Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Insurance Platform Market Snapshot

Chapter 4. Global Insurance Platform Market Variables, Trends & Scope

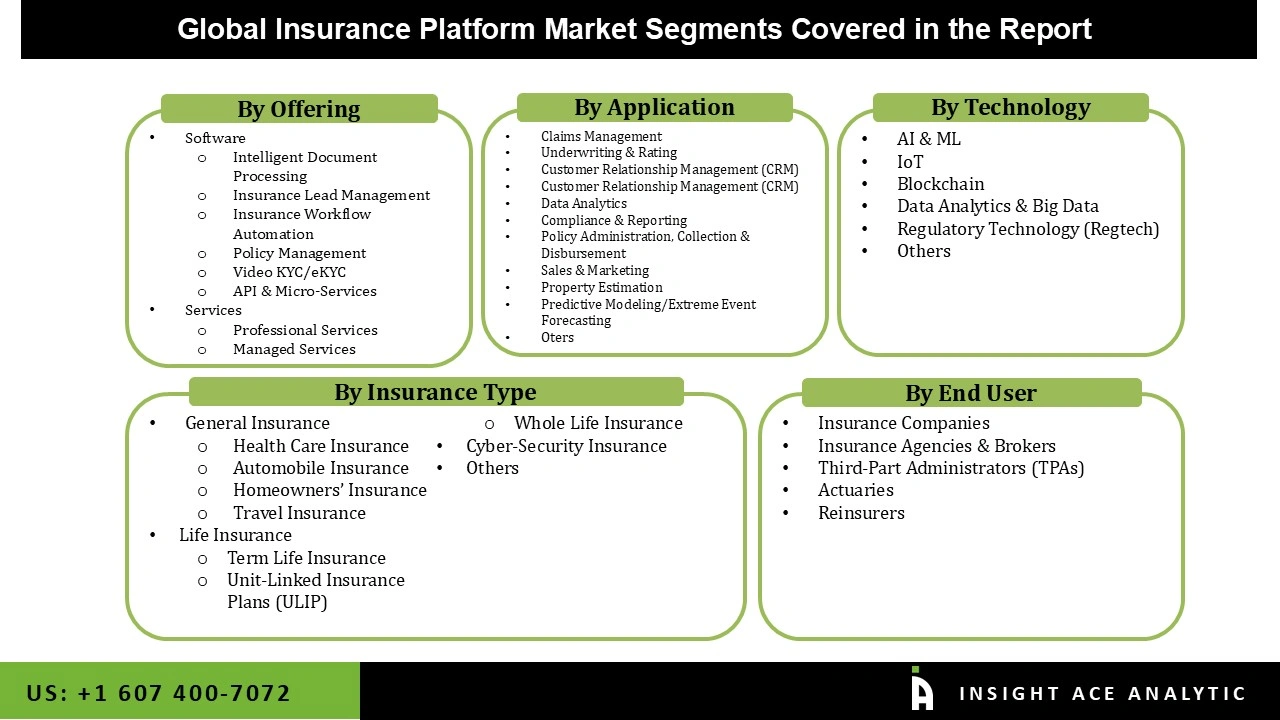

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Offering Estimates & Trend Analysis

5.1. By Offering, & Market Share, 2025 & 2035

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2022 to 2035 for the following By Offering:

