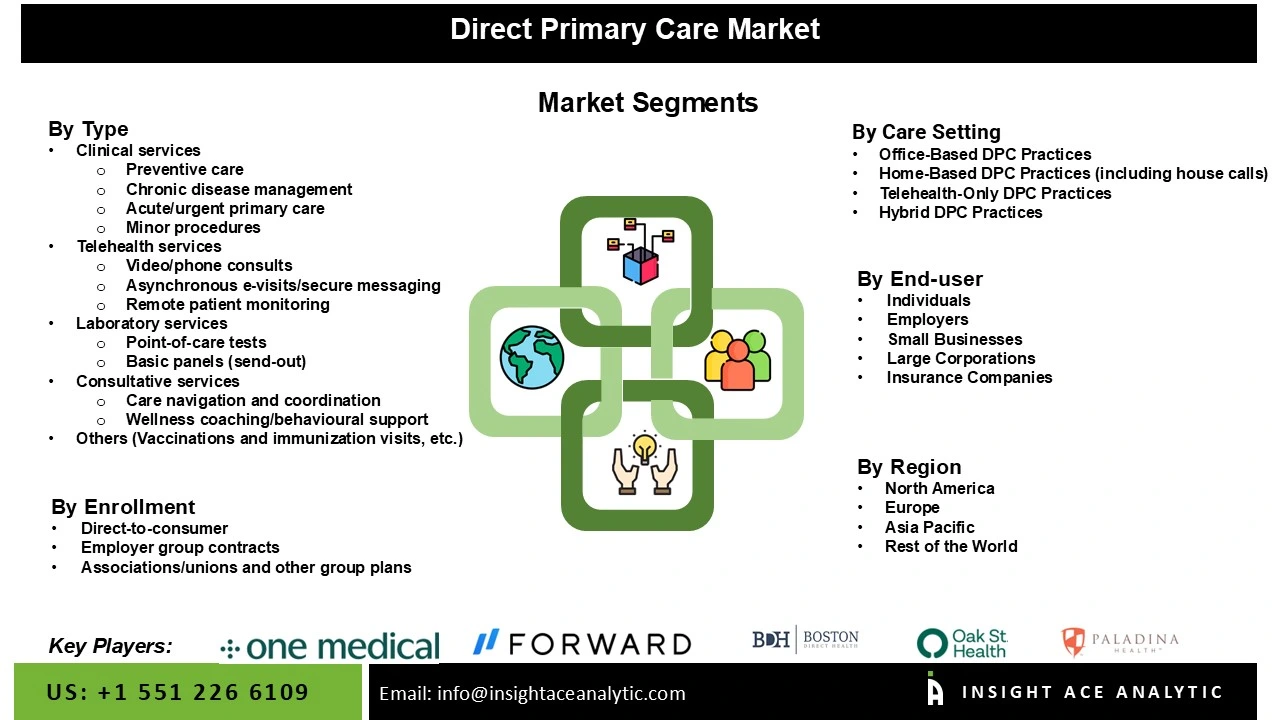

Direct Primary Care Market – By ServiceType

Direct Primary Care Market – Care Setting

Direct Primary Care Market-By Enrollment Channel

Direct Primary Care Market – End Users

Global Direct Primary Care Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Direct Primary Care Market Snapshot

Chapter 4. Global Direct Primary Care Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Service Type Estimates & Trend Analysis

5.1. by Service Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Service Type:

5.2.1. Clinical services

5.2.1.1. Preventive care

5.2.1.2. Chronic disease management

5.2.1.3. Acute/urgent primary care

5.2.1.4. Minor procedures

5.2.2. Telehealth services

5.2.2.1. Video/phone consults

5.2.2.2. Asynchronous e-visits/secure messaging

5.2.2.3. Remote patient monitoring

5.2.3. Laboratory services

5.2.3.1. Point-of-care tests

5.2.3.2. Basic panels (send-out)

5.2.4. Consultative services

5.2.4.1. Care navigation and coordination

5.2.4.2. Wellness coaching/behavioral support

5.2.5. Others (Vaccinations and immunization visits, etc.)

Chapter 6. Market Segmentation 2: Care Setting Estimates & Trend Analysis

6.1. Care Setting & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following Care Setting:

6.2.1. Office-Based DPC Practices

6.2.2. Home-Based DPC Practices (including house calls)

6.2.3. Telehealth-Only DPC Practices

6.2.4. Hybrid DPC Practices

Chapter 7. Market Segmentation 3: Enrollment Channel Estimates & Trend Analysis

7.1. Enrollment Channel & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following Enrollment Channel:

7.2.1. Direct-to-consumer

7.2.2. Employer group contracts

7.2.3. Associations/unions and other group plans

Chapter 8. Market Segmentation 4: End User Estimates & Trend Analysis

8.1. End User & Market Share, 2024 & 2034

8.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following End User:

8.2.1. Individuals

8.2.2. Employers

8.2.3. Small Businesses

8.2.4. Large Corporations

8.2.5. Insurance Companies (offering DPC as part of their plans)

Chapter 9. Direct Primary Care Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. North America

9.1.1. North America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

9.1.2. North America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Care Setting, 2021-2034

9.1.3. North America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.1.4. North America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Enrollment Channel, 2021-2034

9.1.5. North America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.2. Europe

9.2.1. Europe Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

9.2.2. Europe Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Care Setting, 2021-2034

9.2.3. Europe Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.2.4. Europe Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Enrollment Channel, 2021-2034

9.2.5. Europe Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.3. Asia Pacific

9.3.1. Asia Pacific Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

9.3.2. Asia Pacific Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Care Setting, 2021-2034

9.3.3. Asia-Pacific Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.3.4. Asia-Pacific Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Enrollment Channel, 2021-2034

9.3.5. Asia Pacific Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.4. Latin America

9.4.1. Latin America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

9.4.2. Latin America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Care Setting, 2021-2034

9.4.3. Latin America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.4.4. Latin America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Enrollment Channel, 2021-2034

9.4.5. Latin America Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.5. Middle East & Africa

9.5.1. Middle East & Africa Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Service Type, 2021-2034

9.5.2. Middle East & Africa Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Care Setting, 2021-2034

9.5.3. Middle East & Africa Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by Enrollment Channel, 2021-2034

9.5.4. Middle East & Africa Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.5.5. Middle East & Africa Direct Primary Care Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. Consumer / Membership-based DPC Providers

10.2.1.1. One Medical (Amazon-owned; membership-based hybrid primary care)

10.2.1.2. Plum Health

10.2.1.3. PeakMed

10.2.1.4. Nextera Healthcare (rebranded to KerixHealth)

10.2.1.5. Boston Direct Health

10.2.1.6. EverMed

10.2.1.7. HipNation

10.2.1.8. Zenith Direct Care

10.2.2. Employer-focused / On-site & Near-site Advanced Primary Care

10.2.2.1. Oak Street Health (CVS-owned; value-based primary care for Medicare adults)

10.2.2.2. Everside Health (formerly Paladina Health)

10.2.2.3. Marathon Health (merged with Everside; still operating jointly)

10.2.2.4. Premise Health

10.2.2.5. Crossover Health

10.2.2.6. CareATC

10.2.2.7. QuadMed

10.2.2.8. apree health (Vera Whole Health + Castlight merger)

10.2.2.9. Eden Health

10.2.3. Hybrid / Virtual-first Primary Care Platforms

10.2.3.1. Carbon Health

10.2.3.2. K Health

10.2.3.3. Hint Connect (DPC network for employers and benefit advisors)

10.2.3.4. Atlas MD (DPC EMR + flagship clinics)

10.2.3.5. Healthcare2U

10.2.3.6. Frontier Direct Care

10.2.3.7. First Primary Care

10.2.4. Others

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.