The Global Pharmacy Automation Market Size is valued at 6.7 Billion in 2024 and is predicted to reach 15.86 Billion by the year 2034 at an 9.1% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the report:

The advantages of pharmacy automation technology include increased patient safety, decreased reliance on pharmaceutical shortages, reduced medicine waste and decreased cost per dosage. The market is anticipated that total efficiency will increase due to pharmacies utilizing RFID, barcode scanning, smart dashboards, and data security for a more fluid workflow. Businesses are under increased external pressure to increase transparency and use cutting-edge technology as a result of the challenging and unprecedented problem of managing corporate compliance in a digital environment.

Recent technology developments in pharmacy automation have made various automated solutions possible. The benefits over the forecast period include quicker prescription processing, fewer pharmaceutical errors and inventory issues, and lower pharmacy costs. Additionally, enhancements to the most significant rising healthcare infrastructure will probably create new opportunities for market growth. On the other hand, significant capital costs and rigid informal standards are substantial roadblocks to market expansion in the coming years.

Additionally, in quest of new prospects over the future years, pharmacy automation companies are expanding their footprint throughout emerging regions. The pharmacy automation market will also be driven by the rising need for specialized drug prescription filling solutions, the aim to lower medication errors, and the decentralization of pharmacies. However, constraints such as a reluctance to accept pharmacy automation systems due to the high cost of the pharmacy automation system are expected to hinder pharmacy automation system adoption, limiting the market's growth during the forecast period.

The requirement to reduce medication errors, manual drug dispensing, and the advancement of advanced parts innovation is driving the pharmacy automation system market. In addition, the rise in work costs and an increase in the geriatric population have fueled the expansion of the pharmacy automation market over the upcoming years.

The pharmacy automation market is segmented on product and end users. Based on product type, the market is segmented as automated medication dispensing and storage systems, automated packaging and labeling systems, automated tabletop counters, automated medication compounding systems and other pharmacy automation systems. Based on application, the market is divided into automated packaging and labeling systems, tabletop counters, medication compounding systems, and other pharmacy automation systems. Based on end users, the market is divided into inpatient pharmacies, outpatient pharmacies, retail pharmacies, hospital settings, pharmacy benefit management organizations, and mail-order pharmacies.

The automated medication dispensing and storage systems segment is anticipated to grow at the most significant rate during the forecast period. The recycled content packaging provides better use of eco-friendly resources and techniques, driving the segment's growth during the forecast period. Recycled content packaging uses plastic, metal, paper, and glass, which manufacturers reuse as raw materials to make new packaging products.

Retail pharmacies hold the largest share of the market during the forecast period. Retail pharmacies include supermarkets, chains, mass merchandisers, and independent pharmacies. The expanding need to prevent dispensing errors, the expansion in retail pharmacies and the increased pressure on pharmacists contribute to the segment's growth. Furthermore, key technological companies like Microsoft, IBM, and Google are working on automation and cloud solutions for the pharmaceutical and healthcare industries to overcome security gaps and secure healthcare and pharmaceutical manufacturing networks from outside threats.

North America region is growing at the highest CAGR during the forecast period. The increased number of drug prescriptions at pharmacies because of the aging population is related to the rise of North America's pharmacy automation system market. Additionally, the markets for pharmacy automation equipment in North America are expected to rise because of technological advances in drug administration in hospitals and pharmacies. Increased concerns about insufficient inventory management may encourage the development of high-volume dispensing cabinets in the region, as this will increase the cost of maintaining items, putting merchants under financial hardship.

The market for pharmacy automation equipment in North America is projected to be driven by technological developments in drug administration in hospitals and pharmacies. In addition, during the forecast period, Asia Pacific is expected to grow the fastest. The increased need to reduce pharmaceutical errors, pharmacy decentralization, player technical improvements, and the rapidly growing geriatric population are expected to drive market expansion.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 6.7 Billion |

|

Revenue Forecast In 2034 |

USD 15.86 Billion |

|

Growth Rate CAGR |

CAGR of 9.1% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

Product, End-User |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; Japan; South Korea; South East Asia |

|

Competitive Landscape |

Becton,Dickinson and Company (US), Omnicell, Inc. (US), Kuka AG (Swisslog Healthcare) (Germany), Baxter International Inc. (US), Capsa Healthcare (US), Baxter International Inc. (US), Capsa Healthcare (US), Cerner Corporation (US), Yuvama Co., Ltd, (Japan), ARxIUM Inc. (US), Parata Systems, LLC (US), RXsafe, LLC (US), ScriptPro LLC (US), Pearson Medical Technologies, LLC (US), Medical Packaging Inc., LLC (US),Tension Corporation (US), Noritsu Pharmacy Automation (US), Euclid Medical Products (US), TouchPoint Medical Solutions (US), Meditech Pharmacy Management Solutions (Beligum). |

|

Customization Scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Pharmacy Automation Market Snapshot

Chapter 4. Global Pharmacy Automation Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Product Type Estimates & Trend Analysis

5.1. by Product Type & Market Share, 2019 & 2031

5.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2023 to 2031 for the following by Product Type:

