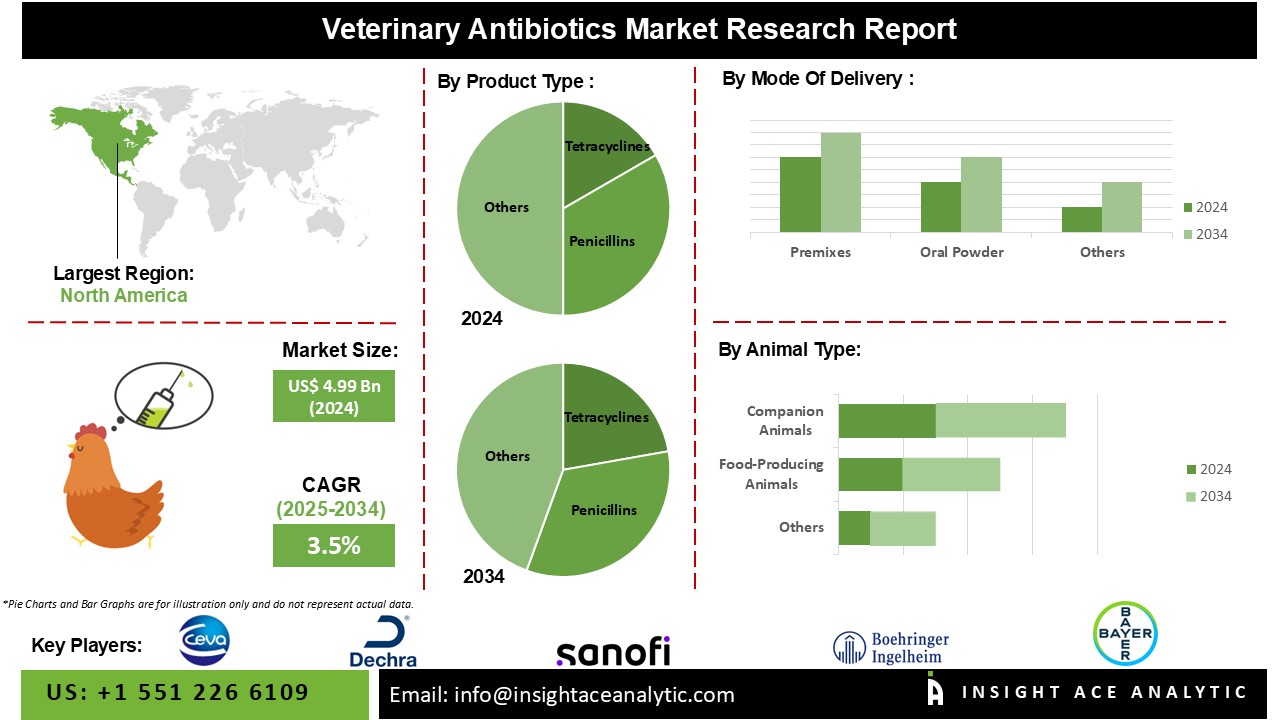

Veterinary Antibiotics Market Size is valued at USD 4.99 Billion in 2024 and is predicted to reach USD 6.95 Billion by the year 2034 at a 3.5 % CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Antibiotics can be used to treat a single animal with clinical disease or a large group of animals. In many countries, antibiotics are commonly added to commercial feed for growth promotion in chickens. Antibiotics have effectively improved the rate and efficiency of gain in swine, cattle, and poultry. The different applications of antibiotics in food animals have been described as therapeutic use, prophylactic use, and subtherapeutic use. The global Veterinary antibiotics market is driven by end-use verticals consisting of dairy, meat industry applications. The increasing consumer preference for various dairy products and the rise in companion animal ownership is expected to increase the demand. Increasing animal disease outbreaks and increasing initiatives concerning animal health and welfare is anticipated to further strengthen its demand over the forecast period.

The Global Veterinary Antibiotics market is categorized on the basis of Product Type, Mode Of Delivery, Animal Type, and region. On the basis of Product Type, the market is segmented into Tetracyclines, Penicillins, Sulfonamides, Macrolides, Aminoglycosides, Lincosamides, Fluoroquinolones, Other Antimicrobials and Antibiotics. Based on Mode of delivery, the market is segmented into Premixes, Oral Powder, Oral Solution, Injection, and Others. Whereas Animal type segment includes Food-Producing Animals (Cattle, Pigs, Poultry, Sheep and Goats, Other Food-producing Animals) and Companion Animals (Dogs, Cats, Horses, Other Companion Animals). Based on region, the market is studied across North America, Asia-Pacific, Europe, and LAMEA. On the other hand, North America is expected to dominate the market during the analysis of the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 4.99 Billion |

| Revenue Forecast In 2034 | USD 6.95 Billion |

| Growth Rate CAGR | CAGR of 3.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Mode Of Delivery, By Animal Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Bayer AG, Boehringer Ingelheim GmbH, Ceva Sante Animale S.A., Crystal Pharma, Dechra Pharmaceuticals PLC, Huvepharma AD, Eli Lilly Company, Elanco, Merck & Co., Inc., Sanofi S.A., Vetoquinol S.A., Virbac, Zoetis, Inc., Inovet Group, Dopharma, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Veterinary Antibiotics Market by Product Type

Global Veterinary Antibiotics Market by Mode of Delivery

Global Veterinary Antibiotics Market by Animal Type

Global Veterinary Antibiotics Market Based on Region

Europe

North America

Asia Pacific

Latin America

Middle East & Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.