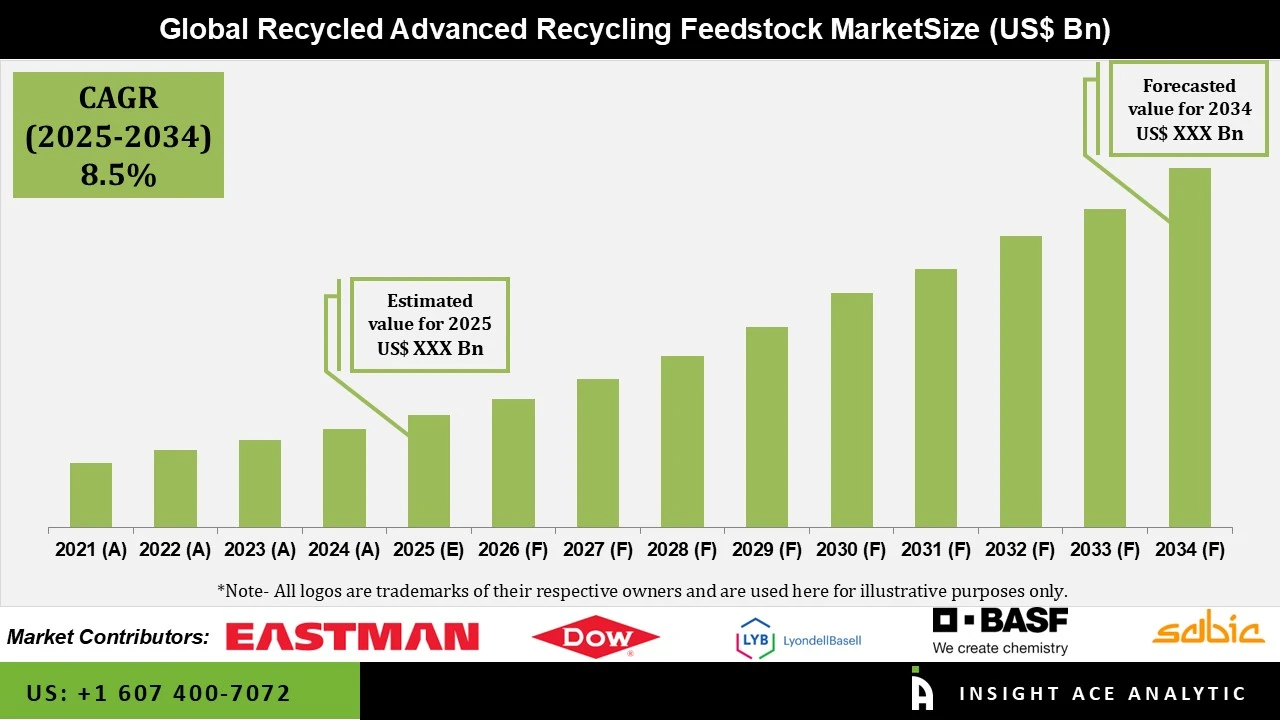

Global Recycled Advanced Recycling Feedstock Market Size is predicted to grow at a 8.5% CAGR during the forecast period for 2025-2034.