5.2.1. Automated Medication Dispensing and Storage Systems

5.2.1.1. Automated Medication Dispensing and Storage Systems, by Type

5.2.1.1.1. Robots/Robotic Automated Dispensing Systems

5.2.1.1.1.1. Centralized Pharmacies

5.2.1.1.1.2. Decentralized Pharmacies

5.2.1.1.1.3. Retail Pharmacies

5.2.1.1.2. Carousels

5.2.1.1.3. Automated Dispensing Cabinets

5.2.1.1.3.1. Centralized Pharmacies

5.2.1.1.3.2. Decentralized Pharmacies

5.2.1.1.3.3. Retail Pharmacies

5.2.1.2. Automated Medication Dispensing and Storage Systems, By Application/Operation

5.2.1.2.1. Centralized Pharmacies

5.2.1.2.2. Decentralized Pharmacies

5.2.1.2.3. Retail Pharmacies

5.2.2. Automated Packaging and Labelling Systems

5.2.3. Automated Tabletop Counters

5.2.4. Automated Medication Compounding Systems

5.2.5. Other Pharmacy Automation Systems

Chapter 6. Market Segmentation 2: by End-users Estimates & Trend Analysis

6.1. by End-users & Market Share, 2019 & 2031

6.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2023 to 2031 for the following by End-users:

6.2.1. Inpatient Pharmacies

6.2.1.1. Acute Care Settings

6.2.1.2. Long Term Care Facilities

6.2.2. Outpatient Pharmacies

6.2.2.1. Outpatient/Fast Track Clinics

6.2.2.2. Hospital Retail Settings

6.2.3. Retail Pharmacies

6.2.4. Pharmacy Benefit Management Organization And Mail Order Pharmacies

Chapter 7. Pharmacy Automation Market Segmentation 3: Regional Estimates & Trend Analysis

7.1. North America

7.1.1. North America Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

7.1.2. North America Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2024-2031

7.1.3. North America Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

7.2. Europe

7.2.1. Europe Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

7.2.2. Europe Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2024-2031

7.2.3. Europe Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

7.3. Asia Pacific

7.3.1. Asia Pacific Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

7.3.2. Asia Pacific Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2024-2031

7.3.3. Asia Pacific Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

7.4. Latin America

7.4.1. Latin America Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

7.4.2. Latin America Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2024-2031

7.4.3. Latin America Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

7.5. Middle East & Africa

7.5.1. Middle East & Africa Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2024-2031

7.5.2. Middle East & Africa Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2024-2031

7.5.3. Middle East & Africa Pharmacy Automation Market Revenue (US$ Million) Estimates and Forecasts by country, 2024-2031

Chapter 8. Competitive Landscape

8.1. Major Mergers and Acquisitions/Strategic Alliances

8.2. Company Profiles

8.2.1. Becton,Dickinson and Company (US),

8.2.2. Omnicell, Inc. (US),

8.2.3. Kuka AG (Swisslog Healthcare) (Germany),

8.2.4. Baxter International Inc. (US),

8.2.5. Capsa Healthcare (US),

8.2.6. Baxter International Inc. (US),

8.2.7. Capsa Healthcare (US),

8.2.8. Cerner Corporation (US),

8.2.9. Yuvama Co., Ltd, (Japan),

8.2.10. ARxIUM Inc. (US),

8.2.11. Parata Systems, LLC (US),

8.2.12. RXsafe, LLC (US),

8.2.13. ScriptPro LLC (US),

8.2.14. Pearson Medical Technologies, LLC (US),

8.2.15. Medical Packaging Inc., LLC (US),

8.2.16. Tension Corporation (US),

8.2.17. Noritsu Pharmacy Automation (US),

8.2.18. Euclid Medical Products (US),

8.2.19. TouchPoint Medical Solutions (US),

8.2.20. Meditech Pharmacy Management Solutions (Beligum)

8.2.21. Other Prominent Players

By Product-

By End User

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

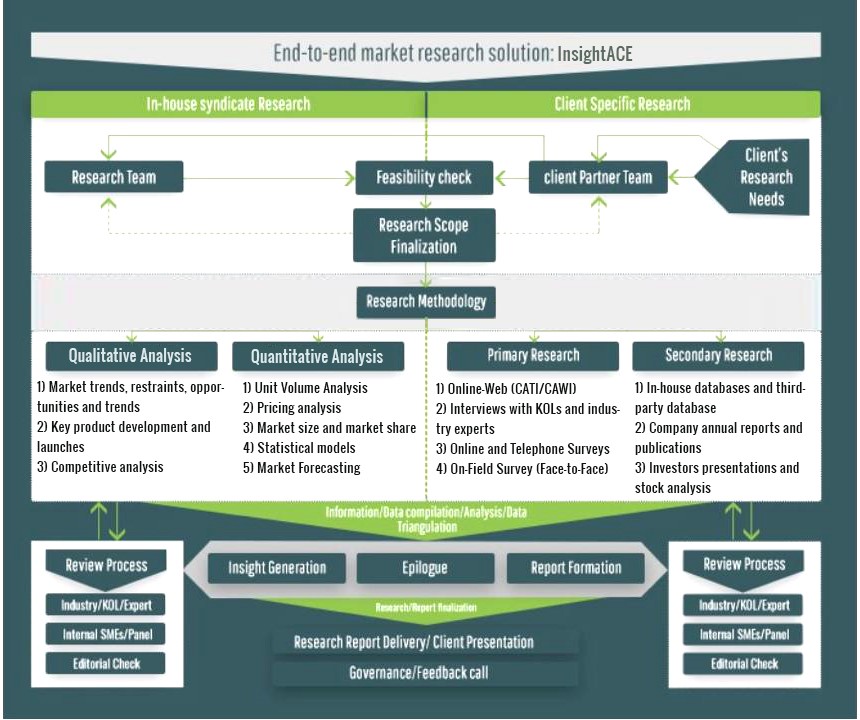

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.