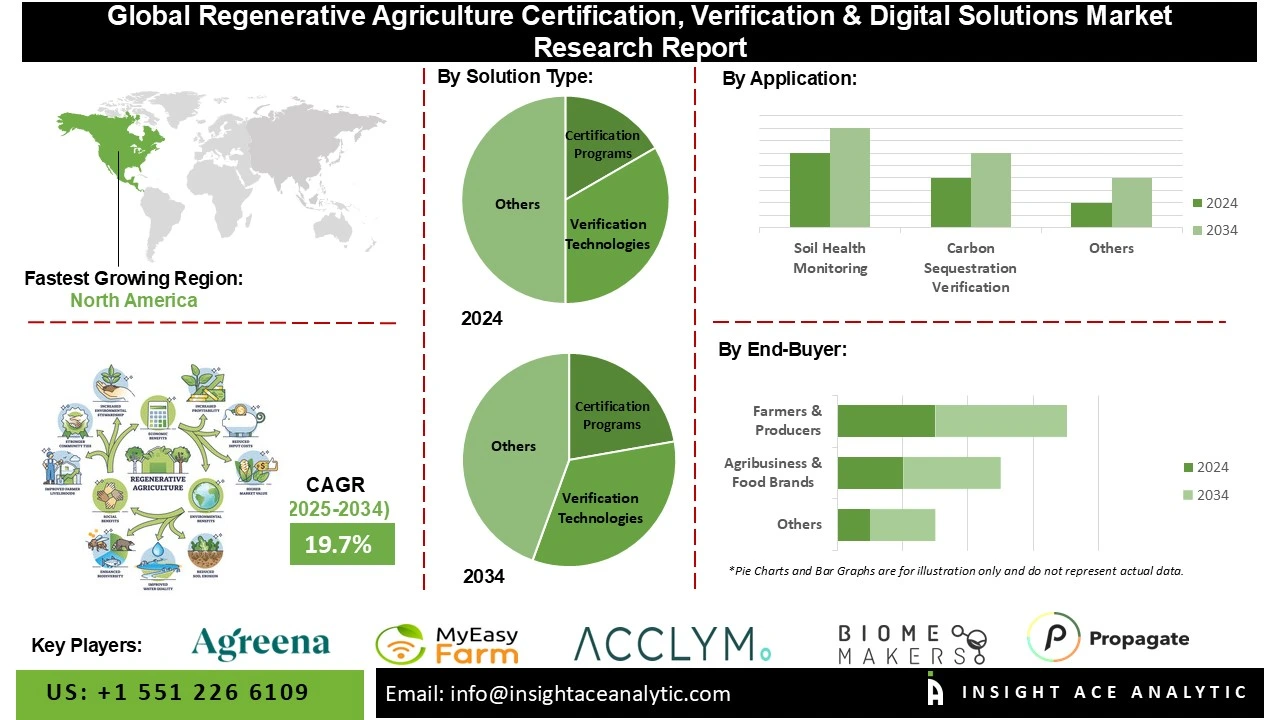

The Regenerative Agriculture Certification, Verification & Digital Solutions Market Size is predicted to grow at a 19.7 % CAGR during the forecast period for 2025 to 2034.

