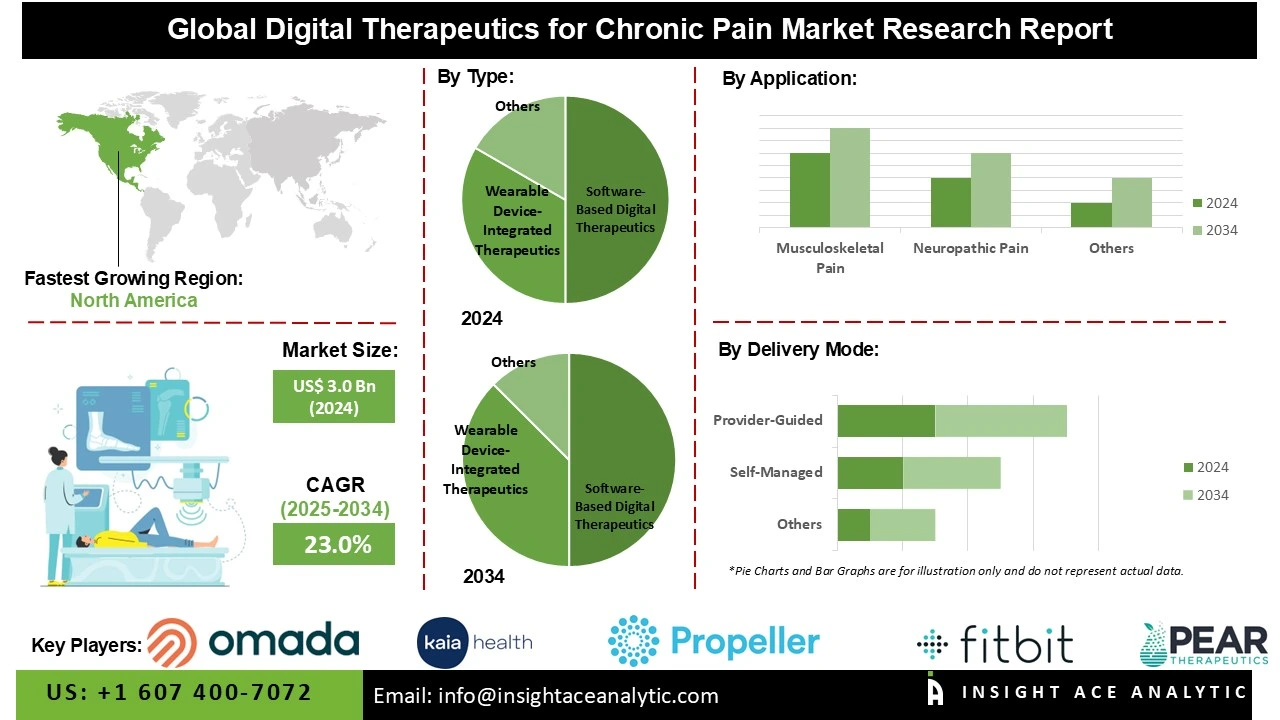

Digital Therapeutics for Chronic Pain Market is valued at US$ 3.0 Bn in 2024 and it is expected to reach US$ 23.58 Bn by 2034, with a CAGR of 23.0% during the forecast period of 2025-2034.

Digital therapeutics represent a transformative class of medicine for chronic pain, delivering evidence-based behavioral and psychological interventions through software. These regulated medical technologies translate proven techniques like cognitive-behavioral therapy (CBT), mindfulness, and personalized exercise into accessible digital formats. By addressing the biopsychosocial complexity of pain, they help patients reconceptualize their pain experience, develop self-management skills, and reduce medication dependence.

The field is rapidly evolving from standalone applications to integrated care pathways that combine AI-driven personalization with human coaching. This evolution is creating a new ecosystem for pain management that prioritizes functional improvement and value-based outcomes over passive symptom treatment, fundamentally reshaping how chronic pain is understood and managed across global healthcare systems.

