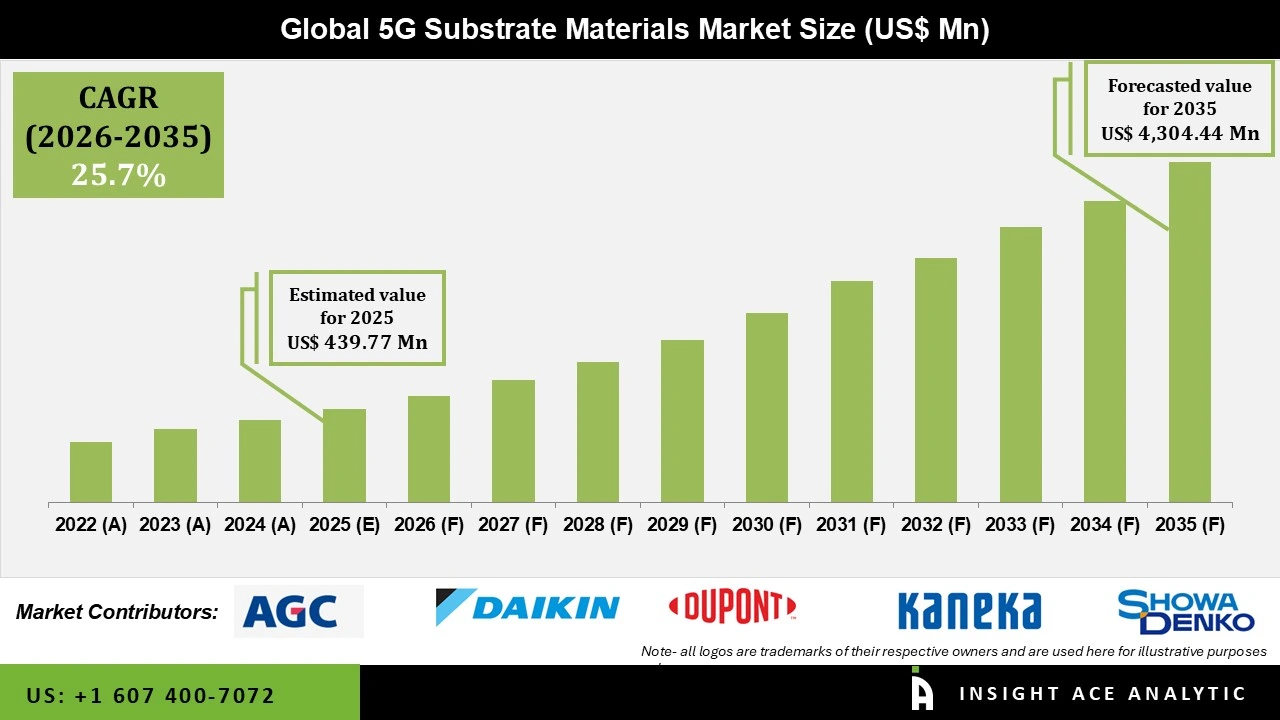

Global 5G Substrate Materials Market Size is valued at USD 439.77 Mn in 2025 and is predicted to reach USD 4,304.45 Mn by the year 2035 at a 25.7% CAGR during the forecast period for 2026 to 2035.