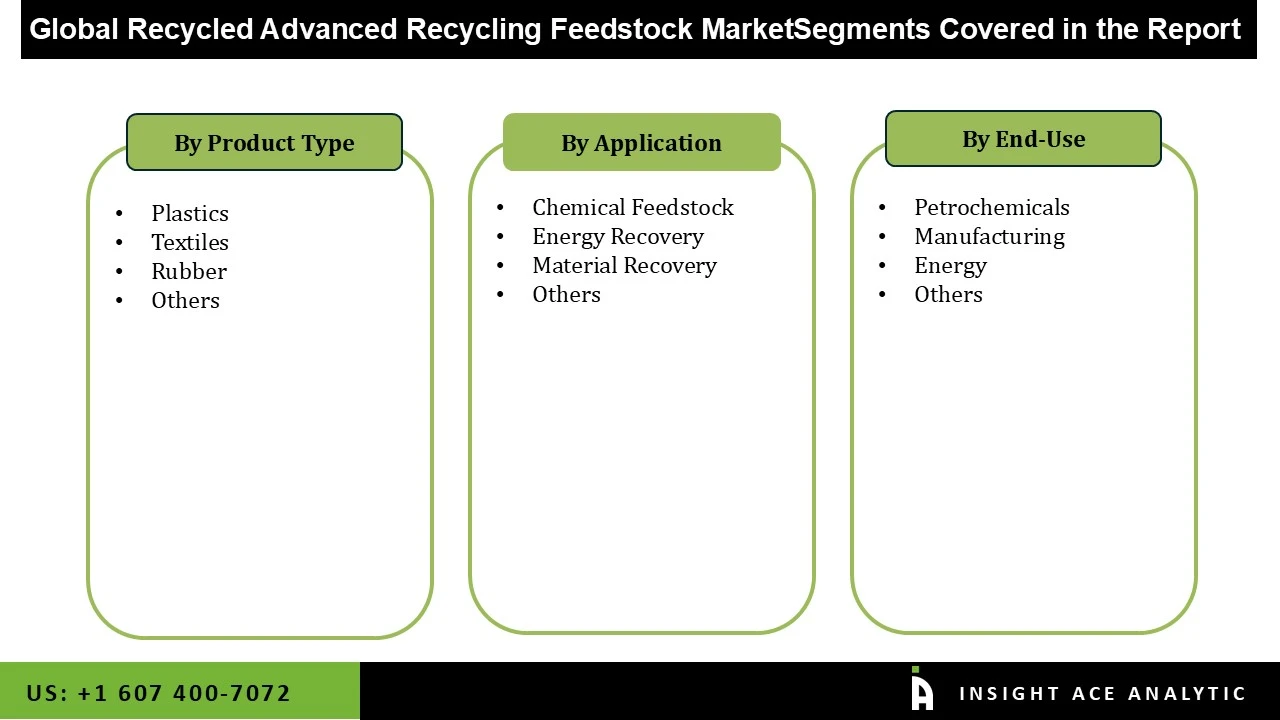

Recycled Advanced Recycling Feedstock Market Size, Share & Trends Analysis Distribution by Type (Textiles, Rubber, Plastics, and Others), Application (Energy Recovery, Chemical Feedstock, Material Recovery, and Others), End-use (Manufacturing, Petrochemicals, Energy, and Others), and Segment Forecasts, 2025 to 2034

Recycled advanced recycling feedstock is plastic waste that has been reduced to its most basic chemical components through advanced recycling techniques such as gasification, pyrolysis, or depolymerization. Advanced recycling transforms challenging-to-recycle materials (such as mixed, contaminated, or multilayer plastics) into high-quality feedstock that can be used to produce new, virgin-grade plastics or chemicals, unlike conventional mechanical recycling, which only melts and remolds polymers. By reducing reliance on fossil-based raw materials, reducing environmental impact, and allowing industry to repurpose plastics that would otherwise wind up in landfills or be incinerated, this feedstock helps close the loop in the circular economy. The primary driver of the recycled advanced recycling feedstock market’s strong expansion is the growing emphasis on sustainability and circular-economy projects around the world, which has forced governments and businesses to seek creative ways to reduce packaging waste and use resources more effectively.

The Environmental Protection Agency (EPA) and other organizations have implemented strict environmental regulations, such as the Restriction of Hazardous Substances (RoHS) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), which are expected to increase demand for recycled advanced recycling feedstock technologies. Additionally, the need for sophisticated recycling technology is being driven by mechanical recycling restrictions, such as weakening fiber, difficulties in recovering mixed plastic waste, and the prohibition on being used in various industries. Moreover, growing investments from packaging companies and a global emphasis on circular-economy models are additional factors supporting the growth of the recycled advanced recycling feedstock market. The recycled advanced recycling feedstock is emerging as a key component of global sustainable packaging projects as both the public and private sectors intensify efforts to lower landfill waste and carbon footprints.

