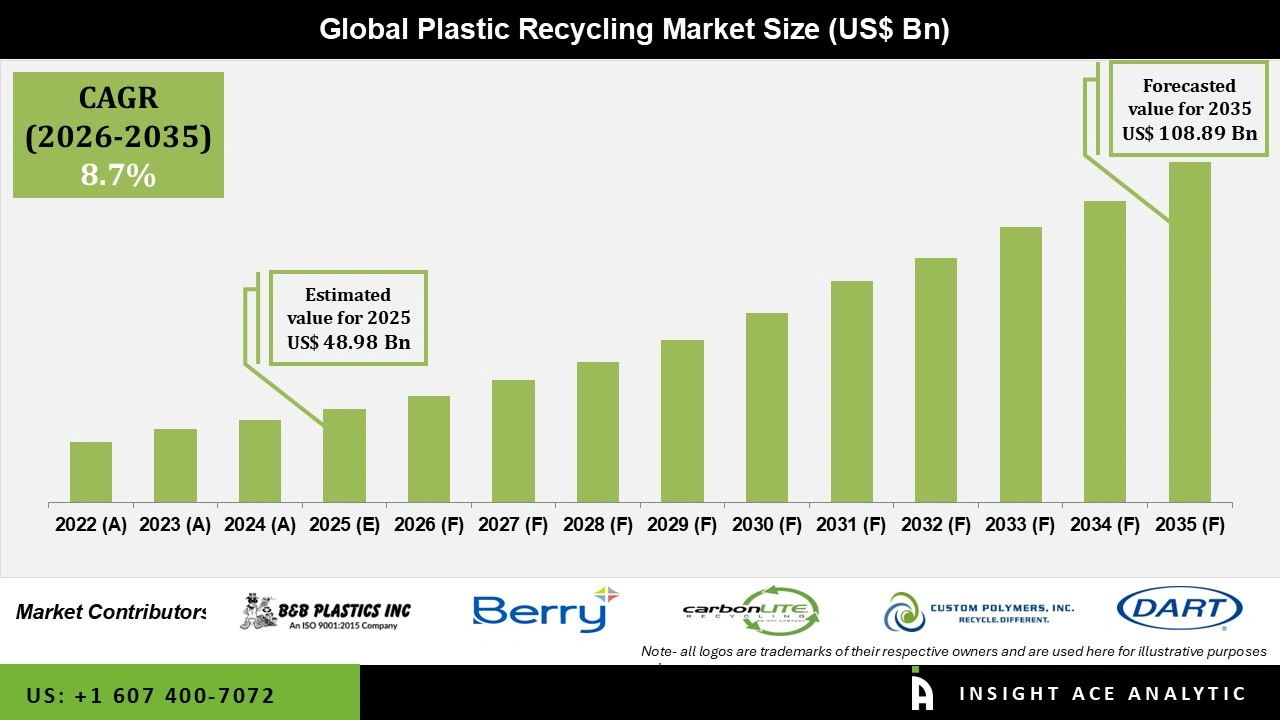

Global Plastic Recycling Market Size is valued at USD 48.98 Billion in 2025 and is predicted to reach USD 108.89 Billion by the year 2035 at a 8.7% CAGR during the forecast period for 2026 to 2035.

