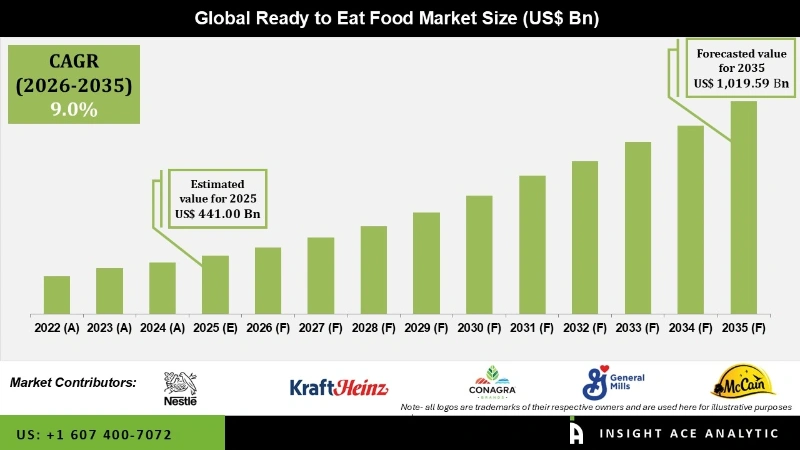

Global Ready To Eat Food Market Size is valued at USD 441 Billion in 2025 and is predicted to reach USD 1,019.59 Billion by the year 2035 at a 9.0% CAGR during the forecast period for 2026 to 2035.

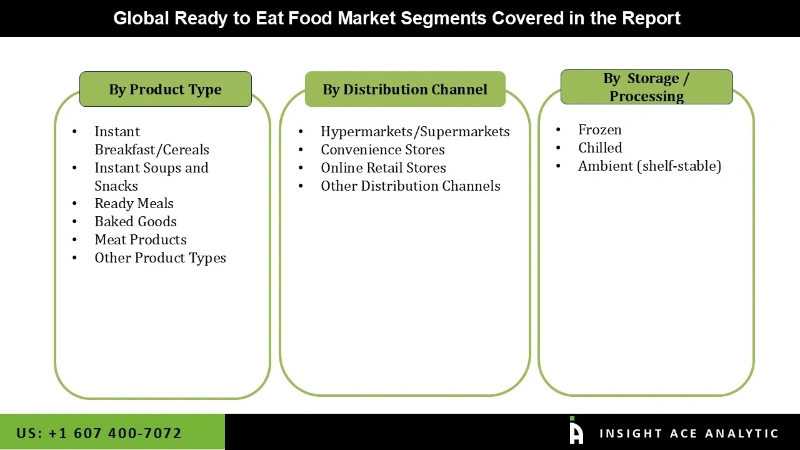

Ready To Eat Food Market Size, Share & Trends Analysis Report by Product Type (Instant Breakfast/Cereals, Instant Soups and Snacks, Ready Meals, Baked Goods, Meat Products, and Other Product Types); Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores), By Storage, Region And Segment Forecasts, 2026 to 2035.

Food ready-to-eat is growing increasingly popular in industrialized nations, where consumption is higher than in poor nations. A gradual departure from the conventional paradigm of daily cooking has been brought about by the rise in the number of workers in developing nations like China and India, as well as the tendency toward longer and more erratic workweeks which drives market growth. Furthermore, strong demand for frozen ready-to-eat food results from rising convenience trends and a corresponding surge in demand for certain meal options. Since it provides everything from frozen desserts to appetizers and meals, the food and beverage business is seen as a one-stop shop for consumers on the go.

Moreover, young people and Millennials are the easiest demographics to sell to with ready-to-eat food. Additionally, new apps that make it easier for customers to choose their favorite products and online grocery shopping are two of the most current advancements in the sector which accelerate the market growth.

· Nestlé

· Kraft Heinz

· Conagra Brands

· General Mills

· McCain Foods

· Unilever

· Mars Inc.

· Tyson Foods

· Barilla

· Nomad Foods

· Dr. Oetker

· Ajinomoto Co.

