Global Direct Primary Care Market Size is valued at USD 59.5 Bn in 2024 and is predicted to reach USD 92.9 Bn by the year 2034 at an 4.6% CAGR during the forecast period for 2025 to 2034.

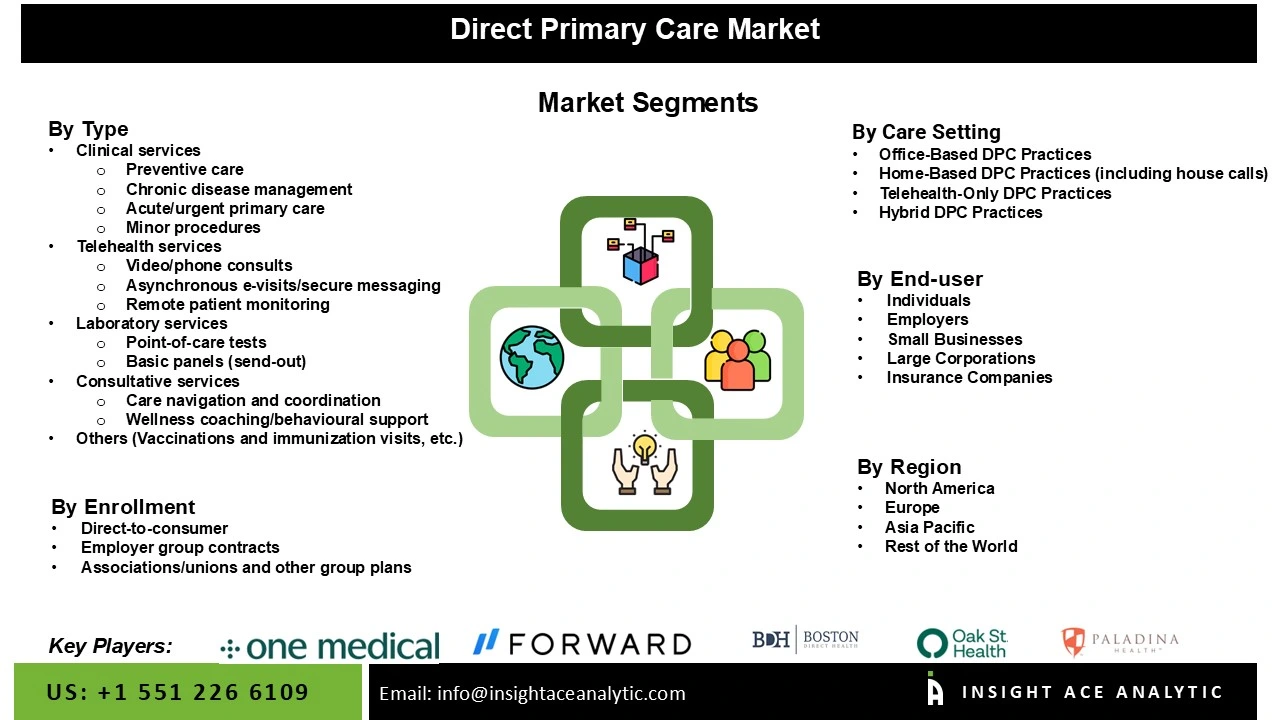

Direct Primary Care Market Share & Trends Analysis Report By Type (Clinical services, Telehealth services, Laboratory services, Consultative services, Others (Vaccinations and immunization visits, etc.)), By Care Setting (Office-based DPC practices, Home-based DPC practices, Telehealth-only DPC practices, Hybrid DPC practices), By Enrollment Channel (Direct-to-consumer, Employer group contracts, Associations/unions and other group plans), By End User, By Region, and Segment Forecasts, 2025 to 2034

Direct Primary Care (DPC) represents an innovative primary care practice model where patients gain unlimited access to a range of primary care services by paying a monthly membership fee specific to each practice. This model stands out as a bottom-up, physician-driven approach, diverging from the traditional top-down, insurer-centric healthcare reform efforts. Despite its potential benefits, the extent of physician awareness about DPC and their perception of its effectiveness in addressing primary care challenges, such as improving access and reducing administrative burdens, remains uncertain. Understanding physician perspectives on DPC is crucial to evaluating its viability and potential impact on the healthcare system.

