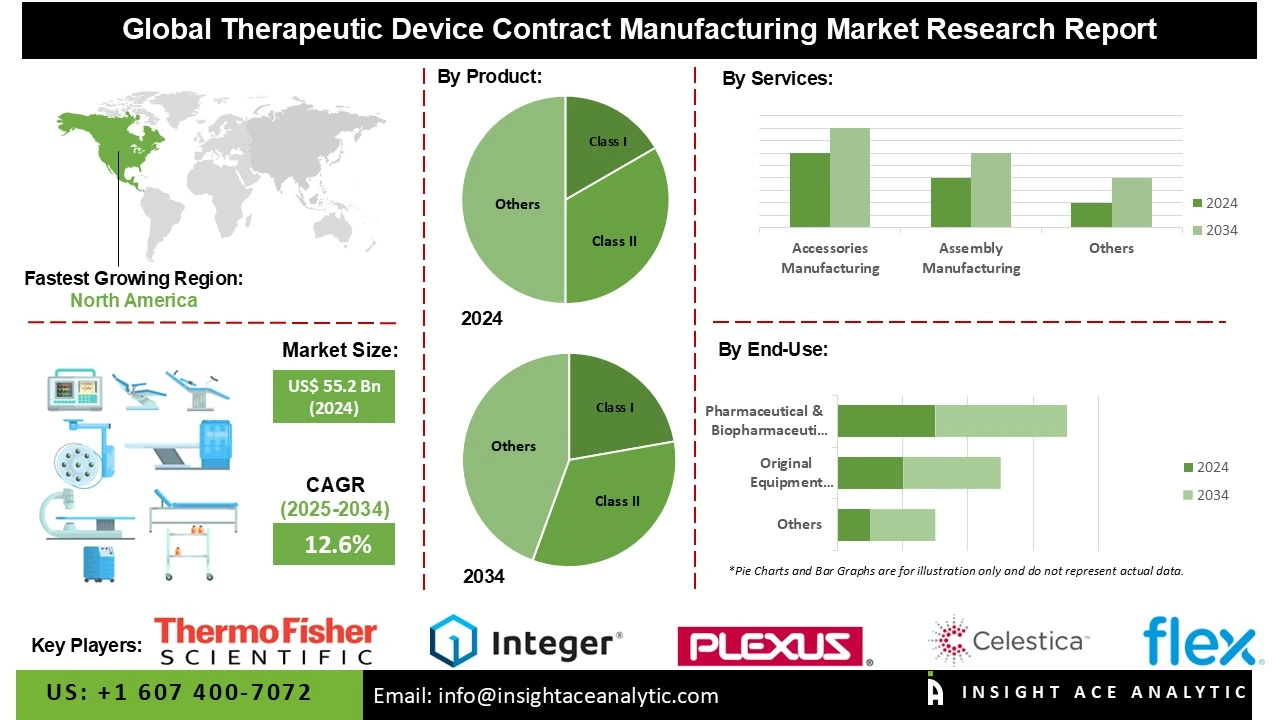

Global Therapeutic Device Contract Manufacturing Market Size is valued at US$ 55.2 Bn in 2024 and is predicted to reach US$ 175.7 Bn by the year 2034 at an 12.6% CAGR during the forecast period for 2025 to 2034.

Therapeutic Device Contract Manufacturing Market Size, Share & Trends Analysis Distribution by Product (Class I, Class II, and Class III), By Services (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, Packaging and Labeling, and Others), By Therapeutic Area (Cardiovascular Devices, Orthopedic Devices, Ophthalmic Devices, Respiratory Devices, Surgical Instruments, Dental, and Others), By End Use (Original Equipment Manufacturers (OEMs), Pharmaceutical & Biopharmaceutical Companies, and Others), and Segment Forecasts, 2025 to 2034

Therapeutic device contract manufacturing provides medical device companies with a strategic and capital-efficient production model, eliminating the need for heavy investment in internal manufacturing facilities. This approach is particularly critical for complex, high-risk devices such as pacemakers, insulin pumps, orthopedic implants, and respiratory systems. By partnering with specialized contract manufacturers (CMs), original equipment manufacturers (OEMs) gain access to expert-driven quality control, guaranteed regulatory compliance, and accelerated time-to-market.