5.2.1. Software

5.2.1.1. Intelligent Document Processing

5.2.1.1.1. Digital Document Depository

5.2.1.1.2. Document Collaboration

5.2.1.1.3. Document Verification

5.2.1.1.4. Document Version Control

5.2.1.2. Insurance Lead Management

5.2.1.2.1. Lead Tracking & Assignment

5.2.1.2.2. Lead Scoring & Nurturing

5.2.1.2.3. Lead Analytics

5.2.1.2.4. Cross-Selling & Upselling

5.2.2. Insurance Workflow Automation

5.2.2.1.1. Claims Workflow Automation

5.2.2.1.2. Underwriting Workflow Automation

5.2.2.1.3. Customer Onboarding Automation

5.2.2.1.4. Compliance Workflow Automation

5.2.3. Policy Management

5.2.3.1.1. Policy Issuance & Renewal

5.2.3.1.2. Policy Documentation

5.2.3.1.3. Policy Premium Calculations

5.2.3.1.4. Policy Quotation Management

5.2.4. Video KYC/eKYC

5.2.4.1.1. Identity & Biometric Verification

5.2.4.1.2. Compliance Reporting

5.2.4.1.3. Audit Trails

5.2.5. API & Microservices

5.2.5.1.1. API-Driven Insurance Integration Platforms

5.2.5.1.2. Partner Ecosystem Integration Platforms

5.2.5.1.3. API-Enabled Insurance Distribution Platforms

5.2.5.1.4. Microservices

5.2.5.1.4.1. Rating Microservices

5.2.5.1.4.2. Document Generation Microservices

5.2.5.1.4.3. Transaction Microservices

5.2.5.1.4.4. Workflow Microservices

5.2.5.1.4.5. Rating Microservices

5.2.5.1.4.6. Utility Microservices

5.2.5.1.4.7. Metadata Microservices

5.2.5.1.4.8. Product Management Microservices

5.2.6. Others

Chapter 6. Market Segmentation 2: By End-user Estimates & Trend Analysis

6.1. By End-user & Market Share, 2025 & 2035

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2022 to 2035 for the following By End-user:

6.2.1. Claims Management

6.2.1.1.1. Virtual Claims Handling

6.2.1.1.2. Claims Processing

6.2.1.1.3. Claims Analytics

6.2.2. Underwriting & Rating

6.2.2.1.1. Group Insurance Underwriting

6.2.2.1.2. Customer Risk Profiling

6.2.2.1.3. Collaboration & Self-Service

6.2.2.1.4. Pricing & Quote Management

6.2.3. Customer Relationship Management (CRM)

6.2.3.1.1. Customer Data Management

6.2.3.1.2. Customer Interaction & Engagement

6.2.3.1.3. Customer Support & Service

6.2.4. Billing & Payments

6.2.4.1.1. Premium Billing & Invoicing

6.2.4.1.2. Online Payment Processing

6.2.4.1.3. Reconciliation & Accounting

6.2.5. Data Analytics

6.2.5.1.1. Subrogation Analytics

6.2.5.1.2. Performance Tracking & Reporting

6.2.5.1.3. Fraud Detection & Prevention

6.2.6. Compliance & Reporting

6.2.6.1.1. Regulatory Compliance Management

6.2.6.1.2. Reporting Automation

6.2.7. Policy Administration, Collection & Disbursement

6.2.7.1.1. Policy Creation & Modification

6.2.7.1.2. Premium Collection

6.2.7.1.3. Payout & Disbursement Management

6.2.8. Sales & Marketing

6.2.8.1.1. Agent & Broker Management

6.2.8.1.2. Direct-To-Consumer Sales

6.2.8.1.3. Digital Sales Enablement

6.2.9. Property Estimation

6.2.9.1.1. Property Valuation

6.2.9.1.2. Claims Estimation

6.2.9.1.3. Property Inspection

6.2.10. Predictive Modeling/Extreme Event Forecasting

6.2.10.1.1. Claims Severity Modelling

6.2.10.1.2. Policy Recommendation Engines

6.2.10.1.3. Extreme Event Analysis

6.2.10.1.4. Catastrophe Modeling

6.2.11. Others

Chapter 7. Market Segmentation 3: By Insurance Type Estimates & Trend Analysis

7.1. By Insurance Type & Market Share, 2025 & 2035

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2022 to 2035 for the following By Insurance Type:

7.2.1. General Insurance

7.2.1.1. Health Care Insurance

7.2.1.1.1. Individual Health Insurance

7.2.1.1.2. Family Floater Insurance

7.2.1.1.3. Critical Illness Coverage

7.2.1.1.4. Senior Citizen Health Insurance

7.2.1.1.5. Group Health Insurance

7.2.1.2. Automobile Insurance

7.2.1.2.1. Car Insurance

7.2.1.2.2. Bike Insurance

7.2.1.2.3. Commercial Vehicle Insurance

7.2.1.3. Homeowners' Insurance

7.2.1.3.1. Home Building Insurance

7.2.1.3.2. Public Liability Coverage

7.2.1.3.3. Standard Fire & Special Perils Policy

7.2.1.4. Travel Insurance

7.2.1.4.1. Trip Cancellation

7.2.1.4.2. Medical Coverage

7.2.1.4.3. Baggage Loss

7.2.2. Life Insurance

7.2.2.1. Term Life Insurance

7.2.2.1.1. Level Term Life Insurance

7.2.2.1.2. Increasing Term Insurance

7.2.2.1.3. Decreasing Term Insurance

7.2.2.1.4. Return Of Premium Term Insurance

7.2.2.1.5. Convertible Term Plans

7.2.2.2. Unit-Linked Insurance Plans (ULIP)

7.2.2.2.1. Type 1 ULIP

7.2.2.2.2. Type 2 ULIP

7.2.2.3. Whole Life Insurance

7.2.2.3.1. Indexed Whole Life Insurance

7.2.2.3.2. Guaranteed Issue Whole Life Insurance

7.2.2.3.3. Limited Payment Whole Life Insurance

7.2.2.3.4. Joint Whole Life Insurance

7.2.2.3.5. Modified Whole Life Insurance

7.2.2.3.6. Reduced Paid-Up Whole Life Insurance

7.2.2.3.7. Simplified Issue Whole Life Insurance

7.2.2.3.8. Single-Premium Whole Life Insurance

7.2.2.3.9. Variable Whole Life Insurance

7.2.2.3.10. Whole Life Insurance For Children

7.2.3. Cybersecurity Insurance

7.2.3.1.1. Data Breach Coverage

7.2.3.1.2. Cyber Extortion & Ransomware Coverage

7.2.3.1.3. Regulatory Fines & Penalties Coverage

7.2.3.1.4. Cyber Terrorism Insurance

7.2.4. Others

Chapter 8. Market Segmentation 4: By Technology Estimates & Trend Analysis

8.1. By Technology & Market Share, 2025 & 2035

8.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2022 to 2035 for the following By Technology:

8.2.1. AI & ML

8.2.1.1. Ai-Powered Underwriting Platforms

8.2.1.2. ML-Based Claims Processing Platforms

8.2.1.3. Ai-Driven Customer Service & Chatbot Platforms

8.2.1.4. insurance platform-Based Content Marketing

8.2.1.5. Robotic Process Automation

8.2.1.6. Others

8.2.2. IoT

8.2.2.1. IoT-Enabled Telematics Platforms

8.2.2.2. Connected Home & Property Insurance Platforms

8.2.2.3. Wearable Device Integration for Health Insurance

8.2.2.4. Others

8.2.3. Blockchain

8.2.3.1. Blockchain-Based Insurance Platforms

8.2.3.2. Smart Contract Insurance Platforms

8.2.3.3. Decentralized Insurance Platforms

8.2.3.4. Others

8.2.4. Data Analytics & Big Data

8.2.4.1. Big Data Analytics For Risk Assessment

8.2.4.2. Predictive Analytics For Pricing & Underwriting

8.2.4.3. Data-Driven Claims Processing Platforms

8.2.4.4. Others

8.2.5. Regulatory Technology (Regtech)

8.2.5.1. Regulatory Compliance & Reporting Platforms

8.2.5.2. KYC & AML Compliance Solutions

8.2.5.3. Regulatory Risk Assessment & Management

8.2.5.4. Others

8.2.6. Others

Chapter 9. Market Segmentation 5: By End-user Estimates & Trend Analysis

9.1. By End-user & Market Share, 2025 & 2035

9.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2022 to 2035 for the following By End-user:

9.2.1. Insurance Companies

9.2.1.1. Large Carriers

9.2.1.2. Mid-Sized Carriers

9.2.1.3. Small & Startup Insurers

9.2.2. Insurance Agencies & Brokers

9.2.2.1. Independent Agencies

9.2.2.2. Brokerage Firms

9.2.2.3. Online Aggregators

9.2.3. Third-Party Administrators (TPAs)

9.2.3.1. Claims Handing Firms

9.2.3.2. Policy Management Service Providers

9.2.4. Actuaries

9.2.5. Reinsurers

Chapter 10. Insurance Platform Market Segmentation 6: Regional Estimates & Trend Analysis

10.1. North America

10.1.1. North America Insurance Platform Market revenue (US$ Million) estimates and forecasts By Offering, 2022-2035

10.1.2. North America Insurance Platform Market revenue (US$ Million) estimates and forecasts By End-user, 2022-2035

10.1.3. North America Insurance Platform Market revenue (US$ Million) estimates and forecasts By Insurance Type, 2022-2035