Direct Primary Care (DPC) covers only essential primary care services, meaning patients may still need to purchase additional insurance or spend out-of-pocket for specialty care, hospitalizations, and other services not included in the DPC model. While DPC is not a substitute for comprehensive health insurance, it enhances primary care through telehealth services, enabling patients to consult with physicians easily for routine consultations, follow-ups, and minor health concerns. Moreover, DPC practices often offer flexible scheduling, including cell visits or house calls, which minimizes time spent on administrative tasks and allows physicians to focus more on direct patient care. This model provides a streamlined and accessible approach to primary care, enhancing the overall patient experience while maintaining the need for broader health coverage.

DPC offers predictable, transparent pricing through a flat monthly fee, which can lead to overall patient cost savings by avoiding the complexities and high costs of insurance billing. People are becoming more proactive about their health, and DPC's focus on preventive care aligns well with this trend.

The information is segmented based on type and application. The type segment is divided into clinical services, telehealth Services, laboratory services, consultative services, and others. Based on the care setting, the market is categorized into office-based DPC practices, home-based DPC practices, telehealth-only DPC practices, and hybrid DPC practices. The end-users are segmented into Individuals, Employers, Small Businesses, Large Corporations, and Insurance Companies.

The market is categorized by type into clinical services, telehealth services, laboratory services, consultative services, and others. The telehealth services segment is expected to have the highest growth rate during the forecast period. The convenience and accessibility of telehealth have led to a surge in patient demand, particularly for routine consultations, follow-ups, and minor health concerns. The COVID-19 pandemic enormously accelerated the adoption of telehealth as patients and healthcare providers sought safer, contactless consultation methods. Furthermore, the easing of regulations and increased reimbursement for telehealth services by insurers and governments have further fueled its growth. As a result, telehealth has become an crucial part of the healthcare landscape, proffering a viable solution for continuous care while minimizing the risks associated with in-person visits.

End-users segment is divided into individuals, employers, small businesses, large corporations, and insurance companies (offering DPC as part of their plans). Among These, the employer's segment dominates the market. DPC can significantly reduce healthcare costs for employers by providing primary care services through a flat monthly fee, minimizing the need for more expensive urgent care, emergency room visits, and hospitalizations. This cost-effective approach appeals to employers aiming to manage healthcare expenditures efficiently. Additionally, DPC focuses on preventive care and chronic disease management, leading to better employee health outcomes. Healthier employees are more productive, have fewer sick days, and contribute to a more efficient and effective workforce.

North America, particularly the United States, is a hub for innovative healthcare delivery models. The region's openness to new approaches has facilitated the growth of DPC practices. Many employers in North America are incorporating DPC into their employee benefits packages to reduce overall healthcare costs and improve employee wellness, which boosts market growth. There is a growing demand among patients for more personalized, accessible, and preventive care, which DPC models effectively provide.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 59.5 Billion |

| Revenue Forecast In 2034 | USD 92.9 Billion |

| Growth Rate CAGR | CAGR of 4.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Serivce Type, Care Setting, Enrollment Channel and End user. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | One Medical (Amazon-owned; membership-based hybrid primary care), Plum Health, PeakMed, Nextera Healthcare (rebranded to KerixHealth), Boston Direct Health, EverMed, HipNation, Zenith Direct Care, Oak Street Health (CVS-owned; value-based primary care for Medicare adults), Everside Health (formerly Paladina Health), Marathon Health (merged with Everside; still operating jointly), Premise Health, Crossover Health, CareATC, QuadMed, apree health (Vera Whole Health + Castlight merger), Eden Health, Carbon Health, K Health, Hint Connect (DPC network for employers and benefit advisors), Atlas MD (DPC EMR + flagship clinics), Healthcare2U, Frontier Direct Care, First Primary Care |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Direct Primary Care Market – By ServiceType

Direct Primary Care Market – Care Setting

Direct Primary Care Market-By Enrollment Channel

Direct Primary Care Market – End Users

Global Direct Primary Care Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.