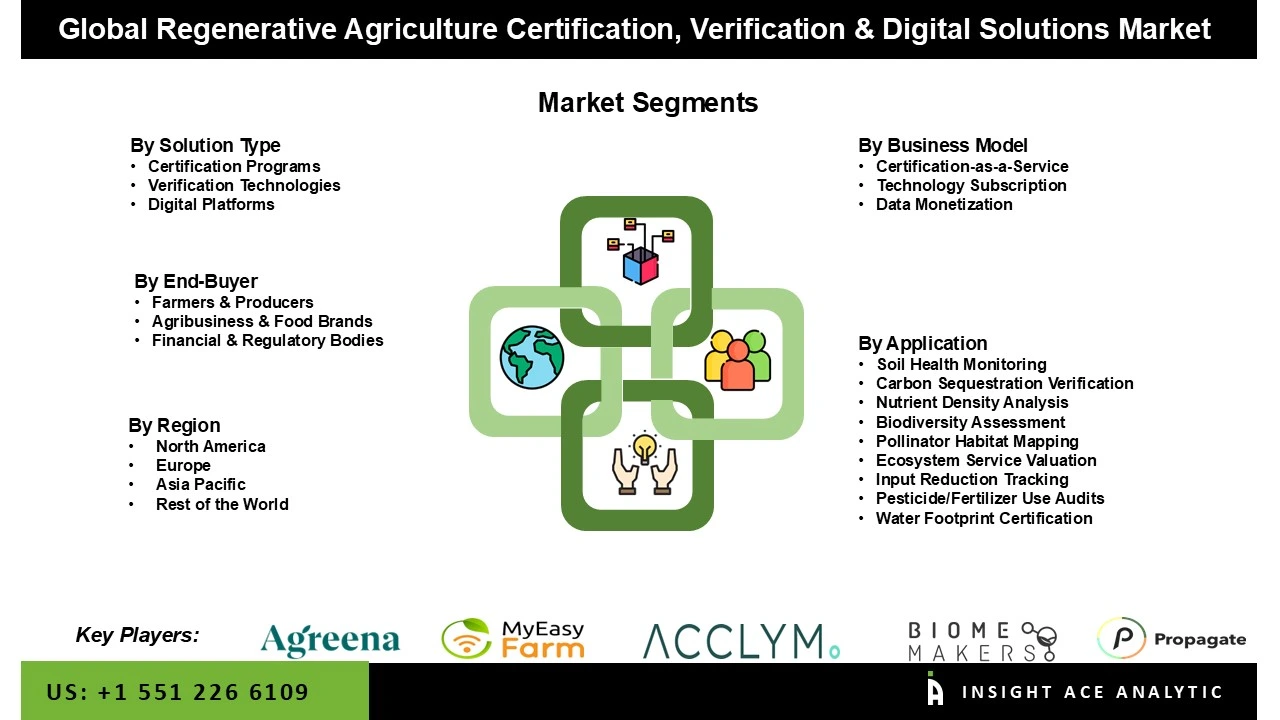

Regenerative Agriculture Certification, Verification & Digital Solutions Market, Share & Trends Analysis Report, By Solution Type (Certification Programs, Verification Technologies, Digital Platforms), By End-Buyer (Farmers & Producers, Agribusiness & Food Brands, Financial & Regulatory Bodies), By Application, By Business Model, By Region, and Segment Forecasts, 2025 to 2034.

“Regenerative Agriculture Certification, Verification, and Digital Solutions” encompass structured frameworks, standardized guidelines, and technology-driven tools designed to validate and promote farming practices that enhance soil health, biodiversity, and water quality. These systems aim to strengthen ecosystem resilience, support farmer livelihoods, and contribute to climate change mitigation by ensuring transparency, accountability, and measurable outcomes in sustainable agriculture. Certifications for regenerative agriculture are official seals or labels attesting to a farm's or product's adherence to particular regenerative methods. These certificates seek to reward farmers for sustainable practices, stop greenwashing, and provide customers transparency. Certifications in regenerative farming are official initiatives created to teach and certify individuals or organizations in the concepts and methods of regenerative agriculture.

The holistic farming methods that emphasize soil health, water conservation, carbon sequestration, and biodiversity enhancement are the main focus of these certifications. Regenerative farming certificates, in contrast to conventional farming certifications, place an emphasis on how ecosystems are interconnected and how agriculture contributes to the restoration of ecological equilibrium.

Regenerative agriculture certification, verification, and digital solutions are gaining strong momentum as farming systems shift toward climate-positive and resilient models. Current innovations include blockchain and distributed ledger technologies that ensure product traceability from farm to shelf, digital platforms that automate certification processes, and satellite, drone, and IoT-based soil and crop monitoring systems. These technologies reduce reliance on costly, manual inspections and create transparent data flows that verify regenerative outcomes such as improved soil organic carbon, water retention, biodiversity protection, and reduced chemical use. Rising consumer demand for sustainable and ethically produced food, brand-level commitments to carbon neutrality and regenerative sourcing, and government policies offering incentives or subsidies for climate-smart agriculture is expected to drive the market growth.

Some of the Major Key Players in the Regenerative Agriculture Certification, Verification & Digital Solutions Market are :

The regenerative agriculture certification, verification & digital solutions market is segmented into solution type, end-buyer, application, business model. Based on the solution type, the market is segmented into certification programs, verification technologies, digital platforms. Based on the end-buyer, the market is divided into farmers & producers, agribusiness & food brands, financial & regulatory bodies. Based on the Application, the market is divided into soil health monitoring, carbon sequestration verification, nutrient density analysis, biodiversity assessment, pollinator habitat mapping, ecosystem service valuation, input reduction tracking, pesticide/fertilizer use audits, water footprint certification. Based on the business model, the market is divided into certification-as-a-service, technology subscription, data monetization.

