Global Radiopharmaceutical CDMO/CMO Services Market Size is valued at USD 2.9 Billion in 2024 and is predicted to reach USD 7.0 Billion by the year 2034 at a 9.2% CAGR during the forecast period for 2025 to 2034.

Radiopharmaceutical CDMO/CMO Services Market Size, Share & Trends Analysis Distribution (Application (Diagnostic Radiopharmaceuticals and Therapeutic Radiopharmaceuticals), Type of Radioisotope (Technetium-99m, Fluorine-18, Leutetium-177, Gallium-68, Actinium-225 and Other Radioisotopes), Source of Manufacturing (Nuclear Reactors and Cyclotrons), Scale of Operation (Preclinical, Clinical and Commercial), Therapeutic Area (Cardiovascular Disorders, Neurological Disorders, Oncological Disorders and Other Disorders) and Segment Forecasts, 2025 to 2034

Radiopharmaceutical drugs, introduced with radioactive isotopes, are pivotal in both diagnosing and treating medical conditions. These compounds emit detectable radiation, helping in the visualization of specific organs or tissues through techniques like scintigraphy.

Radiopharmaceutical CDMO/CMO services offer specialized outsourcing solutions for the development and manufacturing of these drugs, ensuring regulatory compliance and expertise from drug initiation to commercialization.

These services are integral in optimizing the manufacturing process and providing regulatory guidance, enabling pharmaceutical companies to focus on core objectives like drug development. With a growing emphasis on early-stage clinical support, the integration of CRO and CMO capabilities into a unified CDMO model has become prevalent. Selecting the right CDMO or CMO is crucial for comprehensive support throughout the drug development and manufacturing journey, including early-phase research and beyond.

The rise in chronic diseases like cancer and cardiovascular disorders is fueling the demand for radiopharmaceuticals, essential for diagnostic imaging and therapy. This demand pushes pharmaceutical companies to outsource complex manufacturing to CDMOs to cut costs, accelerate product launches, and meet growing needs effectively. Additionally, research advancements and the trend toward personalized medicine are driving the exponential growth of the Radiopharmaceutical CDMO market.

· NorthStar Medical Radioisotopes

· Nucleus RadioPharma

· Evergreen Theragnostics

· SpectronRx

· PharmaLogic

· Cardinal Health

· SOFIE Biosciences

· POINT Biopharma (Lantheus)

· BWXT Medical

· GE Healthcare

· Ratio Therapeutics

· RadioMedix

· Viewpoint Molecular Targeting

· AtomVie Global Radiopharma

· Fusion Pharmaceuticals

· Isologic Innovative Radiopharmaceuticals

· Nordion

· TRIUMF Innovations

· ITM Isotope Technologies Munich SE

· Eckert & Ziegler

· Bayer

· Curium Pharma

· ITM Radiopharma GmbH

· Theragnostics Ltd.

· Quotient Sciences

· Advanced Accelerator Applications (Novartis)

