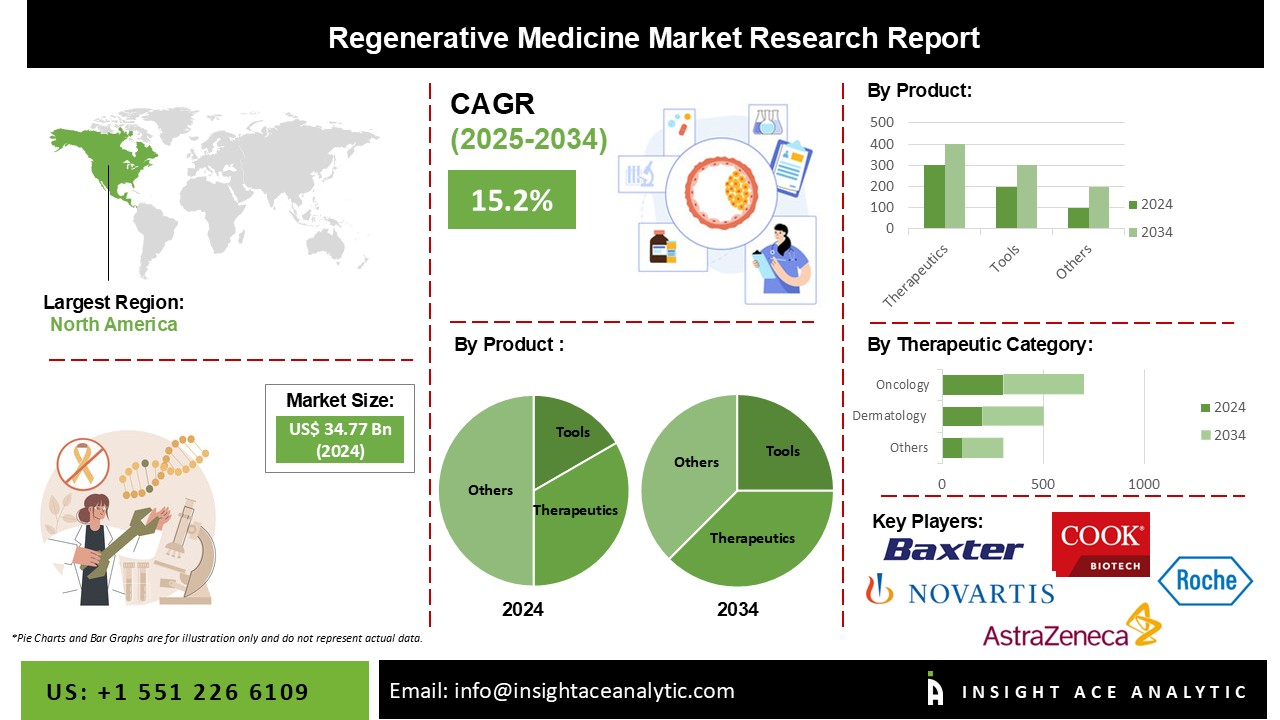

Global Regenerative Medicine Market Size is valued at USD 34.77 billion in 2024 and is predicted to reach USD 141.87 billion by the year 2034 at a 15.2% CAGR during the forecast period for 2025 to 2034.

Regenerative Medicine Market Size, Share & Trends Analysis Report By Product (Therapeutics, Primary cell-based therapeutics, Stem Cell & Progenitor Cell-based therapeutics), By Therapeutic Category (Dermatology, Musculoskeletal, Immunology & Inflammation, and Oncology), By Region, And Segment Forecasts, 2025 to 2034

The preference for individualized therapeutic approaches over conventional treatment modalities has changed due to several developments in biological therapy. For those in the market working on creating natural treatments, this has opened up a lot of prospects. Numerous developments in biological therapeutics have shifted the preference towards personalized medicinal strategies over traditional treatment methods, resulting in the Regenerative Medicine market expansion.

The COVID-19 pandemic has significantly influenced several businesses, notably the T-cell therapies and regenerative medicine industry. The SARS-CoV-2 coronavirus outbreak has dramatically impacted the delivery of CAR T-cell therapy. This effect has spread beyond patient care to include administration, logistics, and the scarcity of healthcare resources. Clinical trial enrolment and other research activity have slowed down at some universities. Yet, as market participants like Novartis continue to open up access to treatments like MultiStem, a very relevant COVID-19 medication from Athersys, Inc., the market continues to grow.

The Regenerative Medicine market is segmented based on product and therapeutic category. Based on product, the market is segmented as Therapeutics, Primary cell-based therapeutics, Stem Cell & Progenitor Cell-based therapeutics. By therapeutics category, the market is segmented into Dermatology, Musculoskeletal, Immunology & Inflammation, and Oncology.

Due to the growing elderly population and more excellent incidence rates of age-related and degenerative illnesses, the therapeutics category held the most significant revenue share of the regenerative medicine market. Researchers have been inspired to create alternative solutions by the rising prevalence of diseases for which there are no effective treatments, including cancer, diabetes, and neurodegenerative illnesses like AMD. For instance, Kite, a Gilead Company, declared in April 2022 that the U.S. FDA had approved Yescarta, a CAR T-cell therapy product, for treating refractory or relapsed large B-cell lymphoma.

Due to the rising incidence of cancer worldwide, the oncology segment led the market for regenerative medicine. Numerous governmental agencies and private businesses have invested much in cancer research and the creation of cutting-edge cell therapies. A partnership agreement between Calidi Biotherapeutics (CBT) and First Light Acquisition Group (FLAG) was signed in January 2023 with the intention of using stem cell-based platforms to revolutionize oncolytic virotherapies.

North America controlled the market for regenerative medicine. The significant regenerative medicine market growth is attributable to the availability of public and private development financing, the existence of cutting-edge technological frameworks to assist the quick detection of chronic diseases, and the high healthcare spending in the area. In addition, the region has grown as a result of numerous ongoing clinical trials for regenerative medicine by important industry players. To prevent acute graft versus host disease in adults and paediatric patients two years of age and older undergoing hematopoietic stem cell transplantation, Bristol Myers Squibb acquired U.S. FDA approval for Orencia in December 2021. (HSCT).

| Report Attribute | Specifications |

| Market size value in 2023 | USD 34.77 Bn |

| Revenue forecast in 2031 | USD 141.87 Bn |

| Growth rate CAGR | CAGR of 15.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product And Therapeutic Category |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK); Baxter International, Inc.; Boehringer Ingelheim; Amgen, Inc.; Cesca Therapeutics, Inc.; U.S. Stem Cell, Inc.; Bristol-Myers Squibb; Eli Lilly and Company; NuVasive, Inc.; Organogenesis, Inc.; MiMedx Group, Inc.; Takara Bio, Inc.; Osiris Therapeutics, Inc.; Corline Biomedical AB. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Regenerative Medicine Market By Product-

Regenerative Medicine Market By Therapeutic Category-

Regenerative Medicine Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.