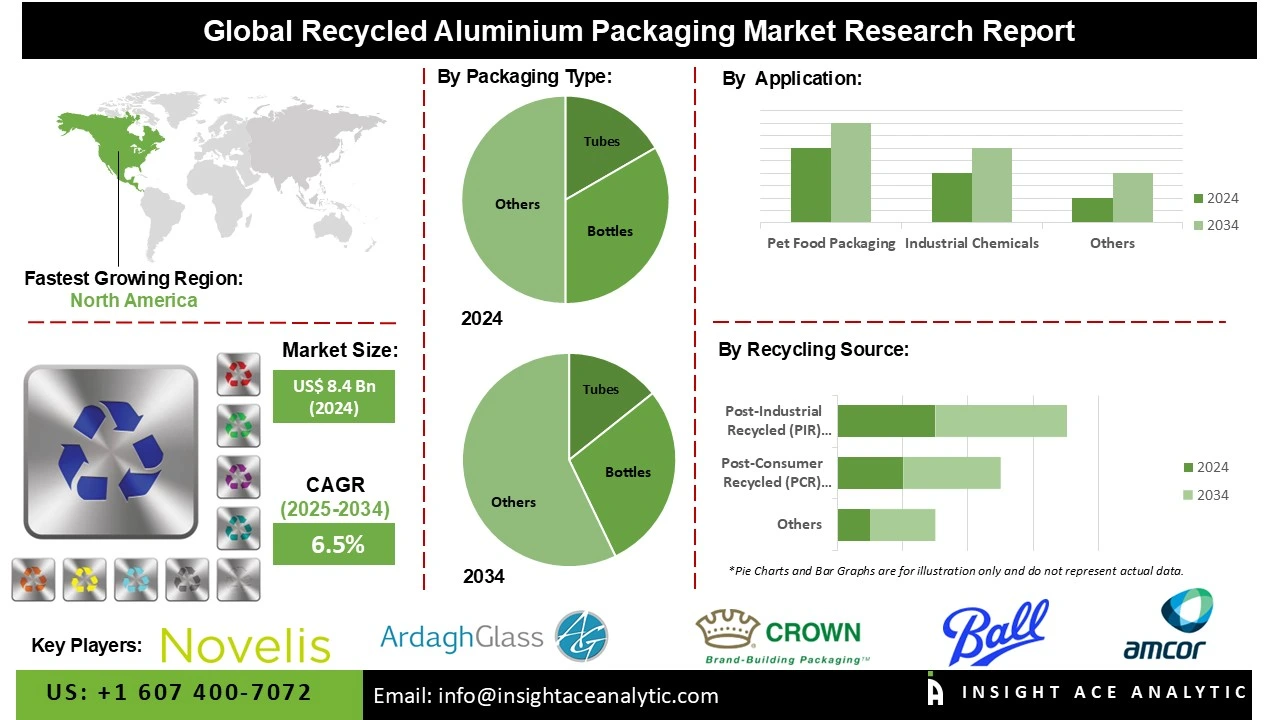

Recycled Aluminum Packaging Market Size is valued at US$ 8.4 Bn in 2024 and is predicted to reach US$ 15.5 Bn by the year 2034 at an 6.5% CAGR during the forecast period for 2025-2034.

The use of secondary, or recycled, aluminum in the production of many kinds of packaging items, including cans, foils, trays, tubes, and bottles, is the main emphasis of the recycled aluminum packaging market. Despite using up to 95% less energy during production, recycled aluminum has almost the same physical and chemical characteristics as primary aluminum. The market for recycled aluminum packaging is expanding and changing significantly due to a number of factors. Due to increased consumer preferences for sustainable packaging options, regulatory challenges, and growing environmental awareness, the industry—which includes a variety of packaging materials such as cans, foils, and containers made from recycled aluminum is experiencing a surge in demand.

Additionally, the market is primarily driven by the growing emphasis on environmental sustainability. Consumers and businesses are looking for alternatives to conventional packaging materials like plastic and virgin aluminum as worries about resource depletion and climate impact grow. Furthermore, the use of recycled aluminum packaging is also being accelerated by regulatory actions aimed at reducing waste and promoting recycling. To encourage the use of recycled materials and discourage single-use packaging, governments around the world are putting laws like extended producer responsibility (EPR) schemes, deposit-return systems, and recycling objectives into place.