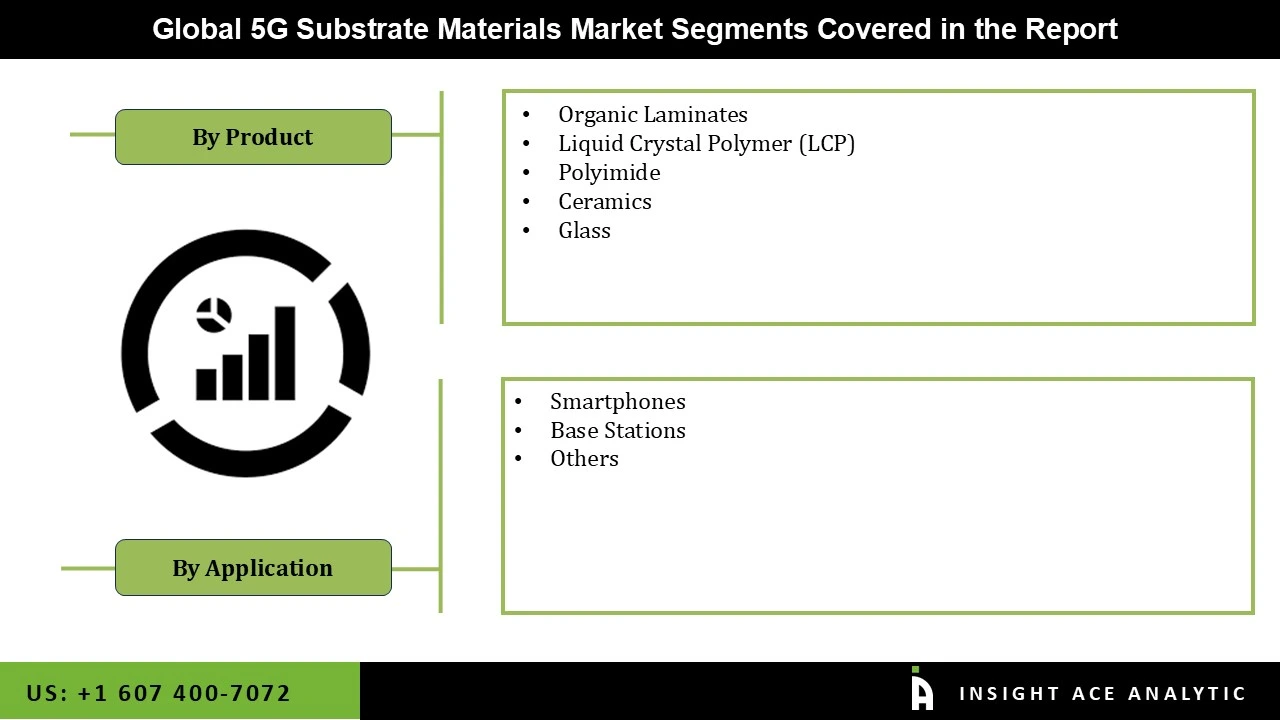

5G Substrate Materials Market Size, Share & Trends Analysis Report By Application (Smartphones, Base Station) And Product (Organic Laminates, Liquid Crystal Polymer (LCP), Polyimide, Ceramics, And Glass), Region And Segment Forecasts, 2026 to 2035

5G, the latest generation of communication infrastructure, is opening up revolutionary possibilities in fields as diverse as medicine, transportation, industry, and the armed forces. 5G has several benefits, such as density, speed (ten times faster than 4G), and latency (at least ten times lower than 4G). With 5G, the devices' performance, reliability, security, and service quality would significantly improve. Manufacturing 5G-specific devices will rely heavily on materials like polymers and ceramics due to the increasing number of 5G systems and technology rollouts. Materials with a low dielectric constant that are affordable and enhance antenna bandwidth and efficiency will be in high demand due to the requirement for multiple-input multiple-output (MIMO) antennas for 5G base stations. Furthermore, the 5G substrate materials market is expected to see numerous growth prospects because of the rising demand for nanotechnology, high-end computing systems, and the medical industry.

However, the market growth is hampered by the high-cost criteria for the safety and health of the 5G substrate materials market and the product's inability to prevent fog in environments with dramatic temperature fluctuations or high 5G substrate materials because the high cost of 5G infrastructure is the main factor slowing its development. Businesses and corporations need to put money into getting their firm 5G-enabled with the IoT.

The use of antennas and operational equipment with high frequencies is necessary for these services. The high price of 5G infrastructure is largely due to the high cost of materials. To function properly, mm-wave components must possess several desirable qualities, including a low dielectric constant, resistance to moisture, and minimal transmission losses. The COVID-19 epidemic has stretched the timelines for many projects, including installing base stations, auctioning off of frequency spectrum, and causing the expected drop in demand for 5G handsets.

The 5G substrate materials market is segmented based on application and product. Application segment includes smartphones, base stations, and others. By product, the market is segmented into organic laminates, liquid crystal polymer (LCP), polyimide, ceramics, and glass.

The smartphone 5G substrate materials market is expected to hold a major global market share in 2022. With smartphones, people can carry all their essential tools in their hands. Many things are possible with modern cell phones, including communication, entertainment, and navigation. Our smartphones also enable us to multitask, meaning we can do many things simultaneously and save time. The smartphone antennas category is expected to reign supreme in the worldwide 5G substrate materials market, leading by volume during the forecast period.