10.1.4. North America Insurance Platform Market revenue (US$ Million) estimates and forecasts By Technology, 2022-2035

10.1.5. North America Insurance Platform Market revenue (US$ Million) estimates and forecasts By End-user, 2022-2035

10.1.6. North America Insurance Platform Market revenue (US$ Million) estimates and forecasts by country, 2022-2035

10.2. Europe

10.2.1. Europe Insurance Platform Market revenue (US$ Million) By Offering, 2022-2035

10.2.2. Europe Insurance Platform Market revenue (US$ Million) By End-user, 2022-2035

10.2.3. Europe Insurance Platform Market revenue (US$ Million) By Insurance Type, 2022-2035

10.2.4. Europe Insurance Platform Market revenue (US$ Million) By Technology, 2022-2035

10.2.5. Europe Insurance Platform Market revenue (US$ Million) By End-user, 2022-2035

10.2.6. Europe Insurance Platform Market revenue (US$ Million) by country, 2022-2035

10.3. Asia Pacific

10.3.1. Asia Pacific Insurance Platform Market revenue (US$ Million) By Offering, 2022-2035

10.3.2. Asia Pacific Insurance Platform Market revenue (US$ Million) By End-user, 2022-2035

10.3.3. Asia Pacific Insurance Platform Market revenue (US$ Million) By Insurance Type, 2022-2035

10.3.4. Asia Pacific Insurance Platform Market revenue (US$ Million) By Technology, 2022-2035

10.3.5. Asia Pacific Insurance Platform Market revenue (US$ Million) By End-user, 2022-2035

10.3.6. Asia Pacific Insurance Platform Market revenue (US$ Million) by country, 2022-2035

10.4. Latin America

10.4.1. Latin America Insurance Platform Market revenue (US$ Million) By Offering, (US$ Million) 2022-2035

10.4.2. Latin America Insurance Platform Market revenue (US$ Million) By End-user, (US$ Million) 2022-2035

10.4.3. Latin America Insurance Platform Market revenue (US$ Million) By Insurance Type, (US$ Million) 2022-2035

10.4.4. Latin America Insurance Platform Market revenue (US$ Million) By Technology, (US$ Million) 2022-2035

10.4.5. Latin America Insurance Platform Market revenue (US$ Million) By End-user, (US$ Million) 2022-2035

10.4.6. Latin America Insurance Platform Market revenue (US$ Million) by country, 2022-2035

10.5. Middle East & Africa

10.5.1. Middle East & Africa Insurance Platform Market revenue (US$ Million) By Offering, (US$ Million) 2022-2035

10.5.2. Middle East & Africa Insurance Platform Market revenue (US$ Million) By End-user, (US$ Million) 2022-2035

10.5.3. Middle East & Africa Insurance Platform Market revenue (US$ Million) By Insurance Type, (US$ Million) 2022-2035

10.5.4. Middle East & Africa Insurance Platform Market revenue (US$ Million) By Technology, (US$ Million) 2022-2035

10.5.5. Middle East & Africa Insurance Platform Market revenue (US$ Million) By End-user, (US$ Million) 2022-2035

10.5.6. Middle East & Africa Insurance Platform Market revenue (US$ Million) by country, 2022-2035

Chapter 11. Competitive Landscape

11.1. Major Mergers and Acquisitions/Strategic Alliances

11.2. Company Profiles

11.2.1. Microsoft (US)

11.2.2. Adobe (US)

11.2.3. Salesforce (US)

11.2.4. IBM (US)

11.2.5. Oracle (US)

11.2.6. SAP (Germany)

11.2.7. Pegasystems (US)

11.2.8. Accenture (Ireland)

11.2.9. DXC Technology (US)

11.2.10. Guidewire Software (US)

11.2.11. Duck Creek Technologies (US)

11.2.12. Applied Systems (US)

11.2.13. Fineos (Ireland)

11.2.14. Cognizant (US)

11.2.15. Appian (US)

11.2.16. LTIMindtree (India)

11.2.17. Prima Solutions (France)

11.2.18. Majesco (US)

11.2.19. EIS Group (US)

11.2.20. Cogitate Technology Solutions (US)

11.2.21. Vertafore (US)

11.2.22. Sapiens International Corporation (Israel)

11.2.23. Bolt Insurance (US)

11.2.24. Inzura (UK)

11.2.25. Britecore (US)

11.2.26. Shift Technology (France

11.2.27. Zipari (US)

11.2.28. Qauntemplate (US)

11.2.29. PerfectQuote (US)

11.2.30. Outsystems (US)

11.2.31. Zywave (US)

11.2.32. Socotra (US)

11.2.33. InsuredMine (US)

11.2.34. InsuredHQ (New Zealand)

11.2.35. CodeMetro (US)

11.2.36. AgencySmart (US)

11.2.37. OneShield (US)

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.