Some of the Key Players in Recycled Aluminum Packaging Market:

· Amcor Plc

· Ball Corporation

· Ardagh Group

· Constellium SE

· Novelis Inc. (Hindalco)

· Crown Holdings Inc.

· Alucon Public Company Ltd.

· Reynolds Consumer Products

· Nampak Ltd.

· Montebello Packaging

· Envases Group

· Cosmopak Ltd.

· Hindustan Tin Works Ltd.

· Others

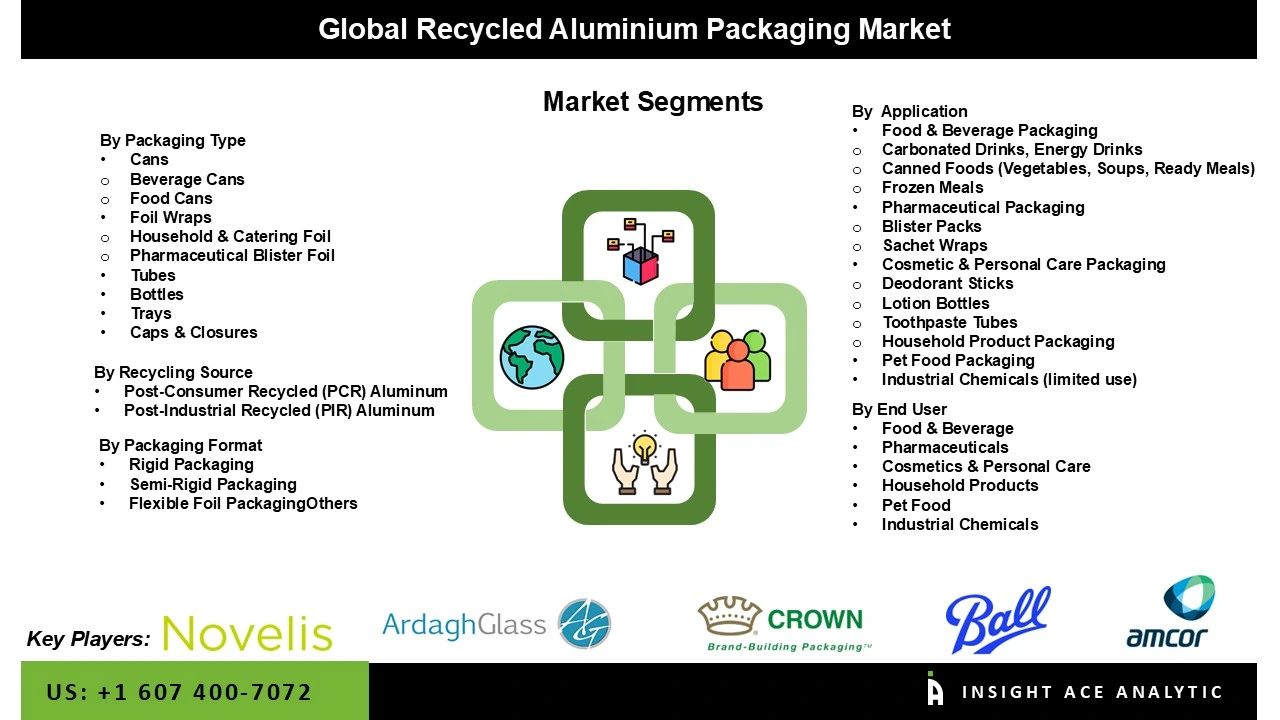

The recycled aluminum packaging market is segmented by packaging type, packaging format, recycling source, application, and end-use. By packaging type, the market is segmented into cans (food cans, beverage cans), tubes, trays, caps & closures, bottles, and foil wraps (household & catering foil, pharmaceutical blister foil). By packaging format, the market is segmented into rigid packaging, semi-rigid packaging, and flexible foil packaging.

By recycling source, the market is segmented into post-consumer recycled (PCR) aluminum and post-industrial recycled (PIR) aluminum. by application, the market is segmented into food & beverage packaging (frozen meals, carbonated drinks, energy drinks, canned foods (vegetables, soups, ready meals)) cosmetic & personal care packaging (deodorant sticks, lotion bottles, household product packaging, toothpaste tubes), pharmaceutical packaging (blister packs, sachet wraps), pet food packaging, and industrial chemicals (limited use). by end-use, the market is segmented into food & beverage, household products, cosmetics & personal care, pharmaceuticals, pet food, and industrial chemicals.

