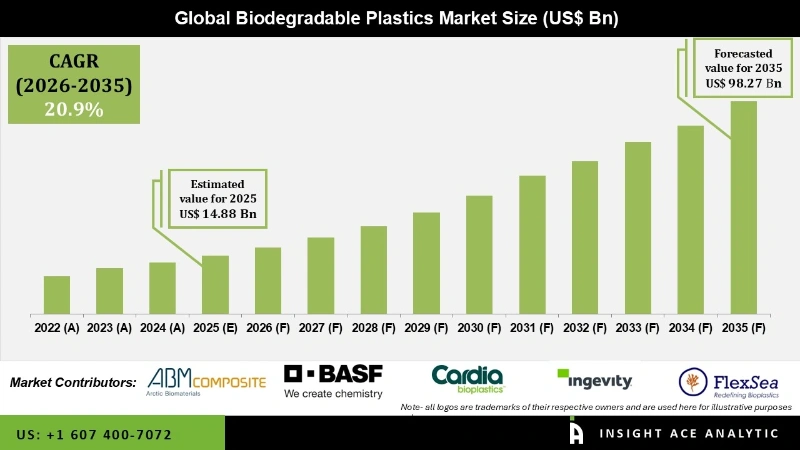

Global Biodegradable Plastics Market Size is valued at USD 14.88 Billion in 2025 and is predicted to reach USD 98.27 Billion by the year 2035 at a 20.9% CAGR during the forecast period for 2026 to 2035.

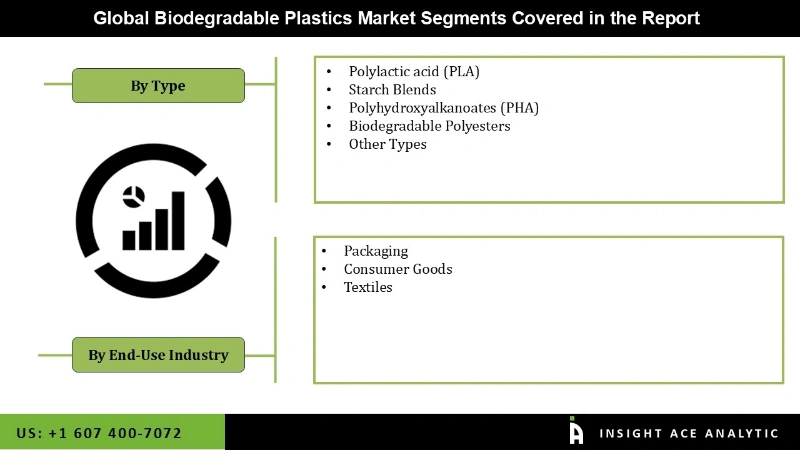

Biodegradable Plastics Market Size, Share & Trends Analysis Report By Types (Polylactic Acid (PLA), Starch Blends, Polyhydroxyalkanoates (PHA), Biodegradable Polyesters [Polycaprolactone (PCL), Polybutylene Adipate Terephthalate (PBAT), Polybutylene Succinate (PBS)]), By End-user, By Region, And Segment Forecasts, 2026 to 2035.

Biodegradable plastics are a type of plastic material that can break down, decompose, and return to natural elements relatively quickly through the action of biological processes, such as the activities of microorganisms like bacteria, fungi, and other natural environmental factors. Unlike traditional plastics, which can persist in the environment for long tenure without breaking down, biodegradable plastics are designed to degrade more rapidly, reducing their impact on the environment.

Developing waste dumps and landfills has contributed to a severe environmental catastrophe with several detrimental effects on ecosystem flora and animals. The usage of biodegradable plastics is encouraged by rising consumer awareness of the consequences. As a result, the biodegradable plastics market is driven by a shift in customer preference toward utilizing ecologically friendly plastic products. Mulching films and plant pots are made with biopolymers for farming and agriculture. This is one of the primary drivers of market expansion, along with the rising use of agricultural products in the expanding (F&B) industry.

Market competition in the Biodegradable Plastics industry is intense, with various companies vying to lead in sustainable solutions. Established players and startups are innovating to develop high-performance biodegradable materials that meet diverse application needs. Differentiated product offerings, cost-effective production methods, and strategic partnerships are key factors driving competitive advantage.

An increase in biodegradable plastics market revenue is anticipated during the forecast period due to the potential role that biodegradable plastics might play in developing a fully sustainable and circular economy. Compared to traditional plastics, biodegradable plastics have a lower carbon footprint and less intensive resource depletion than those made from fossil fuels. This is because renewable resources are used instead of fossil fuels.

The market is likely to increase due to rising federal programs, such as supporting legislation and subsidies to promote susainable alternatives to plastics made of fossil fuels. Producers of biodegradable plastics can provide their goods at lower prices thanks to the favorable regulations and subsidies provided by governments of various nations.

In December 2022, Futerro announced its plans to construct the first-ever vertically integrated biorefinery in Europe at Normandy, France, for the production and recycling of PLA. The biorefinery aims to include a PLA conversion unit, a lactic acid unit for transforming raw materials sourced from agriculture, and a unit for the molecular recycling of PLA.

