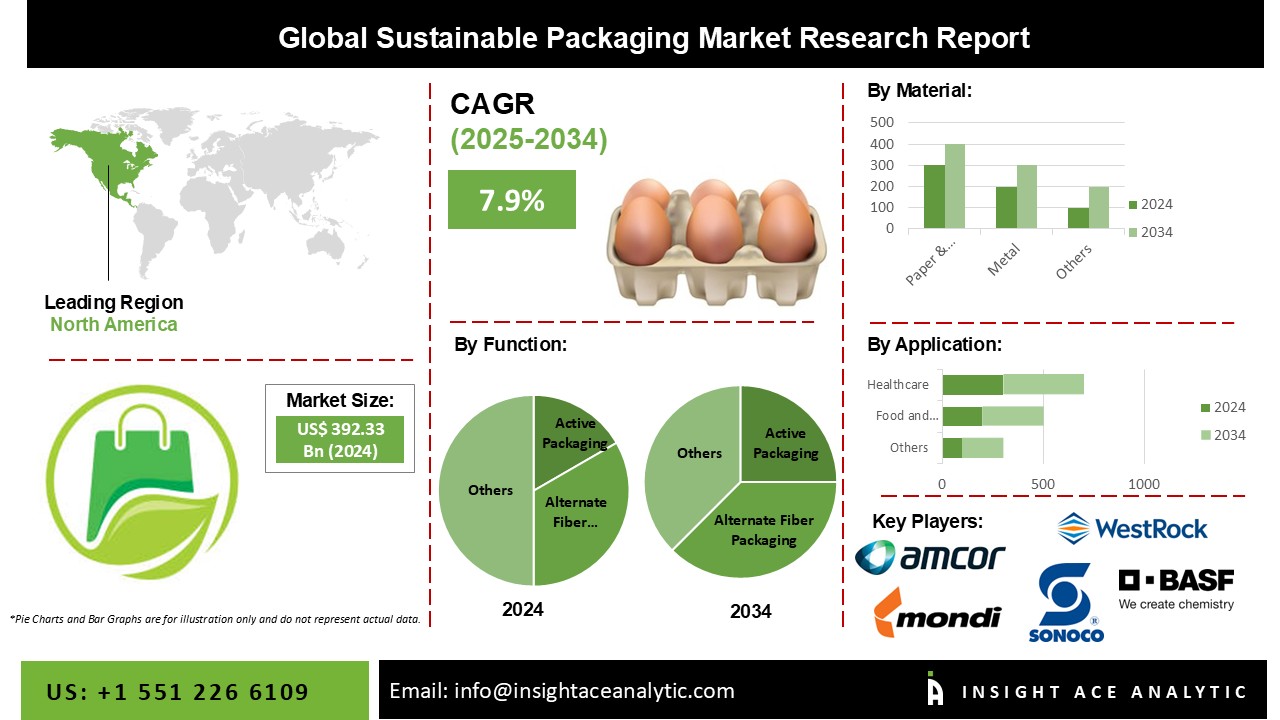

Global Sustainable Packaging Market Size is valued at USD 392.33 Bn in 2024 and is predicted to reach USD 833.31 Bn by the year 2034 at a 7.9% CAGR during the forecast period for 2025-2034.

Sustainable packaging is the production and usage of packaging that improves sustainability. It makes greater use of life cycle assessments and inventories to inform packaging decisions and reduce environmental impact. Growing consumer awareness of sustainable packaging and strict bans on the use of single-use plastics are expected to drive industry growth.

The business is expected to increase steadily due to the expanding food and beverage industry, which increasingly uses packaging made from biodegradable and recyclable materials. Single-use plastic straws, lids, closures, caps, cups, and food trays are being replaced by products made of paper or compostable alternatives in the food service industry. Product demand in the food service industry will continue to rise as consumer preferences shift towards convenience and packaged foods.

However, the healthcare packaging market has experienced huge hurdles surrounding sustainable packaging, which increased post-COVID-19. This is due to the numerous constraint’s businesses experience during packaging product manufacturing.

The sustainable packaging market is segmented on material, function, process, layer, application, and region. Based on material, the market is segmented into paper & paperboard, plastic, metal, and glass. The function segment includes active packaging, molded pulp packaging, and alternate fiber packaging. By process, the market is segmented into recycled content packaging, reusable packaging, and degradable packaging. The layer segment includes primary, secondary, and tertiary. By application, the market is categorized into food & beverage packaging, healthcare packaging, personal care packaging, and others (electronic appliances and home care packaging).

The reusable packaging category will hold a considerable share of the global sustainable packaging market in 2024. Plastics are also incredibly cost-effective, which has made them a popular material choice, particularly in emerging economies where product pricing is a significant consideration. Due to the increasing popularity of flexible pouches in many end-use sectors, the plastics segment is predicted to rise rapidly throughout the forecast period.

The food & beverage packaging segment is projected to grow rapidly in the global sustainable packaging market. Several restaurants, quick food chains, packaged food firms, and informal dining venues are embracing molded pulp and compostable packaging, which is expected to drive the food and beverages industry. Plastic pouches and bags are expected to remain a popular form of packaging during the forecast period due to their ability to retain the freshness of food goods and extend product shelf life.

Europe's sustainable packaging market is expected to register the highest market share in revenue in the near future. This can be attributed to the strict laws set by the European Union and other European countries concerning single-use plastics. The European Directive created the concept of a circular economy, along with sustainability principles and goals.

Companies in Europe have begun to follow the circular economy roadmap by embracing recyclable, recycled, and biodegradable products. Asia Pacific placed second in terms of value, as the area sees an increase in government legislation and programs encouraging firms to use green packaging. China, the world's giant industrial powerhouse, is modifying its packaging habits and materials to be more environmentally friendly. Because of the massive number of products exported out of China, this decision will have a significant impact on regional market growth.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 392.33 Bn |

| Revenue forecast in 2034 | USD 833.31 Bn |

| Growth rate CAGR | CAGR of 7.9% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume (Tons), and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Packaging Type, Printing Technology, Embellishing Type, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Amcor Limited, Bemis Company, Inc., Tetra Laval International S.A., Mondi Plc., Westrock Company, BASF SE, Sonoco Products Company, Smurfit Kappa Group Plc., Sealed Air Corporation, and Huhtamaki OYJ. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Sustainable Packaging Market By Material-

Sustainable Packaging Market By Layer-

Sustainable Packaging Market By Process

Sustainable Packaging Market By Function

Sustainable Packaging Market By Application

Sustainable Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.