The ceramics industry makes up the bulk of 5G substrate materials usage because Ceramics provides some unique material properties and traits as compared to older, less technologically advanced non-ferrous materials like steel and plastic. Ceramics have several desirable qualities, such as resistance to wear and corrosion, high compressive strength, and electrical resistance, especially in countries like the US, Germany, the UK, China, and India.

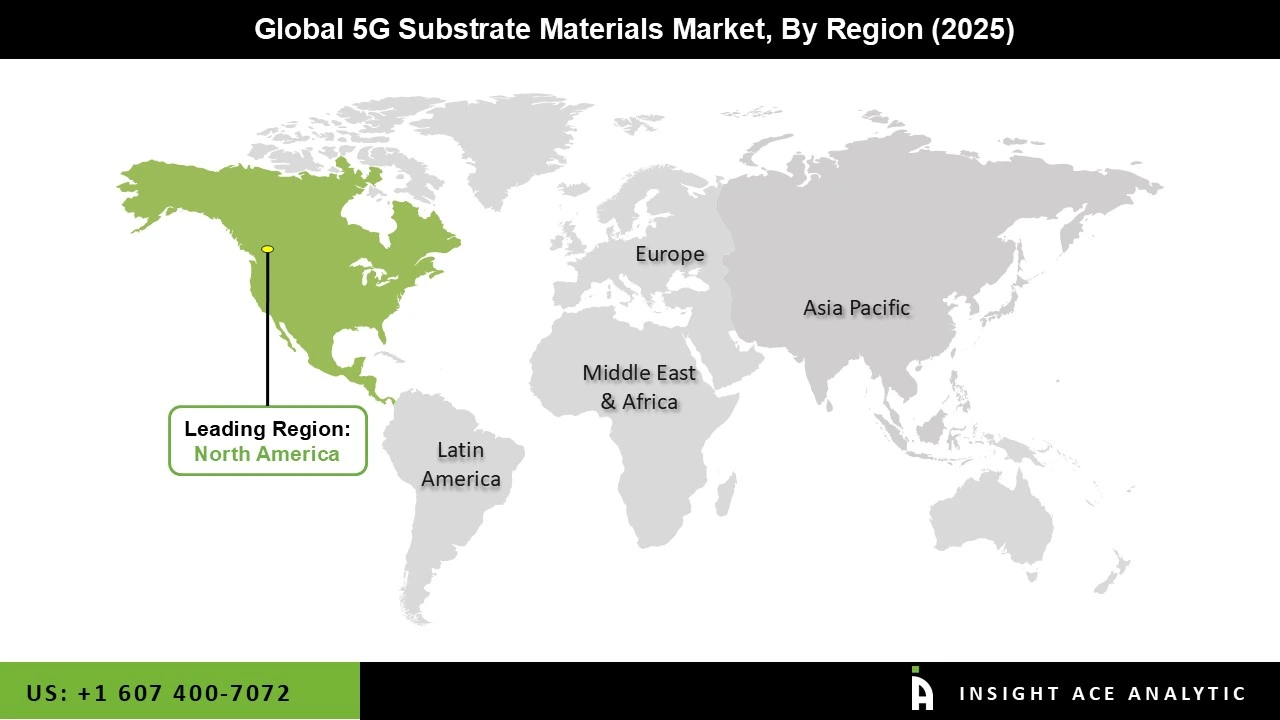

The North American 5G substrate materials market is expected to register the highest market share in revenue in the near future. It can be attributed to because of monetary prosperity and technical progress.

Factories are gradually moving to nations in the region with high demand and low production costs. In addition, Asia Pacific is projected to grow rapidly in the global 5G substrate materials market because of the area's booming economy, rapidly expanding end-use sectors, and competitive manufacturing costs.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 439.77 Mn |

| Revenue Forecast In 2035 | USD 4,304.45 Mn |

| Growth Rate CAGR | CAGR of 25.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million, Volume (Tons) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By Process, By Mining Equipment, By Energy Source |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Asahi Glass Company (AGC) Inc., Daikin Industries, DuPont de Nemours Inc, Showa Denko Materials Co. Ltd., ITEQ Corporation, Kaneka Corporation, Kuraray Co. Ltd., Panasonic Corporation, Avient Corporation, Rogers Corporation, Sumitomo Chemical Co. Ltd., The Chemours Company, Toray Industries Inc., Taiwan Union Technology Corporation, and Ventec International Group. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.