In addition, secondary feedstocks are becoming increasingly competitive alternatives to petrochemical feedstocks due to technological advancements in chemical and thermochemical processes (pyrolysis, depolymerization, and upgrading). Additionally, growing investor and corporate commitments, along with increasing capital flows into advanced recycling projects, are funding supply-chain integration and scale-up, further accelerating the expansion of the recycled advanced recycling feedstock market. The costs and commercial uptake of pyrolysis oils and recycled intermediates are also supported by increased demand for alternative feedstocks for fuels, industrial heating, and petrochemicals. However, for small and medium-sized businesses (SMEs), in particular, the high cost of modern recycling technology can be a major obstacle in the growth of the recycled advanced recycling feedstock market. Many of these technologies are expensive to implement, which may discourage businesses from doing so. Furthermore, the effectiveness of recycling procedures may be hampered by insufficient infrastructure for garbage collection and processing.

Driver

Growing Demand for Premium Recycled Polymers

The recycled advanced recycling feedstock market is mostly driven by the growing demand for premium recycled polymers from the consumer goods, automotive, and packaging sectors worldwide. The need for recycled inputs that have the same performance, consistency, and purity as virgin polymers qualities that conventional mechanical recycling frequently fails to provide is growing as companies in these industries move toward sustainable materials. Additionally, the advanced recycling techniques, such as pyrolysis and depolymerization, generate feedstock that may be used to make premium consumer goods, durable vehicle parts, and food-grade packaging, which attracts a lot of downstream businesses. Moreover, investments and adoption of advanced recycling feedstock are accelerating due to the growing need for high-quality, circular-grade materials.

Restrain/Challenge

High Capital Costs and Technological Complexity

The widespread use of recycled advanced recycling feedstock technology is still hampered by high capital costs and technological complexity. Scalability is a problem for small and mid-sized firms because setting up chemical recycling factories demands a large expenditure. Additionally, process efficiency and product yield are impacted by uncertainty about feedstock quality and supply consistency, making it challenging to ensure constant outputs. Since standards for chemically recovered materials are still developing, regional regulatory variations make the recycled advanced recycling feedstock market expansion even more difficult.

The plastics category held the largest share in the recycled advanced recycling feedstock market in 2024 as businesses look for superior recycled substitutes for virgin plastic more and more. Multilayer films, flexible packaging, complicated resins, and other mixed, contaminated, or difficult-to-recycle plastic trash can all be transformed into high-purity feedstock that can be used to create new polymers thanks to advanced recycling processes. The packaging, automobile, textile, and consumer goods industries all of which demand materials with virgin-like performance are rapidly adopting this capacity. Additionally, the demand is being further accelerated by increasing regulatory pressure to decrease plastic waste and obligatory recycled-content requirements in certain locations.

In 2024, the petrochemicals category dominated the recycled advanced recycling feedstock market. Major chemical firms' sustainability pledges, supply chain diversification tactics, and regulatory pressure to cut carbon emissions are some of the factors driving this segment's growth. The prominent petrochemical companies are constructing new plants and upgrading old ones to process recycled feedstock in addition to or instead of virgin resources. Additionally, the use of advanced recycling feedstock is accelerated by its smooth integration into the current infrastructure for petrochemical processing. Petrochemical manufacturers are placing advanced recycling feedstock as a strategic input, greatly propelling growth within this market segment as demand for high-purity recycled polymers used in consumer products, automobiles, and packaging rises.