The cans segment led the recycled aluminum packaging market in 2024 because aluminum cans in this category have a unique combination of qualities that make them ideal for a range of beverages, including energy drinks, beer, soft drinks, mineral water, cocktails, and even dairy-based drinks. From the perspective of product quality, their ability to rapidly cool, preserve carbonation, and block light and oxygen makes them ideal for various designs. But in today's sustainability-driven society, their environmental advantages are what make them unique. Aluminum may be processed indefinitely without any restrictions or quality deterioration because it is 100% recyclable. These cans are aesthetically pleasing, long-lasting, and convenient for consumers.

The recycled aluminum packaging market in 2024 was led by the food & beverage segment. Because of its many uses, recycled aluminum is frequently used in food packaging. Its ability to act as an efficient barrier, shielding food from light and air while monitoring its quality, is one of its key advantages. Additionally, aluminum packaging is easily recyclable and can be customized to fit specific customer requirements regarding size and pattern. Aluminum is the ideal material for food packaging in a variety of contexts because of these factors. The use of aluminum in food and beverage packaging has several other benefits.

In 2024, the North American region led the market for recycled aluminum packaging due to its strong recycling infrastructure, favorable laws, and high consumer demand for environmentally friendly products. The United States and Canada contribute significantly to the market volume. Strong demand from the food and beverage industries and high recycling rates are two crucial elements. Additionally, the US government's focus on corporate sustainability goals and environmental programs spurs business innovation and expansion. Due to consumer demand for eco-friendly packaging choices, the market for recycled aluminum packaging is expanding and increasing.

The recycled aluminum packaging market in Asia Pacific is expected to grow at the quickest rate during the projected period. The packaging sector is expanding quickly in this area, and aluminum packaging is no exception. It significantly affects the packaging of pharmaceuticals and food items. Changes in aluminum packaging have a direct impact on the packaging sector. But China is the world's largest consumer of aluminum. As a result, the potential for aluminum manufacture has grown dramatically due to regulatory demands and initiatives to lower emissions. A great opportunity to start an aluminum recycling business in India is highlighted by this action.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 8.4 Bn |

| Revenue Forecast In 2034 | USD 15.5 Bn |

| Growth Rate CAGR | CAGR of 6.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Packaging Type, By Packaging Format, By Recycling Source, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Amcor Plc, Ball Corporation, Ardagh Group, Constellium SE, Novelis Inc. (Hindalco), Crown Holdings Inc., Alucon Public Company Ltd., Reynolds Consumer Products, Nampak Ltd., Montebello Packaging, Envases Group, Cosmopak Ltd., and Hindustan Tin Works Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Recycled Aluminum Packaging Market by Packaging Type

· Cans

o Food Cans

o Beverage Cans

· Tubes

· Trays

· Caps & Closures

· Bottles

· Foil Wraps

o Household & Catering Foil

o Pharmaceutical Blister Foil

Recycled Aluminum Packaging Market by Packaging Format

· Rigid Packaging

· Semi-Rigid Packaging

· Flexible Foil Packaging

Recycled Aluminum Packaging Market by Recycling Source

· Post-Consumer Recycled (PCR) Aluminum

· Post-Industrial Recycled (PIR) Aluminum

Recycled Aluminum Packaging Market by Application

· Food & Beverage Packaging

o Frozen Meals

o Carbonated Drinks, Energy Drinks

o Canned Foods (Vegetables, Soups, Ready Meals)

· Cosmetic & Personal Care Packaging

o Deodorant Sticks

o Lotion Bottles

o Household Product Packaging

o Toothpaste Tubes

· Pharmaceutical Packaging

o Blister Packs

o Sachet Wraps

· Pet Food Packaging

· Industrial Chemicals (limited use)

Recycled Aluminum Packaging Market by End-use

· Food & Beverage

· Household Products

· Cosmetics & Personal Care

· Pharmaceuticals

· Pet Food

· Industrial Chemicals

Recycled Aluminum Packaging Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.