· Nissin Foods Holdings

· ITC Limited

· Orkla ASA

· Premier Foods

· Bakkavor Foods

· Greencore Group

· Haldiram’s

· MTR Foods

The ready to eat food market is based on product and distributional channels. Based on product, the ready to eat food market is segmented as instant breakfast/cereals, meat products, instant soups and snacks, ready meals, baked goods, and other product types. The market is segmented by application into hypermarkets/supermarkets, convenience stores, online retail stores, and other distribution channels.

The baked goods category will hold a major share of the global Ready to Eat Food market in 2022. A crucial segment of the ready-to-eat food market is baked goods. These products cover a wide range of foods such as bread, pastries, cakes, cookies, and muffins that don't require any additional baking or preparation and are fully cooked and ready for eating. Because they are readily available and convenient, baked foods are well-liked in the ready-to-eat food market. These goods are readily available from supermarkets, bakeries, or internet retailers, and consumers can consume them immediately without further baking or cooking.

The online category is projected to grow rapidly in the global market. The overall demand for brands of pre-packaged meals has increased via Internet channels. Online delivery is a key factor in the industry's growth and is offered by major supermarkets and hypermarkets, including Walmart, Target, and Aldi. Many supermarkets have started offering the same packed meal brands independently or in collaboration with cloud kitchens.

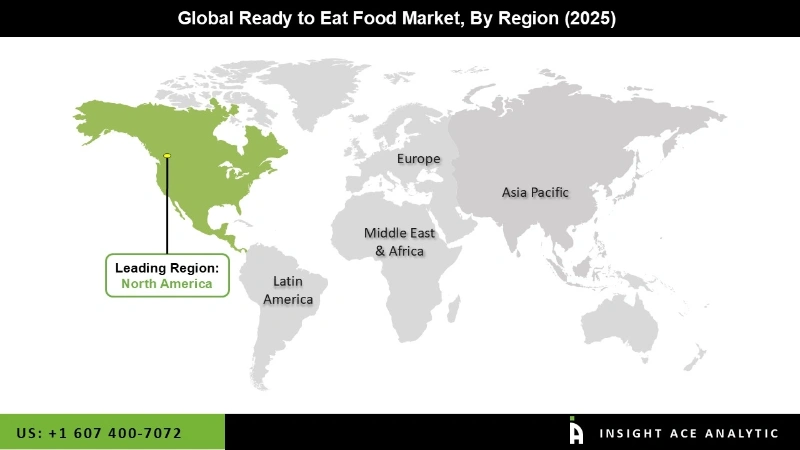

The North American region ready to eat food market is projected to register a tremendous market share in revenue shortly. The region's product demand is driven by customers' changing food tastes due to rising health consciousness and worries about food safety. Additionally, pre-packaged vegan, gluten-free, and organic foods are valuable for consumer trust and perceptions of healthfulness.

The popularity of ready-to-eat meals is rising due to their mobility, convenience, and accessibility to new options. In addition, the Asia Pacific region is anticipated to develop rapidly in the global ready to eat food because of the expanding target population in the area. Additionally, rising consumer disposable income and increased knowledge of ready-meal items foster industry expansion. Furthermore, the demand for pre-packaged meals will benefit from rising living standards and quick industrialization in developing nations like India.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 441 Billion |

| Revenue Forecast In 2035 | USD 1,019.59 Billion |

| Growth Rate CAGR | CAGR of 9.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product And Distributional Channels |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Nomad Foods Ltd General Mills, Inc., McCain Foods Limited, Nestlé S.A., Premier Foods Group Limited, Conagra Brands, Inc., Amy's Kitchen, Dr. August Oetker Nahrungsmittel KG, Campbell Soup Company and The Kraft Heinz Company. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Ready to Eat Food Market By Product Type

Ready to Eat Food Market By Distribution Channel

Ready to Eat Food Market By Storage / Processing

· Frozen

· Chilled

· Ambient (shelf-stable)

Ready to Eat Food Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.