The biodegradable plastics market is segmented on the basis of types, end-users, and region. The types segment comprises polylactic acid (PLA), starch blends, polyhydroxyalkanoates (PHA), biodegradable polyesters [polycaprolactone (PCL), polybutylene adipate terephthalate (PBAT), Polybutylene succinate (PBS)], and other types [regenerative cellulose, cellulose derivative]. The PLA segment is anticipated to hold the largest market share during the forecast period due to its several attractive mechanical properties and low cost.

By end-users, the market is divided into packaging [rigid packaging, flexible packaging], consumer goods [electrical appliances, domestic appliances, and others], textiles [medical & healthcare textile, personal care, clothes & other textiles], agriculture & horticulture [tapes & mulch films, and others].

The PLA category is expected to hold the highest share of the global market in 2021 due to its expanding use across various terminal industries, including goods and services and packaging. Significant growth rates and higher PLA manufacturing investments are predicted for this market in the United States and Europe. Because it is made of bio-based ingredients, PLA is marketed as an eco-friendly material. It is less costly and has various attractive mechanical properties compared to other biopolymers. The demand for PLA is rising because it degrades quickly without releasing dangerous chemicals into the ground and water supply. In addition to making transparent and transparent hard plastics for containers, bottles, and durable products, PLA can also be used to make fibers and films for various purposes.

The packaging segment is projected to grow rapidly in the global biodegradable plastics market. The usage of biodegradable polymers in the packaging industry for the manufacturing of water and juice bottles, bakery goods, processed food, dry snacks & sweets, and meat trays is growing as consumer preferences for environment-conscious products shift. In the packaging industry, the need for biodegradable plastic is rising due to strict laws surrounding plastic and plastic products. Both rigid and flexible packaging uses biodegradable polymers. Over 500,000 tons of bioplastics are used in flexible packaging. To create more sustainable packaging solutions and reduce their carbon.

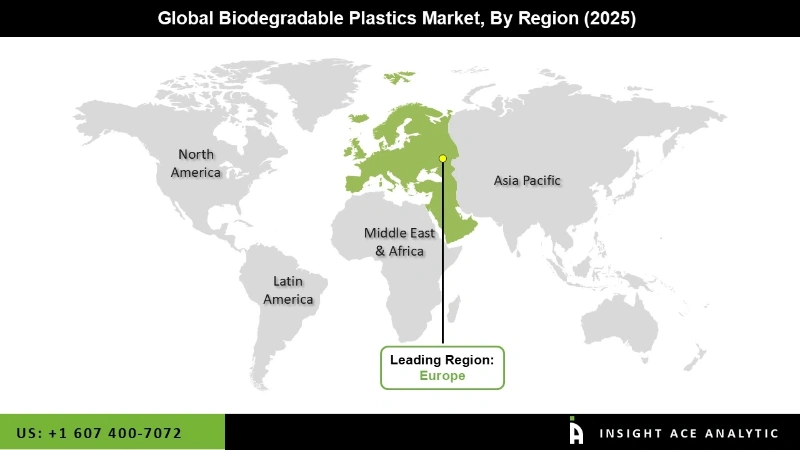

Europe region's biodegradable plastics market is expected to witness the highest market share in revenue soon. The rising use of biodegradable plastics in a broad range of industries, notably food and beverage, personal care, packaging, automotive, and others, can be ascribed to the region's strong environmental focus. The region's chemical sector also makes biodegradable polymers to create environmentally friendly and long-term solutions. The region's target market is expected to increase due to rising demand for bio-based components across sectors and the growing use of biodegradable polymers in manufacturing intermediates chemicals.

In addition, due to escalating environmental concerns, fast industrialization, social programs, and rising financing in numerous industries, Asia Pacific is anticipated to grow quickly in the global biodegradable plastics market. Due to the adoption of health promotion and the resulting pressure on customers to choose fresh products, plant-based food items are becoming increasingly popular in the Asia Pacific area. This should increase the demand for plant-based foods. Due to increased consumer health worries about animal-based protein sources, ethical concerns, and environmental misgivings, plant-based meat products are also anticipated to see a rise in popularity in the upcoming years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 14.88 Billion |

| Revenue forecast in 2035 | USD 98.27 Billion |

| Growth rate CAGR | CAGR of 20.9 % from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Types, End-Users |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF (Germany), NatureWorks (US), Total Corbion (Netherlands), Novamont (Italy), Biome Bioplastics (UK), Mitsubishi, Chemical Holding Corporation (Japan), Toray Industries (Japan), Plantic Technologies (Australia), Danimer Scientific (US), Fkur Kunstsoff (Germany), Amcor limited (Switzerland), Mondi Group (UK), Kruger Inc. (Canada), and others. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biodegradable Plastics Market Based On The Type:

Biodegradable Plastics Market Based On The End-Use Industry:

Biodegradable Plastics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.