· Orano Med

· Cyclopharma Laboratories

· ITEL Pharma

· IRE-ELiT

· Cyclotron Company

· SCK CEN

· Minerva Imaging

· Isotopia Molecular Imaging

· Eczacıbaşı-Monrol Nuclear Products

· Nihon Medi-Physics

· FUJIFILM Toyama Chemical

· Canon Healthcare

· Dongcheng Pharmaceutical Group

· Sinotau Pharmaceutical Group

· FutureChem

· DuChemBio

· Telix Pharmaceuticals

· ANSTO Health

· Cyclotek

· Global Medical Solutions

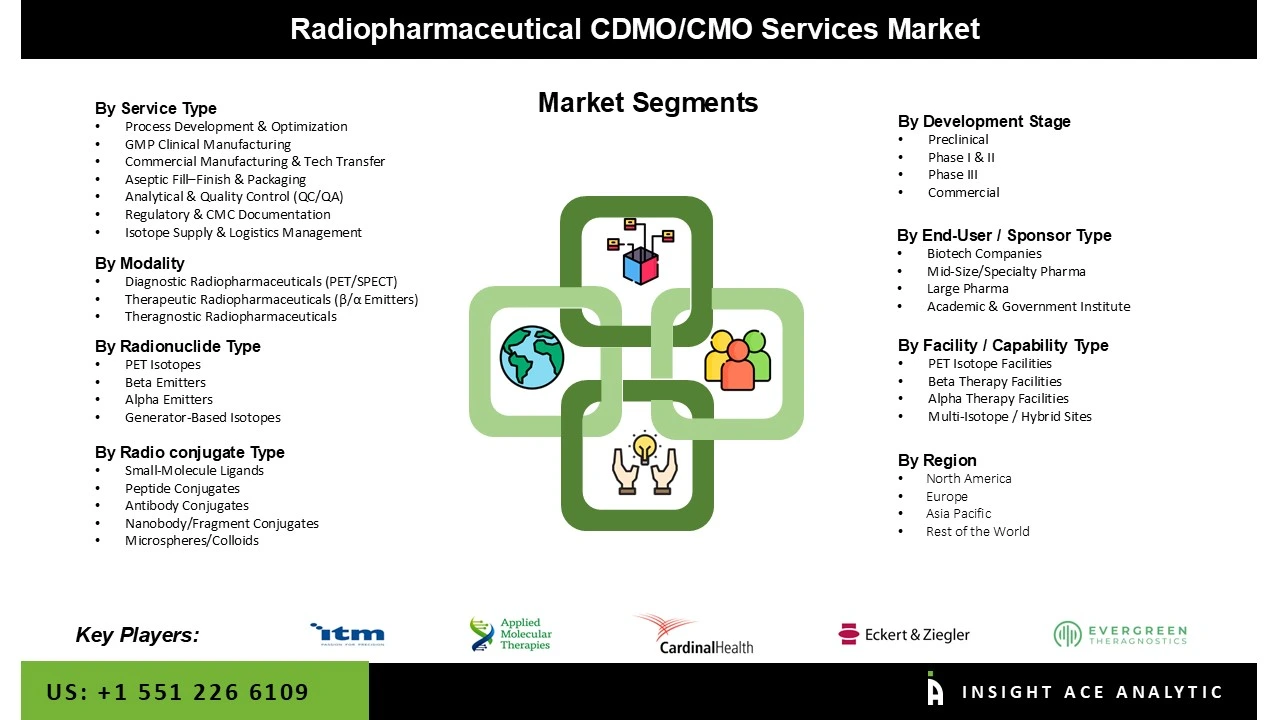

The radiopharmaceutical CDMO/CMO services market is segmented based on application, type of radioisotope, scale of operation, source of manufacturing and therapeutic area. By application the market is segmented into diagnostic radiopharmaceuticals and therapeutic radiopharmaceuticals, Diagnostic radiopharmaceutical segment is categorized into positron emission tomography radiopharmaceuticals and SPECT Radiopharmaceuticals, Therapeutic radiopharmaceutical segment is sub-segmented into alpha emitters, beta emitters and other therapeutic radiopharmaceuticals, By type of radioisotope, market is segmented into technetium-99m, fluorine-18, leutetium-177, gallium-68, actinium-225 and other radioisotopes. Based on source of manufacturing, market is divided into nuclear reactors and cyclotrons, On the basis of scale of operation, market is segmented into preclinical, clinical and commercial. By therapeutic area, market is categorized into cardiovascular disorders, neurological disorders, oncological disorders and other disorders.

The diagnostic radiopharmaceutical segment is expected to dominate the market. This segment has shown dominance in the market, with a significant contribution to market growth. Diagnostic radiopharmaceuticals play a crucial role in nuclear medicine by enabling the visualization and diagnosis of various medical conditions through imaging techniques like positron emission tomography (PET) and single-photon emission computed tomography (SPECT). The diagnostic radiopharmaceuticals segment is essential for providing accurate and detailed imaging for medical professionals to diagnose and monitor diseases effectively, making it a key driver in the Radiopharmaceutical CDMO/CMO Services Market. According to World Nuclear Association, over 10,000 hospitals globally use radioisotopes for a range of therapeutic and diagnostic applications.

The oncology segment in the radiopharmaceutical CDMO/CMO services market is growing rapidly due to several factors. These include the increasing incidence of cancer, advancements in radiopharmaceutical technology, and supportive regulatory approvals. Strategic collaborations and investments, the trend towards personalized medicine, and the aging population further drive demand. Additionally, increased funding for cancer research and improved production capabilities by CDMOs/CMOs contribute to this growth. Overall, the need for innovative cancer diagnostics and treatments is propelling the expansion of the oncology segment.

North America dominates half of the world's radiopharmaceutical production, showing that many pharmaceutical companies and services are based there. The region's rising demand for radiopharmaceuticals, driven by the growing number of chronic diseases like cancer and heart problems, is pushing companies to outsource the making of these drugs to CDMOs and CMOs, fueling the growth of this market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.9 Billion |

| Revenue Forecast In 2034 | USD 7.0 Billion |

| Growth Rate CAGR | CAGR of 9.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Service Type,By Modality,By Radionuclide Type, By Radio conjugate Type,By Development Stage,By End-User / Sponsor Type and By Facility / Capability Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany, Denmark, Turkey, Romania, Bulgaria, Austria, Norway, China; Australia; Taiwan; Thailand; South Korea; Rest of Asia Pacific; Brazil; Rest of Latin America; France; Kuwait; U.A.E.; Egypt; Rest of MEA |

| Competitive Landscape | NorthStar Medical Radioisotopes, Nucleus RadioPharma, Evergreen Theragnostics, SpectronRx, PharmaLogic, Cardinal Health, SOFIE Biosciences, POINT Biopharma (Lantheus), BWXT Medical, GE Healthcare, Ratio Therapeutics, RadioMedix, Viewpoint Molecular Targeting, AtomVie Global Radiopharma, Fusion Pharmaceuticals, Isologic Innovative Radiopharmaceuticals, Nordion, TRIUMF Innovations, ITM Isotope Technologies Munich SE, Eckert & Ziegler, Bayer, Curium Pharma, ITM Radiopharma GmbH, Theragnostics Ltd., Quotient Sciences, Advanced Accelerator Applications (Novartis), Orano Med, Cyclopharma Laboratories, ITEL Pharma, IRE-ELiT, Cyclotron Company, SCK CEN, Minerva Imaging, Isotopia Molecular Imaging, Eczacıbaşı-Monrol Nuclear Products, Nihon Medi-Physics, FUJIFILM Toyama Chemical, Canon Healthcare, Dongcheng Pharmaceutical Group, Sinotau Pharmaceutical Group, FutureChem, DuChemBio, Telix Pharmaceuticals, ANSTO Health, Cyclotek, Global Medical Solutions |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Radiopharmaceutical CDMO/CMO Services Market-By Service Type :

Radiopharmaceutical CDMO/CMO Services Market-By Modality:

Radiopharmaceutical CDMO/CMO Services Market -By Radionuclide Type:

Radiopharmaceutical CDMO/CMO Services Market -By Radio Conjugate Type:

Radiopharmaceutical CDMO/CMO Services Market -By Development Stage:

Radiopharmaceutical CDMO/CMO Services Market -By End-User / Sponsor Type:

Radiopharmaceutical CDMO/CMO Services Market -By Facility / Capability Type:

Radiopharmaceutical CDMO/CMO Services Market -By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.