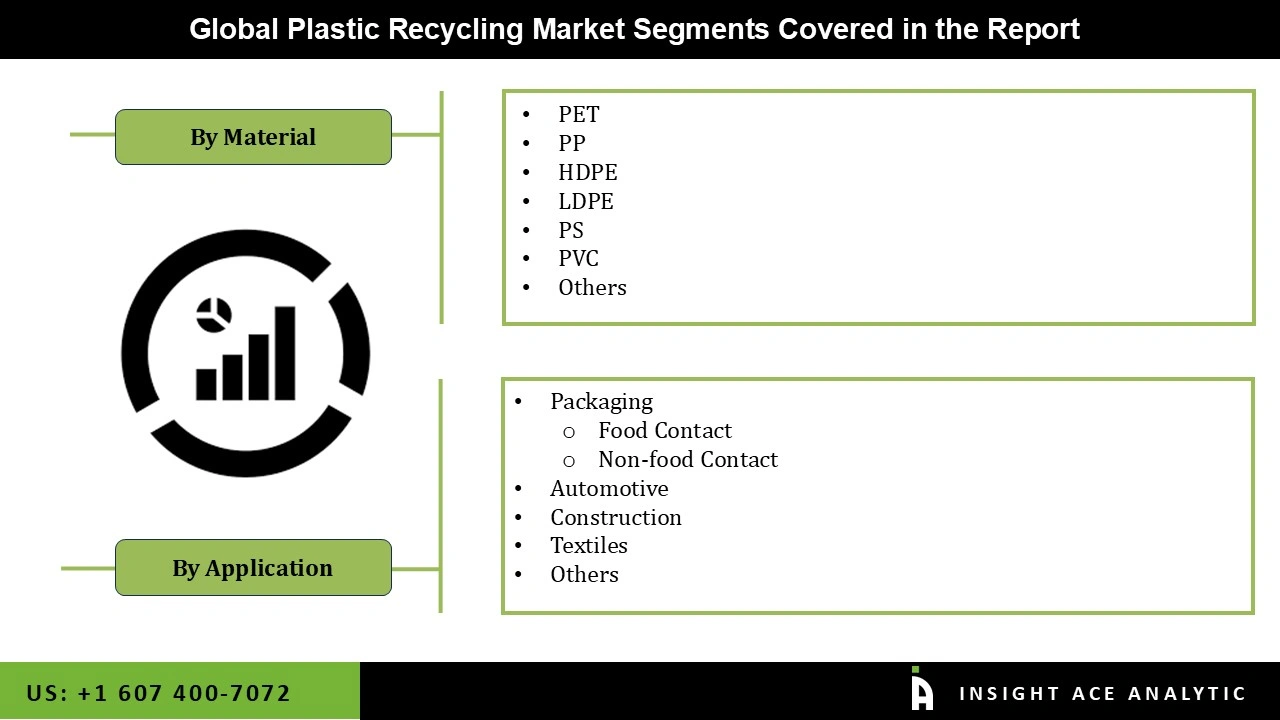

Plastic Recycling Market Size, Share & Trends Analysis Report By Packaging Material (PET, PP, HDPE, LDPE, PS, PVC), Application (Packaging, Automotive, Construction, Textiles), By Region, and Segment Forecasts, 2026 to 2035.

Plastic recycling reclaims several categories of plastic materials that can be utilized in other contexts. Global plastic recycling market demand is fueled by increasing environmental sustainability practices, which have prompted businesses to concentrate on plastic recycling. The growing usage of plastic in several industrial uses, including food packaging, electrical devices, and automobile upholstery, is another factor contributing to the increased attention on plastic recycling. Several textile manufacturers also produce materials from recycled plastic.

Key Industry Insights & Findings from the Report:

The availability of cutting-edge technologies for managing plastic trash is another significant driver driving the plastic recycling market growth. Ample growth prospects are also foreseen in the worldwide plastic recycling market due to producers' consistently rising R&D expenditures to create sustainable and environment and compostable plastics from plastic waste.

Additionally, it is anticipated that the growing use of recycled plastic goods for manufacturing materials in the textile industry will spur plastic recycling market expansion soon. However, the lack of knowledge about the value of recycled plastics in reducing the need for virgin plastics and the high cost of recycled products because collecting plastic garbage is a tough task are impeding the growth of the plastic recycling business.

The market is divided into material and application. Based on material, the plastic recycling market is segmented as PET, PP, HDPE, LDPE, PS, PVC and Others. By application, the plastic recycling market is segmented into packaging, food contact, non-food contact construction, textile, automotive, etc.

The packaging category will hold a major share of the global plastic recycling market in 2021. Plastics, including polyethylene terephthalate, high-density polyethylene, and polypropylene, are recycled and utilized in various packaging applications worldwide. Because consumers are becoming more aware of the advantages of recycled plastics, an increased demand for sustainable packaging is anticipated to fuel the market's expansion throughout the projected period. Due to customer demand for environmentalism, biodegradable materials will be used more often in food-grade packaging. The market is anticipated to rise during the forecast period due to the rising need for plastic recycling in the packaging industry. This increased demand is predicted to encourage greater plastic recycling.

The PET segment is projected to grow rapidly in the global plastic recycling market. One of the most abundant and widely used types of plastic, this material is used extensively in various industries, including clothes, carpets, automotive components, structural materials, and food packaging. PET is the most recycled plastic globally because it is so simple. Scientific institutions and industry players are actively contributing to the market's expansion of recycled PET portfolios since the material has a variety of qualities and a large range of end-use applications., especially in countries such as the US, Germany, the UK, China, and India.