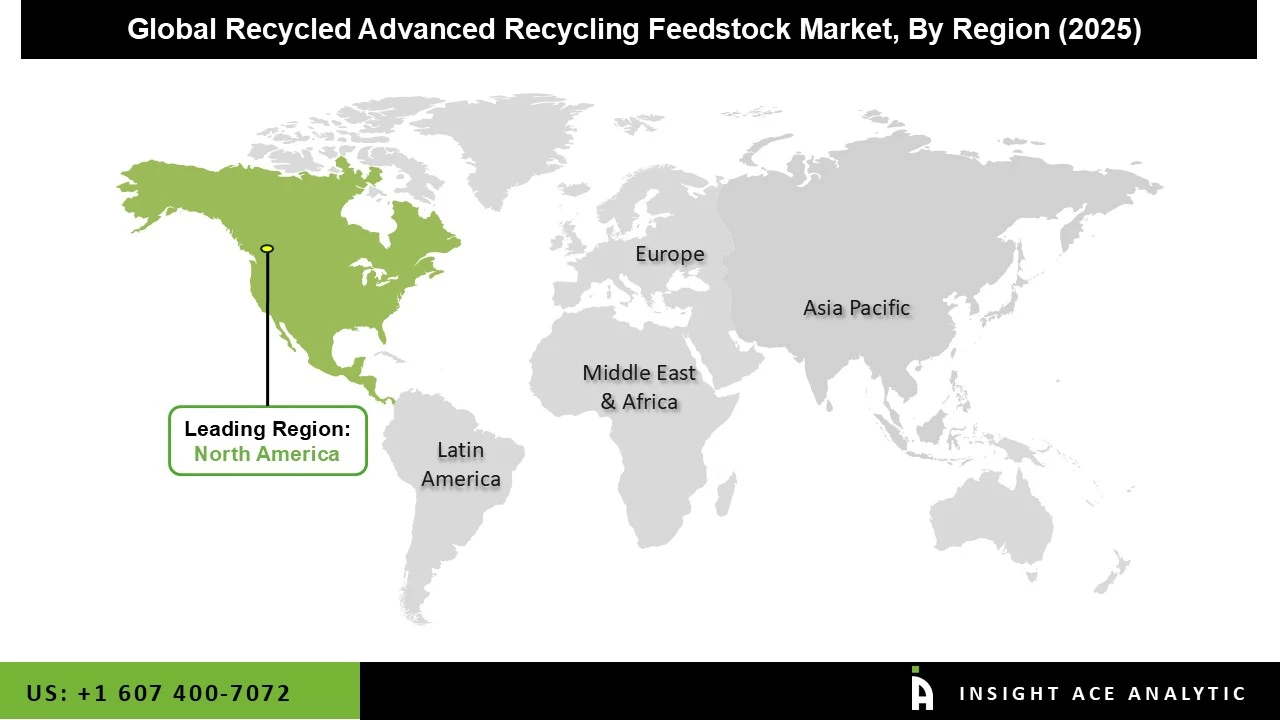

The Recycled Advanced Recycling Feedstock market was dominated by the North America region in 2024, driven by growing interest in and funding for these recycling solutions from both the public and commercial sectors, expanding environmental concerns, growing regulatory demands, rising demand for recovered plastics, and increased investment in waste management infrastructure.

Furthermore, it is anticipated that the growing shift to the circular economy would accelerate the North American region's adoption of cutting-edge recycled advanced recycling feedstock technologies. Additionally, the government actively participates in trash management by promoting sustainable habits nationwide and introducing laws and policies to reduce plastic waste.

• September 2025: Greenback Recycling Technologies announced that its Enval advanced recycling module would be deployed for the first time in the UK at the Amcor's facility in Heanor, Derbyshire. The module will go through a six-month commissioning and trial period there. By showcasing the possibility of co-locating modular recycling units within current industrial infrastructure, the partnership with Amcor hopes to advance the circular economy.

• July 2024: LyondellBasell Industries announced the successful opening of its state-of-the-art recycling facility in Germany. This facility uses MoReTec technology to transform plastic waste into feedstock for the manufacturing of new plastic, reaching 95% conversion efficiency and creating materials that are on par with virgin quality.

• June 2024: Loop Industries and SK Geo Centric reached a final agreement to construct a 70,000-ton PET recycling facility in South Korea. The facility will use Loop's exclusive depolymerization technology to turn waste PET into virgin-quality materials for food-grade packaging applications

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2024-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE, LyondellBasell Industries Holdings B.V., Dow Inc., Eastman Chemical Company, SABIC, Loop Industries, Inc., Agilyx Corporation, Covestro AG, Indorama Ventures Public Company Limited, and Pyrowave Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.