While the growth of digital therapeutics for chronic pain is driven by the rising global prevalence of chronic conditions, a shift towards non-opioid pain management, and advancements in AI and wearable technology, the sector faces significant hurdles. Key challenges include securing consistent insurance reimbursement, demonstrating long-term efficacy to clinicians and payers, ensuring patient engagement and adherence, and navigating complex and varying regulatory frameworks across different global markets.

Some of the Key Players in the Digital Therapeutics for Chronic Pain Market:

The digital therapeutics for chronic pain market is segmented by type, delivery mode, application, and end-use. By type, the market is segmented into software-based digital therapeutics, mobile application therapeutics, and wearable device-integrated therapeutics. The delivery mode segment is segmented into self-managed and provider-guided. According to the application, the market includes neuropathic pain, musculoskeletal pain, fibromyalgia, and post-surgical pain. By end-use, the market is segmented into patients and healthcare providers.

In 2024, due to their accessibility, user-friendly interfaces, and broad smartphone adoption, mobile application therapeutics accounted for the largest segment of the digital therapeutics for chronic pain market. With these applications, users can efficiently manage their pain from the comfort of their homes, thanks to features such as pain tracking, medication reminders, guided workouts, and educational materials. Additionally, the ongoing development of app features, such as telehealth capabilities and integration with AI-driven analytics, is strengthening their value proposition and driving expansion of the digital therapeutics for chronic pain market.

In 2024, the neuropathic pain category led the digital therapeutics for chronic pain market. Because of its complexity and poor responsiveness to traditional pharmaceutical therapies, neuropathic pain—which results from nerve damage or dysfunction—is a prominent topic of focus. Additionally, advanced features such as AI-driven symptom tracking, customized fitness plans, and cognitive-behavioral therapy modules are frequently used in digital therapeutics for neuropathic pain. By helping patients better understand their pain patterns, recognize triggers, and put effective self-management techniques into practice, these solutions improve quality of life and lessen dependency on medication.

In 2024, the North America region led the digital therapeutics for chronic pain market. The region's strong rates of wearable and mobile technology use, sophisticated digital health infrastructure, and encouraging reimbursement practices are all factors contributing to its leadership. Additionally, due to significant investments in digital health innovation, a sizable population of people with chronic pain, and growing consumer and healthcare provider acceptance of digital medicines, the United States is at the forefront. With government programs advancing digital health literacy and virtual care, North America is also experiencing consistent growth.

The Asia Pacific is likely to grow at the fastest rate in the digital therapeutics for chronic pain market over the forecast period, driven by rising healthcare costs in many Asia-Pacific countries and the growing incidence of chronic pain among aging, urbanizing populations. The rapid adoption of smartphones and broadband, the growing acceptability of telehealth in the wake of the COVID-19 pandemic, and the growing use of wearables and remote monitoring devices provide the technical foundation for scalable, continuous digital medicine delivery.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 3.0 Bn |

| Revenue Forecast In 2034 | USD 23.5 Bn |

| Growth Rate CAGR | CAGR of 23.0% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Delivery Mode, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Omada Health, Kaia Health, Pear Therapeutics, Fitbit, Propeller Health, Biofourmis, Click Therapeutics, Happify Health, Akili Interactive, Better Therapeutics, Altoida, Kaiku Health, Curable, Pathway Genomics, Twill, AppliedVR, Mymee, SWORD Health, MedRhythms, MindMaze, Cognoa, Welldoc, Newtopia, Grand Rounds, and Hinge Health |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Therapeutics for Chronic Pain Market by Type-

· Software-Based Digital Therapeutics

· Mobile Application Therapeutics

· Wearable Device-Integrated Therapeutics

Digital Therapeutics for Chronic Pain Market by Delivery Mode -

· Self-Managed

· Provider-Guided

Digital Therapeutics for Chronic Pain Market by Application-

· Neuropathic Pain

· Musculoskeletal Pain

· Fibromyalgia

· Post-Surgical Pain

Digital Therapeutics for Chronic Pain Market by End-use-

· Patients

· Healthcare Providers

Digital Therapeutics for Chronic Pain Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.