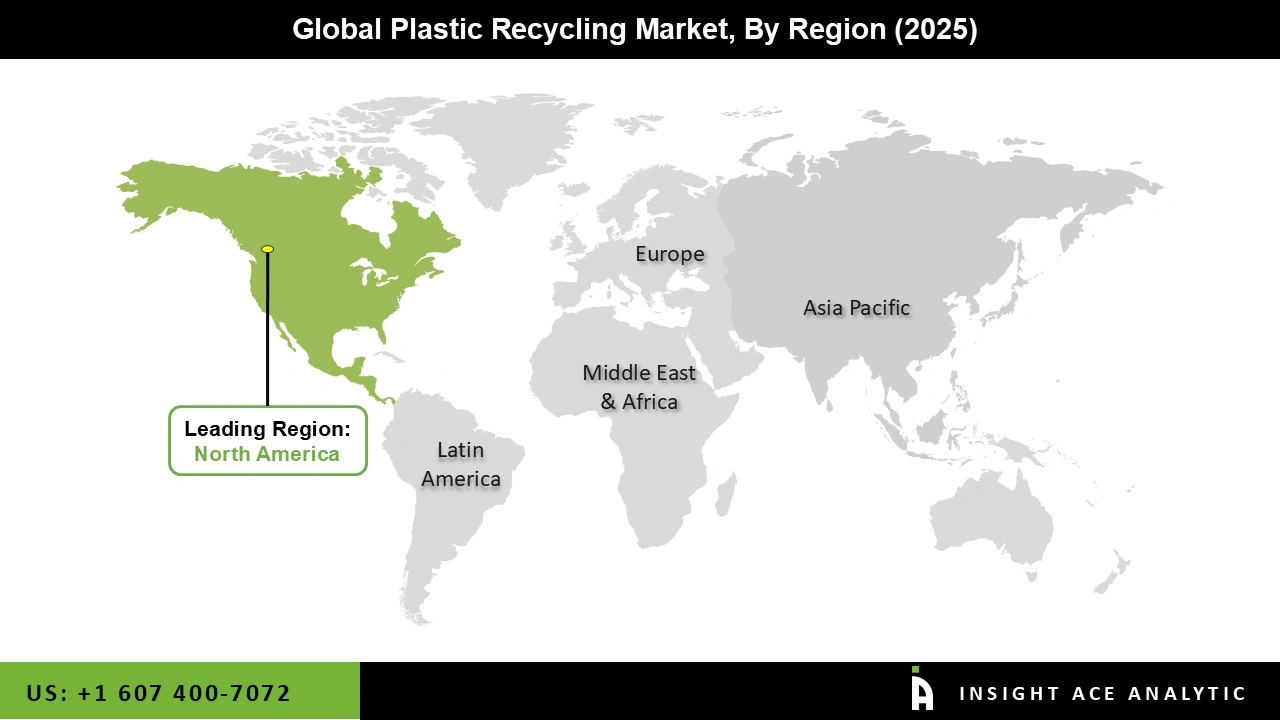

The North American plastic recycling industry is expected to witness the highest market share in revenue shortly. The strict restrictions on the use of virgin plastic and public programs to promote the use of recycled content are primarily to blame for the market expansion in North America. The industry will rise in the following years due to large consumer goods providers such as Coca-Cola, Walmart, Campbell, and other suppliers substituting recycled materials for traditional plastics.

In addition, the Asia Pacific region is predicted to increase in the global plastic recycling market. Its supremacy attributed to Asia-Pacific is the main center for plastic recycling since labor is inexpensive and a sizable customer base exists. Also, encouraging government policies to promote recycled plastic is anticipated to fuel market expansion in this region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 48.98 Billion |

| Revenue forecast in 2035 | USD 108.89 Billion |

| Growth rate CAGR | CAGR of 8.7% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (KT), and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Material And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | Kuusakoski, Berry Global Inc., B&B Plastic Inc., Plastipak Holdings, Inc., WM Recycle America, LLC, Carbonite Industries LLC, Custom Polymers, Inc., Dart Container Corporation, Novolin, KW Plastics, MBA Polymers Inc. And Well pine Plastic Industrial Co., Ltd". |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.