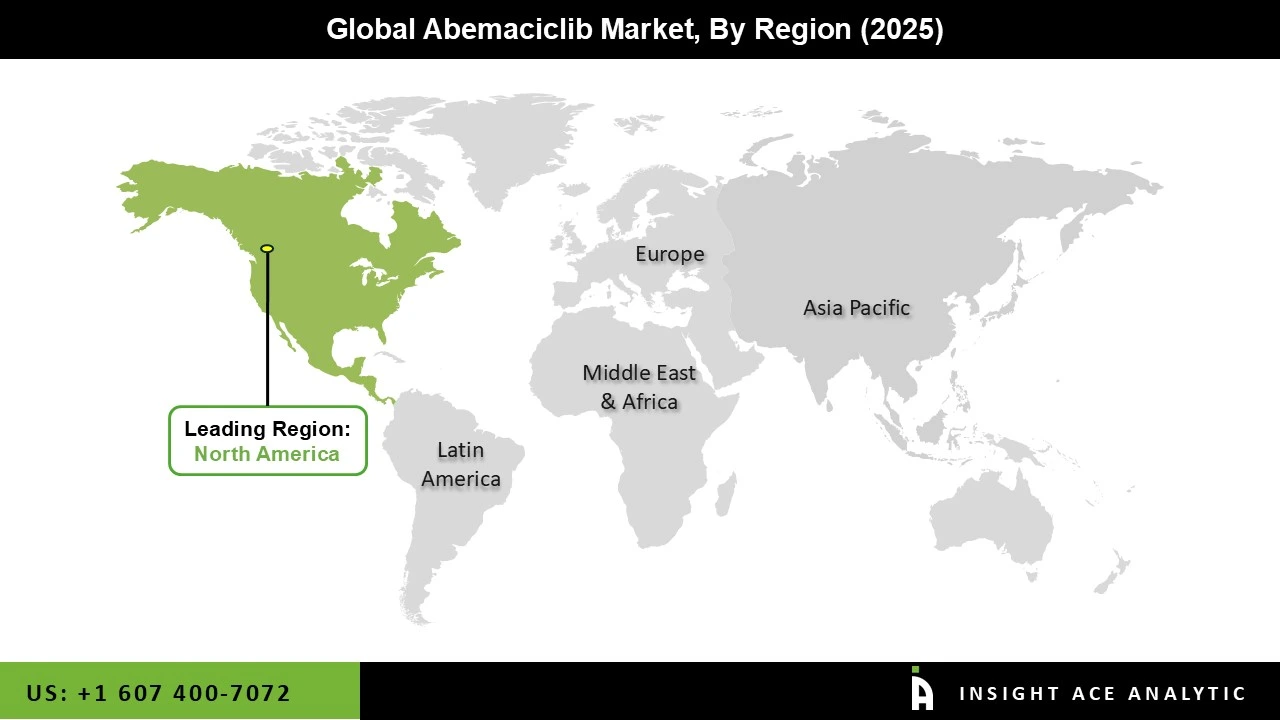

The abemaciclib market was dominated by the North America region in 2025, fueled by the region's strong research and development efforts, high cancer incidence, and sophisticated healthcare infrastructure. North America's dominant position is further reinforced by the existence of important market participants and a strong emphasis on innovation.

Because of its extensive cancer care facilities and advantageous payment rules, the United States, in particular, contributes significantly to the regional market. Additionally, with continued improvements in cancer therapy and rising patient awareness, the North American abemaciclib market is expected to maintain its growth trajectory at a stable rate.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.0 Bn |

| Revenue forecast in 2034 | USD 5.5 Bn |

| Growth Rate CAGR | CAGR of 12.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Therapy Type, Indication, Dosage Strength, Line of Therapy, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Eli Lilly and Company |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.