A growing number of farmers and producers are using certifications like Regenified, Land to Market, and Regenerative Organic Certified (ROC) to differentiate themselves in a crowded market. By showcasing their dedication to biodiversity, soil health, and climate resilience, these labels allow them to access premium pricing. Many uses outcome-based criteria, such as Land to Market's Ecological Outcome Verification (EOV) procedure, which assesses observable gains in biodiversity, ecosystem resilience, and soil health, to support these assertions. Third-party verification services are in high demand since this procedure necessitates baseline evaluations and ongoing monitoring. The farmers and producers segment drives the regenerative agriculture certification, verification, and digital solutions market by adopting certifications to access premium markets, engaging in verification processes to validate practices, and leveraging digital tools for transparency and efficiency. Their engagement generates demand for trustworthy standards, fosters innovation in verification methods, and incorporates regenerative practices into global supply chains.

Soil health monitoring supports scalable regenerative techniques by providing data for continual improvement. Programs like the Soil & Climate Initiative (SCI) use soil parameters to support farmers across production systems, boosting market growth. The lack of a universal soil health parameter spurs innovation in monitoring instruments adapted to regional soils, as evidenced in Ethos™’s farmer-co-created techniques, further increasing the digital solutions market. The soil health monitoring segment drives the regenerative agriculture market by providing critical data for certifications (e.g., ROC, Regenified), supporting outcome-based verification (e.g., EOV), and integrating with digital platforms (e.g., Regenagri Digital Hub) for transparency and scalability. It fuels farmer adoption, meets consumer and brand desires, and supports economic and environmental benefits, despite barriers like cost and standardization.

The market for regenerative agriculture certification, verification, and digital solutions is dominated by North America, primarily due to aggressive corporate and farmer participation, favorable government regulations, sophisticated agricultural technology, and high consumer demand for sustainable products. In order to facilitate soil health monitoring and carbon sequestration verification, the region has led the way in using precision agriculture technologies including IoT sensors, satellite images, and AI-driven analytics. These technologies are used by digital platforms such as EthosTM and Regenagri's Digital Hub to provide real-time data that enhances the transparency and credibility of certification. Furthermore, developments like BeZero Carbon's 2024 regenerative agricultural credit scoring system, which uses blockchain technology to guarantee transparent carbon tracking, are expanding digital solutions throughout the United States and Canada and securing North America's market leadership.

Global Regenerative Agriculture Certification, Verification & Digital Solutions Market- By Solution Type

· Certification Programs

o Tiered Certification

o Crop-Specific Standards

o Region-Specific Frameworks

· Verification Technologies

o Remote Sensing

o IoT & Ground Sensors

o Blockchain Traceability

o AI-Powered MRV

· Digital Platforms

o Farm Management SaaS

o Carbon Credit Marketplaces

o Supply Chain Transparency Tools

Global Regenerative Agriculture Certification, Verification & Digital Solutions Market – By End-Buyer

· Farmers & Producers

o Smallholders

o Large-Scale Commercial Farms

· Agribusiness & Food Brands

o CPG Manufacturers (e.g., Unilever, Nestlé)

o Raw Material Sourcing Divisions

· Financial & Regulatory Bodies

o Carbon Offset Buyers

o Government Agricultural Agencies

o ESG Investors

Global Regenerative Agriculture Certification, Verification & Digital Solutions Market – By Application

· Soil Health Monitoring

· Carbon Sequestration Verification

· Nutrient Density Analysis

· Biodiversity Assessment

· Pollinator Habitat Mapping

· Ecosystem Service Valuation

· Input Reduction Tracking

· Pesticide/Fertilizer Use Audits

· Water Footprint Certification

Global Regenerative Agriculture Certification, Verification & Digital Solutions Market- By Business Model

· Certification-as-a-Service

o Audit Fees

o License Fees (e.g., use of certification logo)

· Technology Subscription

o SaaS Platforms (Per-acre/user fees)

o Pay-Per-Verification

· Data Monetization

o Anonymized Farm Data Aggregation

o Carbon Credit Brokerage Fees

Global Regenerative Agriculture Certification, Verification & Digital Solutions Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.