The model offers inherent scalability, allowing production to flexibly meet fluctuating global demand. This outsourcing enables device companies to reallocate vital resources and capital toward core competencies like research, development, and commercial expansion, driving innovation in patient care.

The global market for therapeutic device contract manufacturing is experiencing significant growth, propelled by the medical industry's strategic shift towards outsourcing to reduce operational costs and enhance efficiency. This trend is further amplified by the rising global prevalence of chronic diseases and an aging population, which fuels demand for advanced therapeutic devices.

While the market is strong, it faces challenges, including global supply chain vulnerabilities that can disrupt production timelines. Nonetheless, the future outlook is highly positive. Key opportunities lie in the escalating demand for sophisticated, connected medical devices and the expanding adoption of outsourcing, particularly by small and mid-sized innovators, ensuring the market's continued expansion.

The Therapeutic Device Contract Manufacturing market is segmented by Product, Services, Therapeutic Area, and End Use. By Product, the market is segmented into Class I, Class II, and Class III. By Services, the market is segmented into Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, Packaging and Labeling, and Others. By Therapeutic Area, the market is segmented into Cardiovascular Devices, Orthopedic Devices, Ophthalmic Devices, Respiratory Devices, Surgical Instruments, Dental, and Others. By End Use, the market is segmented into Original Equipment Manufacturers (OEMs), Pharmaceutical & Biopharmaceutical Companies, and Others.

The class II category led the Therapeutic Device Contract Manufacturing market in 2024. This convergence is fueled by the increasing prevalence of moderately complex therapeutic devices such as infusion pumps, diagnostic imaging equipment, and orthopedic devices, which typically fall under Class II classification.

The largest and fastest-growing service is accessories Manufacturing, a trend driven by the high demand for complementary components and add-on devices that support therapeutic devices, such as catheters, tubing sets, connectors, and sensor attachments. For contract manufacturers, these accessories are a consistent source of income because they are necessary for the correct operation and usability of primary treatment equipment. This material appears overly automated.

North America dominated the Therapeutic Device Contract Manufacturing market in 2024. The United States is at the forefront of this expansion. This is due to technological developments and the existence of established healthcare systems. The growing demand for state-of-the-art medical devices, and the growing need for medical device companies to outsource in order to lower operating costs all of which are anticipated to spur efficiency, innovation, and save money for research and development are all responsible for this.

With an increase in healthcare expenditure, these conditions are becoming increasingly common in the Asia-Pacific area. The Therapeutic Device Contract Manufacturing market is expanding at the strongest and fastest rate in this region. Additionally, there is potential for multiple opportunities in the region, primarily in Japan, China, and India. In the Asia Pacific, growth is already expected as the region is seen as one of the most sustainable options for the medical device market expansion. Because of lower costs and the regulatory environment, the region is beginning to emerge as an important step in the supply chain for drug discovery outsourcing activities.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 55.2 Bn |

| Revenue Forecast In 2034 | USD 175.7 Bn |

| Growth Rate CAGR | CAGR of 12.6% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, By Services, By Therapeutic Area, By End Use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Thermo Fisher Scientific Inc., Integer Holdings Corporation, FLEX LTD., Celestica Inc., Phillips-Medisize, Plexus Corp., Nipro Corporation, Viant Technology LLC, West Pharmaceutical Services, Inc., and Synecco Ltd |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Therapeutic Device Contract Manufacturing Market by Product-

· Class I

· Class II

· Class III

.webp)

Therapeutic Device Contract Manufacturing Market by Services-

· Accessories Manufacturing

· Assembly Manufacturing

· Component Manufacturing

· Device Manufacturing

· Packaging and Labeling

· Others

Therapeutic Device Contract Manufacturing Market by Therapeutic Area-

· Cardiovascular Devices

· Orthopedic Devices

· Ophthalmic Devices

· Respiratory Devices

· Surgical Instruments

· Dental

· Others

Therapeutic Device Contract Manufacturing Market by End Use-

· Original Equipment Manufacturers (OEMs)

· Pharmaceutical & Biopharmaceutical Companies

· Others

Therapeutic Device Contract Manufacturing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.